Preliminary Results for the Year Ended 31 December 2023

- None.

- None.

Insights

Biodexa Pharmaceuticals PLC's disclosure of their audited preliminary results marks a critical juncture for investors and industry observers alike. An immediate flag for investors is the performance metrics such as revenue growth, expenses and ultimately net income. In the biopharmaceutical sector, where product development cycles are long and capital-intensive, these financials are pivotal in assessing the company's ability to sustain operations and invest in research and development.

Investors should scrutinize the burn rate and compare it with the company's current cash reserves to determine runway length. This is especially important in the clinical stage where companies like Biodexa rely heavily on capital markets for financing. Any significant changes in operating expenses, particularly R&D expenditure, could signal evolving strategies or reflect on the progress of their product pipeline. Revenue streams may be minimal at this stage, but any partnerships or grants could alleviate financial pressures.

Understanding the nuances of these results requires examining the balance sheet for asset management and liability accrual. Investors should check for any debt financing which may have been strategically utilized to fund the company’s initiatives and also the terms of such financing. A key aspect to consider is the research and development tax credits, typically relevant to biopharmaceutical companies for offsetting some of the costs.

From a drug development perspective, progress in clinical trials is of monumental importance to Biodexa Pharmaceuticals. The reported results can provide clues on the trajectory of their brain cancer drugs. Critical to note is the phase of clinical trials the products are in, as this affects their risk profile and the timeline to potential market entry. For instance, progression from Phase 2 to Phase 3 trials indicates a higher likelihood of regulatory approval, influencing investor sentiment and stock valuation.

Furthermore, updates on the safety and efficacy data from these trials could have a significant impact on the company's credibility and the drugs' commercial potential. Any setbacks, like a trial not meeting its endpoints, can seriously dampen future prospects. Conversely, positive data can lead to an uptick in investor confidence, potentially leading to an increase in stock price.

Evaluation of the company's portfolio should also include any strategic partnerships or collaborations they have entered into, which could be instrumental in reducing costs and expediting drug development timelines.

Assessing Biodexa Pharmaceuticals PLC within the broader market context, the demand for innovative treatments in oncology, especially for brain-related cancers, remains strong. How Biodexa positions itself against competitors, patent cliffs and regulatory environment in different geographies can influence its market share and growth prospects.

Investors should consider the potential addressable market size for Biodexa's pipeline products and their pricing strategy. The company's capability to navigate the complex regulatory pathways and secure insurance coverage will also be key determinants in the commercialization success of its products.

Moreover, investor relations and market sentiment can be swayed by external factors such as regulatory changes or shifts in healthcare policies. Therefore, keeping an eye on the political and economic climate, as well as industry trends, is essential for a comprehensive investment decision.

19 April 2024

Biodexa Pharmaceuticals PLC

(“Biodexa” or the “Company” or, together with its subsidiaries, the “Group”)

Preliminary Results for the Year Ended 31 December 2023

Biodexa Pharmaceuticals PLC (NASDAQ: BDRX), a clinical stage biopharmaceutical company developing a pipeline of products aimed at primary and metastatic cancers of the brain, announces its audited preliminary results for the year ended 31 December 2023.

For more information, please contact:

Biodexa Pharmaceuticals PLC |

| Stephen Stamp, CEO, CFO |

| Tel: +44 (0)29 2048 0180 |

| www.biodexapharma.com |

About Biodexa Pharmaceuticals PLC

Biodexa Pharmaceuticals PLC (listed on NASDAQ: BDRX) is a clinical stage biopharmaceutical company developing a pipeline of innovative products for the treatment of diseases with unmet medical needs. The Company’s lead development programmes include tolimidone, under development as a novel agent for the treatment of type 1 diabetes and MTX110, which is being studied in aggressive rare/orphan brain cancer indications.

Tolimidone is an orally delivered, potent and selective inhibitor of Lyn kinase. Lyn is a member of the Src family of protein tyrosine kinases, which is mainly expressed in hematopoietic cells, in neural tissues, liver, and adipose tissue. Tolimidone demonstrates glycemic control via insulin sensitization in animal models of diabetes and has the potential to become a first in class blood glucose modulating agent.

MTX110 is a solubilised formulation of the histone deacetylase (HDAC) inhibitor, panobinostat. This proprietary formulation enables delivery of the product via convection-enhanced delivery (CED) at chemotherapeutic doses directly to the site of the tumour, by-passing the blood-brain barrier and potentially avoiding systemic toxicity.

Biodexa is supported by three proprietary drug delivery technologies focused on improving the bio-delivery and bio-distribution of medicines. Biodexa’s headquarters and R&D facility is in Cardiff, UK. For more information visit www.biodexapharma.com.

Forward-Looking Statements

Certain statements in this announcement are forward-looking statements or information (collectively, forward-looking statements). Biodexa hereby provides cautionary statements identifying important factors that could cause the actual results to differ materially from those projected in the forward-looking statements. Any statements that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions or future events or performance (often, but not always, through the use of words or phrases such as “may”, “is expected to”, “anticipates”, “estimates”, “intends”, “plans”, “projection”, “could”, “vision”, “goals”, “objective” and “outlook”) are not historical facts and may be forward-looking and may involve estimates, assumptions and uncertainties which could cause actual results or outcomes to differ materially from those expressed in the forward-looking statements.

By their nature, forward-looking statements involve numerous assumptions, inherent risks and uncertainties, both general and specific, which contribute to the possibility that the predicted outcomes may not occur or may be delayed. The risks, uncertainties and other factors many of which are beyond the control of Biodexa, that could influence actual results include, but are not limited to: a limited operating history; regulatory risks; substantial capital and liquidity requirements; financing risks and dilution to shareholders; competition; reliance on management and dependence on key personnel; conflicts of interest of management; exposure to potential litigation, and other factors beyond the control of Biodexa.

Forward looking statements are based on estimates and assumptions made by management in light of their experience of historical trends, current conditions and expected future developments, as well as factors that are believed to be appropriate. Such factors include, among others, Biodexa’s future product revenues, stage of development, additional capital requirements, risks associated with the completion and timing of clinical trials and obtaining regulatory approval to market Biodexa’s products, the ability to protect its intellectual property, dependence upon collaborative partners, changes in government regulation or regulatory approval processes and rapid technological change in the industry. These factors should be considered carefully and readers are cautioned to not place undue reliance on such forward-looking statements.

Further, any forward-looking statement speaks only as of the date on which such statement is made, and, except as required by applicable law, Biodexa undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statements are made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for management to predict all such factors and to assess in advance the impact of each such factor on the business of the Company or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement.

Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data. You should, however, review the factors and risks we describe in the reports we will file from time to time with the US Securities and Exchange Commission after the date of this announcement. As a result of these factors, we cannot assure you that the forward-looking statements in this announcement will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified timeframe, or at all.

INTRODUCTION

Headquartered in Cardiff, UK, with its American Depositary Shares (“ADSs”) quoted on the NASDAQ exchange in the US, Biodexa is a clinical-stage biotechnology company developing a pipeline of innovative products for the treatment of diseases with unmet medical needs including Type 1 diabetes and rare / orphan brain cancers. The Company de-listed from the AIM market as of 26 April 2023.

STRATEGY

In the course of seeking additional funding for the Company, it became clear that raising significant funds for a drug delivery platform company was going to be difficult, if not impossible, in the then prevailing financial markets. Accordingly, we decided to re-position the Company as a therapeutics company and began looking for assets to complement our MTX110 programmes.

Following the re-positioning of the Company, our priorities for 2024 reflect our modified strategy as follows:

| Strategic Imperatives | Progress in 2023 | Priorities for 2024 |

| Advance our clinical -stage assets through to proof-of-concept data | We announced the completion of recruitment into Cohort A of our MAGIC-G1 study of MTX110 in patients with recurrent glioblastoma (rGBM). In an Investigator Initiated Trial, Columbia University completed recruitment of a Phase I study of MTX110 in patients with Diffuse Midline Glioma (DMG). | In respect of our Phase I study in rGBM, deliver interim safety and efficacy data (in the form of Progression Free Survival data) in respect of Cohort A patients and begin recruitment of Cohort B patients. Initiate recruitment of a Phase IIa dose confirmation study of tolimidone in Type 1 diabetes patients. Seek an IND from FDA to commence a Phase II study of MTX110 in DMG. |

| Develop and broaden our drug development pipeline | We in-licensed tolimidone, a Phase II ready asset with very substantial preclinical and toxicology data which has been studied in over 700 patients. In preclinical experiments, tolimidone showed potential to be disease modifying in Type 1 diabetes. We initiated a new research programme, coded MTD217, to explore the potential for MTX110 in combination with an OXPHOS inhibitor for the treatment of Leptomeningeal Disease, a severe complication of solid cancers with metastasis in the leptomeningeal space of the CNS. | Generate in vitro data to support the disease modifying potential of tolimidone in Type 1 diabetes. Generate in vitro and in vivo data to demonstrate the effectiveness of MTD217 in Leptomeningeal Disease models. Seek additional pre-IND and/or clinical-stage assets to acquire or in-license. Expand further our patent portfolio to cover new inventions and divisionals to strengthen existing patent families. |

| Provide a healthy and stimulating environment in which our staff members can continue to thrive | We have been compliant with ISO 9001 since 2014. Implement the new COSHH assessment procedures developed in 2023. | Continue to monitor third party advice and regulation to maintain a safe environment for our staff members. Develop individualised learning programmes for staff members through participation in conferences, webinars and/or training programmes. |

BUSINESS MODEL

In order to make the Company more investable and secure additional financing, the Board decided to re-position the Company as a therapeutics (as opposed to drug delivery) company in early 2023. As a result, the delivery of proof-of-concept clinical data is the primary focus of our business model going forward.

Development

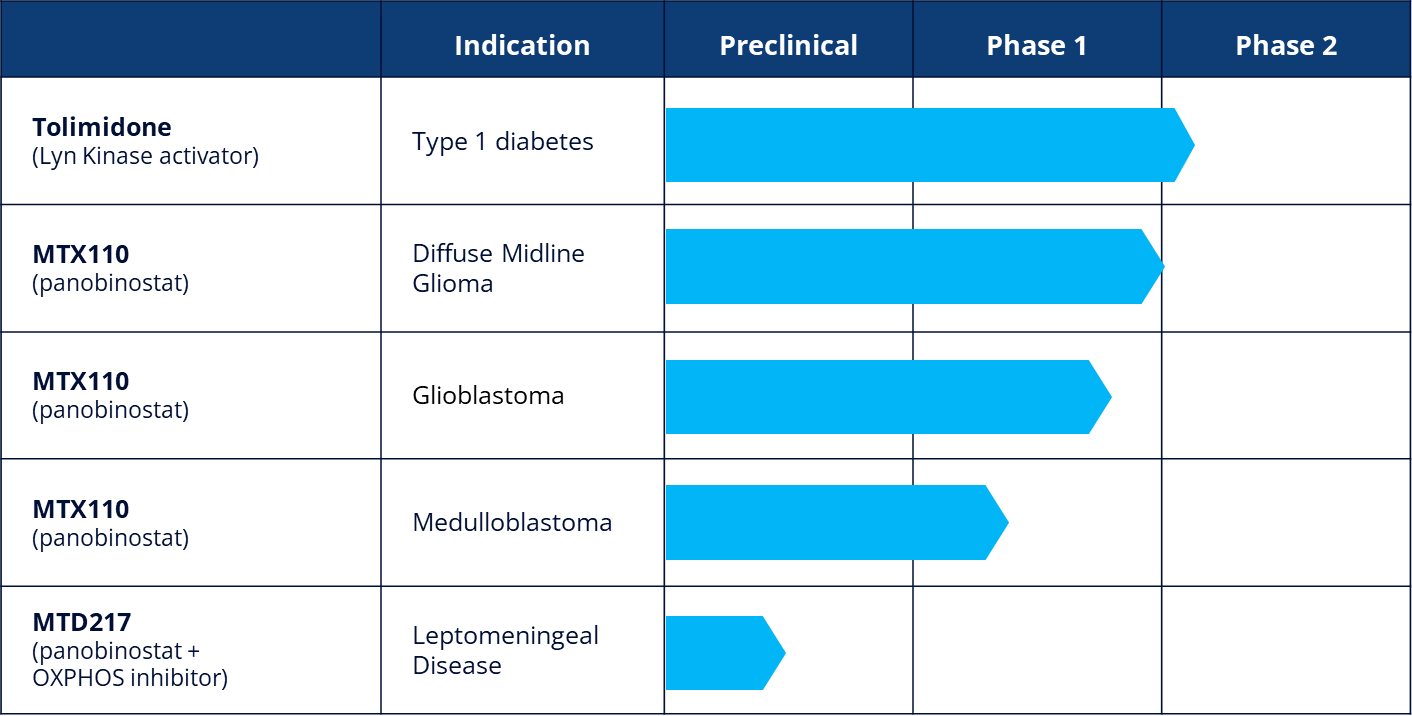

Our intention is to build a balanced portfolio of clinical-stage development assets, ideally with a focus on rare / orphan indications. Tolimidone, which was in-licensed in December 2023, is a Phase II ready asset which we intend to develop for Type 1 diabetes. MTX110 is currently in Phase I development for three rare / orphan brain cancers.

Our aim is to develop our clinical assets to proof of concept stage before securing partners to undertake the most expensive, later stage development.

Manufacturing

We do not intend to establish our own manufacturing capabilities. For clinical trial material we utilise GMP-certified contract manufacturers.

Commercialisation

Once proof-of-concept has been established, we intend to seek to license our products to a partner who would complete the clinical development and subsequently market and sell them in the licensed territory. In addition to reimbursement of development costs, the partner would be expected to make milestone payments based on sales targets and royalty payments.

Our development pipeline now includes five projects, four of which are at clinical stage, as follows:

CLINICAL-STAGE ASSETS

Tolimidone

Tolimidone was originally discovered by Pfizer Inc. (“Pfizer”) and was developed through Phase II for the treatment of gastric ulcers. Pfizer undertook a broad pre-clinical program to characterise the pharmacology, pharmacokinetics, metabolism and toxicology of tolimidone. Pfizer discontinued development of the drug due to lack of efficacy for that indication in Phase II. Tolimidone is a selective activator of the enzyme Lyn kinase which increases phosphorylation of insulin substrate -1, thereby amplifying the signalling cascade initiated by the binding of insulin to its receptor.

We intend to develop tolimidone for the treatment of Type-1 diabetes (“T1D”). As a Lyn kinase activator, tolimidone has been shown in preclinical experiments to have a role in beta cell survival and proliferation. If replicated in clinical studies, tolimidone could have the potential to be disease modifying and change the treatment paradigm for T1D. T1D affects approximately 8.4 million people worldwide and there are approximately 500,000 new diagnoses per annum.

As a first step in the planned continued clinical development of tolimidone, we intend to initiate a Phase IIa dose confirmation study to establish the optimum dose of tolimidone in patients with T1D. The Phase IIa study will be open-label in approximately 15 patients with T1D treated over a period of three months with endpoints of change in C-peptide levels, HbA1c and number of hyperglycaemic events.

MTX110

Using our MidaSolve technology in combination with panobinostat, an otherwise insoluble drug, MTX110 is designed for direct-to-tumour administration via a catheter system (Convection Enhanced Delivery, or "CED") thereby bypassing the blood-brain barrier and allowing for high drug concentrations and broader drug distribution in and around the tumour while simultaneously minimising systemic toxicity and other side effects. Panobinostat is currently marketed under the brand Farydak® which is used orally in combination therapy for the treatment of multiple myeloma. We are currently researching the utility of MTX110 to proof of concept stage in three indications:

Glioblastoma Multiforme (GBM):

GBM is the most common and aggressive form of brain cancer in adults, usually occurring in the white matter of the cerebrum. Treatments include radiation, surgical resection and chemotherapy although, in almost all cases, tumours recur. There are approximately 2-3/100,000(1) population diagnoses of GBM per annum. Survival with standard of care treatment ranges from approximately 13 months in unmethylated MGMT patients to approximately 30 months in highly methylated MGMT patients(2). Once it has recurred, median survival is 6.5 months(3).

During 2023 we completed recruitment of patients in the first cohort of a Phase I study to assess the utility of MTX110 in recurrent GBM. The Phase I study is an open-label, dose escalation study designed to assess the feasibility and safety of intermittent infusions of MTX110 administered by convection enhanced delivery (CED) via implanted refillable pump and catheter. The study aims to recruit two cohorts, each with a minimum of four patients; the first cohort received MTX110 only and the second cohort will also receive MTX110 but, at the option of the treating clinician, the catheter may be re-positioned once recurrence occurs.

Diffuse Midline Glioma (DMG), formerly known as Diffuse Intrinsic Pontine Glioma, or DIPG:

DMG tumours are located in the pons (middle) of the brain stem and are diffusely infiltrating. Occurring mostly in children, approximately 1,000 patients(4) worldwide are diagnosed with DIPG per annum and median survival is approximately 10 months(5). There is no effective treatment since surgical resection is not possible. The standard of care is radiotherapy, which transiently improves symptoms and survival. Chemotherapy does not improve survival and one likely reason is that many anti-cancer drugs cannot cross the blood-brain barrier to access the tumour.

In October 2020, we reported the first-in-human study by the University of California, San Francisco (“UCSF”) of MTX110 in DIPG using a convection enhanced delivery (“CED”) system. The Phase I study established a recommended dose range for Phase II, a good safety and tolerability profile but also encouraging median survival data of 26 months in the seven patients treated.

An additional Phase I Investigator Initiated Trial by Columbia University is expected to report data in 2Q24. Thereafter, we intend to explore the possibility of seeking an IND for a Phase II study of MTX110 in DMG.

Medulloblastoma:

Medulloblastomas are malignant embryonal tumours that start in the cerebellum. They are invasive and, unlike most brain tumours, spread through the cerebrospinal fluid (“CSF”) and frequently metastasize to different locations in the brain and spinal cord. Treatments include resection, radiation and chemotherapy. Approximately 350 patients(6) are diagnosed with medulloblastoma per annum and 3,800 people are living with the disease in the US. The cumulative survival rate is approximately

The University of Texas is undertaking a Phase I exploratory study in recurrent medulloblastoma patients using direct administration of MTX110 into the fourth ventricle, enabling it to circulate throughout the central spinal fluid.

PRECLINICAL ASSET

MTD217

Our programme is centred around a water-soluble drug formulation that can be easily infused or injected simultaneously, or sequentially, directly into the cancer microenvironment, disrupting metabolic functions in a highly localised manner and limiting off-target toxicity. Our initial target is treatment of leptomeningeal disease (“LMD”), a lethal complication in which metastatic cancer cells invade the cerebrospinal fluid and central nervous system. Approximately

(1) American Association of Neurosurgeons

(2) Radke et al (2019). Predictive MGMT status in a homogeneous cohort of IDH wildtype glioblastoma patients. Acta Neuropathologica Communications 7:89 Online: https://doi.org/10.1186/s40478-019-0745-z

(3) J Neurooncol. 2017; 135(1): 183–192

(4) Louis DN, Ellison DW, et al. The 2016 World Health Organization Classification of Tumors of the Central Nervous System: a summary. Acta Neuropathol 2016; 131:803–820

(5) Jansen et al, 2015. Neuro-Oncology 17(1):160-166

(6) Aboian et al (2018). Neuro-Oncology Practice, Volume 5, Issue 4, December 2018

(7) Smoll NR (March 2012). "Relative survival of childhood and adult medulloblastomas and primitive neuroectodermal tumors (PNETs)". Cancer. 118 (5): 1313–22

(8) https://my.clevelandclinic.org/health/diseases/22737-leptomeningeal-disease

CHIEF EXECUTIVE’S REVIEW

Introduction

With the backdrop of a continued difficult market for financing biotech companies, 2023 was again dominated by efforts to re-finance the Company and bring in additional clinical-stage assets into the development pipeline to diversify risk, enhance news flow and provide more opportunities for success.

R&D Update

Tolimidone

In December 2023 we were delighted to secure the global rights to develop and commercialise tolimidone. It is not often a company of Biodexa’s size and resources has an opportunity to in-license a Phase II ready product supported by very substantial preclinical data, that has been exposed to more than 700 patients and has demonstrated compelling preclinical data to support our chosen indication of T1D.

In T1D, the body’s immune system attacks pancreatic beta cells such that they can no longer produce insulin which is required to regulate plasma glucose levels. The causes of T1D are not fully understood and there is currently no cure. Patients with T1D are dependent on daily administration of insulin (via injection or infusion).

Tolimidone is a Lyn kinase activator and its potential utility in T1D was first demonstrated by several ground-breaking preclinical studies conducted at the University of Alberta, where Lyn kinase was identified as a key factor for beta cell survival and proliferation in in vitro and in vivo models. Tolimidone was shown to both prevent beta cell degradation and to stimulate beta cell proliferation.

As soon as we closed the in-license of tolimidone we began preparing for a Phase IIa dose confirming study which is expected to begin recruitment in the second quarter of 2024. The Phase IIa study will be open-label and include three doses with approximately 15 patients studied over three months with a follow up period. End points are expected to include C-peptide levels (a marker for insulin), HbA1c levels (a marker for plasma glucose) and number of severe hyperglycaemic events. Thereafter, we expect to follow up by a double-blind, placebo-controlled Phase IIb study in approximately 40-45 patients with similar clinical endpoints.

MTX110

In October 2023, we announced completion of recruitment of Cohort A of our ongoing open-label Phase I dose-escalation study which is designed to assess the feasibility and safety of intermittent infusions of MTX110 administered by CED via implanted refillable pump and catheter. Because no drug-related adverse events were observed within the first 30 days from the start of treatment, the minimum number of four patients were recruited into Cohort A. Patient #1 received weekly infusions of 60µM of MTX110 and Patients # 2, 3 and 4 each received 90µM, the expected optimum dose. The study site reported 12 months of survival from the start of the treatment in the 1st patient (OS=12 months).

We initially began developing MTX110 for DMG, the ultra-rare, highly aggressive and inoperable form of childhood brain cancer. In February 2024 we announced the results of a Phase I study conducted by Columbia University Irving Medical Center. As this was the first ever study of repeated infusions to the pons via an implanted CED catheter, the primary objective of the study was safety and tolerability and, accordingly, the number of infusions was limited to two, each of 48 hours, 7 days apart. Nine patients were treated in the study (30 M group, n=3; 60 M group, n=4; 90 M group (optimal dose), n=2). One patient in the 60 M group suffered a severe adverse event assessed by the investigators as not related to the study drug but related to the infusion and tumour anatomy. Although the study was not powered to reliably demonstrate efficacy, median overall survival (OS) of patients in the study was 16.5 months.

We are also evaluating the utility of MTX110 in medulloblastoma in a pilot study at the University of Texas.

MTD217

During the year we initiated a new preclinical programme, coded MTD217, to explore the simultaneous inhibition of two key metabolic pathways used by cancer cells to generate ATP. Blocking mitochondrial oxidative phosphorylation limits metabolic plasticity that enables cancer cells to adapt and survive. Our initial target for MTD217 is treatment of Leptomeningeal Disease, a lethal complication in which metastatic cancer cells invade the cerebrospinal fluid and central nervous system. In collaboration with a CRO, we developed a Leptomeningeal Disease in vivo model and awaiting results.

Financings

Private Placement, February 2023

On 15 February 2023 we raised

Registered Direct Offering, May 2023

On 26 May 2023 we raised

Registered Offering, December 2023

In connection with Assignment and Exchange Agreement with Adhera Therapeutics, Inc and the in-license from Melior Pharmaceuticals I, Inc. of tolimidone, on 21 December 2023 we raised

435,544,800 Ordinary Shares (1,088,887 ADSs) and 1,911,176 Pre-funded Warrants (764,470,400 Ordinary Shares). We also issued to investors Series E Warrants exercisable into 1,200,025,200 Ordinary Shares (3,000,063 ADSs) and Series F Warrants exercisable into 1,200,025,200 Ordinary Shares (3,000,063 ADSs). None of the Series E Warrants or the Series F Warrants have been exercised. The Series E Warrants and the Series F Warrants are exercisable at

De-listing from AIM

Following shareholder approval at a General meeting on 24 March 2023, the Company was de-listed from the AIM market with effect from 26 April 2023. The Board decided to recommend cancelling the Company’s AIM listing for a number of reasons including: an increasingly smaller proportion of trading in the Ordinary Shares is conducted on AIM compared to NASDAQ ; improved liquidity through concentration of trading in the Company’s securities on a single market; and, the cost, management time commitment and the burden of complying with the AIM Rules and maintaining a quotation on AIM is duplicative of that for complying with the NASDAQ rules. In addition, as was demonstrated with the in-licensing of tolimidone, we intend to seek opportunities to expand our pipeline through the acquisition and / or in-licensing of additional development programmes. Given our market capitalisation, most transactions are likely to be deemed reverse takeovers under AIM rules, requiring suspension and re-listing via a new Admission Document which is both time-consuming and costly.

Change of Name

Our intention is that re-positioning as a therapeutics company should represent a “fresh start” for the Company. To reflect this change the Company’s name was changed to Biodexa Pharmaceuticals PLC following a General Meeting on 24 March 2023.

Outlook

Taking into account the

FINANCIAL REVIEW

Introduction

Biodexa Pharmaceuticals PLC (the "Company") was incorporated as a company on 12 September 2014 and is domiciled in England and Wales.

Financial analysis

Key performance indicators

| 2023 | 2022 | Change | ||

| Total gross revenue(1) | (46)% | |||

| R&D expenditure | (20)% | |||

| R&D as % of operating costs | n/a | |||

| Net cash inflow/(outflow) for the year | | ( | n/m | |

| ============ | ============ | ============ | ||

| (1) | Total gross revenue represents collaboration income. | |||

Revenue

In the year ended 31 December 2023, Biodexa generated consolidated total gross revenue of

Research and development expenditure

Research and development costs were

Administrative costs

Administrative costs in the year reduced by

Staff costs

During the year, the average number of staff decreased to decreased to 21 (2022: 27), reflecting the cost reduction program undertaken in March 2023. Total staff cost reduced

Taxation

During 2023 and 2022 we recognized U.K research and development tax credits of

Capital expenditure

Purchase of tangible fixed assets in 2023 was

Cash flow

Net cash outflow from operating activities in 2023 was

Investing activities outflow in 2023 of

Financing activities inflow in 2023 of

As a result of the foregoing, net cash inflow for the year was

Share consolidation and ADS Ratio

At a General Meeting on 24 March 2023, shareholders approved a consolidation of the Company’s Ordinary Shares on a one for 20 basis. As a result the par value of the Ordinary Shares was changed from

At a General Meeting on 14 June 2023, shareholders approved the subdivision and redesignation of the Company’s Issued Ordinary Shares of

On 5 July 2023 the Company affected a change in the ratio of the Company’s Ordinary Shares from each ADS representing 5 Ordinary Shares to each ADS representing 400 Ordinary Shares.

Going Concern – material uncertainty

The Group and Company has experienced net losses and significant cash outflows from cash used in operating activities over the past years as it develops its portfolio. For the year ended 31 December 2023, the Group incurred a consolidated loss for the year of

The Group’s future viability is dependent on its ability to raise cash from financing activities to finance its development plans until milestones and/or royalties can be secured from partnering the Company’s assets. The Group’s failure to raise capital as and when needed could have a negative impact on its financial condition and ability to pursue its business strategies.

The Directors believe there are adequate options and time available to secure additional financing for the Company and after considering the uncertainties, the Directors consider it is appropriate to continue to adopt the going concern basis in preparing these financial statements. The Group's consolidated financial statements have therefore been presented on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business.

As at 31 December 2023, the Group had cash and cash equivalents of

Our forecast of the period of time through which our financial resources will be adequate to support our operations is a forward-looking statement and involves risks and uncertainties, and actual results could vary as a result of a number of factors, including the timing of clinical trials. We have based this estimate on assumptions that may prove to be wrong, and we could utilize our available capital resources sooner than we currently expect. If we lack sufficient capital to expand our operations or otherwise capitalize on our business opportunities, our business, financial condition and results of operations could be materially adversely affected.

If we raise additional funds through the issuance of debt securities or additional equity securities, it could result in dilution to our existing shareholders, increased fixed payment obligations and these securities may have rights senior to those of our ordinary shares (including the ADSs) and could contain covenants that would restrict our operations and potentially impair our competitiveness, such as limitations on our ability to incur additional debt, limitations on our ability to acquire, sell or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business. Any of these events could significantly harm our business, financial condition and prospects.

In the Directors’ opinion, the environment for financing of small and micro-cap biotech companies remains challenging. While this may present acquisition and/or merger opportunities with other companies with limited or no access to financing, as noted above, any attendant financings by Biodexa are likely to be dilutive. The Directors continue to evaluate financing options, including those connected to acquisitions and/or mergers, potentially available to the Group. Any alternatives considered are contingent upon the agreement of counterparties and accordingly, there can be no assurance that any alternative courses of action to finance the Company would be successful.

This requirement for additional financing in the short term represents a material uncertainty that may cast significant doubt upon the Group and Parent Company’s ability to continue as a going concern. Should it become evident in the future that there are no realistic financing options available to the Company which are actionable before its cash resources run out then the Company will no longer be a going concern. In such circumstances, we would no longer be able to prepare financial statements under paragraph 25 of IAS 1. Instead, the financial statements would be prepared on a liquidation basis and assets would be stated at net realizable value and all liabilities would be accelerated to current liabilities.

Macro-economic environment

The invasion by the Russian Federation military in Ukraine in early 2022 and the recent Israeli/Palestinian conflict in the Middle East has had a destabilising impact on the global economy. Although there has been no immediate impact on the Group, it is not possible to assess the medium- and long-term impact of these conflicts on the Group and the global economy generally.

Environmental matters, community, human rights issues and employees

As at 31 December 2023 the Group had 16 employees, of whom 10 were routinely based at its offices in Cardiff, Accordingly the Company believes it has a relatively modest environmental impact. All materials imported into the Company’s laboratories are assessed for safety purposes and appropriate handling and storage safeguards imposed as necessary. Any small quantities of hazardous materials are removed by licensed waste management contractors. A number of policies and procedures governing expectations of ethical standards and the treatment of employees and other stakeholders are set out in the Company’s Employee Handbook. The Company has also established an anti-slavery policy pursuant to the Modern Slavery Act 2015.

The Company strives to be an equal opportunity employer, irrespective of race or gender. At 31 December 2023, the number of male/female employees was

Annual greenhouse gas emissions

We measure our environmental performance by reporting our carbon footprint in terms of tonne CO2 equivalent. We report separately on our indirect emissions from consumption of electricity (Scope 2) and emissions consisting of employee travel in cars on Group business estimated on the basis of miles travelled (Scope 3). The Group have elected to monitor and report its energy efficiency using tonnes of CO2 per employee as an intensity ratio.

Methodology

In calculating the reported energy usage and equivalent greenhouse gas emissions the Group have referred to the HM Government Environment Reporting Guidelines and the GHG Reporting Protocol. A location-based allocation methodology was used to calculate electricity usage.

| Tonnes CO2e | 2023 | 2022 |

| Scope 2 | 18 | 15 |

| Scope 3 | 3 | 3 |

| Total | 21 | 18 |

| Intensity ratio (tonnes of CO2 per employee) | 1.0 | 0.7 |

The Group’s electricity costs for 2023 were approximately

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

For the year ended 31 December

| Note | 2023 £’000 | 2022 £’000 | 2021 £’000 | |

| Revenue | 381 | 699 | 578 | |

| Other income | 14 | 22 | 24 | |

| Research and development costs | (4,067) | (5,111) | (4,654) | |

| Administrative costs | (4,342) | (4,542) | (2,946) | |

| Loss from operations | (8,014) | (8,932) | (6,998) | |

| Finance income | 2 | 570 | 497 | 936 |

| Finance expense | 2 | (41) | (53) | (44) |

| Loss before tax | (7,485) | (8,488) | (6,106) | |

| Taxation | 3 | 406 | 832 | 646 |

| Loss for the year attributable to the owners of the parent | (7,079) | (7,656) | (5,460) | |

| Other comprehensive income: | ||||

| Items that will or may be reclassified subsequently to profit or loss: | ||||

| Total other comprehensive income net of tax | – | – | – | |

| Total comprehensive loss attributable to the owners of the parent | (7,079) | (7,656) | (5,460) | |

| Loss per share | ||||

| Continuing operations | ||||

| Basic and diluted loss per ordinary share - pence | 4 | (2)p | (155) p | (136) p |

The notes form an integral part of these consolidated financial statements.

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

At 31 December

| Company number 09216368 | Note | 2023 £’000 | 2022 £’000 | 2021 £’000 |

| Assets | ||||

| Non-current assets | ||||

| Property, plant and equipment | 571 | 831 | 1,152 | |

| Intangible assets | 5 | 2,941 | 6 | – |

| 3,512 | 837 | 1,152 | ||

| Current assets | ||||

| Trade and other receivables | 637 | 1,006 | 1,034 | |

| Current taxation receivable | 422 | 846 | 670 | |

| Cash and cash equivalents | 5,971 | 2,836 | 10,057 | |

| 7,030 | 4,688 | 11,761 | ||

| Total assets | 10,542 | 5,525 | 12,913 | |

| Liabilities | ||||

| Non-current liabilities | ||||

| Borrowings | 6 | 295 | 463 | 620 |

| 295 | 463 | 620 | ||

| Current liabilities | ||||

| Trade and other payables | 1,240 | 1,447 | 1,092 | |

| Borrowings | 6 | 169 | 161 | 146 |

| Provisions | 7 | – | 207 | 50 |

| Derivative financial liability | 8 | 4,160 | 85 | 553 |

| 5,569 | 1,900 | 1,841 | ||

| Total liabilities | 5,864 | 2,363 | 2,461 |

| CONSOLIDATED STATEMENTS OF FINANCIAL POSITION(CONTINUED) At 31 December | ||||

| Note | 2023 £’000 | 2022 £’000 | 2021 £’000 | |

| Issued capital and reserves attributable to owners of the parent | ||||

| Share capital | 9 | 6,253 | 1,108 | 1,098 |

| Share premium | 86,732 | 83,667 | 83,434 | |

| Merger reserve | 53,003 | 53,003 | 53,003 | |

| Warrant reserve | 3,457 | 720 | 720 | |

| Accumulated deficit | (144,767) | (135,336) | (127,803) | |

| Total equity | 4,678 | 3,162 | 10,452 | |

| Total equity and liabilities | 10,542 | 5,525 | 12,913 | |

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the year ended 31 December

| Note | 2023 £’000 | 2022 £’000 | 2021 £’000 | |

| Cash flows from operating activities | ||||

| Loss for the year | (7,079) | (7,656) | (5,460) | |

| Adjustments for: | ||||

| Depreciation of property, plant and equipment | 143 | 174 | 213 | |

| Depreciation of right of use asset | 137 | 166 | 190 | |

| Amortisation of intangible fixed assets | 5 | 3 | 3 | – |

| Loss/(Profit) on disposal of property, plant and equipment | 2 | 14 | (39) | |

| Impairment of loan | 79 | 207 | – | |

| Finance income | 2 | (570) | (497) | (936) |

| Finance expense | 2 | 41 | 53 | 44 |

| Share-based payment charge | 28 | 123 | 89 | |

| Taxation | 3 | (406) | (832) | (646) |

| Foreign exchange gains | – | (1) | (3) | |

| Cash flows from operating activities before changes in working capital | (7,622) | (8,246) | (6,548) | |

| Decrease/(Increase) in trade and other receivables | 365 | 7 | (487) | |

| (Decrease)/Increase in trade and other payables | (207) | 356 | (130) | |

| (Decrease)/Increase in provisions | 7 | (207) | 157 | – |

| Cash used in operations | (7,671) | (7,726) | (7,165) | |

| Taxes received | 845 | 678 | 1,157 | |

| Net cash used in operating activities | (6,826) | (7,048) | (6,008) |

CONSOLIDATED STATEMENTS OF CASH FLOWS(CONTINUED)

For the year ended 31 December

| Note | 2023 £’000 | 2022 £’000 | 2021 £’000 | |

| Investing activities | ||||

| Purchases of property, plant and equipment | (26) | (62) | (320) | |

| Proceeds from disposal of fixed assets | 4 | 20 | 42 | |

| Purchase intangible asset | 5 | (237) | – | – |

| Loan granted | (79) | (207) | – | |

| Interest received | 73 | 29 | – | |

| Net cash (used in)/generated from investing activities | (265) | (220) | (278) | |

| Financing activities | ||||

| Interest paid | (13) | (18) | (15) | |

| Amounts paid on lease liabilities | (188) | (178) | (112) | |

| Repayment from Government loan | – | – | (103) | |

| Share issues including warrants, net of costs | 10,427 | 243 | 9,035 | |

| Net cash generated from financing activities | 10,226 | 47 | 8,805 | |

| Net increase/(decrease) in cash and cash equivalents | 3,135 | (7,221) | 2,519 | |

| Cash and cash equivalents at beginning of year | 2,836 | 10,057 | 7,546 | |

| Exchange (losses)/gains on cash and cash equivalents | – | – | (8) | |

| Cash and cash equivalents at end of year | 5,971 | 2,836 | 10,057 |

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

For the year ended 31 December

| Note | Share capital £’000 | Share premium £’000 | Merger reserve £’000 | Warrant reserve £’000 | Accumulated deficit £’000 | Total equity £’000 | |

| At 1 January 2023 | 1,108 | 83,667 | 53,003 | 720 | (135,336) | 3,162 | |

| Loss for the year | – | – | – | – | (7,079) | (7,079) | |

| Total comprehensive loss | – | – | – | – | (7,079) | (7,079) | |

| Transactions with owners | |||||||

| Shares issued on 15 February 2023 | 9 | 1,956 | 3,013 | – | – | – | 4,969 |

| Costs associated with share issue on 15 February 2023 | 9 | – | (903) | – | – | – | (903) |

| Shares issued on 26 May 2023 | 9 | 2,380 | – | (355) | 2,025 | ||

| Costs associated with share issue on 26 May 2023 | 9 | – | – | – | (527) | (527) | |

| Shares issued on 21 December 2023 | 9 | 485 | – | – | 1,315 | (1,273) | 527 |

| Costs associated with share issue on 21 December 2023 | 9 | – | – | – | – | (441) | (441) |

| Issue of shares to purchase intangible asset | 5 | 324 | 955 | – | 1,422 | – | 2,701 |

| Share-based payment charge | – | – | – | – | 244 | 244 | |

| Total contribution by and distributions to owners | 5,145 | 3,065 | – | 2,737 | (2,352) | 8,595 | |

| At 31 December 2023 | 6,253 | 86,732 | 53,003 | 3,457 | (144,767) | 4,678 |

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY(CONTINUED)

| Note | Share capital £’000 | Share premium £’000 | Merger reserve £’000 | Warrant reserve £’000 | Accumulated deficit £’000 | Total equity £’000 | |

| At 1 January 2022 | 1,098 | 83,434 | 53,003 | 720 | (127,803) | 10,452 | |

| Loss for the year | – | – | – | – | (7,656) | (7,656) | |

| Total comprehensive loss | – | – | – | – | (7,656) | (7,656) | |

| Transactions with owners | |||||||

| Exercise of warrants on 22 March 2022 | 14,21 | – | – | – | – | – | – |

| Shares issued on 19 December 2022 | 14,21 | 10 | 311 | – | – | – | 321 |

| Costs associated with share issue on 19 December 2022 | 14,21 | – | (78) | – | – | – | (78) |

| Share-based payment charge | – | – | – | – | 123 | 123 | |

| Total contribution by and distributions to owners | 10 | 233 | – | – | 123 | 366 | |

| At 31 December 2022 | 1,108 | 83,667 | 53,003 | 720 | (135,336) | 3,162 |

NOTES FORMING PART OF THE FINANCIAL STATEMENTS

For the year ended 31 December 2023

- Basis of preparation

The consolidated financial statements have been prepared in accordance with international accounting standards in conformity with the requirements of the Companies Act 2006, and they are prepared in accordance with international financial reporting standards. The consolidated financial statements have been prepared on a historical cost basis except that the following assets and liabilities are stated at their fair value: certain financial assets and financial liabilities measured at fair value, and liabilities for cash-settled share-based payments.

The financial information contained in this final announcement does not constitute statutory financial statements as defined in Section 435 of the Companies Act 2006. The financial information has been extracted from the financial statements for the year ended 31 December 2023 which have been approved by the Board of Directors, and the comparative figures for the year ended 31 December 2022 and 31 December 2021 are based on the financial statements for that year.

The financial statements for 2022 and 2021 have been delivered to the Registrar of Companies and the 2023 financial statements will be delivered after the Annual General Meeting.

The auditor’s report for the Company’s 2023 Annual Report and Accounts was unqualified but did draw attention to the material uncertainty relating to going concern. The auditor’s report did not contain statements under s498(2) or (3) of the Companies Act 2006.

Whilst the financial information included in this results announcement has been prepared in accordance with International Financial Reporting Standards (IFRSs) this announcement does not itself contain sufficient information to comply with IFRSs. The information in this results announcement was approved by the board on • April 2024.

Going concern – material uncertainty

The Group and Company has experienced net losses and significant cash outflows from cash used in operating activities over the past years as it develops its portfolio. For the year ended 31 December 2023, the Group incurred a consolidated loss for the year of

The Group’s future viability is dependent on its ability to raise cash from financing activities to finance its development plans until milestones and/or royalties can be secured from partnering the Company’s assets. The Group’s failure to raise capital as and when needed could have a negative impact on its financial condition and ability to pursue its business strategies.

The Directors believe there are adequate options and time available to secure additional financing for the Company and after considering the uncertainties, the Directors consider it is appropriate to continue to adopt the going concern basis in preparing these financial statements. The Group's consolidated financial statements have therefore been presented on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business.

As at 31 December 2023, the Group had cash and cash equivalents of

Our forecast of the period of time through which our financial resources will be adequate to support our operations is a forward-looking statement and involves risks and uncertainties, and actual results could vary as a result of a number of factors, including the timing of clinical trials. We have based this estimate on assumptions that may prove to be wrong, and we could utilize our available capital resources sooner than we currently expect. If we lack sufficient capital to expand our operations or otherwise capitalize on our business opportunities, our business, financial condition and results of operations could be materially adversely affected.

If we raise additional funds through the issuance of debt securities or additional equity securities, it could result in dilution to our existing shareholders, increased fixed payment obligations and these securities may have rights senior to those of our ordinary shares (including the ADSs) and could contain covenants that would restrict our operations and potentially impair our competitiveness, such as limitations on our ability to incur additional debt, limitations on our ability to acquire, sell or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business. Any of these events could significantly harm our business, financial condition and prospects.

In the Directors’ opinion, the environment for financing of small and micro-cap biotech companies remains challenging. While this may present acquisition and/or merger opportunities with other companies with limited or no access to financing, as noted above, any attendant financings by Biodexa are likely to be dilutive. The Directors continue to evaluate financing options, including those connected to acquisitions and/or mergers, potentially available to the Group. Any alternatives considered are contingent upon the agreement of counterparties and accordingly, there can be no assurance that any alternative courses of action to finance the Company would be successful.

This requirement for additional financing in the short term represents a material uncertainty that may cast significant doubt upon the Group and Parent Company’s ability to continue as a going concern. Should it become evident in the future that there are no realistic financing options available to the Company which are actionable before its cash resources run out then the Company will no longer be a going concern. In such circumstances, we would no longer be able to prepare financial statements under paragraph 25 of IAS 1. Instead, the financial statements would be prepared on a liquidation basis and assets would be stated at net realizable value and all liabilities would be accelerated to current liabilities.

2 Finance income and expense

| 2023 £’000 | 2022 £’000 | 2021 £’000 | |

| Finance income | |||

| Interest received on bank deposits | 73 | 29 | – |

| Other interest receivable | 10 | – | – |

| Gain on equity settled derivative financial liability | 487 | 468 | 936 |

| Total finance income | 570 | 497 | 936 |

| 2023 £’000 | 2022 £’000 | 2021 £’000 | |

| Finance expense | |||

| Interest expense on lease liabilities | 28 | 43 | 36 |

| Other loans | 13 | 10 | 8 |

| Total finance expense | 41 | 53 | 44 |

The gain on the equity settled derivative financial liability in 2023, 2022 and 2021 arose as a result of the movement in share price.

3 Taxation

| 2023 £’000 | 2022 £’000 | 2021 £’000 | |

| Current tax credit | |||

| Current tax credited to the income statement | 407 | 825 | 646 |

| Adjustment in respect of prior year | (1) | 7 | – |

| 406 | 832 | 646 | |

| Deferred tax credit | |||

| Reversal of temporary differences | – | – | – |

| Total tax credit | 406 | 832 | 646 |

The reasons for the difference between the actual tax charge for the year and the standard rate of corporation tax in the United Kingdom applied to losses for the year are as follows:

| 2023 £’000 | 2022 £’000 | 2021 £’000 | |

| Loss before tax | (7,485) | (8,488) | (6,106) |

| Expected tax credit based on the standard rate of United Kingdom corporation tax at the domestic rate of | (1,764) | (1,613) | (1,160) |

| Expenses not deductible for tax purposes | 408 | 392 | 75 |

| Income not taxable | (5) | (4) | (2) |

| Adjustment in respect of prior period | 1 | (7) | – |

| Effect of R&D relief | 26 | (357) | (280) |

| Deferred tax not recognised | 928 | 757 | 721 |

| Total tax credited to the income statement | (406) | (832) | (646) |

The taxation credit arises on the enhanced research and development tax credits accrued for the respective periods.

4 Loss per share

| 2023 £’000 | 2022 £’000 | 2021 £’000 | |

| Numerator | |||

| Loss used in basic EPS and diluted EPS: | |||

| Continuing operations | (7,079) | (7,656) | (5,460) |

| Denominator | |||

| Weighted average number of ordinary shares used in basic EPS: | 315,849,600 | 4,941,793 | 4,027,345 |

| Basic and diluted loss per share: | |||

| Continuing operations – pence | (2)p | (155) p | (136) p |

At a General Meeting on 24 March 2023, shareholders approved a consolidation of the Company’s Ordinary Shares on a one for 20 basis. As a result, the par value of the Ordinary Shares was changed from

At a General Meeting on 14 June 2023, shareholders approved the subdivision and redesignation of the Company’s Issued Ordinary Shares of

During the year the Company issued warrants that were accounted through the Warrant Reserve as detailed in note 9.

The Company has considered the guidance set out in IAS 33 in calculating the denominator in connection with the issuance of Pre-Funded, Series A, Series B and Series C warrants as disclosed in note 9. Management have recognised the warrants from the date of grant rather than the date of issue of the corresponding Ordinary Shares when calculating the denominator.

The Group has made a loss in the current and previous periods presented, and therefore the options and warrants are anti-dilutive. As a result, diluted earnings per share is presented on the same basis as basic earning per share.

5 Intangible assets

| In-process research and development £’000 | Goodwill £’000 | IT/Website costs £’000 | Total £’000 | |

| Cost | ||||

| At 1 January 2021 | 13,378 | 2,291 | – | 15,669 |

| At 31 December 2021 | 13,378 | 2,291 | – | 15,669 |

| Transfer from property, plant and equipment | – | – | 122 | 122 |

| Disposal | – | – | (12) | (12) |

| At 31 December 2022 | 13,378 | 2,291 | 110 | 15,779 |

| Acquisition | 2,938 | – | – | 2,938 |

| At 31 December 2023 | 16,316 | 2,291 | 110 | 18,717 |

| In-process research and development £’000 | Goodwill £’000 | IT/Website Costs £’000 | Total £’000 | |

| Accumulated amortisation and impairment | ||||

| At 1 January 2021 | 13,378 | 2,291 | – | 15,669 |

| At 31 December 2021 | 13,378 | 2,291 | – | 15,669 |

| Amortisation charge for the year | – | – | 3 | 3 |

| Transfer from property, plant and equipment | – | – | 113 | 113 |

| Disposal | – | – | (12) | (12) |

| At 31 December 2022 | 13,378 | 2,291 | 104 | 15,773 |

| Amortisation charge for the year | – | – | 3 | 3 |

| Disposal | – | – | – | – |

| At 31 December 2023 | 13,378 | 2,291 | 107 | 15,776 |

| Net book value | ||||

| At 31 December 2023 | 2,938 | – | 3 | 2,941 |

| At 31 December 2022 | – | – | 6 | 6 |

| At 31 December 2021 | – | – | – | – |

The individual intangible asset which is material to the financial statements is as follows:

| Carrying amount | Remaining amortisation period | |||||

| 2023 £’000 | 2022 £’000 | 2021 £’000 | 2023 (years) | 2022 (years) | 2021 (years) | |

| MTX228 tolimidone acquired IPRD* | 2,938 | – | – | n/a | n/a | n/a |

*asset is not yet in use and has not started amortising

On 21 December 2023 the Company executed an Assignment and Exchange Agreement with Adhera for assignment of Adhera’s rights and a new licence for tolimidone (MTX228) with Melior for total consideration of

| $’000 | £’000 | |

| Cash paid to Adhera | 300 | 237 |

| 100,356 ADSs, valued at the Offer price issued to Adhera Loan Noteholders | 201 | 159 |

| 899,642 Pre-funded warrants at the Offering price issued to Adhera Loan Noteholders | 1,799 | 1,422 |

| 708,856 ADSs at the Offer price issued to Melior | 1,418 | 1,120 |

| Recognised as intangible asset purchase | 3,718 | 2,938 |

In addition, conditional upon Adhera Loan Noteholders subscribing for not less than

The Assignment and Exchange Agreement also provides for deferred consideration totalling

The ADSs issued under the transaction are subject to restrictions on their resale.

The Group reviews the carrying amounts of its intangible assets to determine whether there are any indications that those assets have suffered an impairment loss. If any such indications exist, the recoverable amount of the asset is estimated in order to determine the extent of the impairment loss. Impairment indications include events causing significant changes in any of the underlying assumptions used in the income approach utilised in valuing in process R&D. The key assumptions are : estimation of future cash flows which is dependent on the probability of success, the discount factor, the timing of future revenue flows, market penetration and peak sales assumptions, and expenditure required to complete development, estimation of the long-term rate of growth for the business, estimation of the useful life over which cash flows will occur and determination of our weighted-average cost of capital.

6 Borrowings

| 2023 £’000 | 2022 £’000 | 2021 £’000 | |

| Current | |||

| Lease liabilities | 169 | 161 | 146 |

| Total | 169 | 161 | 146 |

| Non-current | |||

| Lease liabilities | 295 | 463 | 620 |

| Total | 295 | 463 | 620 |

Book values approximate to fair value at 31 December 2023, 2022 and 2021.

Obligations under finance leases are secured by a fixed charge over the fixed assets to which they relate.

Government loans in Spain

During 2021 a euro denominated government and research loan of

7 Provisions

| 2023 £’000 | 2022 £’000 | 2021 £’000 | |

| Opening provision at 1 January | 207 | 50 | 50 |

| Utilisation of provision | (207) | (43) | – |

| Provision recognised in the year | – | 200 | – |

| At 31 December | – | 207 | 50 |

| Less: non-current portion | – | – | – |

| Current portion | – | 207 | 50 |

The provision as at 31 December 2021 represents management’s best estimate of the ‘making good’ clause on the Cardiff office which was vacated during the fourth quarter of 2021. This liability was settled during 2022.

Bioasis Loans

On 19 December 2022 the Company entered into a Promissory Note and Security Agreement with Bioasis to assist in the short term with Bioasis’ working capital requirements. Under the agreement the Company agreed to advance Bioasis up to US

The Company advanced US

Management considered recovery of the debt to be uncertain and in 2022 recognised an impairment provision of

On 3 February 2023 Bioasis announced they were ‘urgently exploring and evaluating all financing and strategic alternatives that may be available to address its liquidity requirements’ which triggered an event of default. As a result of this the 3rd payment under the agreement was not made in the post year end period. On 5 March 2023 Bioasis were served with a notice of an event of default. On 20 June 2023 Bioasis announced the suspension of operations.

In 2023 the provision was utilised against the advance made to Bioasis in January 2023.

8 Derivative financial liability – current

| 2023 £’000 | 2022 £’000 | 2021 £’000 | |

| Equity settled derivative financial liability | |||

| At 1 January | 85 | 553 | 1,559 |

| Warrants issued | 4,562 | – | – |

| Transfer to share premium on exercise of warrants | – | – | (70) |

| Gain recognised in finance (income)/expense within the consolidated statement of comprehensive income | (487) | (468) | (936) |

| At 31 December | 4,160 | 85 | 553 |

Equity settled derivative financial liability is a liability that is not to be settled for cash.

No warrants recognised as equity settled derivatives were exercised in 2023, 2022 or 2021.

The Company issues warrants in the ADSs of the Company as part of registered direct offerings and private placements in the US. The number of ADSs to be issued when exercised is fixed, however the exercise price is denominated in US Dollars being different to the functional currency of the Company. Therefore, the warrants are classified as equity settled derivative financial liabilities recognised at fair value through the profit and loss account (‘FVTPL’). The financial liability is valued using the Black-Scholes model in 2023, in previous periods the Monte Carlo model was used. The change in methodology is as result of the Company de-listing from AIM in 2023 and no longer needing to consider foreign exchange movements in fair value calculation. Financial liabilities at FVTPL are stated at fair value, with any gains or losses arising on re-measurement recognised in profit or loss. The net gain or loss recognised in profit or loss incorporates any interest paid on the financial liability and is included in the ‘finance income’ or ‘finance expense’ lines item in the income statement. A key input in the valuation of the instrument is the Company share price.

Details of the warrants are as follows:

December 2023 warrants

In December 2023 the Company issued 3,000,063 Series E ADS Warrants and 3,000,063 Series F ADS Warrants as part of the Registered Offering in the US. The exercise price per ADS is

May 2023 warrants

In June 2023 the Company issued 276,689 Series D ADS Warrants as part of a registered direct offering and private placement in the US after securing shareholder approval. The exercise price per ADS was

May 2020 warrants

In May 2020 the Company issued 838 ADS warrants as part of a registered direct offering in the US.

October 2019 warrants

In October 2019 the Company issued 392 ADS warrants as part of a registered direct offering in the US.

May 2020 and October 2019 warrant re-price

On 13 December 2022 the Company entered into a Securities Purchase Agreement with Armistice Capital Master Fund Ltd (‘Armistice’) to re-price previously issued ADS warrants issued to Armistice to

| ADS Warrants Number* | Original price per ADS* | New price per ADS | Equivalent Ordinary Shares (400 ordinary shares per ADS) Number | |

| October 2019 warrants | 375 | 150,000 | ||

| May 2020 warrants | 406 | 162,400 |

*Number and original price of warrants have been adjusted to reflect the share consolidation and ratio change of ADS’s to ordinary shares that occurred on 2 March 2020 and 24 March 2023 and the ratio change of ADS’s to ordinary shares on 26 September 2022 and 5 July 2023.

DARA warrants and share options

The Group also assumed fully vested warrants and share options on the acquisition of DARA Biosciences, Inc. (which took place in 2015). The number of ordinary shares to be issued when exercised is fixed, however the exercise prices are denominated in US Dollars. The warrants are classified equity settled derivative financial liabilities and accounted for in the same way as those detailed above. The financial liability is valued using the Black-Scholes option pricing model. The exercise price of the outstanding options is

The following table details the outstanding warrants over ADSs and ordinary shares as at 31 December and also the movement in the year:

| At 1 January 2021 | Lapsed | Exercised | At 31 December 2021 | Lapsed | At 31 December 2022 | Lapsed | Granted | At 31 December 2023 | |

| ADSs | |||||||||

| December 2023 grant | – | – | – | – | – | – | 6,000,126 | 6,000,126 | |

| May 2023 grant | – | – | – | – | – | – | 276,689 | 276,689 | |

| May 2020 grant | 876 | – | (38) | 838 | – | 838 | – | – | 838 |

| October 19 grant | 392 | – | – | 392 | – | 392 | – | – | 392 |

| Ordinary Shares | |||||||||

| DARA Warrants | 231 | (27) | – | 204 | (204) | – | – | – | – |

| DARA Options | 138 | – | – | 138 | 138 | (10) | – | 128 |

*Number and original price of warrants have been adjusted to reflect the share consolidation and ratio change of ADS’s to ordinary shares that occurred on 2 March 2020 and 24 March 2023 and the ratio change of ADS’s to ordinary shares on 26 September 2022 and 5 July 2023.

9 Share capital

| Authorised, allotted and fully paid – classified as equity | 2023 Number | 2023 £ | 2022 Number | 2022 £ | 2021 Number | 2021 £ |

| At 31 December | ||||||

| Ordinary shares of | 1,189,577,722 | 1,189,578 | 5,417,137 | 108,343 | 4,923,420 | 98,468 |

| ‘A’ Deferred shares of | 1,000,001 | 1,000,001 | 1,000,001 | 1,000,001 | 1,000,001 | 1,000,001 |

| ‘B’ Deferred shares of | 4,063,321,418 | 4,063,321 | – | – | – | – |

| Total | 6,252,900 | 1,108,344 | 1,098,469 |

At a General Meeting on 24 March 2023, shareholders approved a consolidation of the Company’s Ordinary Shares on a one for 20 basis. As a result, the par value of the Ordinary Shares was changed from

At a General Meeting on 14 June 2023, shareholders approved the subdivision and redesignation of the Company’s Issued Ordinary Shares of

On 5 July 2023 the Company effected a ratio change in the number of Ordinary Shares represented by ADSs from five Ordinary Shares per ADS to 400 Ordinary Shares per ADS.

On 26 May 2023 the Company entered into Private Placement and on 21 December 2023 the Company entered into a Registered Offering. As no share premium was recognised in relation to these transactions the transaction costs have been charged to retained earnings.

During the year the Company issued the following warrants over ADSs, and these were recognised in the warrant reserve until exercise:

| Pre-Funded Warrants | Series A Warrants | Series B Warrants | Series C Warrants | |

| Exercise price | ||||

| As at 1 January 2023 | – | – | – | – |

| Issued: | ||||

| Private Placement February 2023 | 155,461 | 32,327 | 48,491 | – |

| Registered Direct Offering May 2023 | – | – | – | 415,043 |

| Registered Offering December 2023 | 1,911,176 | – | – | – |

| Adhera Assignment and Exchange Agreement | 899,642 | – | – | – |

| Exercised | (155,461) | (32,327) | (48,491) | (415,043) |

| As at 31 December 2023 | 2,810,818 | – | – | – |

The Series A, Series B and Series C warrants are exercisable on an ‘alternative cashless basis’ effectively allowing the holders to exercise for nil consideration.

Numbers of shares and share options/ warrants and related exercise/issue prices are after the impact of the 24 March 2023 share consolidation, ADS ratio changes on 24 March 2023 and 5 July 2023.

In accordance with the Articles of Association for the Company adopted on 14 June 2023, the share capital of the Company consists of an unlimited number of ordinary shares of nominal value

Rights attaching to the shares following the incorporation of Biodexa Pharmaceuticals plc

Shares classified as equity

The holders of ordinary shares in the capital of the Company have the following rights:

(a) to receive notice of, to attend and to vote at all general meetings of the Company, in which case shareholders shall have one vote for each share of which he is the holder; and,

(b) to receive such dividend as is declared by the Board on each share held.

The holders of both classes of deferred shares in the capital of the Company:

(a) shall not be entitled to receive notice of or to attend or speak at any general meeting of the Company or to vote on any resolution to be proposed at any general meeting of the Company; and

(b) shall not be entitled to receive any dividend or other distribution of out of the profits of the Company.

In the event of a distribution of assets, the deferred shareholders shall receive the nominal amount paid up on such share after the holder of each ordinary share shall have received (in cash or specie) the amount paid up or credited as paid up on such ordinary share together with an additional payment of

| Ordinary Shares Number | ‘A’ Deferred Shares Number | ‘B’ Deferred Shares Number | Share Price £ | Total consideration £’000 | ||

| At 1 January 2021 | 3,153,694 | 1,000,001 | ||||

| 19 February 2021 | Exercise of warrants | 15,340 | 5.960 | 91 | ||

| 6 July 2021 | Placing | 1,754,386 | 5.700 | 10,000 | ||

| At 31 December 2021 | 4,923,420 | 1,000,001 | ||||

| 22 March 2022 | Exercise of Warrants | 1 | 200.000 | - | ||

| 3 May 2022 | Share issue to SIPP trustee | 1,250 | 0.001 | - | ||

| 19 December 2022 | Registered District Offering | 492,466 | 0.666 | 321 | ||

| At 31 December 2022 | 5,417,137 | 1,000,001 | ||||

| 15 February 2023 | Private Placements* | 98,387,275 | 0.0505 | 4,967 | ||

| 26 May 2023 | Registered Direct Offering* | 276,697,310 | 0.0097 | 2,690 | ||

| 14 June 2023 | Share sub-division and re-designation | 4,063,321,418 | n/a | n/a | ||

| 21 December 2023 | Shares issued to purchase Intangible asset (see note 5) | 323,684,800 | 0.0040 | 1,279 | ||

| 21 December 2023 | Registered Offering | 485,391,200 | 0.0040 | 1,918 | ||

| At 31 December 2023 | 1,189,577,722 | 1,000,001 | 4,063,321,418 | |||

*Number of shares issued includes exercise of pre-funded warrants and Series A, Series B and Series C warrants that were exercisable on an ‘alternative cashless basis’.

10 Contingent liabilities

The Company entered into an Arrangement Agreement with Bioasis on 13 December 2022 as amended on 18 December 2022. Under the agreement the Company agreed to acquire the entire issued share capital of Bioasis for consideration of, in aggregate, approximately C

As at 31 December 2023 and 31 December 2022 the Company had a contingent liability of

11 Post Balance Sheet Events

On 22 January 2024 membership of the Board Committees were changed to the following:

| Audit Committee | Remuneration Committee | Nominations Committee | |

| Stephen Parker | X | X* | |

| Sijmen de Vries | X* | X | |

| Ann Merchant | X | X | |

| Simon Turton | X* | X | X |

| *Chair of Committee |