Bradda Head Lithium Ltd Announces Channel Sample Results at San Domingo Project

Bradda Head Lithium (AIM:BHL, TSXV:BHLI) has announced positive channel sample results from its San Domingo pegmatite project in Arizona. Highlights include:

- 8.80m @ 0.97% Li2O with 174 ppm Cs at Dragon South

- 10.40m @ 0.68% Li2O with 341 ppm Cs at Dragon South

- 4.80m @ 0.41% Li2O with 336 ppm Cs at Dragon North

The results reveal significant lithium mineralization and elevated cesium levels, which is considered a strategic metal by the DOE. The company has commenced drill hole permitting on the Dragon targets, proposing up to 40 drill sites to test shallow lithium mineralization. Additionally, Bradda Head has announced a repricing of 9,000,000 outstanding share options to £0.017 (CA$0.03) per ordinary share, subject to TSX Venture Exchange and shareholder approval.

Bradda Head Lithium (AIM:BHL, TSXV:BHLI) ha annunciato risultati positivi dai campioni di canale del suo progetto di pegmatite San Domingo in Arizona. I punti salienti includono:

- 8.80m @ 0.97% Li2O con 174 ppm Cs a Dragon South

- 10.40m @ 0.68% Li2O con 341 ppm Cs a Dragon South

- 4.80m @ 0.41% Li2O con 336 ppm Cs a Dragon North

I risultati rivelano una significativa mineralizzazione di litio e livelli elevati di cesio, considerato un metallo strategico dal DOE. L'azienda ha avviato l'autorizzazione dei pozzi di perforazione sui target Dragon, proponendo fino a 40 siti di perforazione per testare la mineralizzazione di litio a bassa profondità. Inoltre, Bradda Head ha annunciato un riadattamento di 9.000.000 opzioni su azioni in circolazione a £0.017 (CA$0.03) per azione ordinaria, soggetto all'approvazione di TSX Venture Exchange e degli azionisti.

Bradda Head Lithium (AIM:BHL, TSXV:BHLI) ha anunciado resultados positivos de muestras de canal de su proyecto de pegmatita San Domingo en Arizona. Los aspectos destacados incluyen:

- 8.80m @ 0.97% Li2O con 174 ppm Cs en Dragon South

- 10.40m @ 0.68% Li2O con 341 ppm Cs en Dragon South

- 4.80m @ 0.41% Li2O con 336 ppm Cs en Dragon North

Los resultados revelan una mineralización significativa de litio y niveles elevados de cesio, considerado un metal estratégico por el DOE. La empresa ha iniciado la obtención de permisos de perforación en los objetivos Dragon, proponiendo hasta 40 sitios de perforación para probar la mineralización de litio a poca profundidad. Además, Bradda Head ha anunciado un ajuste de 9,000,000 de opciones de acciones pendientes a £0.017 (CA$0.03) por acción ordinaria, sujeto a la aprobación de TSX Venture Exchange y de los accionistas.

브라다 헤드 리튬 (AIM:BHL, TSXV:BHLI)는 아리조나에 위치한 산 돈미고 페그마이트 프로젝트에서 긍정적인 채널 샘플 결과를 발표했습니다. 주요 내용은 다음과 같습니다:

- Dragon South에서 0.97% Li2O로 8.80m와 174 ppm Cs

- Dragon South에서 0.68% Li2O로 10.40m와 341 ppm Cs

- Dragon North에서 0.41% Li2O로 4.80m와 336 ppm Cs

결과는 중요한 리튬 광화와 높은 세슘 수치를 보여주며, 이는 DOE에 의해 전략적 금속으로 간주됩니다. 회사는 Dragon 목표에 대한 드릴 홀 허가를 시작했으며, 리튬 광화를 시험하기 위해 최대 40개의 드릴 사이트를 제안했습니다. 또한, Bradda Head는 9,000,000개의 미결 주식 옵션 재가격 책정을 £0.017(CA$0.03)로 조정했으며, 이는 TSX 벤처 거래소 및 주주 승인에 따라 다릅니다.

Bradda Head Lithium (AIM:BHL, TSXV:BHLI) a annoncé des résultats positifs d'échantillons de canaux de son projet de pegmatite San Domingo en Arizona. Les points forts comprennent :

- 8.80m @ 0.97% Li2O avec 174 ppm Cs à Dragon South

- 10.40m @ 0.68% Li2O avec 341 ppm Cs à Dragon South

- 4.80m @ 0.41% Li2O avec 336 ppm Cs à Dragon North

Les résultats révèlent une minéralisation significative de lithium et des niveaux élevés de césium, considéré comme un métal stratégique par le DOE. L'entreprise a commencé le permis de forage sur les cibles Dragon, proposant jusqu'à 40 sites de forage pour tester la minéralisation de lithium à faible profondeur. De plus, Bradda Head a annoncé une revalorisation de 9.000.000 d'options d'actions en circulation à £0.017 (CA$0.03) par action ordinaire, sous réserve de l'approbation de la bourse TSX et des actionnaires.

Bradda Head Lithium (AIM:BHL, TSXV:BHLI) hat positive Kanalmusterergebnisse aus seinem San Domingo Pegmatitprojekt in Arizona bekannt gegeben. Zu den Höhepunkten gehören:

- 8.80m @ 0.97% Li2O mit 174 ppm Cs in Dragon South

- 10.40m @ 0.68% Li2O mit 341 ppm Cs in Dragon South

- 4.80m @ 0.41% Li2O mit 336 ppm Cs in Dragon North

Die Ergebnisse zeigen eine signifikante Lithiumerzlagerstätte und erhöhte Cäsiumwerte, die vom DOE als strategisches Metall betrachtet werden. Das Unternehmen hat mit der Genehmigung von Bohrlöchern an den Dragon-Zielen begonnen und schlägt bis zu 40 Bohrstandorte vor, um flache Lithiumvorkommen zu testen. Darüber hinaus hat Bradda Head eine Neupreisung von 9.000.000 ausstehenden Aktienoptionen auf £0.017 (CA$0.03) pro Stammaktie angekündigt, vorbehaltlich der Genehmigung durch die TSX-Venture-Börse und die Aktionäre.

- Channel samples revealed high-grade lithium mineralization, with up to 0.97% Li2O over 8.80m

- Elevated cesium levels detected, which is considered a strategic metal by the Department of Energy

- Company has commenced drill hole permitting for up to 40 sites to test shallow lithium mineralization

- New drill targets developed following detailed surface channel sampling program

- Geochemical analysis indicates highly fractionated pegmatites with robust lithium content

- Share option repricing indicates current market challenges in the lithium sector

- Repricing of options may lead to potential shareholder dilution

BRITISH VIRGIN ISLANDS / ACCESSWIRE / September 3, 2024 / Bradda Head Lithium Ltd (AIM:BHL)(TSXV:BHLI,), the North America-focused lithium development group, is pleased to announce the results from surface channel samples at the San Domingo ("SD") pegmatite project in central Arizona. The Dragon target contains 8.80 meters of

Channel Sample Highlights:

8.80m @

0.97% Li20 with 174 ppm Cs at Dragon South10.40m @

0.68% Li2O with 341 ppm Cs at Dragon South4.80m @

0.41% Li2O with 336 ppm Cs at Dragon North9.00m @

0.29% Li2O with 325 ppm Cs at Dragon North4.70m @

0.28% Li2O with 176 ppm Cs at Dragon North1.90m @

0.29% Li2O with 609 ppm Cs at Dragon South

Highlights

Significant new drill tagetes developed at San Domingo following on from a detailed surface channel sampling programme

A total of 84 channel samples were collected from Dragon South and North targets at the San Domingo project and an additional 83 grab rock chip samples from across the project;

The Dragon channel sampling focused on historic prospects where exposure was fair to excellent;

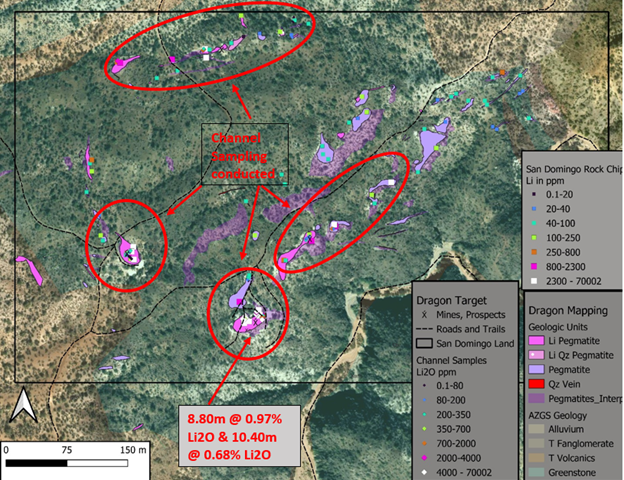

Dragon South contains an excellent exposure on a northeast trending pegmatite where sampling was conducted across its two prospects, one of which is a large cut exposing abundant coarse spodumene crystals and bordered by massive quartz, typical LCE pegmatite zoning;

Elevated Cs is also noted across the Dragon targets with channel samples running as high as 994 ppm and grab samples up to 1,317 ppm, important as the DOE considers Cs a strategic and critical metal and actively seeking it;

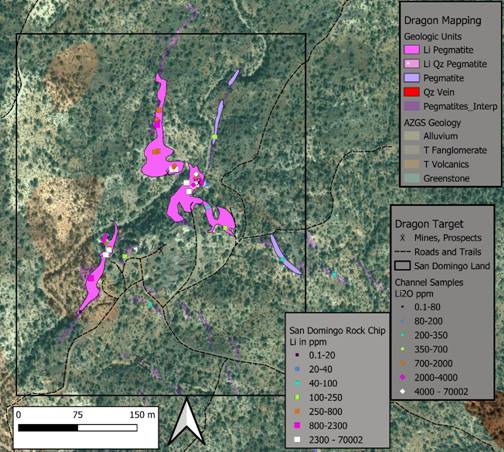

Three open cuts at Dragon North were sampled, some of which consist of very coarse spodumene and lepidolite, containing 4.80m at

0.41% Li2O;A geographically dispersed set of 52 mica samples were collected from pegmatites and analyzed with Libs, several revealing highly fractionated pegmatites with robust lithium content and excellent K/Rb ratios, fractionation across pegmatite swarms implicates higher degree of lithium development;

The Company has commenced drill hole permitting on the Dragon targets, proposing up to 40 drill sites to thoroughly test shallow lithium mineralization;

The Company continues building additional geochemical and geological data across the project with an emphasis on supporting shallow drilling at Midnight Owl, Lone Giant, Thunder, White Ridge, Lower Jumbo, and Morning Star.

Ian Stalker, Executive Chair, commented:

"These surface channel samples collected at the Dragon targets highlight just a few of the objectives the Company is building for the next drilling program and gaining encouragement on the extent of lithium mineralization across the entire property. As we explore new or orphaned areas, we continue to uncover new targets worthy of drill testing and hope to continue bringing value to the San Domingo pegmatite project."

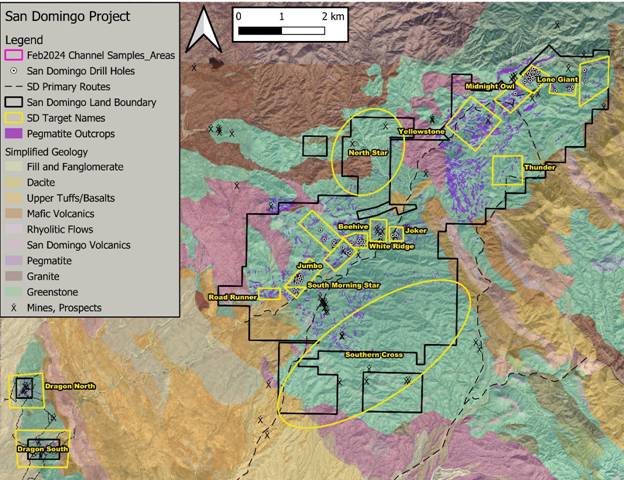

The Dragon target is broken into two areas, North and South (Figure 1, Table 1). The Dragon South target (Figure 2) contains several historic prospects sunk on lithium-bearing pegmatites, mineralization that exhibits an abundance of large spodumene crystals, >1.0m. Prior surface rock chip samples contain upwards of

Figure 1. Location map of property, geology, drilling, Dragon North and South targets to lower left of map

The channel sampling targeted both naturally outcropping pegmatite, dozer cut pegmatite, and historically excavated/mined pegmatite across both Dragon South and North. Naturally exposed samples returned lower lithium values likely due to surface weathering, but new (since 1945) exposures detected better lithium values as the fresher spodumene reveals less exposure to weathering. The best interval contains 8.80m at

Figure 2. Dragon South channel and rock chip samples, geology, access routes

Several exposures are found at Dragon North (Figure 4) and courtesy of historic mining plus excavation on lithium bearing pegmatites. The south end of the northeast-southwest trending pegmatite contains spodumene>lepidolite whereas the northern extent has lepidolite>spodumene, noting the very coarse nature of muscovite (pink lepidolite) intergrown with quartz and minor feldspar. Recent excavations contain 4.80 meters at

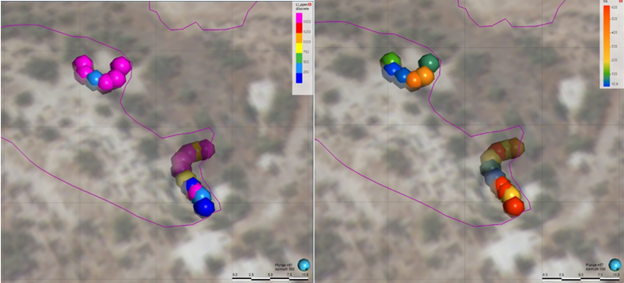

Figures 3a & 3b above. Dragon South Li2O ppm (left) in channel samples 8.80m @

Figure 4. Dragon North channel and rock chip samples, geology, access routes

Additional and new surface grab rock samples include

Dozens of muscovite ("mica") samples were collected across the project and scanned by a third party with a Libs hand-held scanning device, resulting in identification of several highly fractionated pegmatites, including the Dragon area pegmatites. Libs are widely used across the industry and provide lithium, potassium, and rubidium geochemistry of mica minerals within pegmatites. The Libs data helps identify and prioritize the targets across the project. Further work into the results will continue and possibly expanded where rock geochemistry is inconclusive.

Table 1.

Dragon South | ||||

Interval_m | Li2O % | Cs_ppm | Sn_ppm | Ta2O5 |

8.80 | 0.970 | 174 | 131 | 45 |

10.40 | 0.680 | 341 | 107 | 89 |

6.20 | 0.004 | 509 | 25 | 26 |

1.90 | 0.290 | 609 | 253 | 137 |

4.70 | 0.070 | 300 | 25 | 57 |

Dragon North | ||||

13.30 | 0.130 | 139 | 60 | 92 |

2.30 | 0.040 | 42 | 330 | 132 |

4.80 | 0.410 | 336 | 25 | 121 |

2.50 | 0.190 | 27 | 134 | 534 |

4.70 | 0.280 | 391 | 25 | 103 |

5.60 | 0.150 | 391 | 25 | 138 |

QAQC

Channel samples were cut in the field under the supervision of Joey Wilkins. Sample location sites were labelled, rock channels were bagged, tied-off, then transported to the core shed under lock and key. Samples were shipped by the Company directly to SGS Laboratories in Burnaby, B.C., Canada where SGS prepped then analysed all samples using sodium peroxide fusion combined ICP-AES and ICP-MS, method GE_ICM90A50. Certified standards were inserted into the sample stream and reviewed by the Qualified Person. Mr Wilkins consents to the inclusion of the technical information in this release and context in which it appears.

Qualified Person (Bradda Head)

Joey Wilkins, B.Sc., P.Geo., is Chief Operating Officer at Bradda Head and the Qualified Person who reviewed and approved the technical disclosures in this news release. Mr Wilkins is a graduate of the University of Arizona with a B.Sc. in Geology with more than 38 years of experience in mineral exploration and is a qualified person under the AIM Rules and a Qualified Person as defined under NI-43-101. Mr Wilkins consents to the inclusion of the technical information in this release and context in which it appears.

Share Option Repricing

The Company also announces that pursuant to its share option plan, it has reduced the exercise price of 9,000,000 outstanding share options ("Existing Options").

The repricing applies to Existing Options previously granted to, amongst others, certain Directors and Management of the Company pursuant to the Company's share option plan. The Existing Options will be repriced from an exercise price of £0.06 (CA

The repricing of the Existing Options is subject to the approval the TSX Venture Exchange, as well as by a majority of votes cast at a meeting of shareholders of the Company, excluding the votes cast by shareholders who are subject to the repricing of the Existing Options. In the event that any of such approval is not obtained, the Existing Options will not be repriced. No Options may be exercised until such approvals are obtained. Disinterested shareholder approval is expected to be sought at the Company's next annual and special meeting of shareholders, anticipated to be held in November 2024.

Directors and persons discharging managerial responsibilities ("PDMRs") included in the repricing are detailed in the table below:

Director/ PDMR | Options Subject to Repricing | Total Options Held |

Ian Stalker | 5,250,000 | 19,250,000 |

Joey Wilkins | 1,500,000 | 2,500,000 |

Piotr Schabik | 500,000 | 1,500,000 |

The repricing of the Existing Options previously issued to insiders of the Company constitutes a "related party transaction" under Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The repricing is exempt from the formal valuation requirements of Section 5.4 of MI 61-101 pursuant to subsection 5.5(b) of MI 61-101 as no securities of the Company are listed on certain exchanges specific by MI 61-101. It is also exempt from the minority shareholder approval requirements of Section 5.6 of MI 61-101 pursuant to Section 5.7(a) of MI 61-101 insofar as the fair market value of such repricing is less than

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES OF THE MARKET ABUSE REGULATION (EU No. 596/2014) AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018. UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN AND SUCH PERSONS SHALL THEREFORE CEASE TO BE IN POSSESSION OF INSIDE INFORMATION.

For further information please visit the Company's website: www.braddaheadltd.com.

ENDS

Contact:

Bradda Head Lithium Limited | +44 (0) 1624 639 396 |

Ian Stalker, Executive Chair Denham Eke, Finance Director |

|

|

|

Beaumont Cornish (Nomad) James Biddle / Roland Cornish | +44 20 7628 3396 |

|

|

Panmure Liberum (Joint Broker) | +44 20 7886 2500 |

Kieron Hodgson / Rauf Munir |

|

|

|

Shard Capital (Joint Broker) | +44 207 186 9927 |

Damon Heath / Isabella Pierre |

|

|

|

Red Cloud (North American Broker) | +1 416 803 3562 |

Joe Fars |

|

|

|

Tavistock (PR) | + 44 20 7920 3150 |

Nick Elwes / Josephine Clerkin | braddahead@tavistock.co.uk |

About Bradda Head Lithium Ltd.

Bradda Head Lithium Ltd. is a North America-focused lithium development group. The Company currently has interests in a variety of projects, the most advanced of which are in Central and Western Arizona: The Basin Project (Basin East Project, and the Basin West Project) and the Wikieup Project.

The Basin East Project has a Measured Mineral Resource of 20 Mt at an average grade of 929 ppm Li for a total of 99 kt LCE and an Indicated Mineral Resource of 122 Mt at an average grade of 860 ppm Li and an Inferred Mineral Resource of 499 Mt at an average grade of 810 ppm Li for a total of 2.81 Mt LCE. The Group intends to continue to develop its three phase one projects in Arizona, whilst endeavouring to unlock value at its other prospective pegmatite and brine assets in Arizona, Nevada, and Pennsylvania. All of Bradda Head's licences are held on a

Technical Glossary

Kt | Thousand tonnes |

% | Percent |

Ppm | Parts per million |

Exploration Target | An estimate of the exploration potential of a mineral deposit in a defined geological setting where the statement or estimate, quoted as a range of tonnes and a range of grade (or quality), relates to mineralisation for which there has been insufficient exploration to estimate a Mineral Resource. |

Inferred Mineral Resource | That part of a Mineral Resource for which quantity and grade (or quality) are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological grade (or quality) continuity. It is based on exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings, and drill holes. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to an Ore Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. |

Indicated Mineral Resource | That part of a Mineral Resource for which quantity, grade (or quality), densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings, and drill holes, and is sufficient to assume geological and grade (or quality) continuity between points of observation where data and samples are gathered. |

Sn | Tin |

Li2O % | Lithium Oxide |

Cs | Cesium |

Ta2O5 | Tantalum pentoxide |

K | Potassium |

Rb | Rubidium |

Forward-Looking Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This News Release includes certain "forward-looking statements" which are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "intends to", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management's expectations. Risks, uncertainties, and other factors involved with forward-looking information could cause actual events, results, performance, prospects, and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, following: The Company's objectives, goals, or future plans. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to: failure to identify mineral resources; failure to convert estimated mineral resources to reserves; delays in obtaining or failures to obtain required regulatory, governmental, environmental or other project approvals; political risks; future operating and capital costs, timelines, permit timelines, the market and future price of and demand for lithium, and the ongoing ability to work cooperatively with stakeholders, including the local levels of government; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices; delays in the development of projects, capital and operating costs varying significantly from estimates; an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains; and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company's public documents filed on SEDARplus. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Beaumont Cornish Limited ("Beaumont Cornish") is the Company's Nominated Adviser and is authorised and regulated by the FCA. Beaumont Cornish's responsibilities as the Company's Nominated Adviser, including a responsibility to advise and guide the Company on its responsibilities under the AIM Rules for Companies and AIM Rules for Nominated Advisers, are owed solely to the London Stock Exchange. Beaumont Cornish is not acting for and will not be responsible to any other persons for providing protections afforded to customers of Beaumont Cornish nor for advising them in relation to the proposed arrangements described in this announcement or any matter referred to in it.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

SOURCE: Bradda Head Lithium Limited

View the original press release on accesswire.com