Environmental Case For Black Iron's Expected High Grade 68% Iron Ore

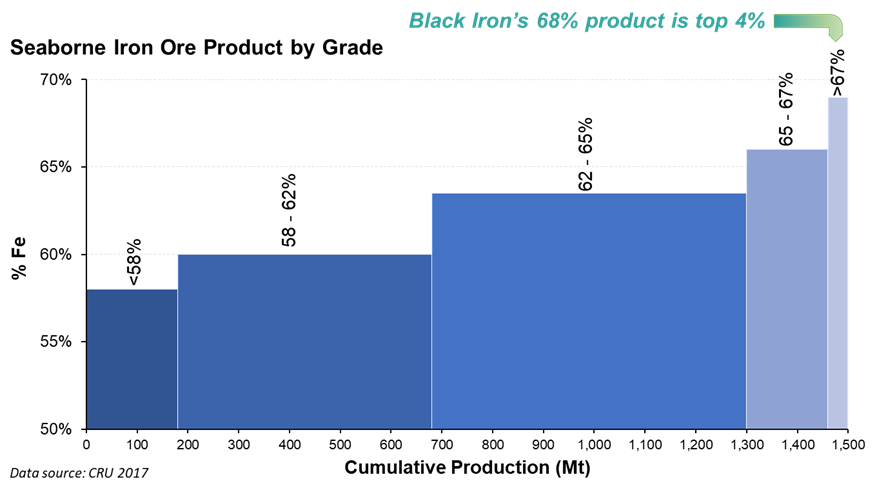

Black Iron Inc. announces that its high-grade 68% iron magnetite pellet feed will reduce greenhouse gas (GHG) emissions by approximately 30% compared to standard 62% iron hematite fines. The company’s Shymanivske mine, located in Ukraine, is well-positioned to provide this environmentally friendly product, meeting a growing demand for high purity iron used in steel production.

Additionally, with an expected need for 133 million tonnes of high purity pellet feed by 2035, Black Iron is equipped to capitalize on this trend, especially as the steel industry shifts towards carbon neutrality.

- High-grade 68% iron magnetite pellet feed projected to reduce GHG emissions by ~30%.

- Shymanivske mine's location offers potential for high purity iron supply.

- Expected demand for additional 133 million tonnes of high purity pellet feed by 2035.

- None.

TORONTO, ON / ACCESSWIRE / June 7, 2021 / Black Iron Inc. ("Black Iron" or the "Company") (TSX:BKI)(OTC PINK:BKIRF)(FWB:BIN) announces that the production of steel using Black Iron's anticipated high grade

Investors poured a record US

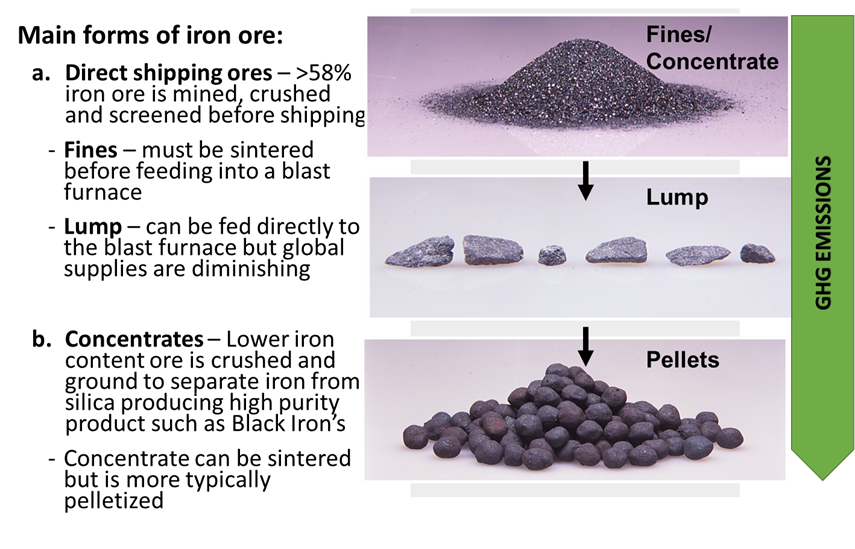

As such there is a fundamental shift occurring in the type of iron ore consumed by steel mills from fines which need to be first sintered (an emission intensive process to fuse fine iron ore particles into larger rocks of various size) to pellets which are small balls of uniform size.

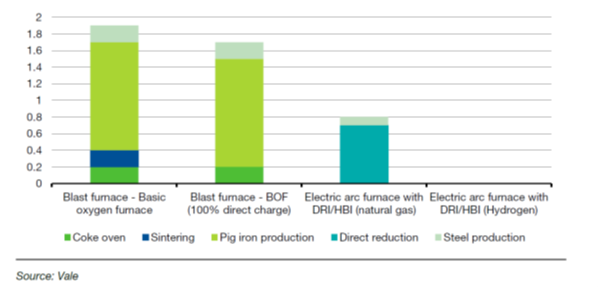

When a steel blast furnace is fed with sinter or lumps, energy needs to be continually added until the last lump, typically the largest, is fully melted. Since pellets are all uniform in size, they melt at roughly the same rate thereby substantially reducing the amount of time, energy and resulting emissions generated to produce steel. When looking at the total energy consumed through the full value chain to produce steel, the net GHG emissions using high grade magnetite pellet feed, as Black Iron plans to produce, are reduced by an estimated

Black Iron's Shymanivske mine will be ideally placed to deliver high grade

To meet future anticipated demand for high purity pellet feed, CRU business intelligence estimates that an additional 133 million tonnes of supply will need to be brought on stream by 2035. Out of this 133 million tonne shortfall, 40 million tonnes will be required for Direct Reduction (DR) steel mills who use natural gas instead of metallurgical coal to produce steel cutting emissions by roughly

Production of steel using green hydrogen is a very promising future source of energy because the only emission generated from the burning of hydrogen is water. Multibillion dollar iron ore mining companies including RioTinto and Ferrexpo are currently investing in technologies to produce green hydrogen as an alternative future source of energy to make steel[v]. Although it is likely a decade away, green hydrogen is showing great promise to reduce the net emissions in the production of steel to negligible levels as seen below but will place an even greater demand on the need for DR grade iron ore pellets and pellet feed as Black Iron could produce.

In conclusion, Black Iron provides a unique opportunity for investors to profit from the Shymanivske projects projected low-cost operation while at the same time providing ESG focused investors a great chance to invest in a cause they can strongly support.

About Black Iron

Black Iron is an iron ore exploration and development company, advancing its

For more information, please contact:

Matt Simpson |

Forward-Looking Information

This press release contains forward-looking information. Forward-looking information is based on what management believes to be reasonable assumptions, opinions and estimates of the date such statements are made based on information available to them at that time. Forward-looking information may include, but is not limited to, statements with respect to the financial viability of the Company's Shymanivske project (the "Project"), , the price of iron ore, the demand for iron ore, the Company's ability to obtain adequate financing, including offtake financing, the impact of new legislation in Ukraine, the Company's ability to acquire the requisite land for Project construction, the Company's ability to develop the Project, the ceasefire of conflict in Ukraine and the Company's future plans. Generally, forward looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: general business, economic, competitive, geopolitical and social uncertainties; the actual results of current exploration activities; other risks of the mining industry and the risks described in the annual information form of the Company. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws. The Company notes that mineral resources that are not mineral reserves do not have demonstrated economic viability.

[i]2011 J. Herbertson and L. Strezov "Implications for the Australian Magnetite Industry of the Introduction of a Price/Tax on Carbon"

[iii]2011 J. Herbertson and L. Strezov "Implications for the Australian Magnetite Industry of the Introduction of a Price/Tax on Carbon"

View source version on accesswire.com:

https://www.accesswire.com/650518/Environmental-Case-For-Black-Irons-Expected-High-Grade-68-Iron-Ore

FAQ

What is Black Iron's environmental impact with its new iron pellet feed?

How much iron pellet feed is needed by 2035 according to Black Iron?

Why is Black Iron's Shymanivske mine significant?