Bank of Idaho Holding Company Reports Fourth Quarter 2024 Financial Results

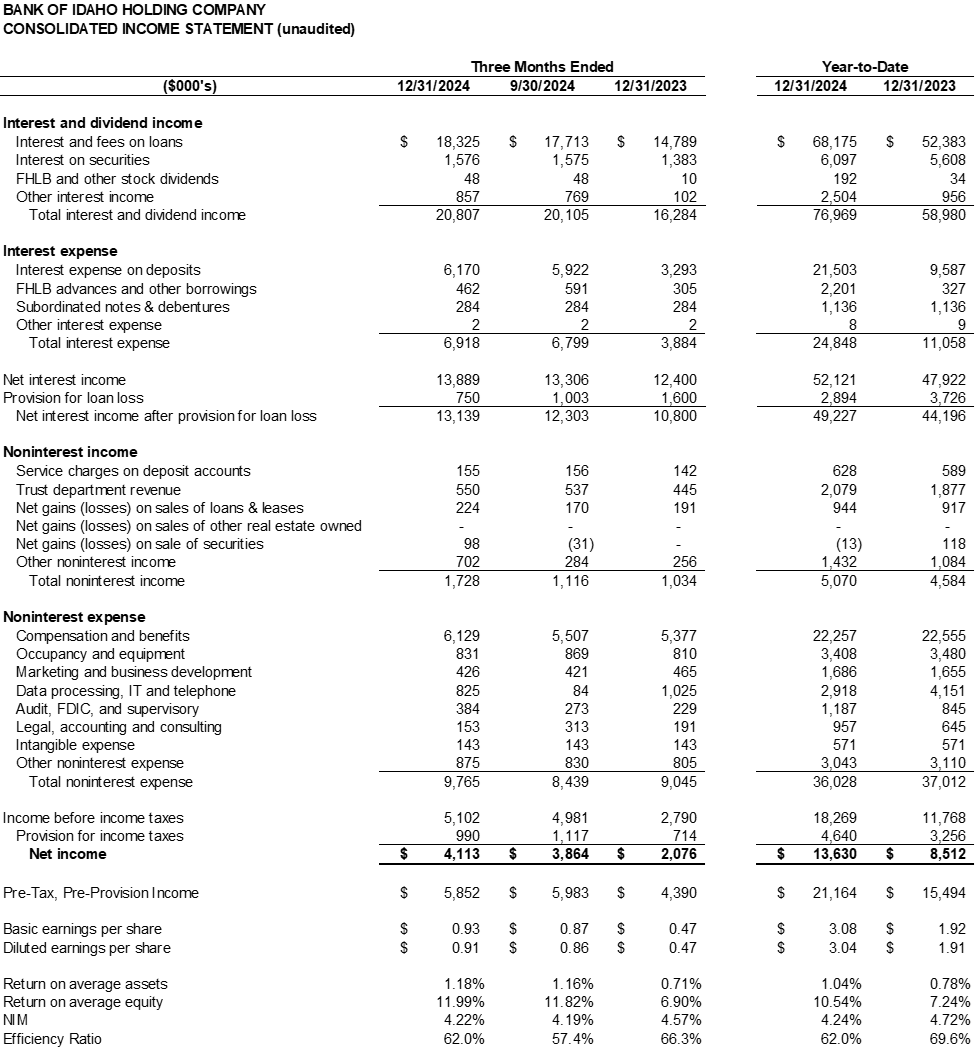

Bank of Idaho Holding Company (OTCQX:BOID) reported strong Q4 2024 financial results with consolidated net income of $4.1 million ($0.91 per diluted share), up from $3.9 million in Q3 2024 and $2.1 million in Q4 2023. Adjusted earnings were $4.3 million ($0.96 per diluted share).

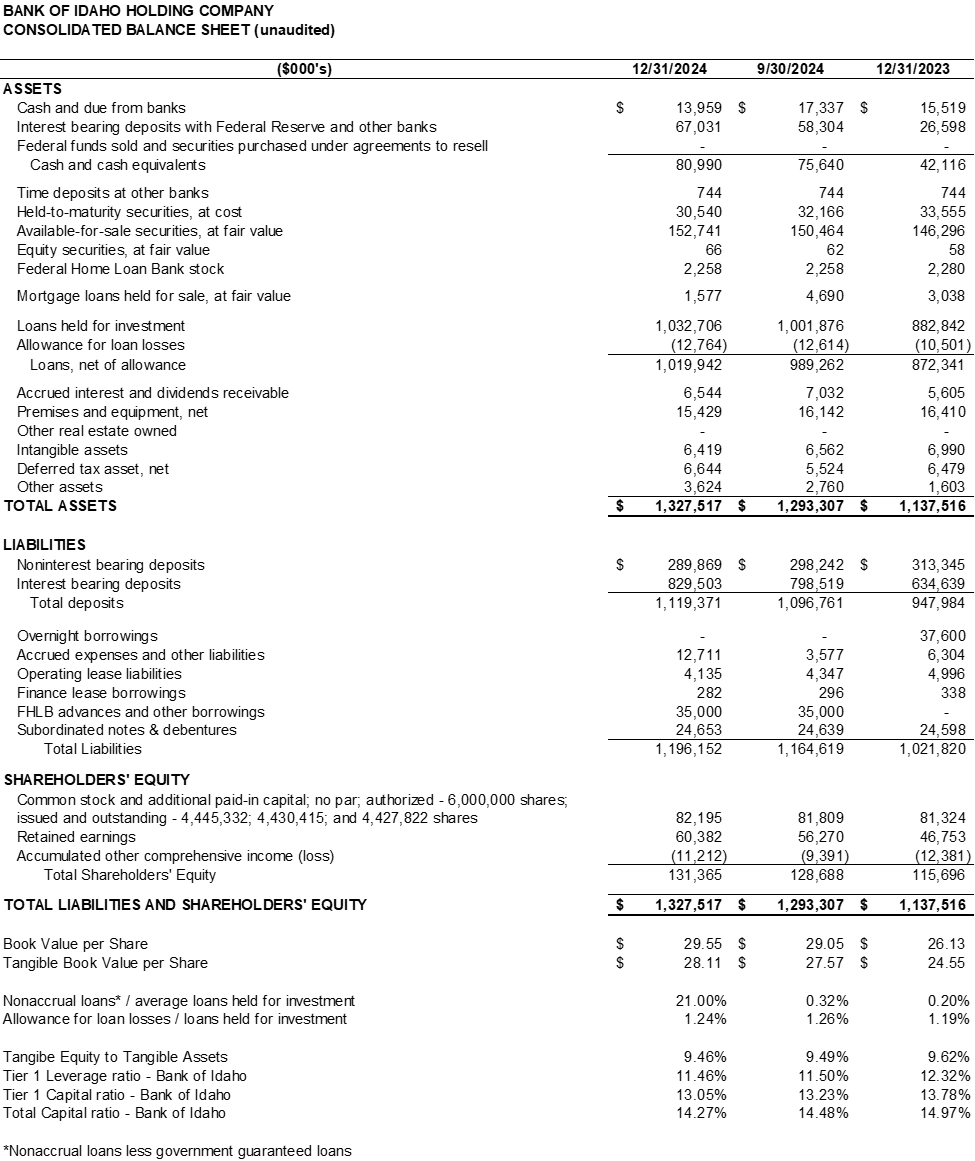

Key highlights include: loans held for investment grew 3.1% to $1.033 billion in Q4; total core deposits increased 2.1% to $1.119 billion; net interest margin was 4.22%; and tangible book value per share rose to $28.11. The company maintained strong asset quality with nonaccrual loans at 0.21% of total loans.

In October 2024, the company negotiated a non-binding letter of intent with Glacier Bancorp, leading to a definitive merger agreement on January 13, 2025, at 2x premium to tangible book value per share.

Bank of Idaho Holding Company (OTCQX:BOID) ha riportato risultati finanziari solidi per il quarto trimestre del 2024, con un reddito netto consolidato di 4,1 milioni di dollari (0,91 dollari per azione diluita), in aumento rispetto ai 3,9 milioni di dollari del terzo trimestre del 2024 e ai 2,1 milioni di dollari del quarto trimestre del 2023. Gli utili rettificati sono stati di 4,3 milioni di dollari (0,96 dollari per azione diluita).

I principali risultati includono: prestiti in portafoglio aumentati del 3,1% a 1,033 miliardi di dollari nel quarto trimestre; depositi core totali aumentati del 2,1% a 1,119 miliardi di dollari; margine di interesse netto del 4,22%; e valore contabile tangibile per azione salito a 28,11 dollari. L'azienda ha mantenuto una qualità degli attivi forte, con prestiti non di accrescita allo 0,21% del totale dei prestiti.

Nel ottobre 2024, l'azienda ha negoziato una lettera di intenti non vincolante con Glacier Bancorp, portando a un accordo di fusione definitivo il 13 gennaio 2025, con un premio di 2 volte il valore contabile tangibile per azione.

Bank of Idaho Holding Company (OTCQX:BOID) reportó resultados financieros sólidos para el cuarto trimestre de 2024, con un ingreso neto consolidado de 4.1 millones de dólares (0.91 dólares por acción diluida), un aumento respecto a los 3.9 millones de dólares en el tercer trimestre de 2024 y a los 2.1 millones de dólares en el cuarto trimestre de 2023. Las ganancias ajustadas fueron de 4.3 millones de dólares (0.96 dólares por acción diluida).

Los aspectos más destacados incluyen: los préstamos mantenidos para inversión crecieron un 3.1% a 1.033 millones de dólares en el cuarto trimestre; los depósitos nucleares totales aumentaron un 2.1% a 1.119 millones de dólares; el margen de interés neto fue del 4.22%; y el valor contable tangible por acción aumentó a 28.11 dólares. La empresa mantuvo una fuerte calidad de activos con préstamos no devengados al 0.21% del total de préstamos.

En octubre de 2024, la empresa negoció una carta de intención no vinculante con Glacier Bancorp, lo que llevó a un acuerdo de fusión definitivo el 13 de enero de 2025, con una prima de 2 veces el valor contable tangible por acción.

아이오와 은행 홀딩 컴퍼니 (OTCQX:BOID)가 2024년 4분기 재무 결과를 발표했습니다. consolidated net income는 410만 달러 (희석주당 0.91달러)로 증가해, 2024년 3분기의 390만 달러와 2023년 4분기의 210만 달러에서 상승했습니다. 조정된 수익은 430만 달러 (희석주당 0.96달러)였습니다.

주요 하이라이트는 다음과 같습니다: 투자용 대출이 3.1% 증가하여 10억 3300만 달러에 이르렀고; 핵심 예금 총액이 2.1% 증가하여 11억 1900만 달러에 이르렀으며; 순이자 마진은 4.22%였고; 희석주당 tangible book value는 28.11달러로 증가했습니다. 회사는 고품질 자산을 유지했으며, 연체 대출은 전체 대출의 0.21%였습니다.

2024년 10월, 회사는 Glacier Bancorp와 비구속적인 의향서(letter of intent)를 협상하였고, 이는 2025년 1월 13일에 tangible book value per share의 2배 프리미엄으로 확정된 합병 계약으로 이어졌습니다.

Bank of Idaho Holding Company (OTCQX:BOID) a annoncé de solides résultats financiers pour le quatrième trimestre de 2024, avec un revenu net consolidé de 4,1 millions de dollars (0,91 dollar par action diluée), en hausse par rapport à 3,9 millions de dollars au troisième trimestre de 2024 et 2,1 millions de dollars au quatrième trimestre de 2023. Les bénéfices ajustés s'élevaient à 4,3 millions de dollars (0,96 dollar par action diluée).

Les points forts comprennent : les prêts détenus pour investissement ont augmenté de 3,1 % pour atteindre 1,033 milliard de dollars au quatrième trimestre ; les dépôts de base totaux ont crû de 2,1 % pour atteindre 1,119 milliard de dollars ; le taux d'intérêt net était de 4,22 % ; et la valeur comptable tangible par action a augmenté à 28,11 dollars. L'entreprise a maintenu une forte qualité d'actifs avec des prêts non échus à 0,21 % du total des prêts.

En octobre 2024, l'entreprise a négocié une lettre d'intention non contraignante avec Glacier Bancorp, entraînant un accord de fusion définitif le 13 janvier 2025, avec une prime de 2x par rapport à la valeur comptable tangible par action.

Bank of Idaho Holding Company (OTCQX:BOID) hat starke Finanzkennzahlen für das 4. Quartal 2024 berichtet, mit einem konsolidierten Nettoeinkommen von 4,1 Millionen Dollar (0,91 Dollar pro verwässerter Aktie), ein Anstieg von 3,9 Millionen Dollar im 3. Quartal 2024 und 2,1 Millionen Dollar im 4. Quartal 2023. Die bereinigten Erträge betrugen 4,3 Millionen Dollar (0,96 Dollar pro verwässerter Aktie).

Wichtige Höhepunkte sind: die für Investitionen gehaltenen Kredite wuchsen um 3,1% auf 1,033 Milliarden Dollar im 4. Quartal; die gesamten Kern-Einlagen stiegen um 2,1% auf 1,119 Milliarden Dollar; die Nettomarge lag bei 4,22%; und der netto buchwert pro Aktie erhöhte sich auf 28,11 Dollar. Das Unternehmen hielt eine hohe Vermögensqualität mit überfälligen Krediten von 0,21% der Gesamtkredite.

Im Oktober 2024 hat das Unternehmen ein nicht verbindliches Absichtsschreiben mit Glacier Bancorp ausgehandelt, was zu einer endgültigen Fusionsvereinbarung am 13. Januar 2025 führte, mit einem Aufpreis von 2x dem Buchwert pro Aktie.

- Net income increased 98.1% YoY to $4.1 million in Q4 2024

- Loans held for investment grew 17.0% YoY to $1.033 billion

- Total core deposits up 19.5% YoY

- Strong asset quality with nonaccrual loans at only 0.21% of total loans

- Merger agreement with Glacier Bancorp at 2x premium to tangible book value

- Non-interest-bearing deposits decreased by $8.4 million (2.8%) QoQ

- Efficiency ratio increased to 62.0% from 57.4% in Q3 2024

- Net charge-offs of $557,000 in Q4 2024

- Net interest margin declined to 4.22% from 4.57% YoY

IDAHO FALLS, ID / ACCESS Newswire / January 22, 2025 / Bank of Idaho Holding Company (the "Company") (OTCQX:BOID), the holding company for Bank of Idaho (the "Bank"), today announced its unaudited financial results for the quarter ended December 31, 2024. The Company reported consolidated net income of

"I am pleased to report a strong fourth quarter for Bank of Idaho, with

Quarterly Summary

Loans held for investment grew

$30.8 million , or3.1% , in Q4 2024 and increased$149.9 million , or17.0% , from Q4 2023.Total core deposits increased

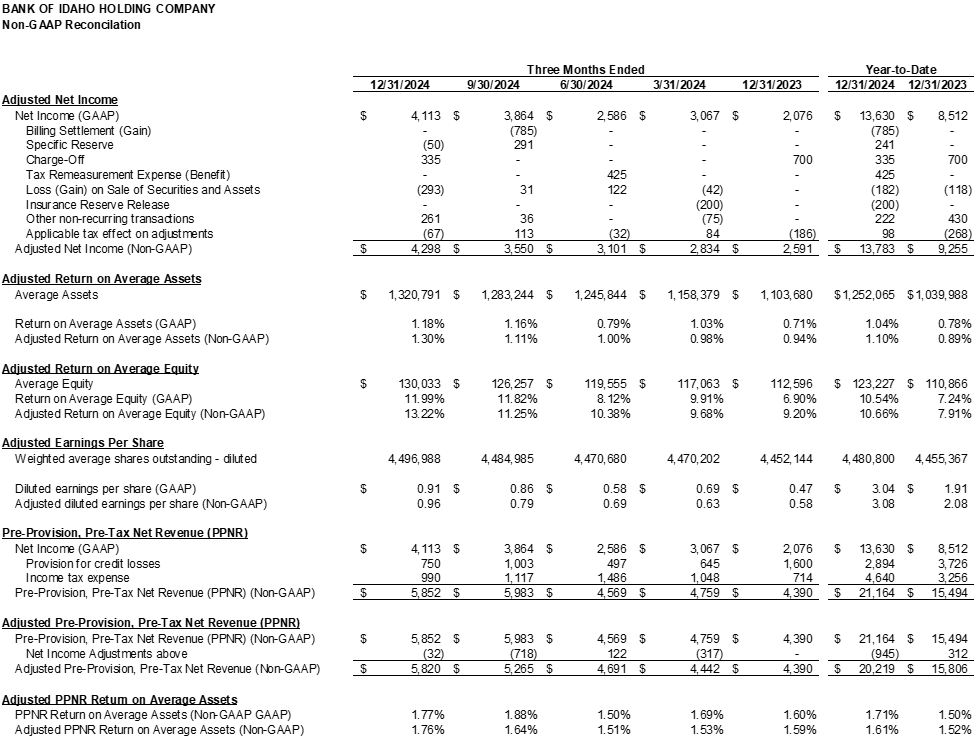

$22.6 million , or2.1% , in Q4 2024 and were up$176.4 million , or19.5% , from Q4 2023.Adjusted return on average assets ("ROAA") was

1.30% in Q4 2024, compared to1.11% in Q3 2024 and0.94% in Q4 2023.Adjusted pre-tax, pre-provision net revenue ("PPNR") was

$5.82 million in Q4 2024, compared to$5.27 million in Q3 2024 and$4.39 million in Q4 2023.Tangible book value ("TBV") per share increased to

$28.11 , or2.0% , from$27.57 at Q3 2024, and increased14.5% from$24.55 at Q4 2023. The increase in TBV is attributable to earnings and a decrease in unrealized losses within our securities portfolio.

Operating Results

Net income for the fourth quarter of 2024 was

Net interest income for Q4 2024 was

Net interest margin for the fourth quarter of 2024 was

Noninterest income, including net gains and losses, for Q4 2024 was

Noninterest expense of

Total assets were

Loans held for investment were

Deposits were

Borrowings were

Asset quality remained strong in Q4 2024. Nonaccrual loans, excluding government guaranteed balances, totaled

The Allowance for Credit Losses ("ACL") totaled

Capital ratios of the Company and Bank continue to exceed the "well-capitalized" capital levels set by our respective regulators. As of December 31, 2024, the Bank's Tier 1 leverage ratio was

About Bank of Idaho Holding Company

Bank of Idaho Holding Company is a bank holding company headquartered in Idaho Falls, Idaho. The Company's subsidiary, Bank of Idaho, is an independent commercial bank providing a range of business, personal, and mortgage banking products and services, as well as trust and wealth management services, to customers in Idaho and eastern Washington. The Company's common stock is traded on the OTCQX exchange under the symbol "BOID."

Non-GAAP Financial Measures

Some of the financial measures included in this press release are not measures of financial performance recognized in accordance with generally accepted accounting principles in the United States ("GAAP"). These non-GAAP financial measures include "efficiency ratio," "tangible common equity," "tangible common equity to tangible assets," "tangible book value per share," and "pre-tax pre-provision net income." Efficiency ratio is computed by dividing total noninterest expense, including intangible expense, by the sum of net interest income and noninterest income, including gains and losses. Tangible common equity is computed by subtracting goodwill and core deposit intangibles from total stockholders' equity. Tangible common equity to tangible assets is computed by dividing total assets, less goodwill and core deposit intangibles, by tangible common equity. Tangible book value per share is computed by dividing tangible common equity by common shares outstanding. Pre-tax, pre-provision net income is computed by adding provision for loan loss expense and income tax expense to net income. The Company believes these non-GAAP financial measures provide both management and investors with a more complete understanding of the Company's financial position and performance. These non-GAAP financial measures are supplemental and are not a substitute for any analysis based on GAAP financial measures. Not all companies use the same calculation of these measures; therefore, this presentation may not be comparable to other similarly titled measures as presented by other companies.

Forward-Looking Statements

This press release contains, among other things, certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, statements preceded by, followed by, or that include the words "may," "could," "should," "would," "believe," "anticipate," "estimate," "expect," "intend," "plan," "projects," "outlook" or similar expressions. These statements are based upon the current belief and expectations of the Company's management team and are subject to significant risks and uncertainties that are subject to change based on various factors (many of which are beyond the Company's control). Although the Company believes that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove to be inaccurate. Therefore, the Company can give no assurance that the results contemplated in the forward-looking statements will be realized. The inclusion of this forward-looking information should not be construed as a representation by the Company or any other person that the future events, plans, or expectations contemplated by the Company will be achieved.

All subsequent written and oral forward-looking statements attributable to the Company or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. The Company does not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statements are made, except as required by law.

CONTACT:

Matt Borud, Bank of Idaho

Phone: 208.412.2322

Email: mattborud@bankofidaho.net

SOURCE: Bank Of Idaho Holding Co

View the original press release on ACCESS Newswire