Ballard Reports Q1 2023 Results

"Our first quarter revenue of

"With our Q1 expenses also on plan, we are tracking to our full-year guidance ranges for operating and capital expenses. We continue to prioritize investments in our technology and product development programs, product cost reduction initiatives, customer platform wins, customer experience, and advanced manufacturing," Mr. MacEwen added.

Mr. MacEwen continued, "As previously communicated, we continue to see gross margin pressures into 2024 given our revenue mix, pricing strategy, investments in production capacity, and timing lag before our production volumes ramp and our product cost reduction initiatives move into production. We ended the quarter with

"We are looking forward to our upcoming Capital Markets Day on June 13th, where we will provide key updates on long-term business plan, including sales growth in our verticals, gross margin progression, our technology and product roadmap, product cost reduction, capital expenditures, and ESG initiatives. We will also unveil our TCO-driven comparative value proposition model for fuel cell trucks," Mr. MacEwen concluded.

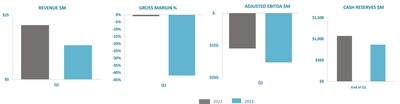

(all comparisons are to Q1 2022 unless otherwise noted)

- Total revenue was

$13.3 million 37% year-over-year. - Heavy Duty Mobility revenue of

$8.7 million 11% , driven primarily by lower revenues from Technology Services contracts inChina relating to our truck vertical, partially offset by higher rail and marine revenue. - Stationary revenue of

$2.5 million 58% due primarily to a decrease in sales of stationary power generation fuel cell modules, stacks, products, and services inAustralia . - Emerging and Other Markets revenue of

$2.1 million 61% due primarily to the completion of the Audi Technology Services program and lower shipments in our Materials Handling segment. - Power products revenue represented more than

70% of our total revenue in the quarter. - Gross margin was (42)% in the quarter, a decrease of 41-points, driven by a combination of a greater weight of power products in the revenue mix, pricing strategy, increased investment in manufacturing capacity, increases in supply and labor costs, and inventory adjustments.

- Total Operating Expenses and Cash Operating Costs3 were

$37.5 million $32.0 million 24% and23% , respectively, from Q1 2022. Increases were driven primarily by higher expenditures on research, technology and product development activities, and sales and marketing activities. - Adjusted EBITDA3 was

( , compared to$38.3) million ( in Q1 2022, primarily as a result of the decrease in gross margin and increase in Cash Operating Costs.$27.5) million - Ballard received approximately

$17.6 million $13.3 million $137.7 million Europe andNorth America in the bus and stationary power markets. These regions combined represent approximately76% of the total Order Backlog, compared to approximately39% at end-Q1 2022. Specifically, the Power Products Order Backlog accounts for nearly75% of our total Order Backlog, an increase of100% since Q1 2022, and is at the highest level in Ballard's history. - The 12-month Order Book was

$73.9 million $16.6 million 29% quarter over quarter increase.

Order Backlog ($M) | Order Backlog | Orders Received | Orders Delivered | Order Backlog |

Total Fuel Cell |

Consistent with the Company's past practice, and in view of the early stage of hydrogen fuel cell market development and adoption, we are not providing revenue or net income (loss) guidance for 2023. In 2023, we continue our plan to invest in the business ahead of the hydrogen growth curve, with Total Operating Expense3 and Capital Expenditure4 guidance ranges as follows:

2023 | Guidance |

Total Operating Expense3 | |

Capital Expenditure4 |

(Millions of | Three months ended March 31 | ||

2023 | 2022 | % Change | |

REVENUE | |||

Fuel Cell Products & Services:1 | |||

Heavy-Duty Mobility | (11 %) | ||

Bus | (28 %) | ||

Truck | (32 %) | ||

Rail | 2 % | ||

Marine | 217 % | ||

Stationary | (58 %) | ||

Emerging and Other Markets | (61 %) | ||

Total Fuel Cell Products & Services Revenue | (37) % | ||

PROFITABILITY | |||

Gross Margin $ | ( | (2,569 %) | |

Gross Margin % | (42 %) | (1 %) | (41)pts |

Total Operating Expenses | 24 % | ||

Cash Operating Costs2 | 23 % | ||

Equity loss in JV & Associates | ( | ( | 59 % |

Adjusted EBITDA3 | ( | ( | (39 %) |

Net Loss | ( | ( | 16 % |

Loss Per Share | ( | ( | 21 % |

CASH | |||

Cash provided by (used in) Operating Activities: | |||

Cash Operating Loss | ( | ( | (12 %) |

Working Capital Changes | ( | ( | 47 % |

Cash used by Operating Activities | ( | ( | 12 % |

Cash Reserves | (19 %) | ||

For a more detailed discussion of Ballard Power Systems' first quarter 2023 results, please see the company's financial statements and management's discussion & analysis, which are available at www.ballard.com/investors, www.sedar.com and www.sec.gov/edgar.shtml.

Ballard will hold a conference call on Wednesday, May 10, 2023 at 8:00 a.m. Pacific Time (11:00 a.m. Eastern Time) to review first quarter 2023 operating results. The live call can be accessed by dialing +1.604.638.5340. Alternatively, a live audio and webcast can be accessed through a link on Ballard's homepage (www.ballard.com). Following the call, the audio webcast and presentation materials will be archived in the 'Earnings, Interviews & Presentations' area of the 'Investors' section of Ballard's website (www.ballard.com/investors).

Ballard also announces the filing of a final short form base shelf prospectus dated May 9, 2023 (the "Prospectus") in each of the provinces and territories of

This release shall not constitute an offer to sell or a solicitation of an offer to buy securities, nor shall there be any sale of securities, in any jurisdiction in which an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

Ballard Power Systems' (NASDAQ: BLDP; TSX: BLDP) vision is to deliver fuel cell power for a sustainable planet. Ballard zero-emission PEM fuel cells are enabling electrification of mobility, including buses, commercial trucks, trains, marine vessels, and stationary power. To learn more about Ballard, please visit www.ballard.com.

Some of the statements contained in this release are forward-looking statements within the meaning of the

Endnotes

1 We report our results in the single operating segment of Fuel Cell Products and Services. Our Fuel Cell Products and Services segment consists of the sale of PEM fuel cell products and services for a variety of applications including Heavy-Duty Mobility (consisting of bus, truck, rail, and marine applications), Stationary Power, and Emerging and Other Markets (consisting of material handling, off-road, and other applications). Revenues from the delivery of Services, including technology solutions, after sales services and training, are included in each of the respective markets. |

2 Note that Cash Operating Costs, EBITDA, and Adjusted EBITDA are non-GAAP measures. Non-GAAP measures do not have any standardized meaning prescribed by GAAP and therefore are unlikely to be comparable to similar measures presented by other companies. Ballard believes that Cash Operating Costs, EBITDA, and Adjusted EBITDA assist investors in assessing Ballard's operating performance. These measures should be used in addition to, and not as a substitute for, net income (loss), cash flows and other measures of financial performance and liquidity reported in accordance with GAAP. For a reconciliation of Cash Operating Costs, EBITDA, and Adjusted EBITDA to the Consolidated Financial Statements, please refer to the tables below. |

Cash Operating Costs measures total operating expenses excluding stock-based compensation expense, depreciation and amortization, impairment losses or recoveries on trade receivables, restructuring charges, acquisition related costs, the impact of unrealized gains or losses on foreign exchange contracts, and financing charges. EBITDA measures net loss excluding finance expense, income taxes, depreciation of property, plant and equipment, and amortization of intangible assets. Adjusted EBITDA adjusts EBITDA for stock-based compensation expense, transactional gains and losses, acquisition related costs, finance and other income, recovery on settlement of contingent consideration, asset impairment charges, and the impact of unrealized gains or losses on foreign exchange contracts. |

3 Total Operating Expenses refer to the measure reported in accordance with IFRS. |

4 Capital Expenditure is defined as Additions to property, plant and equipment and Investment in other intangible assets as disclosed in the Consolidated Statements of Cash Flows |

(Expressed in thousands of | Three months ended March 31, | |||

Cash Operating Costs | 2023 | 2022 | $ Change | |

Total Operating Expenses | $ 37,517 | $ 30,311 | $ 7,206 | |

Stock-based compensation expense | (2,315) | (2,329) | 14 | |

Impairment recovery (losses) on trade receivables | - | - | - | |

Acquisition related costs | (658) | (118) | (540) | |

Restructuring and related costs | (822) | (20) | (802) | |

Impact of unrealized gains (losses) on foreign exchange contracts | 490 | 347 | 143 | |

Depreciation and amortization | (2,178) | (2,102) | (76) | |

Cash Operating Costs | $ 32,034 | $ 26,089 | $ 5,945 | |

(Expressed in thousands of | Three months ended March 31, | ||||

EBITDA and Adjusted EBITDA | 2023 | 2022 | $ Change | ||

Net loss | $ (33,918) | $ (40,395) | $ 6,477 | ||

Depreciation and amortization | 3,167 | 3,109 | 58 | ||

Finance expense | 282 | 347 | (65) | ||

Income taxes (recovery) | - | (200) | 200 | ||

EBITDA | $ (30,469) | $ (37,139) | $ 6,670 | ||

Stock-based compensation expense | 2,315 | 2,329 | (14) | ||

Acquisition related costs | 658 | 118 | 540 | ||

Finance and other (income) loss | (10,294) | 7,491 | (17,785) | ||

Impact of unrealized (gains) losses on foreign exchange contracts | (490) | (347) | (143) | ||

Adjusted EBITDA | $ (38,280) | $ (27,548) | $ (10,732) | ||

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/ballard-reports-q1-2023-results-301820851.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/ballard-reports-q1-2023-results-301820851.html

SOURCE Ballard Power Systems Inc.