Bank of Idaho Holding Company Reports Second Quarter 2024 Financial Results

Rhea-AI Summary

Bank of Idaho Holding Company (OTCQX:BOID) reported consolidated net income of $2,586,000, or $0.58 per diluted share, for Q2 2024. This includes a one-time tax expense of $425,000. Adjusted earnings were $3,011,000, or $0.68 per diluted share. Key highlights:

- Loans held for investment grew 5.1% in Q2 and 23.3% year-over-year

- Total core deposits increased 8.0% in Q2 and 14.7% year-over-year

- Pre-tax, pre-provision net income was $4.57 million

- Tangible book value per share increased to $25.90, up 3.0% from Q1 and 12.3% year-over-year

The company maintained strong asset quality with nonaccrual loans at 0.24% of total loans. The efficiency ratio was 64.8%, and the Bank's Tier 1 leverage ratio was 11.57%.

Positive

- Consolidated net income of $2,586,000 for Q2 2024

- Loans held for investment grew 5.1% in Q2 and 23.3% year-over-year

- Total core deposits increased 8.0% in Q2 and 14.7% year-over-year

- Tangible book value per share increased 3.0% from Q1 and 12.3% year-over-year

- Strong asset quality with nonaccrual loans at 0.24% of total loans

- Bank's Tier 1 leverage ratio of 11.57%, well above regulatory requirements

Negative

- One-time tax expense of $425,000 impacted Q2 earnings

- Net interest margin decreased to 4.19% from 4.43% in Q1 and 4.82% in Q2 2023

- Noninterest income decreased 14.1% from Q1 2024 and 5.7% from Q2 2023

- Efficiency ratio increased to 64.8% from 64.0% in Q1 2024

News Market Reaction – BOID

On the day this news was published, BOID declined NaN%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

IDAHO FALLS, ID / ACCESSWIRE / July 26, 2024 / Bank of Idaho Holding Company (the "Company") (OTCQX:BOID), the holding company for Bank of Idaho (the "Bank"), today announced its unaudited financial results for the quarter ended June 30, 2024. The Company reported consolidated net income of

"We are pleased to announce a strong second quarter with Bank of Idaho generating

Quarterly Summary

Loans held for investment grew

$47.1 million , or5.1% , in Q2 2024 and increased$182.2 million , or23.3% , from Q2 2023.Total core deposits increased

$75.9 million , or8.0% , in Q2 2024 and were up$131.1 million , or14.7% , from Q2 2023.Pre-tax, pre-provision ("PTPP") net income was

$4.57 million in Q2 2024, compared to$4.76 million in Q1 2024 and$3.66 million in Q2 2023.Tangible book value ("TBV") per share increased to

$25.90 , or3.0% , from$25.16 at Q1 2024, and increased12.3% from$23.06 at Q2 2023. The increase in TBV is attributable to earnings and a decrease in unrealized losses within our securities portfolio.

Operating Results

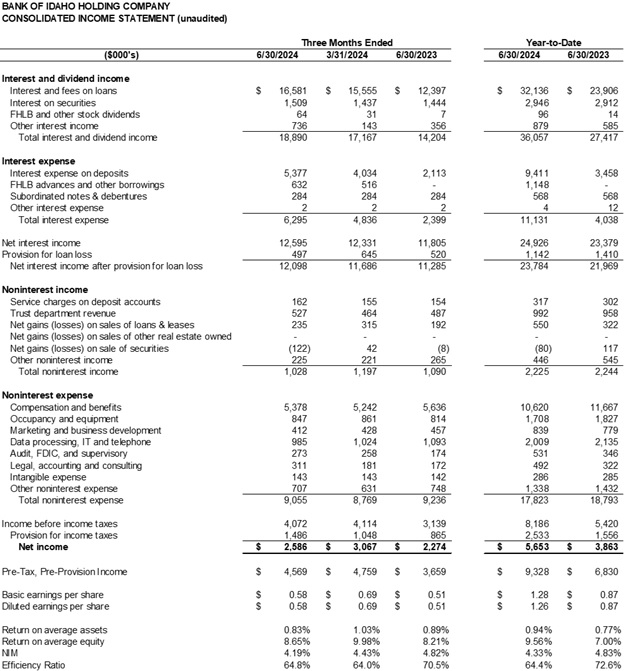

Net income for the second quarter of 2024 was

Net interest income for Q2 2024 was

Net interest margin for the second quarter of 2024 was

Noninterest income, including net gains and losses, for Q2 2024 was

Noninterest expense of

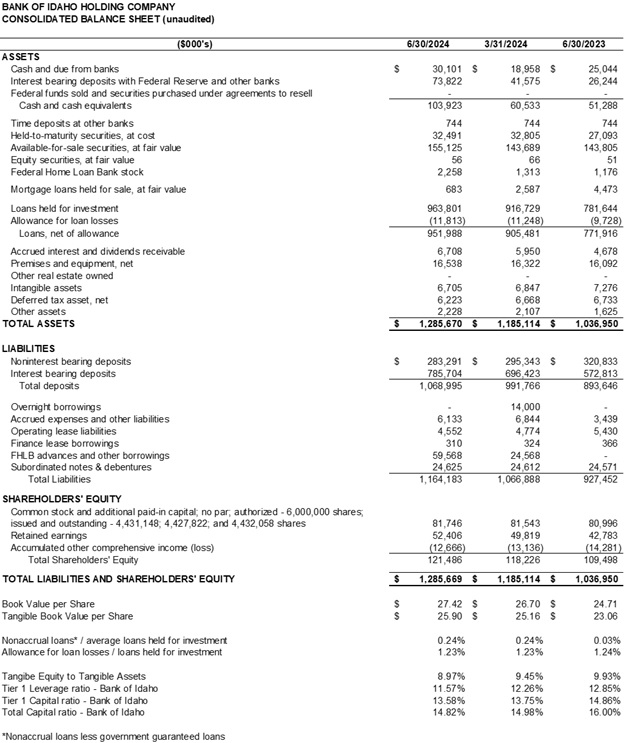

Total assets were

Loans held for investment were

Deposits were

Borrowings were

Asset quality remained strong in Q2 2024. Nonaccrual loans, excluding government guaranteed balances, totaled

The Allowance for Credit Losses ("ACL") totaled

Capital ratios of the Company and Bank continue to exceed the "well-capitalized" capital levels set by our respective regulators. As of June 30, 2024, the Bank's Tier 1 leverage ratio was

About Bank of Idaho Holding Company

Bank of Idaho Holding Company is a bank holding company headquartered in Idaho Falls, Idaho. The Company's subsidiary, Bank of Idaho, is an independent commercial bank providing a range of business, personal, and mortgage banking products and services, as well as trust and wealth management services, to customers in Idaho and eastern Washington. The Company's common stock is traded on the OTCQX exchange under the symbol "BOID."

Non-GAAP Financial Measures

Some of the financial measures included in this press release are not measures of financial performance recognized in accordance with generally accepted accounting principles in the United States ("GAAP"). These non-GAAP financial measures include "efficiency ratio," "tangible common equity," "tangible common equity to tangible assets," "tangible book value per share," and "pre-tax pre-provision net income." Efficiency ratio is computed by dividing total noninterest expense, including intangible expense, by the sum of net interest income and noninterest income, including gains and losses. Tangible common equity is computed by subtracting goodwill and core deposit intangibles from total stockholders' equity. Tangible common equity to tangible assets is computed by dividing total assets, less goodwill and core deposit intangibles, by tangible common equity. Tangible book value per share is computed by dividing tangible common equity by common shares outstanding. Pre-tax, pre-provision net income is computed by adding provision for loan loss expense and income tax expense to net income. The Company believes these non-GAAP financial measures provide both management and investors with a more complete understanding of the Company's financial position and performance. These non-GAAP financial measures are supplemental and are not a substitute for any analysis based on GAAP financial measures. Not all companies use the same calculation of these measures; therefore, this presentation may not be comparable to other similarly titled measures as presented by other companies.

Forward-Looking Statements

This press release contains, among other things, certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, statements preceded by, followed by, or that include the words "may," "could," "should," "would," "believe," "anticipate," "estimate," "expect," "intend," "plan," "projects," "outlook" or similar expressions. These statements are based upon the current belief and expectations of the Company's management team and are subject to significant risks and uncertainties that are subject to change based on various factors (many of which are beyond the Company's control). Although the Company believes that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove to be inaccurate. Therefore, the Company can give no assurance that the results contemplated in the forward-looking statements will be realized. The inclusion of this forward-looking information should not be construed as a representation by the Company or any other person that the future events, plans, or expectations contemplated by the Company will be achieved.

All subsequent written and oral forward-looking statements attributable to the Company or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. The Company does not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statements are made, except as required by law.

###

CONTACT: Matt Borud, Bank of Idaho

Phone: 208.412.2322

Email: mattborud@bankofidaho.net

SOURCE: Bank Of Idaho Holding Co

View the original press release on accesswire.com