Bradda Head Lithium Ltd Announces Mobilization of Drilling & Ancillary Equipment

("Bradda Head", "BHL" or the "Company")

Mobilization of Drilling and Ancillary Equipment to Basin Project, Targeting 2.5MT LCE

BRITISH VIRGIN ISLANDS / ACCESSWIRE / March 4, 2024 / Bradda Head Lithium Ltd (AIM:BHL)(TSX-V:BHLI), the North America-focused lithium development group, is pleased to announce the mobilization of equipment to the Basin Project, Arizona to initiate Resource expansion drilling with a six-hole program designed to significantly expand the Company's lithium in clay Mineral Resource Estimate ("MRE"). This follows the successful 2023 sonic drilling campaign which saw the "tripling" of BHL's Inferred and Indicated MRE at Basin. This six-hole program will build upon Bradda Head's 1.085MT Lithium Carbonate Equivalent (LCE) by drilling holes an additional 1.2 kilometers towards the north on newly permitted drill holes. The objective of this program is to add a minimum of 1.5MT LCE, surpassing the benchmark of 2.5MT LCE which will trigger the final US

Program Summary:

- Six-hole core drilling program of approximately 8,800 feet (2,680m) planned

- Program anticipated to expand LCE from 1.085MT to >2.5MT

- Step-out drill holes at 500 to 700m spacing to maintain Inferred category of MRE

- One hole will be drilled into Precambrian basement in center of gravity low

- Gravity low may represent extensively thick clays both in the Upper, Lower, and Basal Red-Beds

- Holes will test Lower Clay to expand tonnage potential and thicker sequence correlative with gravity low which also has the potential for exceptional lithium grades

Ian Stalker, Executive Chairperson, commented:

"After we completed the MRE in September 2023, we quickly realised the unbridled potential to continue expansion of this important lithium-in-clay resource in Arizona. Our geologists developed a plan, designed a new drilling program and promptly engaged the BLM for an expansion of our Basin North permit. We thank the BLM for delivering a positive decision and look forward to embarking on this exciting drill program.

Not only are we hoping for sizeable expansion of this resource, but are estimating the resource will grow from the current 1.085 MT of LCE to over 2.5 MT, which will trigger an important US

General Background

The Company is building upon the 2023 MRE and NI-43-101 complaint report completed by SRK Consulting (UK) Ltd and reported on 28 September, 2023. In this prior PR, the Company reported the following in Table 1 below:

Table 1.

Classification | Domain | Tonnes | Mean Grade | Contained Metal | ||

Mt | Li (ppm) | K (%) | LCE (kt) | K (kt) | ||

Indicated | Upper Clay | 11 | 720 | 3.5 | 42 | 380 |

Upper Clay HG | 6 | 1350 | 3.2 | 43 | 190 | |

Lower Clay | - | - | - | - | - | |

SubTotal | 17 | 940 | 3.4 | 85 | 570 | |

Inferred | Upper Clay | 143 | 790 | 2.7 | 600 | 3,800 |

Upper Clay HG | 48 | 1290 | 3.1 | 330 | 1,500 | |

Lower Clay | 19 | 690 | 2.8 | 70 | 530 | |

SubTotal | 210 | 900 | 2.8 | 1,000 | 5,800 | |

| ||||||

This new programme is targeting significantly thicker clay sequences, consistent if not higher lithium grades and thicker lower clay sequence, with the potential to also discover new clays within the nearly 2km2 gravity low.

Bradda Head Lithium received an affirmative decision from the BLM on February 28th with confirmation that it could conduct exploration drilling on the Basin North notice of intent (NOI) amendment and based on a reclamation bond increase with permission to proceed on 3.8 acres of surface disturbance. Earth moving equipment was mobilized to prepare drill sites and experienced core drilling contractors brought in to conduct the drilling.

Like previous drilling programs conducted at Basin, drill holes will be vertical, but when clay horizons are encountered the Company's plan is to convert to a triple tube core capture technique which ensures high recovery and provides the Company with many options for sampling, density measurements, and geotechnical data for future studies.

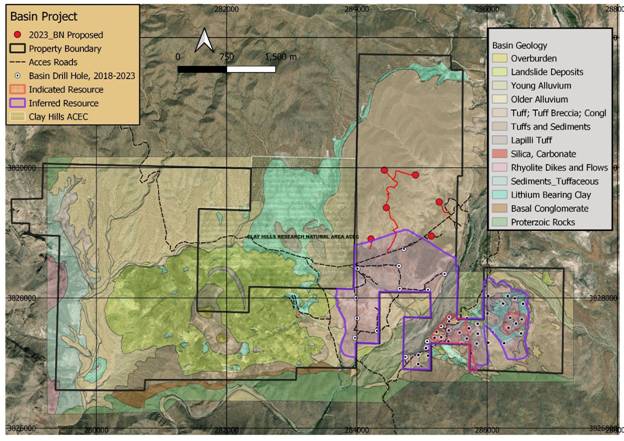

Figure 1. Basin Drill Plan for 2024, prior drilling, geology, land, mineral resource boundaries.

For further information please visit the Company's website: www.braddaheadltd.com.

Qualified Person (BHL)

Joey Wilkins, B.Sc., P.Geo., is Chief Operating Officer at BHL and the Qualified Person who reviewed and approved the technical disclosures in this news release. Mr. Wilkins is a graduate of the University of Arizona with a B.Sc. in Geology with more than 38 years of experience in mineral exploration and is a qualified person under the AIM Rules and a Qualified Person as defined under NI-43-101. Mr. Wilkins consents to the inclusion of the technical information in this release and context in which it appears.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES OF THE MARKET ABUSE REGULATION (EU No. 596/2014) AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018. UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN AND SUCH PERSONS SHALL THEREFORE CEASE TO BE IN POSSESSION OF INSIDE INFORMATION.

ENDS

Contact:

Bradda Head Lithium Limited | +44 (0) 1624 639 396 |

Ian Stalker, Executive Chairperson Denham Eke, Finance Director |

|

Beaumont Cornish (Nomad) | +44 (0) 2076 283 396 |

James Biddle / Roland Cornish | |

Panmure Gordon (Joint Broker) | +44 (0) 2078 862 500 |

Hugh Rich | |

Shard Capital (Joint Broker) | +44 (0) 2071 869 927 |

Damon Heath / Isabella Pierre | |

Red Cloud (North American Broker) | +1 416 803 3562 |

Joe Fars | |

Tavistock (Financial PR) | + 44 20 7920 3150 |

Nick Elwes / Adam Baynes | braddahead@tavistock.co.uk |

About Bradda Head Lithium Ltd.

Bradda Head Lithium Ltd. is a North America-focused lithium development group. The Company currently has interests in a variety of projects, the most advanced of which are in Central and Western Arizona: The Basin Project (Basin East Project, and the Basin West Project) and the Wikieup Project.

The Basin East Project has an Indicated Mineral Resource of 17 Mt at an average grade of 940 ppm Li and

Technical Glossary

Kt | Thousand tonnes |

Ppm | Parts per million |

Exploration Target | An estimate of the exploration potential of a mineral deposit in a defined geological setting where the statement or estimate, quoted as a range of tonnes and a range of grade (or quality), relates to mineralisation for which there has been insufficient exploration to estimate a Mineral Resource. |

Inferred Mineral Resource | That part of a Mineral Resource for which quantity and grade (or quality) are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological grade (or quality) continuity. It is based on exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings, and drill holes. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to an Ore Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. |

Indicated Mineral Resource | That part of a Mineral Resource for which quantity, grade (or quality), densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings, and drill holes, and is sufficient to assume geological and grade (or quality) continuity between points of observation where data and samples are gathered. |

MRE | Mineral Resource Estimate |

Forward-Looking Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This News Release includes certain "forward-looking statements" which are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "intends to", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management's expectations. Risks, uncertainties, and other factors involved with forward-looking information could cause actual events, results, performance, prospects, and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, following: The Company's objectives, goals, or future plans. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to: failure to identify mineral resources; failure to convert estimated mineral resources to reserves; delays in obtaining or failures to obtain required regulatory, governmental, environmental or other project approvals; political risks; future operating and capital costs, timelines, permit timelines, the market and future price of and demand for lithium, and the ongoing ability to work cooperatively with stakeholders, including the local levels of government; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices; delays in the development of projects, capital and operating costs varying significantly from estimates; an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains; and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company's public documents filed on SEDARplus. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Beaumont Cornish Limited ("Beaumont Cornish") is the Company's Nominated Adviser and is authorised and regulated by the FCA. Beaumont Cornish's responsibilities as the Company's Nominated Adviser, including a responsibility to advise and guide the Company on its responsibilities under the AIM Rules for Companies and AIM Rules for Nominated Advisers, are owed solely to the London Stock Exchange. Beaumont Cornish is not acting for and will not be responsible to any other persons for providing protections afforded to customers of Beaumont Cornish nor for advising them in relation to the proposed arrangements described in this announcement or any matter referred to in it.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

SOURCE: Bradda Head Lithium Limited

View the original press release on accesswire.com