Barksdale to Acquire 100% Ownership of the Sunnyside Project

Barksdale Resources Corp. has signed a definitive agreement to acquire Regal Resources Inc.'s remaining interest in the Sunnyside project in Arizona, consolidating 100% ownership. Valued at $0.37 per Regal share, the transaction will eliminate Barksdale's future obligations from a previous option agreement. This acquisition is positioned to be immediately accretive for Barksdale's shareholders and enhances the company's portfolio, including high-quality exploration assets across multiple jurisdictions. The deal requires approval from Regal's shareholders and regulatory bodies.

- Acquisition of 100% interest in the Sunnyside project increases asset control.

- Transaction eliminates future work commitments from previous agreements.

- Expected to be immediately accretive for Barksdale shareholders.

- None.

VANCOUVER, BC / ACCESSWIRE / May 12, 2021 / Barksdale Resources Corp. ("Barksdale" or the "Company") (TSXV:BRO)(OTCQX:BRKCF) is pleased to announce it has entered into a definitive agreement with Regal Resources Inc., ("Regal") whereby Barksdale will consolidate a

Highlights

- Barksdale to acquire the balance of the highly prospective Sunnyside copper-zinc-lead-silver project in Arizona, providing it with full control of the project moving forward.

- The Transaction is immediately accretive to Barksdale shareholders and eliminates all future Barksdale work commitments contained in the 2017 option agreement between Barksdale and Regal.

- The Transaction values Regal shares at

$0.37 per share, which includes repayment of all of Regal's outstanding debt and a partial payment of taxes owing on the Transaction. - The Transaction allows Regal shareholders to participate in a larger, more liquid company that not only holds the consolidated Sunnyside project, but also the

100% owned San Antonio, Goat Canyon, and Canelo copper porphyry exploration projects near Sunnyside as well as the San Javier copper-gold project in Sonora, Mexico. - Transaction approved by both companies' Board of Directors

"This Transaction is the culmination of years of hard work by our team, including productive and detailed negotiations over the past few months with the new Regal board of directors. As we near the end of the Sunnyside permitting process, consolidating the balance of Sunnyside under one roof is the most logical step to unlocking the potential value of not only Sunnyside, but the entire district-scale mineral rights package that Barksdale has been working to expand" stated Rick Trotman, President and CEO of Barksdale.

Darren Blasutti, Chairman of the Board of Barksdale, stated "I must commend Matt Sauder, Chairman of Regal Resources, as well as the other board members at Regal for stepping into an insolvent and cease-traded company, sorting through the many challenges and within less than a year, finding a win-win solution with Barksdale to create a larger, more liquid company. The enhanced Barksdale will have a portfolio of

Benefits to Barksdale Shareholders

100% ownership of Barksdale's flagship Sunnyside asset, which forms the core of our Patagonia mining district portfolio.- Full control of the project moving forward, including the elimination of all further work commitments as well as share and cash payments contained in the 2017 option agreement between Barksdale and Regal.

- An accretive transaction for Barksdale shareholders that allows for Consideration Shares to be released in multiple tranches over a twelve-month timeframe

Benefits to Regal Shareholders

- Regal expects to distribute Barksdale shares to its shareholders in due course, providing them with direct exposure to a larger company with increased liquidity and a dedicated management team.

- The Transaction accelerates the timeline of value delivery to Regal and its shareholders while also allowing the company to repay its significant debt burden.

- Transaction represents a considerable premium over Regal's

$0.06 5 trading price prior to being cease traded in 2015 as well as their last equity financing price of$0.12 in the same year. - Regal shareholders gain exposure to Barksdale's broad portfolio of exploration assets, including the expanded Patagonia mining district properties and San Javier copper-gold project, where drilling will be commencing early in the third quarter.

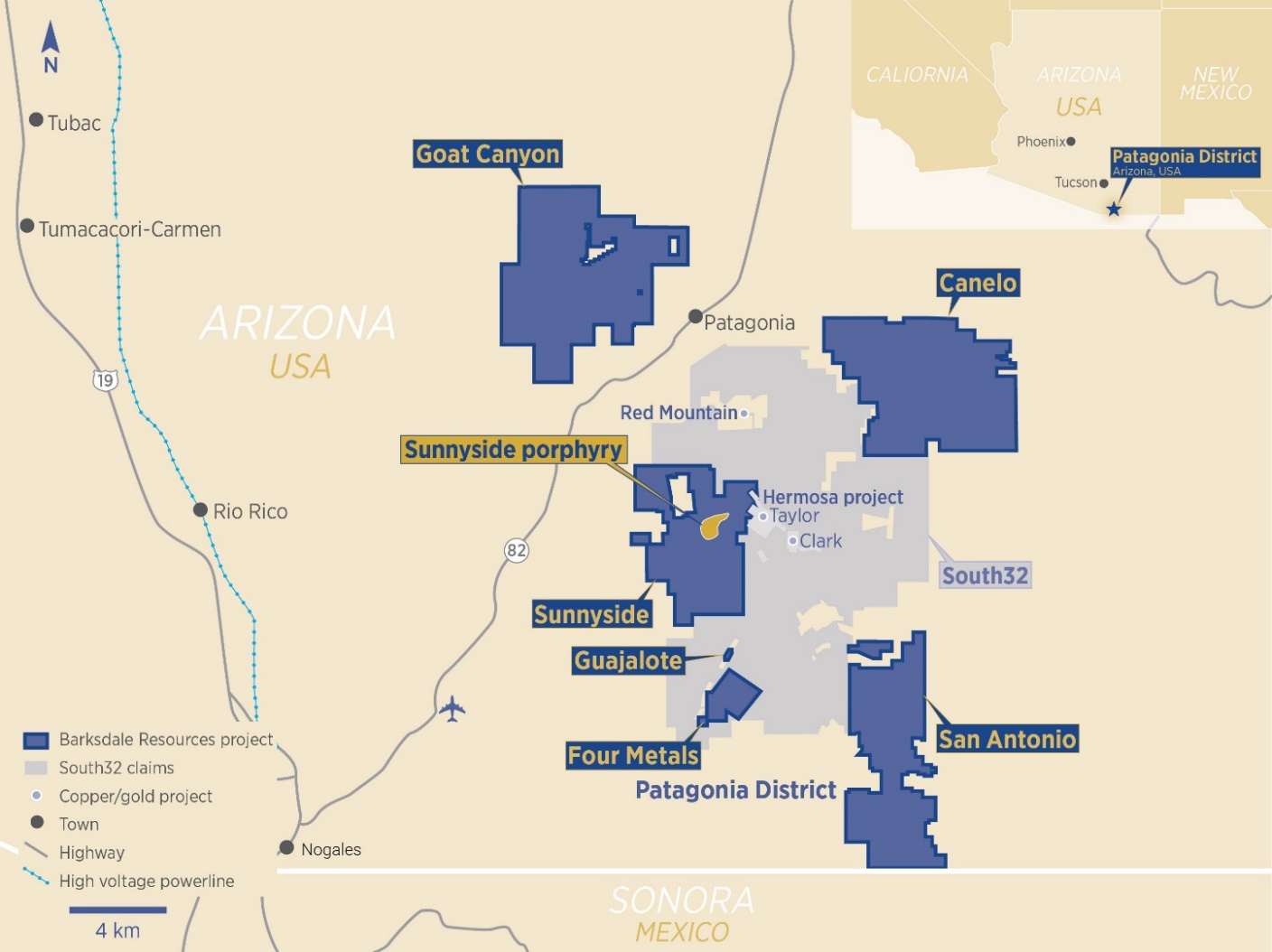

Figure 1. District map highlighting Barksdale's properties, including the newly acquired Canelo and Goat Canyon properties.

Transaction Details

The Transaction for Barksdale to acquire the remaining interest in the Sunnyside project has been agreed to with Regal through a definitive purchase agreement dated May 11, 2021 ("Purchase Agreement") where Barksdale will acquire the shares of Regal Resources USA, Inc., ("Regal USA") which is a wholly owned subsidiary of Regal.

Total consideration for the Transaction consists of the following:

- issuance of up to 18,150,000 common shares of Barksdale ("Consideration Shares");

- release of 3,850,000 common shares of Barksdale that have been held in escrow per the 2017 Option Agreement ("Escrow Shares");

- acquisition and forgiveness of up to

$4,000,000 of Regal's existing debt facilities ("Debt Acquisition"); and - future payments by Barksdale of a portion of US Federal FIRPTA taxes on behalf of Regal.

The Transaction is immediately accretive to Barksdale shareholders, as the Company is consolidating

Debt Acquisition

Upon signing of the Purchase Agreement, Barksdale will (i) acquire an existing

Barksdale will acquire the Demand Loan in exchange for

The Bridge Loan will be secured over Regal's assets, bear an interest rate of

Consideration Shares

Upon completion of the Transaction, Barksdale will release from escrow 3,850,000 common shares of Barksdale that are currently held in Regal's name but escrowed pursuant to the Contribution Agreement (the "Escrow Shares").

Additionally, Barksdale will issue up to an additional 18,150,000 common shares ("Consideration Shares") to Regal in three tranches, as follows:

- 3,483,333 common shares to be issued upon completion of the Transaction (the "First Tranche Shares");

- 7,333,333 common shares to be issued 4 months after completion of the Transaction (the "Second Tranche Shares"); and

- 7,333,334 common shares to be issued 8 months after completion of the Transaction (the "Third Tranche Shares").

The issuance of the Second Tranche Shares and the Third Tranche Shares will be conditional upon Regal having distributed the First Tranche Shares and Escrow Shares, by way of a dividend, a return of capital, or otherwise, to the shareholders of Regal. These issuances shall be in accordance with applicable securities laws and policies of the TSX Venture Exchange, such that no recipient will hold more than

Approvals and Timing

The Transaction is subject to regulatory approval as well as approval by Regal shareholders. The board of directors of Regal has determined that the proposed Transaction is in the best interests of Regal, is fair to its shareholders and is recommending that shareholders of Regal vote in favor of the proposed Transaction.

The Transaction is subject to other conditions customary for a public transaction of this nature including a reciprocal break fee of

The terms and conditions of the proposed Transaction will be summarized in Regal's management information circular, which will be filed and mailed to its shareholders in May 2021. If the Transaction is approved by the shareholders of Regal, it is anticipated that closing of the Transaction would occur in late 2nd Quarter or early 3rd Quarter, 2021.

Advisors

Borden Ladner Gervais LLP is acting as legal counsel to Barksdale in connection to the Transaction. MLT Aikins LLP is acting as legal counsel to Regal.

Barksdale Resources Corp. is a base metal exploration company headquartered in Vancouver, BC, that is focused on the acquisition, exploration and advancement of highly prospective base metal projects in North America. Barksdale is currently advancing the Sunnyside copper-zinc-lead-silver and San Antonio copper projects, both of which are in Patagonia mining district of southern Arizona, as well as the San Javier copper-gold project in central Sonora, Mexico.

ON BEHALF OF BARKSDALE RESOURCES CORP

Rick Trotman

President, CEO and Director

Rick@barksdaleresources.com

Terri Anne Welyki

Vice President of Communications

778-238-2333

TerriAnne@barksdaleresources.com

For more information please phone 778-238-2333, email info@barksdaleresources.com or visit www.BarksdaleResources.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This news release includes "forward-looking information" under applicable Canadian securities legislation. Such forward-looking information reflects management's current beliefs and are based on a number of estimates and assumptions made by and information currently available to the Company that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Readers are cautioned that such forward-looking information are neither promises nor guarantees, and are subject to known and unknown risks and uncertainties including, but not limited to, general business, economic, competitive, political and social uncertainties, uncertain and volatile equity and capital markets, lack of available capital, actual results of exploration activities, environmental risks, future prices of base and other metals, operating risks, accidents, labor issues, delays in obtaining governmental approvals and permits, and other risks in the mining industry. In addition, there is uncertainty about the spread of COVID-19 and the impact it will have on the Company's operations, supply chains, ability to access mineral properties, conduct due diligence or procure equipment, contractors and other personnel on a timely basis or at all and economic activity in general. All forward-looking information contained in this news release is qualified by these cautionary statements and those in our continuous disclosure filings available on SEDAR at www.sedar.com. Accordingly, readers should not place undue reliance on forward-looking information. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by law.

SOURCE: Barksdale Resources Corp.

View source version on accesswire.com:

https://www.accesswire.com/646727/Barksdale-to-Acquire-100-Ownership-of-the-Sunnyside-Project

FAQ

What is the purpose of Barksdale's acquisition of the Sunnyside project?

What are the financial implications of the acquisition for Barksdale Resources (BRKCF)?

When is the transaction expected to close?

How will Regal shareholders benefit from this transaction?