Barton Gold Receives $2.4 Million Cash R&D Tax Refund

Barton Gold Holdings (BGDFF) has received a $2.4 million R&D cash tax refund for the year ended June 30, 2024, through the Federal Government's R&D Tax Incentive Program. The company's unrestricted cash balance now stands at approximately $9.2 million, excluding ~$4.5 million in cash posted as security for rehabilitation bank guarantees.

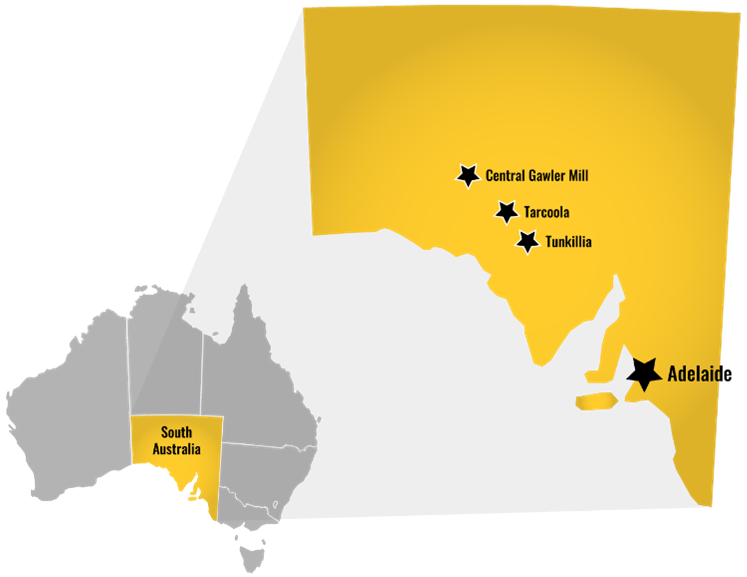

The company has conducted various R&D programs during FY2024, focusing on developing new exploration methodologies and regional geological models near their Tarcoola and Tunkillia Gold Projects. These initiatives have led to significant discoveries, including the new Tolmer Gold System at Tarcoola and several gold zones at Tunkillia (Area 51, 223 North, 223 South, and Area 191). Some programs will continue through 2025 and 2026 fiscal years.

Barton Gold Holdings (BGDFF) ha ricevuto un rimborso fiscale in contante per R&D di $2,4 milioni per l'anno concluso il 30 giugno 2024, attraverso il Programma di Incentivazione Fiscale per R&D del Governo Federale. Il saldo di cassa disponibile dell'azienda è ora di circa $9,2 milioni, escludendo circa $4,5 milioni in contante depositati come garanzia per le fideicommissarie di riabilitazione.

L'azienda ha condotto vari programmi di R&D durante l'anno fiscale 2024, concentrandosi sullo sviluppo di nuove metodologie di esplorazione e modelli geologici regionali vicino ai loro Progetti Oro Tarcoola e Tunkillia. Queste iniziative hanno portato a scoperte significative, inclusa la nuova Sistema Oro Tolmer a Tarcoola e diverse zone aurifere a Tunkillia (Area 51, 223 Nord, 223 Sud e Area 191). Alcuni programmi continueranno durante gli anni fiscali 2025 e 2026.

Barton Gold Holdings (BGDFF) ha recibido un reembolso fiscal en efectivo de R&D de $2.4 millones para el año que terminó el 30 de junio de 2024, a través del Programa de Incentivo Fiscal de R&D del Gobierno Federal. El saldo de efectivo no restringido de la empresa ahora se sitúa en aproximadamente $9.2 millones, excluyendo aproximadamente $4.5 millones en efectivo depositados como garantía para las garantías bancarias de rehabilitación.

La empresa ha llevado a cabo varios programas de I+D durante el año fiscal 2024, centrándose en desarrollar nuevas metodologías de exploración y modelos geológicos regionales cerca de sus Proyectos de Oro Tarcoola y Tunkillia. Estas iniciativas han dado lugar a descubrimientos significativos, incluida la nueva Sistema de Oro Tolmer en Tarcoola y varias zonas de oro en Tunkillia (Área 51, 223 Norte, 223 Sur y Área 191). Algunos programas continuarán durante los años fiscales 2025 y 2026.

바턴 골드 홀딩스 (BGDFF)는 2024년 6월 30일로 종료된 연도에 대해 연방 정부의 R&D 세금 인센티브 프로그램을 통해 240만 달러의 R&D 현금 세금 환급을 받았습니다. 회사의 유동 현금 잔고는 약 920만 달러이며, 재활 은행 보증을 위한 보증금으로 게시된 약 450만 달러는 제외됩니다.

회사는 FY2024 동안 다양한 R&D 프로그램을 수행하였으며, 타르쿨라 및 튼킬리아 금 프로젝트 인근의 새로운 탐사 방법론 및 지역 지질 모델 개발에 중점을 두었습니다. 이러한 이니셔티브는 타르쿨라의 새로운 톨머 금 시스템 및 튼킬리아의 여러 금 구역(51구역, 223 북쪽, 223 남쪽 및 191 구역)을 포함한 중요한 발견으로 이어졌습니다. 일부 프로그램은 2025년 및 2026년 회계 연도에도 계속됩니다.

Barton Gold Holdings (BGDFF) a reçu un remboursement fiscal en espèces de 2,4 millions de dollars pour l'année se terminant le 30 juin 2024, grâce au Programme d'Incitation Fiscale pour la R&D du Gouvernement Fédéral. Le solde de trésorerie non restreint de l'entreprise s'élève désormais à environ 9,2 millions de dollars, sans compter environ 4,5 millions de dollars en espèces déposés en garantie pour des garanties bancaires de réhabilitation.

L'entreprise a mené divers programmes de R&D durant l'exercice 2024, se concentrant sur le développement de nouvelles méthodologies d'exploration et de modèles géologiques régionaux à proximité de ses Projets d'Or Tarcoola et Tunkillia. Ces initiatives ont conduit à des découvertes significatives, y compris le nouveau Système d'Or Tolmer à Tarcoola et plusieurs zones aurifères à Tunkillia (Zone 51, 223 Nord, 223 Sud, et Zone 191). Certains programmes se poursuivront jusqu'aux exercices fiscaux 2025 et 2026.

Barton Gold Holdings (BGDFF) hat eine Rückerstattung von 2,4 Millionen US-Dollar für Forschung und Entwicklung (F&E) für das zum 30. Juni 2024 endende Jahr erhalten, im Rahmen des R&D Steueranreizprogramms der Bundesregierung. Der ungebundene Kassenbestand des Unternehmens beträgt nun etwa 9,2 Millionen US-Dollar, ohne die etwa 4,5 Millionen US-Dollar Bargeld, die als Sicherheit für Rehabilitationsbankgarantien hinterlegt sind.

Das Unternehmen hat im Geschäftsjahr 2024 verschiedene F&E-Programme durchgeführt, die sich auf die Entwicklung neuer Explorationsmethoden und regionaler geologischer Modelle in der Nähe ihrer Goldprojekte Tarcoola und Tunkillia konzentrieren. Diese Initiativen haben zu bedeutenden Entdeckungen geführt, darunter das neue Tolmer-Goldsysten in Tarcoola und mehrere Goldzonen in Tunkillia (Bereich 51, 223 Nord, 223 Süd und Bereich 191). Einige Programme werden bis in die Geschäftsjahre 2025 und 2026 fortgesetzt.

- Received $2.4 million R&D tax refund boosting cash position

- Strong cash position of $9.2 million in unrestricted funds

- Discovery of new gold zones at multiple project sites

- Ongoing government support through R&D Tax Incentive Program

- None.

ADELAIDE, AUSTRALIA / ACCESSWIRE / January 12, 2025 / Barton Gold Holdings Limited (ASX:BGD)(FRA:BGD3)(OTCQB:BGDFF) ( Barton or Company ) is pleased to advise that it has received a ~

Further to the receipt of these funds, Barton's unrestricted cash balance (which excludes ~

Barton has executed a range of R&D work programmes during fiscal year 2024, including trialling multiple technologies to develop new methodologies for exploration under cover in South Australia, and the development of new regional geological models. These work programmes have been completed in the vicinity of the Company's Tarcoola ( Tarcoola ) and Tunkillia Gold Projects ( Tunkillia ). Several of these work programs remain ongoing and are expected to be completed during the 2025 and 2026 financial years.

In conjunction with funding awarded to Barton under the South Australian Government's Accelerated Discovery Initiative ( ADI ), the Federal Government's R&D Tax Incentive Program has directly contributed to the significant acceleration of exploration activity and efficiency in an emerging gold province. [1]

Significant outcomes enabled by this support include the development of a new regional structural model for the Tarcoola Goldfield, new predictive models for alteration zones on the Yarlbrinda Shear Zone (which hosts the Tunkillia project), and the validation of multiple predicted structures and alteration zones. Among others these have resulted in the subsequent identification of the new Tolmer Gold System at Tarcoola and the Area 51, 223 North, 223 South and Area 191 gold zones at Tunkillia. [2]

Commenting on the receipt of R&D Tax Incentive funds, Barton MD Alexander Scanlon said:

"The Federal Government's R&D Tax Incentive Program is a highly beneficial initiative which supports smaller companies to pursue technical innovation across a wide range of Australian industries.

"Barton's participation in this program has enabled us to undertake a wide range of large-scale R&D programs which might otherwise not be possible, and has contributed to multiple significant technical outcomes.

"We are very grateful for the Federal Government's consistent support of our long-term regional efforts, and look forward to continuing these programs in pursuit of further contributions to regional technical development."

Authorised by the Board of Directors of Barton Gold Holdings Limited.

For further information, please contact:

Alexander Scanlon | Jade Cook |

About Barton Gold

Barton Gold is an ASX, OTCQB and Frankfurt Stock Exchange listed Australian gold developer targeting future gold production of 150,000oz annually, with ~1.6Moz Au JORC Mineral Resources (52.3Mt @ 0.94 g/t Au), multiple advanced exploration projects and brownfield mines, and

Tarcoola Gold Project

Existing brownfield open pit mine within trucking distance of Barton's processing plant

Under-explored asset with untapped scale potential

Tunkillia Gold Project *

1.5Moz Au Mineral Resources (51.3Mt @ 0.91 g/t Au)

Scoping Study for competitive ~130kozpa Au mine

Infrastructure

650ktpa CIP process plant, mine village, and airstrip

Tarcoola ~40 person lodging to support mine operations

Tunkillia camp to support dedicated project team

Competent Persons Statement & Previously Reported Information

The information in this announcement that relates to the historic Exploration Results and Mineral Resources as listed in the table below is based on, and fairly represents, information and supporting documentation prepared by the Competent Person whose name appears in the same row, who is an employee of or independent consultant to the Company and is a Member or Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM), Australian Institute of Geoscientists (AIG) or a Recognised Professional Organisation (RPO). Each person named in the table below has sufficient experience which is relevant to the style of mineralisation and types of deposits under consideration and to the activity which he has undertaken to quality as a Competent Person as defined in the JORC Code 2012 ( JORC ).

Activity | Competent Person | Membership | Status |

Tarcoola Mineral Resource (Stockpiles) | Dr Andrew Fowler (Consultant) | AusIMM | Member |

Tarcoola Mineral Resource (Perseverance Mine) | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Tarcoola Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tarcoola Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tunkillia Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Mineral Resource | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Challenger Mineral Resource | Mr Dale Sims (Consultant) | AusIMM / AIG | Fellow / Member |

The information relating to historic Exploration Results and Mineral Resources in this announcement is extracted from the Company's Prospectus dated 14 May 2021 or as otherwise noted in this announcement, available from the Company's website at www.bartongold.com.au or on the ASX website www.asx.com.au . The Company confirms that it is not aware of any new information or data that materially affects the Exploration Results and Mineral Resource information included in previous announcements and, in the case of estimates of Mineral Resources, that all material assumptions and technical parameters underpinning the estimates, and any production targets and forecast financial information derived from the production targets, continue to apply and have not materially changed. The Company confirms that the form and context in which the applicable Competent Persons' findings are presented have not been materially modified from the previous announcements.

Cautionary Statement Regarding Forward-Looking Information

This document may contain forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "expect", "target" and "intend" and statements than an event or result "may", "will", "should", "would", "could", or "might" occur or be achieved and other similar expressions. Forward-looking information is subject to business, legal and economic risks and uncertainties and other factors that could cause actual results to differ materially from those contained in forward-looking statements. Such factors include, among other things, risks relating to property interests, the global economic climate, commodity prices, sovereign and legal risks, and environmental risks. Forward-looking statements are based upon estimates and opinions at the date the statements are made. Barton undertakes no obligation to update these forward-looking statements for events or circumstances that occur subsequent to such dates or to update or keep current any of the information contained herein. Any estimates or projections as to events that may occur in the future (including projections of revenue, expense, net income and performance) are based upon the best judgment of Barton from information available as of the date of this document. There is no guarantee that any of these estimates or projections will be achieved. Actual results will vary from the projections and such variations may be material. Nothing contained herein is, or shall be relied upon as, a promise or representation as to the past or future. Any reliance placed by the reader on this document, or on any forward-looking statement contained in or referred to in this document will be solely at the readers own risk, and readers are cautioned not to place undue reliance on forward-looking statements due to the inherent uncertainty thereof.

[1] Refer to ASX announcements dated 15 June 2022

[2] Refer to ASX announcements dated 5 September 2022, 15 / 21 November 2023, and 14 February and 27 August 2024

*Refer to Barton Prospectus dated 14 May 2021 and ASX announcements dated 4 March and 16 July 2024. Total Barton JORC (2012) Mineral Resources include 833koz Au (26.9Mt @ 0.96 g/t Au) in Indicated and 754koz Au (25.4Mt @ 0.92 g/t Au) in Inferred categories.

SOURCE: Barton Gold Holdings Limited

View the original press release on accesswire.com

FAQ

How much R&D tax refund did Barton Gold (BGDFF) receive in 2024?

What is Barton Gold's (BGDFF) current unrestricted cash balance?

What new gold discoveries has BGDFF made through their R&D programs?