Bradda Head Lithium Ltd Announces Drilling Progress At Basin Lithium in Clay Project

BRITISH VIRGIN ISLANDS / ACCESSWIRE / April 17, 2024 / Bradda Head Lithium Ltd (AIM:BHL)(TSXV:BHLI,), the North America-focused lithium development group, is pleased to provide an update on work at its Basin Project in Arizona. This current drilling program is focused on resource expansion at the Basin North portion of the project. The target is a resource expansion from 1.08 to a minimum of 2.5 million tons (MT) of lithium carbonate equivalent (LCE). Achievement of this would generate a US

The first four holes have been logged, sampled, and shipped to the laboratory while drilling of the fifth hole is in progress. Results on all four holes are pending. A further 3 holes are planned.

Highlights:

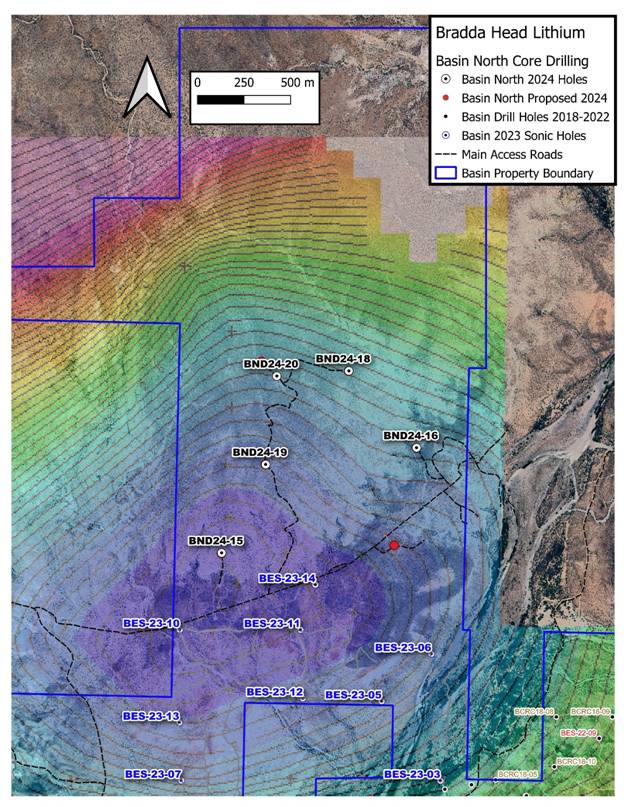

The Company has completed four widely spaced holes for a total of 4,330 feet (1,320m) from a planned program of 8,800 feet/2,680 meters (See RNS 12 March, 2024)

The average Upper Clay thickness, based on visual inspection of the drill core extracted, between the four holes is 85 meters, ranging from 73m to 103m (previous average thickness, excluding Basin East, is 80m)

Hole 19 has encountered the thickest-ever Upper Clay sequence at 103 meters, potentially demarking the depositional center

Holes 16 and 18 have encountered Upper Clay shallower than anticipated, yet maintain good thicknesses, hole 17 was abandoned due to poor drilling conditions at a shallow depth and has now been offset and currently being redrilled as hole number 20.

The four holes (BND24-15, 16, 18, & 19) have encountered between 7 and 37 meters of Lower Clay, a strong indication of continuity from Basin East, located 2.0km to the southeast

A 7th hole will be added to the south of Basin North, twinning last year's sonic hole BES23-11 (See RNS 21 August, 2023), which cut 88.70m of upper clay averaging 903ppm and 12.51m of high grade at 1,427ppm, but did not penetrate the Lower Clay

The programme is scheduled to complete in early May with an updated 43-101 Resource to follow once all assays have been received, for which Bradda Head is targeting early June.

Ian Stalker, Executive Chair, commented:

"Drilling the Basin North clays has been an exciting and promising program. Thus far; we're finding excellent clay thicknesses, as expected, and some clay depths have been shallower than anticipated,which is an encouraging result that supports the viability and potential of this project.

"We have successfully now completed nearly half of the planned program, bringing Bradda Head increasingly closer to achieving the significant milestone of our target of resource 2.5MT, and unlocking the next royalty payment of US

"We look forward to providing further updates in due course."

Figure 1. Basin North drill hole distribution, currently on hole BND24-20. Figure shows 2023 sonic holes in blue, Basin East drill holes on the lower right-hand corner, property boundary in blue, gravity/air photo image base.

QAQC

Core samples were cut and sampled at the core shed under the supervision of Joey Wilkins, the Company's COO. The drill core was cut in half and one-half bagged, labelled, and tied-off. Samples were placed in a secure container until the hole was complete then shipped direct to SGS Laboratories in Burnaby, B.C., Canada where they prepped then analysed all samples using 4-acid digest with ICP-AES. Certified standards were inserted into the sample stream to ensure quality control at the laboratory. Mr. Wilkins consents to the inclusion of the technical information in this release and context in which it appears.

Qualified Person (BHL)

Joey Wilkins, B.Sc., P.Geo., is Chief Operating Officer at BHL and the Qualified Person who reviewed and approved the technical disclosures in this news release. Mr. Wilkins is a graduate of the University of Arizona with a B.Sc. in Geology with more than 38 years of experience in mineral exploration and is a qualified person under the AIM Rules and a Qualified Person as defined under NI-43-101. Mr. Wilkins consents to the inclusion of the technical information in this release and context in which it appears.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES OF THE MARKET ABUSE REGULATION (EU No. 596/2014) AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018. UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN AND SUCH PERSONS SHALL THEREFORE CEASE TO BE IN POSSESSION OF INSIDE INFORMATION.

For further information please visit the Company's website: www.braddaheadltd.com.

ENDS

Contact:

Bradda Head Lithium Limited | +44 (0) 1624 639 396 |

Ian Stalker, Executive Chairman Denham Eke, Finance Director |

|

|

|

Beaumont Cornish (Nomad) | +44 (0) 2076 283 396 |

James Biddle / Roland Cornish | |

Panmure Gordon (Joint Broker) | +44 (0) 2078 862 500 |

Hugh Rich | |

Shard Capital (Joint Broker) | +44 (0) 2071 869 927 |

Damon Heath / Isabella Pierre | |

Red Cloud (North American Broker) | +1 416 803 3562 |

Joe Fars | |

Tavistock (Financial PR) | + 44 20 7920 3150 |

Nick Elwes / Adam Baynes |

About Bradda Head Lithium Ltd.

Bradda Head Lithium Ltd. is a North America-focused lithium development group. The Company currently has interests in a variety of projects, the most advanced of which are in Central and Western Arizona: The Basin Project (Basin East Project, and the Basin West Project) and the Wikieup Project.

The Basin East Project has an Indicated Mineral Resource of 17 Mt at an average grade of 940 ppm Li and

Technical Glossary

Kt | Thousand tonnes |

Ppm | Parts per million |

Exploration Target | An estimate of the exploration potential of a mineral deposit in a defined geological setting where the statement or estimate, quoted as a range of tonnes and a range of grade (or quality), relates to mineralisation for which there has been insufficient exploration to estimate a Mineral Resource. |

Inferred Mineral Resource | That part of a Mineral Resource for which quantity and grade (or quality) are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological grade (or quality) continuity. It is based on exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings, and drill holes. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to an Ore Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. |

Indicated Mineral Resource | That part of a Mineral Resource for which quantity, grade (or quality), densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings, and drill holes, and is sufficient to assume geological and grade (or quality) continuity between points of observation where data and samples are gathered. |

Sn | Tin |

Ta2O5 | Tantalum pentoxide |

Forward-Looking Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This News Release includes certain "forward-looking statements" which are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "intends to", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management's expectations. Risks, uncertainties, and other factors involved with forward-looking information could cause actual events, results, performance, prospects, and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, following: The Company's objectives, goals, or future plans. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to: failure to identify mineral resources; failure to convert estimated mineral resources to reserves; delays in obtaining or failures to obtain required regulatory, governmental, environmental or other project approvals; political risks; future operating and capital costs, timelines, permit timelines, the market and future price of and demand for lithium, and the ongoing ability to work cooperatively with stakeholders, including the local levels of government; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices; delays in the development of projects, capital and operating costs varying significantly from estimates; an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains; and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company's public documents filed on SEDARplus. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Beaumont Cornish Limited ("Beaumont Cornish") is the Company's Nominated Adviser and is authorised and regulated by the FCA. Beaumont Cornish's responsibilities as the Company's Nominated Adviser, including a responsibility to advise and guide the Company on its responsibilities under the AIM Rules for Companies and AIM Rules for Nominated Advisers, are owed solely to the London Stock Exchange. Beaumont Cornish is not acting for and will not be responsible to any other persons for providing protections afforded to customers of Beaumont Cornish nor for advising them in relation to the proposed arrangements described in this announcement or any matter referred to in it.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

SOURCE: Bradda Head Lithium Limited

View the original press release on accesswire.com