B2Gold Announces Positive Preliminary Economic Assessment Results for the Antelope Deposit at the Otjikoto Mine in Namibia; After-Tax NPV (5%) of $131 Million with an After-Tax IRR of 35%

B2Gold Corp. has announced positive Preliminary Economic Assessment (PEA) results for the Antelope deposit at its Otjikoto mine in Namibia. The underground gold mine project shows strong economics with an after-tax NPV of $131 million and an IRR of 35% at a $2,400 gold price.

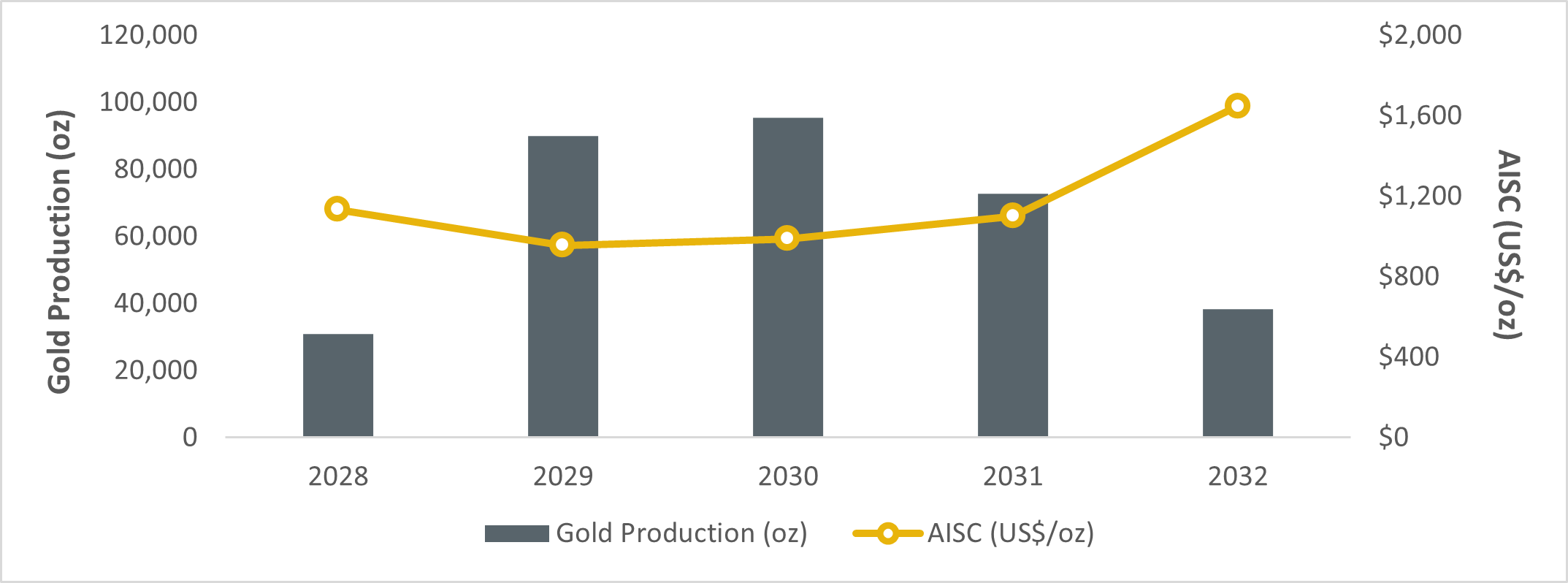

Key highlights include: a 5-year mine life, average grade of 5.75 g/t gold, total production of 327,000 ounces, and average annual production of 65,000 ounces. Combined with existing operations, Otjikoto's annual gold production is expected to reach 110,000 ounces from 2029 through 2032. The project requires $129 million in pre-production capital with projected all-in sustaining costs of $1,095 per gold ounce.

The Antelope deposit contains an Inferred Mineral Resource of 1.75 million tonnes grading 6.91 g/t gold for 390,000 ounces. The company has allocated $7 million for exploration in 2025, planning 44,000 meters of drilling to expand and refine the deposit.

B2Gold Corp. ha annunciato risultati positivi della Valutazione Economica Preliminare (PEA) per il giacimento Antelope presso la sua miniera Otjikoto in Namibia. Il progetto della miniera d'oro sotterranea mostra economie solide con un NPV post-imposte di 131 milioni di dollari e un IRR del 35% a un prezzo dell'oro di 2.400 dollari.

I punti salienti includono: una vita utile della miniera di 5 anni, un tenore medio di 5,75 g/t d'oro, una produzione totale di 327.000 once e una produzione annuale media di 65.000 once. Combinata con le operazioni esistenti, la produzione annuale d'oro di Otjikoto dovrebbe raggiungere 110.000 once dal 2029 al 2032. Il progetto richiede 129 milioni di dollari in capitale per la pre-produzione con costi sostenibili previsti di 1.095 dollari per oncia d'oro.

Il giacimento Antelope contiene una Risorsa Mineraria Indefinita di 1,75 milioni di tonnellate con un grado di 6,91 g/t d'oro per 390.000 once. L'azienda ha stanziato 7 milioni di dollari per l'esplorazione nel 2025, pianificando 44.000 metri di perforazione per espandere e affinare il giacimento.

B2Gold Corp. ha anunciado resultados positivos de la Evaluación Económica Preliminar (PEA) para el depósito Antelope en su mina Otjikoto en Namibia. El proyecto de mina de oro subterránea muestra una economía sólida con un VAN después de impuestos de 131 millones de dólares y un TIR del 35% a un precio del oro de 2,400 dólares.

Los aspectos destacados incluyen: una vida útil de la mina de 5 años, una ley promedio de 5.75 g/t de oro, una producción total de 327,000 onzas y una producción anual promedio de 65,000 onzas. Junto con las operaciones existentes, se espera que la producción anual de oro de Otjikoto alcance las 110,000 onzas desde 2029 hasta 2032. El proyecto requiere 129 millones de dólares en capital previo a la producción con costos sostenibles proyectados de 1,095 dólares por onza de oro.

El depósito Antelope contiene un Recurso Mineral Inferido de 1.75 millones de toneladas con una ley de 6.91 g/t de oro para 390,000 onzas. La empresa ha asignado 7 millones de dólares para exploración en 2025, planeando 44,000 metros de perforación para expandir y refinar el depósito.

B2Gold Corp.는 나미비아의 Otjikoto 광산에 위치한 Antelope 매장지에 대한 긍정적인 예비 경제 평가(PEA) 결과를 발표했습니다. 이 지하 금광 프로젝트는 2,400달러의 금 가격에서 세후 NPV가 1억 3,100만 달러와 IRR이 35%에 달하는 강력한 경제성을 보여줍니다.

핵심 하이라이트에는 5년의 광산 수명, 평균 등급 5.75 g/t 금, 총 생산량 327,000 온스, 연평균 생산량 65,000 온스가 포함됩니다. 기존 운영과 결합하여 2029년부터 2032년까지 Otjikoto의 연간 금 생산량은 110,000 온스에 이를 것으로 예상됩니다. 이 프로젝트는 전 생산 자본으로 1억 2,900만 달러가 필요하며, 금 온스당 예상 전면 유지비용은 1,095달러입니다.

Antelope 매장지는 175만 톤의 추정 광물 자원을 포함하고 있으며, 금 등급은 6.91 g/t로 390,000 온스에 해당합니다. 이 회사는 2025년 탐사를 위해 700만 달러를 배정했으며, 매장지를 확장하고 정제하기 위해 44,000미터의 드릴링을 계획하고 있습니다.

B2Gold Corp. a annoncé des résultats positifs de l'Évaluation Économique Préliminaire (PEA) pour le gisement Antelope de sa mine Otjikoto en Namibie. Le projet de mine d'or souterraine présente une économie solide avec un NPV après impôts de 131 millions de dollars et un TRI de 35% à un prix de l'or de 2,400 dollars.

Les points clés incluent : une durée de vie de mine de 5 ans, une teneur moyenne de 5,75 g/t d'or, une production totale de 327 000 onces et une production annuelle moyenne de 65 000 onces. En combinant avec les opérations existantes, la production annuelle d'or de l'Otjikoto devrait atteindre 110 000 onces de 2029 à 2032. Le projet nécessite 129 millions de dollars de capital pré-production avec des coûts de maintien prévus de 1 095 dollars par once d'or.

Le gisement Antelope contient une Ressource Minérale Inférée de 1,75 million de tonnes avec une teneur de 6,91 g/t d'or pour 390 000 onces. L'entreprise a alloué 7 millions de dollars pour l'exploration en 2025, avec un plan de forage de 44 000 mètres pour développer et affiner le gisement.

B2Gold Corp. hat positive Ergebnisse der Vorläufigen Wirtschaftlichkeitsbewertung (PEA) für das Antelope-Vorkommen in seiner Otjikoto-Mine in Namibia bekannt gegeben. Das unterirdische Goldminenprojekt zeigt starke Wirtschaftlichkeit mit einem nach Steuern NPV von 131 Millionen Dollar und einer IRR von 35% bei einem Goldpreis von 2.400 Dollar.

Wesentliche Höhepunkte sind: eine Lebensdauer der Mine von 5 Jahren, eine durchschnittliche Gehalte von 5,75 g/t Gold, eine Gesamtproduktion von 327.000 Unzen und eine durchschnittliche Jahresproduktion von 65.000 Unzen. In Kombination mit den bestehenden Betrieben wird die jährliche Goldproduktion von Otjikoto voraussichtlich von 2029 bis 2032 110.000 Unzen erreichen. Das Projekt erfordert 129 Millionen Dollar an Investitionskapital mit geschätzten Gesamtkosten von 1.095 Dollar pro Goldunze.

Das Antelope-Vorkommen enthält eine geschätzte Mineralressource von 1,75 Millionen Tonnen mit einem Gehalt von 6,91 g/t Gold für 390.000 Unzen. Das Unternehmen hat 7 Millionen Dollar für die Exploration im Jahr 2025 eingeplant und plant, 44.000 Meter zu bohren, um das Vorkommen auszuweiten und zu verfeinern.

- Strong project economics with 35% IRR and 1.3-year payback period

- High-grade deposit with 5.75 g/t gold average grade

- 95% gold recovery rate expected

- Low AISC of $1,095 per gold ounce

- Existing infrastructure and experienced underground mining team reduces execution risk

- Deposit remains open for expansion along strike in both directions

- Significant upfront capital requirement of $129 million

- Resource currently classified only as Inferred, indicating geological uncertainty

- Relatively short mine life of 5 years

Insights

The Antelope deposit PEA presents a compelling case for B2Gold's expansion at Otjikoto, demonstrating robust economics even under conservative assumptions. The high-grade nature of the deposit at 5.75 g/t gold positions it well above the global underground mining average of ~3.5 g/t, while the 95% recovery rate indicates excellent metallurgical characteristics.

The project's economics are particularly attractive given the existing infrastructure advantages. By leveraging the operational Wolfshag underground mine team and established surface facilities, B2Gold effectively de-risks the project and minimizes capital requirements. The

The sensitivity analysis reveals strong resilience to gold price fluctuations, with positive economics maintained even at

A key strength lies in the exploration upside potential. The planned 44,000m drilling program in 2025, coupled with the deposit remaining open along strike, suggests potential for resource expansion beyond the current 390,000 ounces. The high-grade intersections between the Springbok Zone and Otjikoto Phase 5 pit indicate promising structural continuity that could materially enhance the project's scale.

The operational framework for Antelope demonstrates sophisticated planning that capitalizes on B2Gold's established presence in Namibia. The 20-25% contingency allowances on fixed and variable costs reflect prudent risk management, particularly given the geological setting and mining method requirements.

The decision to employ development-based mining methods with a 3.0 g/t cutoff grade and 4.0m minimum mining width balances operational efficiency with grade optimization. This approach, combined with the existing processing plant's capacity, enables seamless integration of Antelope's ore with low-grade stockpile material, optimizing the overall production profile.

The 3.5km primary decline development represents a significant but manageable undertaking, with the timeline benefiting from transferable experience from Wolfshag. The ventilation and service infrastructure planning appears robust, though successful execution will require careful management of groundwater and geotechnical conditions typical of underground operations in this region.

VANCOUVER, British Columbia, Feb. 04, 2025 (GLOBE NEWSWIRE) -- B2Gold Corp. (TSX: BTO, NYSE AMERICAN: BTG, NSX: B2G) (“B2Gold” or the “Company”) is pleased to announce the preliminary results of a positive Preliminary Economic Assessment (“PEA”) prepared in accordance with National Instrument 43-101 on the Antelope deposit located at the Company’s Otjikoto open pit and underground gold mine in Namibia (“Otjikoto”). The Antelope deposit, which comprises the Springbok Zone, the Oryx Zone, and a possible third structure, Impala, subject to confirmatory drilling, is located approximately 4 kilometers (“km”) southwest of the existing Otjikoto open pit. All dollar figures are in United States dollars unless otherwise indicated.

Highlights

- Enhances the production profile at Otjikoto, with continued strong exploration upside at the Antelope deposit

- Underground gold mine with an initial life of mine of approximately 5 years (“Life of Mine”).

- Average grade processed of 5.75 grams per tonne (“g/t”) gold over the Life of Mine.

- Life of Mine gold production of approximately 327,000 ounces with an average gold recovery of

95% . - Average annual gold production expected to be approximately 65,000 ounces per year over the Life of Mine.

- In combination with the processing of existing low-grade stockpiles, average annual Otjikoto gold production expected to be approximately 110,000 ounces per year from 2029 through 2032.

- Projected all-in sustaining costs (“AISC”) (see “Non-IFRS Measures”) of approximately

$1,095 per gold ounce over the Life of Mine.

- Strong project economics

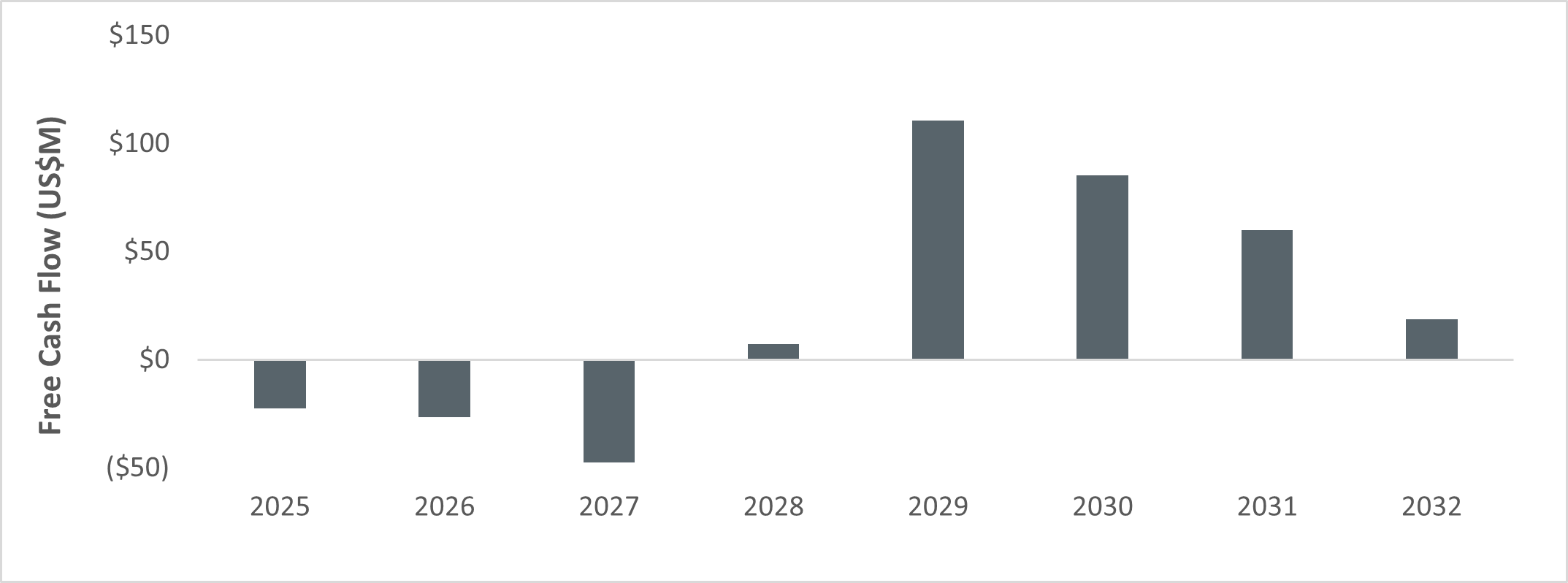

- Life of Mine after-tax free cash flow of

$185 million at$2,400 per ounce gold price. - Assuming a discount rate of

5.0% , net present value (“NPV”) after-tax of$131 million , generating an after-tax internal rate of return (“IRR”) of35% , with a project payback on pre-production capital of 1.3 years. - Estimated pre-production capital cost of

$129 million .

- Life of Mine after-tax free cash flow of

- Leverages experience gained by developing and operating the existing Wolfshag underground mine at Otjikoto

- Permitting and environmental requirements and processes are well understood, and the Antelope deposit is located within the existing mining license area.

- The existing Wolfshag underground mining team can manage the development and operation of the Antelope underground mine.

- Existing relationships with suppliers, contractors, regulators, and consultants increases the confidence level of the PEA and reduces cost and execution risk.

- Surface infrastructure including camp, workshops, offices, and power is in place and operational.

- Exploration upside remains to expand the size of the Antelope deposit

- A total of

$7 million is budgeted for exploration at Otjikoto in 2025 to focus on expanding and refining the Antelope deposit with a total of 44,000 meters (“m”) of drilling planned. - Drilling at the Antelope deposit in 2025 will include 2,500 m of selective infill drilling down to 25 m x 25 m spacing, to better assess the short range continuity of high-grade mineralization in the Springbok Zone.

- Other objectives of the 2025 campaign include extending the footprint of Antelope deposit south of the Springbok Zone and to the north, to establish links between the highly prospective Oryx Zone and high-grade mineralization intersected in drill holes approximately one km south of the Otjikoto Phase 5 open pit.

- A total of

PEA Overview

The PEA, with an effective date of January 15, 2025, was prepared by B2Gold and evaluates recovery of gold from an underground mining operation located approximately 4 km southwest of the existing Otjikoto open pit. Three years of initial mine development includes portal excavation and construction, approximately 3.5 km of primary decline development, and installation of ventilation and other services. The underground mining operation will move up to approximately 1,400 tonnes per day with development-based mining methods (assuming a 3.0 g/t cutoff grade and 4.0 m minimum mining thickness), which will be hauled to the existing processing plant at Otjikoto. Underground gold production will be blended with existing Otjikoto low-grade stockpile feed to increase previously projected gold production by an average of approximately 65,000 ounces per year over the estimated Life of Mine. Engineering and cost parameters, including mine production and development rates and costs, are based on actual costs for the Wolfshag Underground Mine with adjustments for the Antelope Mineral Resource and mine design, and include cost contingencies of

The PEA assumptions include revenues using a gold price of

Table 1 - Key Parameters of the PEA

| Life of Mine | |

| Production Profile | |

| Years | 5 |

| Ore tonnes processed (Mt) | 1.9 |

| Average gold grade processed (g/t) | 5.75 |

| Gold recovery (%) | 95.0 |

| Gold ounces produced (oz) | 327,392 |

| Average annual gold production (oz) | 65,478 |

| Operating & Capital Costs | |

| All-In Sustaining Costs1 ($/oz gold) | 1,095 |

| Pre-production capital ($M) | 129 |

Notes:

- AISC consist of cash operating costs, royalties, corporate G&A, and selling costs and excluding pre-production capital costs. See “Non-IFRS Measures”.

- Capital and operating costs include contingencies of

20% (fixed costs) and25% (variable costs). - Mining parameters include a 3.0 g/t cutoff grade, and minimum thickness of 4.0 m.

Table 2 – Project Economics Summary

| After-Tax | |

| NPV | 131 |

| IRR (%) | 35 |

| Payback (years) | 1.3 |

| Free cash flow ($M) | 185 |

Note:

- NPV

5.0% is calculated as of the start of construction expenditure.

Chart 1 – Incremental Production and Cost Profile by Year

Chart 2 – Free Cash Flow by Year

Note:

- Assumes

$2,400 long-term gold price.

Based on the positive results from the PEA, B2Gold believes that the Antelope deposit has the potential to become a small-scale, low-cost, underground gold mine that can supplement the low-grade stockpile production during the period of 2028 to 2032 and result in a meaningful production profile for Otjikoto into the next decade.

The PEA is subject to a number of assumptions and risks including, among others, that all required permits, permit amendments, and other rights will be obtained in a timely manner, that development of the Antelope deposit will have the support of the government, geotechnical, hydrogeological, and metallurgical assumptions will be confirmed, current selective infill drilling will confirm the continuity of high-grade material in the Springbok Zone, and costs will be similar to the PEA estimates.

The PEA is preliminary in nature and is based on Inferred Mineral Resources that are considered too speculative geologically to have the engineering and economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the PEA based on these Mineral Resources will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Economic Sensitivities

The Antelope deposit is sensitive to the gold price, as demonstrated in the following table:

Table 3 – Economic Sensitivity to Long-Term Gold Price

| Long-Term Gold Price ($/oz) | After-Tax NPV ($M) | After-Tax IRR (%) | |

| 69 | 23 | ||

| 100 | 29 | ||

| 131 | 35 | ||

| 162 | 40 | ||

| 193 | 44 | ||

Antelope Deposit Mineral Resource Estimate

The Mineral Resource estimate for the Antelope deposit has an effective date of June 14, 2024, and is reported using a gold price of

Inferred Mineral Resource Estimate

| Category | Domain | Tonnes | Gold Grade (g/t) | Contained Gold Ounces |

| Inferred | Springbok | 1,630,000 | 7.09 | 370,000 |

| Inferred | Other | 130,000 | 4.60 | 20,000 |

| Inferred | Total | 1,750,000 | 6.91 | 390,000 |

Notes:

- The Qualified Person as defined under National Instrument 43-101 for the Springbok Zone June 2024 Mineral Resource estimate is Andrew Brown, P.Geo., B2Gold’s Vice President, Exploration.

- Mineral Resources have been classified using the 2014 CIM Definition Standards. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. There is no guarantee that all or any part of the Mineral Resource will be converted into a Mineral Reserve. Inferred Resources are considered too geologically speculative to have mining and economic considerations applied to them that would enable them to be categorized as Mineral Reserves.

- Mineral Resources are reported on a

100% basis. - The Springbok Zone June 2024 Mineral Resource Estimate assumes an underground mining method. Mineral resources are reported within optimized stopes that were created using a 3 g/t Au cut-off and minimum thickness of 4 m.

- “Other” resource ounces are adjacent to the main Springbok Zone and are within the 50 x 50 m drill spacing that defines the inferred mineral resource.

- All tonnage, grade and contained metal content estimates have been rounded; rounding may result in apparent summation differences between tonnes, grade, and contained metal content.

Antelope Deposit Next Steps

The Company has approved an initial budget of up to

In addition, as part of the

About B2Gold

B2Gold is a responsible international senior gold producer headquartered in Vancouver, Canada. Founded in 2007, today, B2Gold has operating gold mines in Mali, Namibia and the Philippines, the Goose Project under construction in northern Canada and numerous development and exploration projects in various countries including Mali, Colombia and Finland. B2Gold forecasts total consolidated gold production of between 970,000 and 1,075,000 ounces in 2025.

Qualified Persons

Peter D. Montano, P. Eng., Vice President, Projects, a qualified person under NI 43-101, has approved the scientific and technical information related to operations matters contained in this news release.

Andrew Brown, P. Geo., Vice President, Exploration, a qualified person under NI 43-101, has approved the scientific and technical information related to exploration and mineral resource matters contained in this news release.

ON BEHALF OF B2GOLD CORP.

“Clive T. Johnson”

President and Chief Executive Officer

Source: B2Gold Corp.

The Toronto Stock Exchange and NYSE American LLC neither approve nor disapprove the information contained in this news release.

Production results and production guidance presented in this news release reflect total production at the mines B2Gold operates on a

This news release includes certain "forward-looking information" and "forward-looking statements" (collectively forward-looking statements") within the meaning of applicable Canadian and United States securities legislation, including: projections; outlook; guidance; forecasts; estimates; and other statements regarding future or estimated financial and operational performance, gold production and sales, revenues and cash flows, and capital costs (sustaining and non-sustaining) and operating costs, including projected cash operating costs and AISC, and budgets on a consolidated and mine by mine basis; future or estimated mine life, metal price assumptions, ore grades or sources, gold recovery rates, stripping ratios, throughput, ore processing; statements regarding anticipated exploration, drilling, development, construction, permitting and other activities or achievements of B2Gold; and including, without limitation: total consolidated gold production of between 970,000 and 1,075,000 ounces in 2025; the results and estimates in the Antelope deposit PEA, including the project life, average annual gold production, total gold production, ore tonnes processed, capital cost, net present value, after-tax net cash flow and payback; the potential to convert existing inferred resources to the indicated category; and the potential to develop the Antelope deposit as an underground gold mine. All statements in this news release that address events or developments that we expect to occur in the future are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, although not always, identified by words such as "expect", "plan", "anticipate", "project", "target", "potential", "schedule", "forecast", "budget", "estimate", "intend" or "believe" and similar expressions or their negative connotations, or that events or conditions "will", "would", "may", "could", "should" or "might" occur. All such forward-looking statements are based on the opinions and estimates of management as of the date such statements are made.

Forward-looking statements necessarily involve assumptions, risks and uncertainties, certain of which are beyond B2Gold's control, including risks associated with or related to: the volatility of metal prices and B2Gold's common shares; changes in tax laws; the dangers inherent in exploration, development and mining activities; the uncertainty of reserve and resource estimates; not achieving production, cost or other estimates; actual production, development plans and costs differing materially from the estimates in B2Gold's feasibility and other studies; the ability to obtain and maintain any necessary permits, consents or authorizations required for mining activities; environmental regulations or hazards and compliance with complex regulations associated with mining activities; climate change and climate change regulations; the ability to replace mineral reserves and identify acquisition opportunities; the unknown liabilities of companies acquired by B2Gold; the ability to successfully integrate new acquisitions; fluctuations in exchange rates; the availability of financing; financing and debt activities, including potential restrictions imposed on B2Gold's operations as a result thereof and the ability to generate sufficient cash flows; operations in foreign and developing countries and the compliance with foreign laws, including those associated with operations in Mali, Namibia, the Philippines and Colombia and including risks related to changes in foreign laws and changing policies related to mining and local ownership requirements or resource nationalization generally; remote operations and the availability of adequate infrastructure; fluctuations in price and availability of energy and other inputs necessary for mining operations; shortages or cost increases in necessary equipment, supplies and labour; regulatory, political and country risks, including local instability or acts of terrorism and the effects thereof; the reliance upon contractors, third parties and joint venture partners; the lack of sole decision-making authority related to Filminera Resources Corporation, which owns the Masbate Project; challenges to title or surface rights; the dependence on key personnel and the ability to attract and retain skilled personnel; the risk of an uninsurable or uninsured loss; adverse climate and weather conditions; litigation risk; competition with other mining companies; community support for B2Gold's operations, including risks related to strikes and the halting of such operations from time to time; conflicts with small scale miners; failures of information systems or information security threats; the ability to maintain adequate internal controls over financial reporting as required by law, including Section 404 of the Sarbanes-Oxley Act; compliance with anti-corruption laws, and sanctions or other similar measures; social media and B2Gold's reputation; risks affecting Calibre having an impact on the value of the Company's investment in Calibre, and potential dilution of our equity interest in Calibre; as well as other factors identified and as described in more detail under the heading "Risk Factors" in B2Gold's most recent Annual Information Form, B2Gold's current Form 40-F Annual Report and B2Gold's other filings with Canadian securities regulators and the U.S. Securities and Exchange Commission (the "SEC"), which may be viewed at www.sedar.com and www.sec.gov, respectively (the "Websites"). The list is not exhaustive of the factors that may affect B2Gold's forward-looking statements.

B2Gold's forward-looking statements are based on the applicable assumptions and factors management considers reasonable as of the date hereof, based on the information available to management at such time. These assumptions and factors include, but are not limited to, assumptions and factors related to B2Gold's ability to carry on current and future operations, including: development and exploration activities; the timing, extent, duration and economic viability of such operations, including any mineral resources or reserves identified thereby; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; B2Gold's ability to meet or achieve estimates, projections and forecasts; the availability and cost of inputs; the price and market for outputs, including gold; foreign exchange rates; taxation levels; the timely receipt of necessary approvals or permits; the ability to meet current and future obligations; the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions; and other assumptions and factors generally associated with the mining industry.

B2Gold's forward-looking statements are based on the opinions and estimates of management and reflect their current expectations regarding future events and operating performance and speak only as of the date hereof. B2Gold does not assume any obligation to update forward-looking statements if circumstances or management's beliefs, expectations or opinions should change other than as required by applicable law. There can be no assurance that forward-looking statements will prove to be accurate, and actual results, performance or achievements could differ materially from those expressed in, or implied by, these forward-looking statements. Accordingly, no assurance can be given that any events anticipated by the forward-looking statements will transpire or occur, or if any of them do, what benefits or liabilities B2Gold will derive therefrom. For the reasons set forth above, undue reliance should not be placed on forward-looking statements.

Non-IFRS Measures

This news release includes certain terms or performance measures commonly used in the mining industry that are not defined under International Financial Reporting Standards ("IFRS"), including "all-in sustaining costs" (or "AISC"). Non-IFRS measures do not have any standardized meaning prescribed under IFRS, and therefore they may not be comparable to similar measures employed by other companies. The data presented is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS and should be read in conjunction with B2Gold's consolidated financial statements. Readers should refer to B2Gold's Management Discussion and Analysis, available on the Websites, under the heading "Non-IFRS Measures" for a more detailed discussion of how B2Gold calculates certain of such measures and a reconciliation of certain measures to IFRS terms.

Cautionary Statement Regarding Mineral Reserve and Resource Estimates

The disclosure in this news release was prepared in accordance with Canadian National Instrument 43-101, which differs significantly from the requirements of the United States Securities and Exchange Commission ("SEC"), and resource and reserve information contained or referenced in this news release may not be comparable to similar information disclosed by public companies subject to the technical disclosure requirements of the SEC. Historical results or feasibility models presented herein are not guarantees or expectations of future performance.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/3737a561-8160-4994-903f-08a13c98a4da

https://www.globenewswire.com/NewsRoom/AttachmentNg/bdfad632-8e83-46f2-810e-87dce07d8ade