Value Creation Through Exploration

- None.

- None.

Join Executive Chairman Richard Williams, CEO Sam Ash, and Chief Geologist Mark Crouter for a live virtual event as they provide Bunker Hill Mining’s strategy for value creation through exploration.

The event will be on Monday, January 22nd at 1 pm ET / 9 am PT and you can join by registering at this link.

AME Roundup Conference – Vancouver Conference Centre (22-25 Jan 2024)

- Bunker Hill Mining Corporation will be represented at its Company Stand 1525 within the Vancouver Conference Centre, and attended by the Executive Chair, CEO, CFO and Director: Finance.

Project Update:

- Mine restart project advances on track and on budget, with primary focus being the preparation of the Bunker Hill Yard for the start of construction of the Processing Facility and Tailings Filtration Plant.

- Arrival of Golden Sunlight’s Mill on track for delivery in January which supports 1800 TPD throughput

Value Creation through Exploration – key lines of activity in 2024:

- Concurrent with engineering, construction and other restart activities, the following will be conducted during 2024:

(1) Planned Resource Conversion: 1250m of Infill holes from UG to improve confidence level of grade and thickness of mineralization.

(2) Near Mine Exploration: 1250 m of drilling, leveraging historic mineralization trends to step out and find additional resources close to existing UG infrastructure.

(3) New Target Exploration: Utilizing modern geophysics to refine and add to new, near-surface exploration targets generated in 2022 within the 5,800-acre Land Package.

Key 2024 Exploration Milestone:

- Bunker Hill intends to issue updated resource during Q4 2024

TORONTO, Jan. 19, 2024 (GLOBE NEWSWIRE) -- Bunker Hill Mining Corp. (the “Company”) (TSXV: BNKR) (OTCQB: BHLL) is pleased to provide an update on its planned resource conversion and exploration activities for 2024.

Sam Ash, CEO, said: “In addition to restarting the Bunker Hill mine in 2024, the Company’s geologists, led by our new Chief Geologist - Mark Crouter, intend to expand our resources as well as highlight some of the significant geological upside potential contained within our 5,800 acre claim package. We look forward to discussing this on the 6ix video call on Monday, or in person at the Bunker Hill Booth at the AME Roundup Conference in The Vancouver Conference Centre next week.”

PROJECT UPDATE

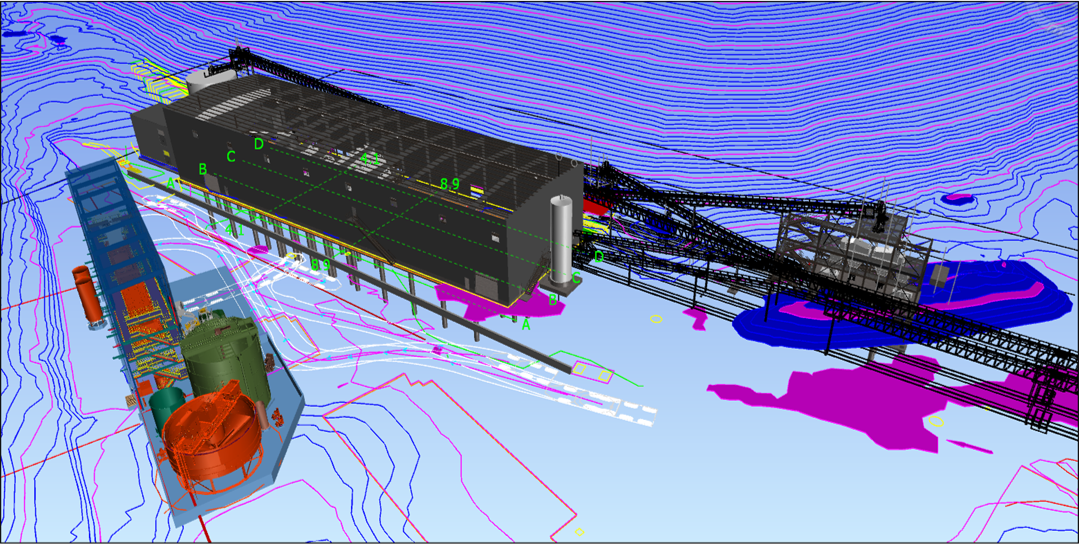

Engineering of the main Process Plant is advancing on track with deep pier establishment scheduled to commence in the next month as part of geotechnical stabilization and preparation of the land for the construction of the Process Plant and Tailings Filtration Plant within the Bunker Hill Yard.

Preparations are ongoing to move all administrative and other staff out of the existing office buildings before they are demolished next month. This will create extra space in the yard for the Tailings Filtration Plant and associated material handling. Administrative and Technical Staff will be moving into new facilities, adjacent but outside to the processing Yard, thereby reducing foot and vehicle traffic within the processing yard.

Up the hill from the Bunker Yard, and adjacent to the expanded Russell Tunnel, the Wardner Mining Operating Yard has recently received an office building which was transferred from Teck’s Pend Oreille closed mine site. This mining operating base is also benefiting from additional investment into surface maintenance facilities and supporting infrastructure, sufficient to support ongoing and planned refurbishment of the underground infrastructure. This includes the installation of refurbished ventilation systems, before starting planned UG Resource Conversion, Expansion and Exploration drilling.

Fig 1 – Enhanced Russell Tunnel and expanded facilities at the Wardner Mining Yard

All main civil, structural and mechanical outputs are on track to be at IFC before year end. Our long-lead item procurement has resulted in purchase orders having already been issued for the Pre-Engineered Metal Building (PEMB), Ore Silo, Conveyors, Ball Mill Starter Motor, Thickeners Tanks and Inching Drive. Refurbishment of the Pend Oreille mill equipment – the source of most mill components – is advancing on track, concurrent with the move to site of the Mill bought from the Golden Sunlight Mine in Montana by the end of January.

Fig 2 – Processing Plant and Tailings Filtration Plant to be in the Bunker Hill Yard.

EXPLORATION VALUE-CREATION STRATEGY

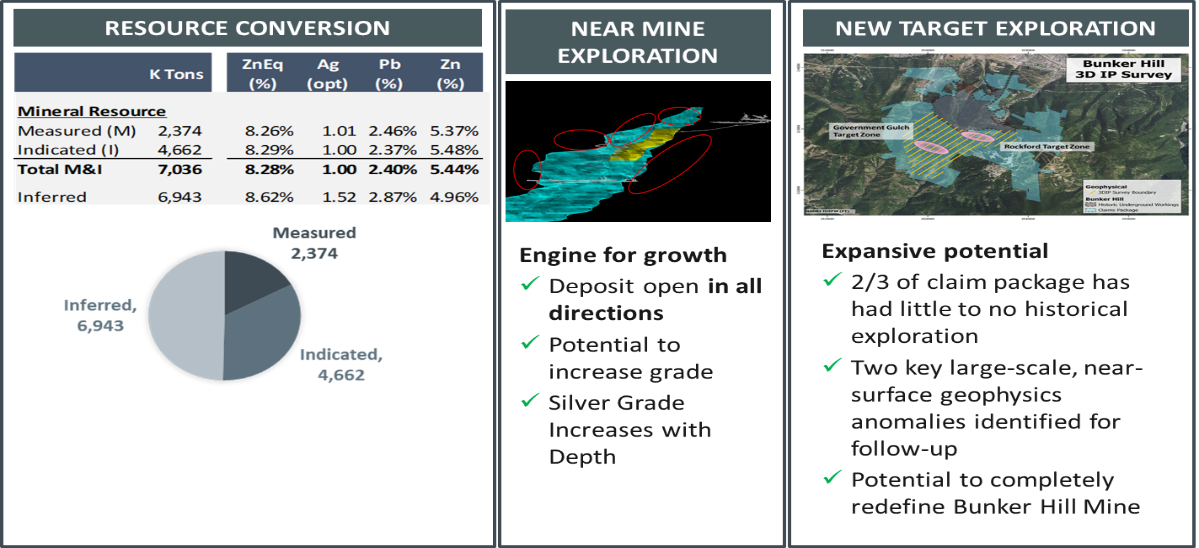

The graphic below outlines the three components of the planned 2024 exploration plan:

(1) Resource Conversion,

(2) Near Mine Resource Expansion and

(3) New Target Exploration.

Fig 3 – Key Components of 2024 Exploration Plan

The planned work program for 2024 is expected to cost

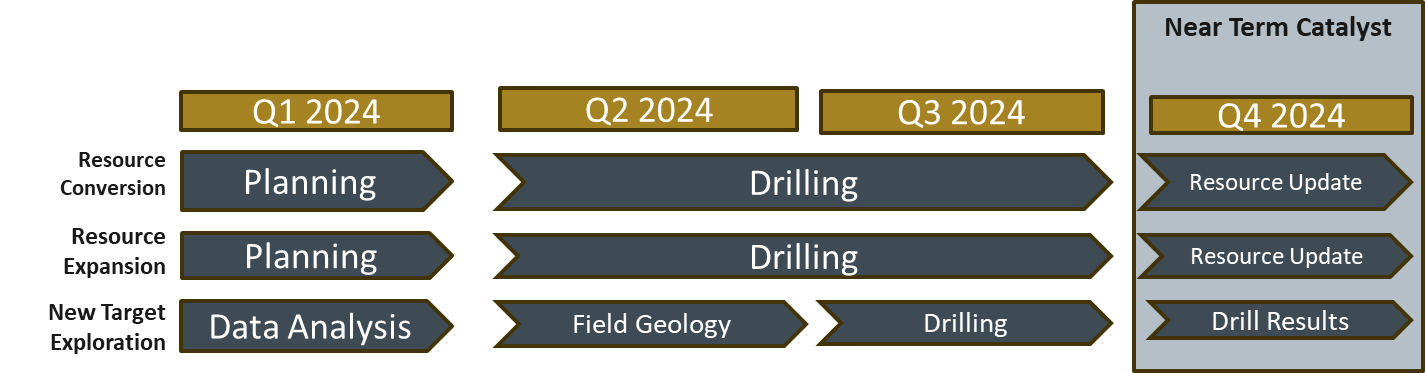

2024 EXECUTION TIMELINE AND KEY CATALYSTS

This work will be led by Mark Crouter, the new Bunker Hill Chief Geologist, and will be conducted over the following timetable, to deliver the exploration products listed below:

Fig 4 – Execution Timeline

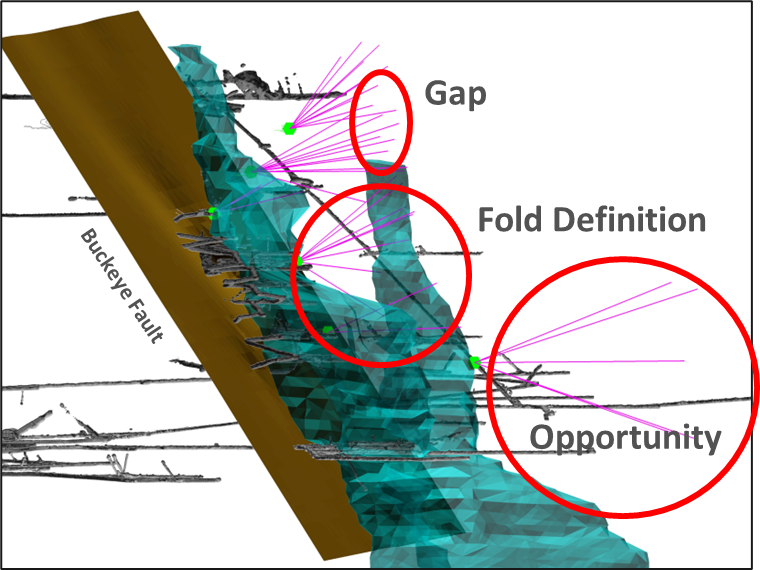

RESOURCE CONVERSION

Following the establishment of upgraded UG ventilation systems, and starting in April 2024, a 2500m UG drilling program is planned to commence which intends to convert 6.9M tons of inferred mineralization into M&I resources. A conversion rate of >

Figure 5 opposite shows the areas planned to be targeted for resource conversion between UG levels 5-8 (all above the water table, and accessed by existing UG infrastructure).

The results of this drilling is expected to inform an updated resource statement which the Company plans to issue in Q4-2024.

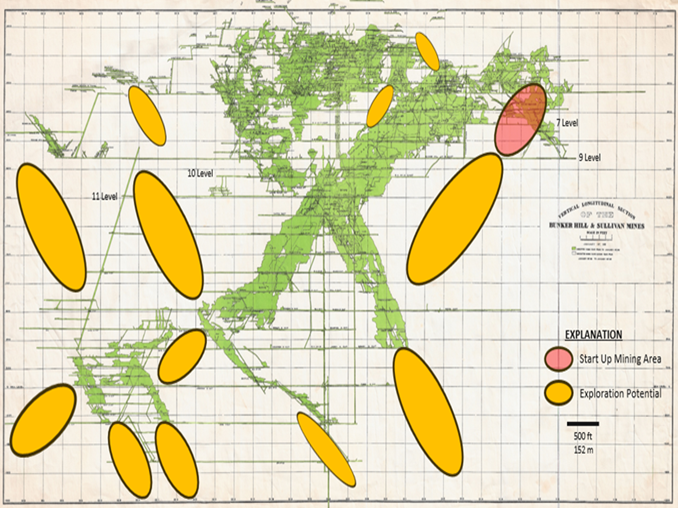

NEAR MINE EXPLORATION

The opportunity to apply modern exploration techniques in conjunction with over 100 years of detailed geologic records presents a unique opportunity to identify and test high quality exploration targets in close proximity to existing mine workings. In addition to resource conversion drilling, a program of near mine exploration drilling is being planned for 2024. The focus of this drilling will initially focus on adding additional resources in the upper levels of the mine where the infrastructure is in place to support drilling. Our goal in 2024 is to add additional resources to our mineral inventory. Target Areas shown in Orange Lozenges in Figure 6, opposite.

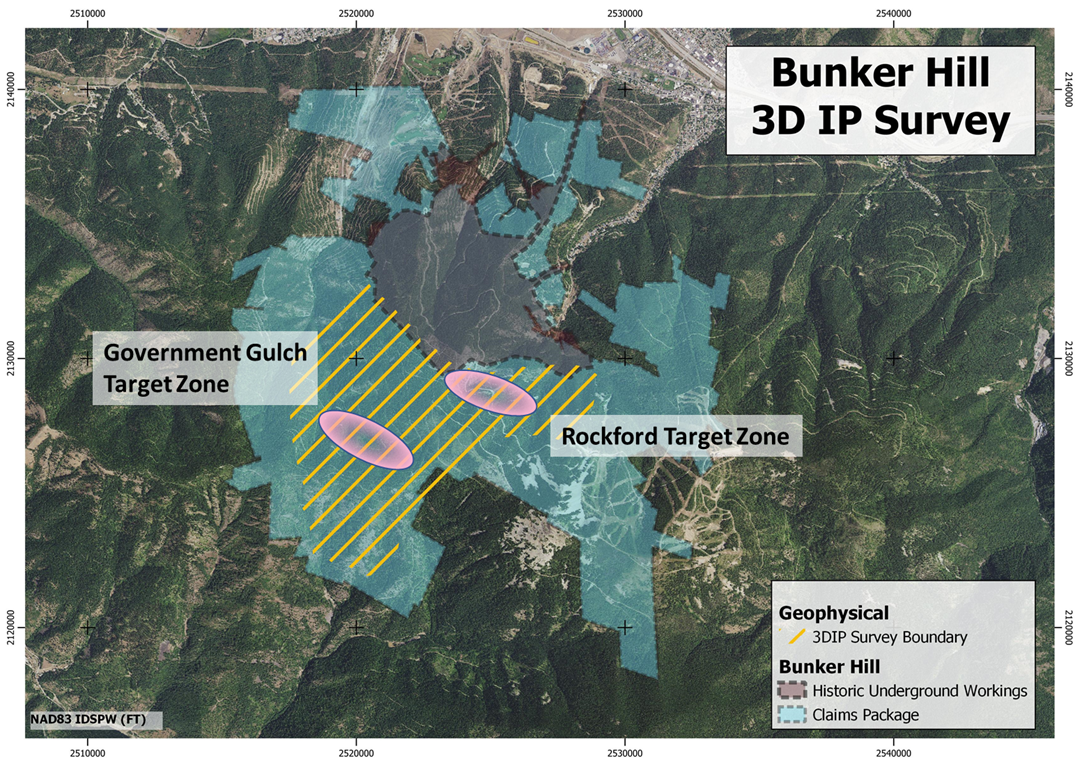

NEW TARGET EXPLORATION

The existing mine footprint at Bunker Hill covers approximately 1/3 of the full claim package. Based on the exciting results of a modern 3D geophysics survey conducted in 2021, we are generating high potential drill targets. The potential associated with these targets – all near surface and close to existing infrastructure – could result in the discovery of a completely new area of mineralization at Bunker Hill.

Fig 7 – Geophysics identified exploration targets for follow-up

QUALIFIED PERSON

Mr. Scott E. Wilson, CPG, President of RDA and a consultant to the Company, is an independent “qualified person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and is acting as the qualified person for the Company. He has reviewed and approved the technical information summarized in this news release, including the sampling, preparation, security and analytical procedures underlying such information, and is not aware of any significant risks and uncertainties that could be expected to affect the reliability or confidence in the information discussed herein.

ABOUT BUNKER HILL MINING CORP.

Under new Idaho-based leadership, Bunker Hill Mining Corp. intends to sustainably restart and develop the Bunker Hill Mine as the first step in consolidating a portfolio of North American mining assets with a balanced focus on silver and critical metals. Information about the Company is available on its website, www.bunkerhillmining.com, or within the SEDAR+ and EDGAR databases.

For additional information contact:

Corporate Secretary

+1 604 506 3613

ir@bunkerhillmining.com

Cautionary Statements

The TSX Venture Exchange (the “TSX-V”) has neither approved nor disapproved the contents of this news release. Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Certain statements in this news release are forward-looking and involve a number of risks and uncertainties. Such forward-looking statements are within the meaning of that term in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, as well as within the meaning of the phrase ‘forward-looking information’ in the Canadian Securities Administrators’ National Instrument 51-102 – Continuous Disclosure Obligations (collectively, “forward-looking statements”). Forward-looking statements are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan” or variations of such words and phrases. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking statements could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking statements.

Forward-looking statements in this news release include, but are not limited to: the Company’s intentions regarding its objectives, goals or future plans and statements, including, without limitation, the expected timing, budget and operating activities of the planned restart of the Bunker Hill Mine; the expected budget, completion time and benefits of the UG upgrades, processing and tailing facilities, and operating yard, including further geotechnical, design and engineering work in support thereof; the expected resource conversion and drilling programs planned for 2024, including the conversion rate, benefits and results thereof; the expected delivery and timing for the updated resource estimate; the planned exploration of new drilling targets and additional resources based on testing and drilling of previous and new exploration targets; the procurement of purchase orders and the timing for and installation of operational equipment; revenue potential opportunities from mining and the sale of ore; increases in cash flow; and the Company’s seeking other value-creating opportunities. Factors that could cause actual results to differ materially from such forward-looking statements include, but are not limited to the Company’s inability to raise sufficient capital for its operations; further testing and drilling not yielding additional mineral resources; the fluctuating price of commodities, capital market conditions, restriction on labour and international travel and supply chains; failure to identify mineral resources; failure to convert estimated mineral resources to mineral reserves at expected rates or at all; the inability to complete a feasibility study which recommends a production decision; the preliminary nature of metallurgical test results; the Company’s ability to restart and develop the Bunker Hill Mine, including the possibility of further required financings, and the risks of not basing a production decision on a feasibility study of mineral reserves demonstrating economic and technical viability, resulting in increased uncertainty due to multiple technical and economic risks of failure which are associated with this production decision, including, among others, areas that are analyzed in more detail in a feasibility study, such as applying economic analysis to resources and reserves, more detailed metallurgy and a number of specialized studies in areas such as mining and recovery methods, market analysis, and environmental and community impacts and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, including increased risks associated with developing a commercially mineable deposit with no guarantee that production will begin as anticipated or at all or that anticipated production costs will be achieved; failure to commence production would have a material adverse impact on the Company's ability to generate revenue and cash flow to fund operations; failure to achieve the anticipated production costs would have a material adverse impact on the Company's cash flow and future profitability; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; political risks; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; the inability of the Company to budget and manage its liquidity in light of the failure to obtain additional financing, including the ability of the Company to complete the payments pursuant to the terms of the agreement to acquire the Bunker Hill Mine Complex; inflation; changes in exchange rates; fluctuations in commodity prices; delays in the development of projects; capital, operating and reclamation costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry; and those risks set out in the Company’s public documents filed on SEDAR+ and EDGAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking statements in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, other than as required by law. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Cautionary Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Mineral Resources

This news release has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Unless otherwise indicated, all resource and reserve estimates included in this news release have been disclosed in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy, and Petroleum (“CIM”) Definition Standards on Mineral Resources and Mineral Reserves. NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. The terms “mineral reserve,” “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with NI 43-101 and the CIM standards. Pursuant to subpart 1300 of Regulation S-K (“S-K 1300”), the U.S. Securities and Exchange Commission (the “SEC”) now recognizes estimates of “measured mineral resources,” “indicated mineral resources” and “inferred mineral resources.” In addition, the SEC has amended its definitions of “proven mineral reserves” and “probable mineral reserves” to be substantially similar to the corresponding standards of the CIM. Investors are cautioned that while terms are substantially similar to CIM standards, there are differences in the definitions and standards under S-K 1300 and the CIM standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as “proven reserves,” “probable reserves,” “measured mineral resources,” “indicated mineral resources” and “inferred mineral resources” under NI 43-101 will be the same as the reserve or resource estimates prepared under the standards adopted under S-K 1300. Investors are also cautioned that while the SEC now recognizes “measured mineral resources,” “indicated mineral resources” and “inferred mineral resources,” investors should not assume that any part or all of mineral deposits in these categories will ever be converted into reserves. Mineralization described using these terms has a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “measured mineral resource,” “indicated mineral resource” or “inferred mineral resource” will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures. Accordingly, information concerning mineral deposits contained in this news release may not be comparable with information made public by companies that report in accordance with U.S. standards.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/3194ae07-ceb1-4ef8-bdb1-e9bc0797f537

https://www.globenewswire.com/NewsRoom/AttachmentNg/e92bcd9e-2dae-45b0-8560-d4c0f670285e

https://www.globenewswire.com/NewsRoom/AttachmentNg/85beb116-4816-4973-8db9-ccde2a093ffc

https://www.globenewswire.com/NewsRoom/AttachmentNg/d4af8042-7d5c-4d9b-91a9-f20b5e3dbd99

https://www.globenewswire.com/NewsRoom/AttachmentNg/3ddf3a3f-3ebe-4b36-abba-d105bd39ad36

https://www.globenewswire.com/NewsRoom/AttachmentNg/0ae3d4e2-d2db-4b93-8d21-8f35f1a7e593

https://www.globenewswire.com/NewsRoom/AttachmentNg/9983d5c0-da67-4713-a55e-17863c412bcc

FAQ

What is the purpose of the live virtual event with Bunker Hill Mining's executives?

What are the key lines of activity in Bunker Hill Mining's exploration plan for 2024?

What is the expected cost of the planned work program for 2024?

Who is leading the 2024 execution timeline and key catalysts for Bunker Hill Mining?