Peter K. Scaturro, Former Partner at Goldman Sachs Global Private Client and Former CEO of Citigroup Global Private Bank, joins Star Mountain Capital as Senior Advisor

Star Mountain Capital, a rapidly growing employee-owned specialized investment firm with over

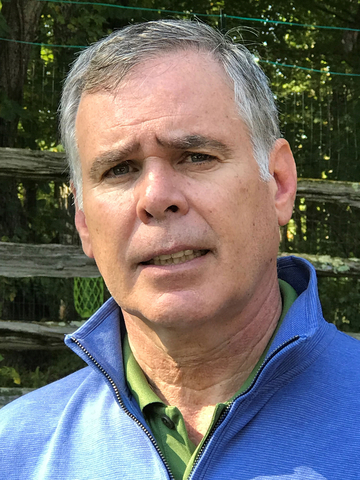

Peter Scaturro, Star Mountain Capital Senior Advisor (Photo: Business Wire)

“We are excited to welcome Peter as an aligned Senior Advisor where we believe his extensive leadership experience across multiple cycles will benefit all of our stakeholders,” said Brett Hickey, Star Mountain Capital Founder & CEO. “Peter’s extensive CEO, board, and 40+ years of financial services experience will add value to our Firm in many ways.”

“The lower middle-market provides a compelling market opportunity that I believe many investors haven’t yet benefitted from as a compelling complement to more traditional investment portfolios,” said Peter Scaturro. “Star Mountain has developed what I believe to be a distinctive platform where I also value its culture of economic alignment with team and investors.”

Mr. Scaturro was most recently a Partner in the Global Private Client Business of Goldman Sachs (NYSE: GS) where he oversaw the Global Private Client Business (

Prior to Goldman Sachs, Mr. Scaturro was the Chief Executive Officer at

Before becoming Chief Executive Officer at

Earlier in his career, Mr. Scaturro was a Partner at Bankers Trust (acquired by Deutsche Bank in 1999). Mr. Scaturro began his career in 1982 at Chase Manhattan Bank in

Mr. Scaturro received a Bachelor of Applied Science in Engineering and a Master of Engineering from

Mr. Scaturro is currently a Managing Partner at Regenerative SportsCare Institute, a world-renowned regenerative-medicine destination for non-surgical, interventional orthobiologic care in

About Star Mountain

With over

Since 2010, Star Mountain has made over 275 direct investments in businesses and over 50 secondary / fund investments within its Collaborative Ecosystem®, focused on the North American lower middle-market. One of Star Mountain’s specialties is seeking current cash income for investors that is materially above the typical yields found in the public markets, often accompanied with potential long-term capital gains equity returns and low correlation to public markets through its distinctive origination, underwriting and value-added investment capabilities.

Star Mountain was recently named one of the Inc. 5000 fastest-growing private companies in America.

For the fifth straight year, Star Mountain was again named one of the Best Places to Work by Crain’s New York Business as well as once again one of the Best Places to Work by Pensions & Investments.

Star Mountain believes its focus and dedication has been productive for job creation and economic development including in underserved areas and communities. Star Mountain is dedicated to this large market of underserved businesses purpose-built to address the challenges and opportunities of these companies. As part of its commitment, Star Mountain has trademarked Investing in the Growth Engine of America®.

Star Mountain’s Charitable Foundation, a not-for-profit 501(c)3 focuses on improving lives through economic development, including job creation, health & wellness and cancer research. Notable missions include helping match veterans and women with high quality small and medium-sized business career opportunities across the country, including within Star Mountain’s portfolio.

Note: This does not constitute an offer to sell or a solicitation of an offer to purchase interests in any investment product. Awards and recognitions by unaffiliated rating services, companies and/or publications should not be construed by a client or prospective client as a guarantee that he / she / it will experience a certain level of results if Star Mountain is engaged, or continues to be engaged, to provide investment advisory services; nor should they be construed as a current or past endorsement, testimonial endorsement, recommendation or referral of Star Mountain or its representatives by any of its clients or any other third party. Rankings published by magazines and others are generally based exclusively on information prepared and / or submitted by the recognized advisor. Moreover, with regard to all performance information contained herein, directly or indirectly, if any, readers should note that past results are not indicative of future results. The description and the selection methodologies of each award and recognition are subjective and will vary.

Awards and recognitions by unaffiliated rating services, companies, and/or publications should not be construed by a client or prospective client as a guarantee that he/she/it will experience a certain level of results if Star Mountain is engaged, or continues to be engaged, to provide investment advisory services; nor should they be construed as a current or past endorsement, testimonial endorsement, recommendation or referral of Star Mountain or its representatives by any of its clients or any other third party. Rankings published by magazines and others are generally based exclusively on information prepared and/or submitted by the recognized advisor.

Crain’s two-part survey process consisted of evaluating each nominated company’s workplace policies, practices, philosophy, systems and demographics. The second part involved an employee survey to measure the employee experience. The combined scores determined the top companies and the final ranking. Star Mountain must pay a fee to Crain’s only for survey collection purposes. Detailed eligibility criteria can be found here: https://bestcompaniesgroup.com/best-companies-to-work-for-in-new-york/eligibility/

To be named to P&I‘s Best Places list, all firms met Best Companies’ high threshold for inclusion and were evaluated against others of similar size. Individual firm profiles, which were compiled based on survey results, reflect

Companies on the 2023 Inc. 5000 are ranked according to percentage revenue growth from 2019 to 2022. To qualify, companies must have been founded and generating revenue by March 31, 2019. They must be

View source version on businesswire.com: https://www.businesswire.com/news/home/20240903047473/en/

John Polis – Media@StarMountainCapital.com

Source: Star Mountain Capital, LLC