Corporación América Airports S.A. Reports November 2024 Passenger Traffic

Corporación América Airports (CAAP) reported a 2.7% year-over-year decrease in passenger traffic for November 2024, or -0.2% excluding Natal airport. International passenger traffic grew 6.6% YoY, while domestic traffic declined 6.7%. Notable highlights include:

- Argentina: Total traffic down 3.3% YoY, with international traffic up 10.3%

- Italy: Strong growth of 15.3% YoY

- Brazil: -8.8% YoY (+4.0% excluding Natal)

- Uruguay: +4.4% YoY with new route developments

Cargo volume increased significantly by 23.2% YoY, with positive contributions from most countries. Aircraft movements rose 7.0% YoY, showing growth across all regions except Brazil.

Corporación América Airports (CAAP) ha riportato una diminuzione del 2,7% nel traffico passeggeri rispetto allo scorso anno per novembre 2024, o -0,2% escludendo l'aeroporto di Natal. Il traffico passeggeri internazionale è cresciuto del 6,6% rispetto all'anno precedente, mentre il traffico domestico è diminuito del 6,7%. I punti salienti includono:

- Argentina: Traffico totale in calo del 3,3% rispetto all'anno precedente, con un aumento del traffico internazionale del 10,3%

- Italia: Forte crescita del 15,3% rispetto all'anno precedente

- Brasile: -8,8% rispetto all'anno precedente (+4,0% escludendo Natal)

- Uruguay: +4,4% rispetto all'anno precedente con nuovi sviluppi di rotte

Il volume delle merci è aumentato significativamente del 23,2% rispetto all'anno precedente, con contributi positivi da parte della maggior parte dei paesi. I movimenti aerei sono aumentati del 7,0% rispetto all'anno precedente, mostrando crescite in tutte le regioni tranne il Brasile.

Corporación América Airports (CAAP) informó una disminución del 2,7% en el tráfico de pasajeros interanual para noviembre de 2024, o -0,2% sin incluir el aeropuerto de Natal. El tráfico de pasajeros internacionales creció un 6,6% interanual, mientras que el tráfico doméstico cayó un 6,7%. Los aspectos destacados incluyen:

- Argentina: Tráfico total en baja del 3,3% interanual, con un aumento del tráfico internacional del 10,3%

- Italia: Fuerte crecimiento del 15,3% interanual

- Brasil: -8,8% interanual (+4,0% sin incluir Natal)

- Uruguay: +4,4% interanual con nuevos desarrollos de rutas

El volumen de carga aumentó significativamente un 23,2% interanual, con contribuciones positivas de la mayoría de los países. Los movimientos de aeronaves aumentaron un 7,0% interanual, mostrando crecimiento en todas las regiones excepto Brasil.

코르포라시온 아메리카 공항 (CAAP)는 2024년 11월 기준으로 연간 여객 교통량이 2.7% 감소했다고 보고했으며, 나탈 공항을 제외하면 -0.2% 감소했습니다. 국제 여객 교통량은 전년 대비 6.6% 증가했지만, 국내 교통량은 6.7% 감소했습니다. 주요 하이라이트는 다음과 같습니다:

- 아르헨티나: 전체 교통량이 전년 대비 3.3% 감소하고, 국제 교통량은 10.3% 증가했습니다.

- 이탈리아: 전년 대비 15.3%의 강력한 성장

- 브라질: -8.8% 감소 (+4.0% 나탈 제외)

- 우루과이: 새로운 노선 개발로 전년 대비 +4.4% 증가

화물 물량은 전년 대비 23.2% 크게 증가했으며, 대부분의 국가에서 긍정적인 기여를 받았습니다. 항공기 운항은 전년 대비 7.0% 증가하여 브라질을 제외한 모든 지역에서 성장을 나타냈습니다.

Corporación América Airports (CAAP) a signalé une baisse de 2,7% du trafic passagers par rapport à l'année précédente pour novembre 2024, soit -0,2% en excluant l'aéroport de Natal. Le trafic passagers international a augmenté de 6,6% par rapport à l'année précédente, tandis que le trafic domestique a diminué de 6,7%. Les points clés comprennent :

- Argentine : Trafic total en baisse de 3,3% par rapport à l'année précédente, avec un trafic international en hausse de 10,3%

- Italie : Forte croissance de 15,3% par rapport à l'année précédente

- Brésil : -8,8% par rapport à l'année précédente (+4,0% en excluant Natal)

- Uruguay : +4,4% par rapport à l'année précédente avec de nouveaux développements de routes

Le volumen des marchandises a augmenté significativement de 23,2% par rapport à l'année précédente, avec des contributions positives de la plupart des pays. Les mouvements d'avion ont augmenté de 7,0% par rapport à l'année précédente, montrant une croissance dans toutes les régions sauf le Brésil.

Corporación América Airports (CAAP) meldete einen Rückgang des Passagieraufkommens um 2,7% im Vergleich zum Vorjahr für November 2024, beziehungsweise -0,2% ohne den Flughafen Natal. Der internationale Passagierverkehr wuchs um 6,6% im Jahresvergleich, während der Inlandsverkehr um 6,7% sank. Erwähnenswerte Höhepunkte sind:

- Argentinien: Gesamter Verkehr um 3,3% im Jahresvergleich gesunken, internationaler Verkehr jedoch um 10,3% gestiegen

- Italien: Starker Anstieg von 15,3% im Jahresvergleich

- Brasilien: -8,8% im Jahresvergleich (+4,0% ohne Natal)

- Uruguay: +4,4% im Jahresvergleich mit neuen Routenentwicklungen

Frachtvolumen stieg signifikant um 23,2% im Jahresvergleich, mit positiven Beiträgen aus den meisten Ländern. Flugbewegungen stiegen um 7,0% im Jahresvergleich und zeigten in allen Regionen Wachstum außer Brasilien.

- International passenger traffic increased 6.6% YoY

- Cargo volume grew 23.2% YoY across most countries

- Aircraft movements up 7.0% YoY

- Strong performance in Italy with 15.3% total traffic growth

- New route developments and increased flight frequencies in multiple markets

- Overall passenger traffic declined 2.7% YoY

- Domestic passenger traffic decreased 6.7% YoY

- Brazil traffic down 8.8% YoY due to Natal airport discontinuation

- Argentina domestic traffic declined 7.2% YoY amid recession

- Ecuador traffic decreased 2.6% YoY due to high airfare prices

Insights

Total passenger traffic down

International passenger traffic up

LUXEMBOURG--(BUSINESS WIRE)--

Corporación América Airports S.A. (NYSE: CAAP), (“CAAP” or the “Company”), one of the leading private airport operators in the world, reported today a

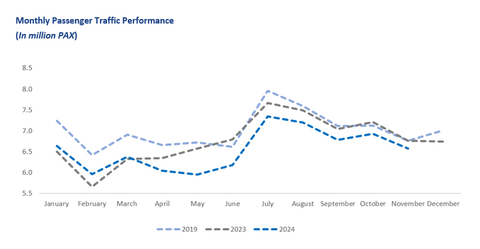

Monthly Passenger Traffic Performance (In million PAX) (Graphic: Business Wire)

Passenger Traffic, Cargo Volume and Aircraft Movements Highlights (2024 vs. 2023) |

|

|

|

|

|||

Statistics |

Nov'24 |

Nov'23 |

% Var. |

|

YTD’24 |

YTD'23 |

% Var. |

Domestic Passengers (thousands) |

3,663 |

3,927 |

- |

|

37,224 |

41,826 |

- |

International Passengers (thousands) |

2,355 |

2,209 |

|

|

28,203 |

26,068 |

|

Transit Passengers (thousands) |

558 |

626 |

- |

|

6,588 |

6,506 |

|

Total Passengers (thousands)1 |

6,576 |

6,761 |

- |

|

72,015 |

74,400 |

- |

Cargo Volume (thousand tons) |

40.0 |

32.5 |

|

|

358.6 |

334.1 |

|

Total Aircraft Movements (thousands) |

68.6 |

64.1 |

|

|

750.4 |

778.0 |

- |

| 1 Excluding Natal for comparison purposes, total passenger traffic was down |

|||||||

Passenger Traffic Overview

Total passenger traffic declined by

In

In

In

In

In

In

Cargo Volume and Aircraft Movements

Cargo volume increased by

Aircraft movements increased by

Summary Passenger Traffic, Cargo Volume and Aircraft Movements (2024 vs. 2023) |

|

|

|

|

|||

|

Nov'24 |

Nov'23 |

% Var. |

|

YTD'24 |

YTD'23 |

% Var. |

Passenger Traffic (thousands) |

|

|

|

|

|

|

|

|

3,793 |

3,923 |

- |

|

38,051 |

39,850 |

- |

|

554 |

480 |

|

|

8,473 |

7,671 |

|

|

1,303 |

1,429 |

- |

|

14,210 |

15,614 |

- |

|

176 |

169 |

|

|

2,041 |

1,766 |

|

|

381 |

391 |

- |

|

4,294 |

4,458 |

- |

|

368 |

369 |

- |

|

4,946 |

5,041 |

- |

TOTAL |

6,576 |

6,761 |

- |

|

72,015 |

74,400 |

- |

(1) Following the friendly termination process concluded in February 2024, CAAP no longer operates Natal airport. Statistics for Natal are available up to February 18, 2024. |

|||||||

Cargo Volume (tons) |

|

|

|

|

|||

|

21,667 |

16,905 |

|

|

186,287 |

172,970 |

|

|

1,170 |

1,231 |

- |

|

11,896 |

11,880 |

|

|

6,130 |

5,826 |

|

|

59,963 |

60,193 |

- |

|

3,269 |

2,792 |

|

|

29,241 |

28,459 |

|

|

3,131 |

3,139 |

- |

|

34,024 |

30,245 |

|

|

4,611 |

2,558 |

|

|

37,185 |

30,398 |

|

TOTAL |

39,977 |

32,451 |

|

|

358,596 |

334,145 |

|

Aircraft Movements |

|

|

|

|

|

|

|

|

39,873 |

34,788 |

|

|

407,025 |

418,382 |

- |

|

5,161 |

4,887 |

|

|

77,074 |

73,133 |

|

|

11,490 |

12,732 |

- |

|

131,326 |

145,151 |

- |

|

2,687 |

2,594 |

|

|

28,878 |

28,374 |

|

|

6,387 |

6,165 |

|

|

69,627 |

71,983 |

- |

|

2,984 |

2,905 |

|

|

36,446 |

40,971 |

- |

TOTAL |

68,582 |

64,071 |

|

|

750,376 |

777,994 |

- |

About Corporación América Airports

Corporación América Airports acquires, develops and operates airport concessions. Currently, the Company operates 52 airports in 6 countries across

View source version on businesswire.com: https://www.businesswire.com/news/home/20241217819655/en/

Investor Relations Contact

Patricio Iñaki Esnaola

Email: patricio.esnaola@caairports.com

Phone: +5411 4899-6716

Source: Corporación América Airports