More Than 5 Million Bank of America Clients Use Life Plan in its First Year to Prioritize Financial Goals and Establish a Path Toward Achieving Them

Bank of America announced that over 5 million clients have adopted its Life Plan feature in its first year, becoming the most rapidly adopted digital offering. Since the launch, client account balances increased by $34 billion. Life Plan allows users to set financial goals and integrates with the AI-driven assistant, Erica, in 2022. The top goals set by users include budgeting (35%) and improving credit (27%). The initiative has spurred over 1 million appointments with financial specialists, showcasing increased client engagement.

- None.

- None.

Insights

Analyzing...

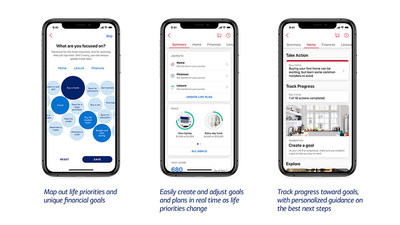

CHARLOTTE, N.C., Oct. 5, 2021 /PRNewswire/ -- Bank of America today announced that more than 5 million clients now use Life Plan®, making it the company's most rapidly adopted digital feature of all time. Available within the Bank of America mobile app and online banking platform, Life Plan offers a personal digital experience that enables clients to set and track near- and long-term goals based on their life priorities, and better understand and act on steps toward achieving them. Since launching nationally one year ago, account balances among Life Plan users have increased by

"Life Plan's ability to help clients set and pursue their unique financial goals shows how personalized planning and timely, relevant insights can drive engagement and positively influence the way people manage their financial lives," said David Tyrie, Chief Digital Officer and Head of Global Marketing at Bank of America. "At Bank of America, we are providing clients with best-in-class digital experiences to help them meet their financial needs today and successfully plan for the future."

In early 2022, Life Plan will be further integrated with Erica, the bank's AI-driven virtual financial assistant. Erica will provide clients who use Life Plan with proactive insights and steps they can take to help them make progress toward their goals. Additional future enhancements will offer integrated tools to help Life Plan users understand how their financial activities can align with their priorities, whether that's budgeting, supporting a small business, community engagement, or all the above.

Available in English and Spanish, Life Plan delivers a holistic view of a client's financial goals and helps track progress toward them. Life Plan also provides information and tips from Better Money Habits®, a free financial education platform that helps clients make sense of their money and take action.

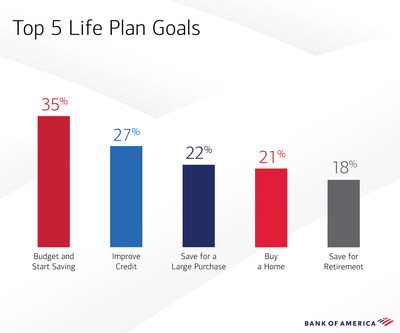

- Top five goals being set by Life Plan users include: Budget and Start Saving (

35% ), Improve Credit (27% ), Save for a Large Purchase (22% ), Buy a Home (21% ), and Save for Retirement (18% ). - Millennial and Gen-Z clients are the most active users, accounting for

62% of the Life Plans created, with Gen X and Baby Boomers making up35% . Students are another active client group, creating20% of Life Plans. Additionally,23% of Bank of America's digitally active Spanish clients have engaged with Life Plan. - Clients continue to take advantage of one-on-one personal guidance with financial specialists. In its first year, the use of Life Plan helped drive more than one million follow-up appointments with Bank of America financial professionals – both in-person and virtually – helping to inform collaborative discussions with clients about their financial goals and strategies to achieve them.

Life Plan's strong first-year growth comes amid a record-setting year for digital engagement across Bank of America. More than

Bank of America's digital leadership in consumer banking has been recognized through various awards in 2021, including being named the Best Consumer Digital Bank in the United States by Global Finance; No. 1 rankings from J.D. Power in customer satisfaction among national banks for both online banking and mobile banking apps; Javelin Strategy & Research named Bank of America "Best in Class," its highest honor, in both mobile and online banking for the fifth consecutive year; and the company received Celent's 2021 Model Bank award for Customer Engagement. Overall this year, Bank of America has been recognized with more than 170 industry awards for its innovation, solutions, financial technology, and delivering exceptional client service and experiences to its Retail, Preferred and Small Business clients.

Download the Bank of America app or visit bankofamerica.com.

Bank of America

Bank of America is one of the world's leading financial institutions, serving individual consumers, small and middle-market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services. The company provides unmatched convenience in the United States, serving approximately 66 million consumer and small business clients with approximately 4,300 retail financial centers, approximately 17,000 ATMs, and award-winning digital banking with approximately 41 million active users, including approximately 32 million mobile users. Bank of America is a global leader in wealth management, corporate and investment banking and trading across a broad range of asset classes, serving corporations, governments, institutions and individuals around the world. Bank of America offers industry-leading support to approximately 3 million small business households through a suite of innovative, easy-to-use online products and services. The company serves clients through operations across the United States, its territories and approximately 35 countries. Bank of America Corporation stock (NYSE: BAC) is listed on the New York Stock Exchange.

Bank of America Life Plan is a registered trademark of the Bank of America Corporation.

For more Bank of America news, including dividend announcements and other important information, visit the Bank of America newsroom and register for news email alerts.

Reporters May Contact:

Andy Aldridge, Bank of America, 980.387.0514

andrew.aldridge@bofa.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/more-than-5-million-bank-of-america-clients-use-life-plan-in-its-first-year-to-prioritize-financial-goals-and-establish-a-path-toward-achieving-them-301392863.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/more-than-5-million-bank-of-america-clients-use-life-plan-in-its-first-year-to-prioritize-financial-goals-and-establish-a-path-toward-achieving-them-301392863.html

SOURCE Bank of America Corporation