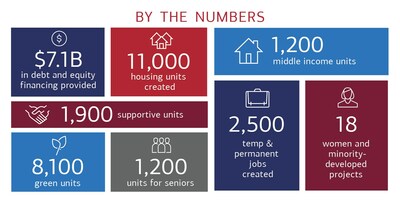

BofA Delivers $7.1 Billion in Financing to Build 11,000 Housing Units

- None.

- None.

Insights

The announcement by Bank of America regarding its $7.1 billion in financing directed towards community development is a significant indicator of the bank's strategic investment in social infrastructure, particularly affordable housing. The allocation of these funds, which has facilitated the creation and preservation of 11,000 housing units, is a response to the acute shortage of affordable housing highlighted by the Joint Center for Housing Studies at Harvard University. This initiative is not only a corporate social responsibility effort but also reflects a broader economic trend where financial institutions are increasingly integrating sustainable and community-focused investments into their portfolios.

From an economic perspective, this move could stimulate local economies by providing construction jobs and supporting ancillary industries. However, the underlying macroeconomic challenges, such as high-interest rates, inflation and supply chain disruptions, may affect the long-term sustainability and affordability of these housing projects. Stakeholders should monitor the effectiveness of the bank's strategies to combat these headwinds, which could include creative financing structures or partnerships that leverage subsidies or tax incentives.

Furthermore, the focus on 'missing middle' housing is a strategic investment in an often-overlooked segment of the housing market. By addressing the needs of those earning between 80% to 120% of the area median income, Bank of America is filling a gap that could reduce the risk of a more significant housing crisis and potentially stabilize communities. The long-term impact on the bank's financials will depend on the success of these investments in promoting economic growth and stability in the communities served.

Bank of America's Community Development Banking (CDB) initiative can be seen as a means to diversify its investment portfolio while also enhancing its corporate image. Such social investment programs are likely to resonate well with socially conscious investors and could potentially attract a new customer base that prioritizes ethical banking practices. In terms of market positioning, this move could differentiate Bank of America from its competitors, presenting it as a leader in community development and social responsibility.

It is also essential to consider the potential impact on the bank's reputation and brand value. By actively engaging in community development and addressing the affordable housing crisis, the bank is likely to receive positive media coverage and public perception, which can be invaluable in today's market where consumers are increasingly making decisions based on corporate ethics and values.

For investors, the performance of Bank of America's stock (NYSE: BAC) could be influenced by the success of its CDB initiatives. Positive outcomes from these investments may lead to increased investor confidence, while any setbacks or criticisms could have the opposite effect. Therefore, the effectiveness of the bank's strategy in navigating the economic challenges associated with affordable housing development will be crucial for maintaining investor trust and stock market performance.

The involvement of Bank of America in financing affordable housing projects through its Community Development Banking arm intersects with various regulatory and legal frameworks. The bank's actions align with the Community Reinvestment Act (CRA), which encourages financial institutions to meet the credit needs of the communities in which they operate, including low- and moderate-income neighborhoods. Compliance with CRA can lead to favorable regulatory evaluations, which can have a positive impact on the bank's ability to expand and merge, subject to regulatory approvals.

Moreover, the bank's investment in affordable housing may qualify for certain tax credits, such as the Low-Income Housing Tax Credit (LIHTC), which can provide a financial incentive for the development of affordable rental housing. Proper utilization of such incentives can enhance the financial viability of the projects and, by extension, the bank's return on investment.

Legal due diligence is critical when entering into partnerships with developers and other stakeholders, as it helps mitigate risks associated with real estate development, such as zoning issues, environmental concerns and community opposition. The bank's legal expertise in structuring these deals is vital to ensure compliance with all applicable laws and to protect its interests in the long term.

Community Development Banking Helps Clients, Communities Thrive Despite Challenging Economic Environment

According to a 2023 report by the Joint Center for Housing Studies at Harvard University, "millions of households are now priced out of homeownership, grappling with housing cost burdens, or lacking shelter altogether."

"The need for affordable housing continues to grow. However, affordable housing developers face the same macroeconomic headwinds challenging other industries – higher interest rates, inflation and supply chain issues," said Maria Barry, Community Development Banking national executive at Bank of America. "This requires our team to be creative, plan for all scenarios and advise our clients on how to mitigate risk and maximize results."

Three factors that help drive the creation of affordable housing, include:

1) Strong partnerships – Whether they do business locally or nationally, affordable housing developers are dealing with rising costs due to interest rate fluctuations, supply chain interruptions and rising construction and insurance costs. Our banking team helps clients work through these challenges and maximize the value of their businesses. CDB provides financing, treasury and advisory services to optimize their companies, so developers can focus on their mission of creating much-needed affordable housing.

"Despite volatile financial markets, the one capital partner that we can always rely on for their stability, leading financial offerings and unmatched capacity is Bank of America," said Gilbert Winn, Chief Executive Officer of WinnCompanies. "Without question there have been certain complex and high impact community housing developments that would not have happened without the bank's financial partnership and unique strength. Our national affordable and mixed-income housing business is fortunate to be able to make Bank of America our first call whenever we plan to pursue community development."

2) Focus on families & attainable housing – CDB explores innovative solutions to expand its impact in communities. In 2023, it worked with Enterprise Community Partners to launch a workforce housing fund. This

"When a good home remains out of reach for millions of families, preservation is an essential component to tackling our nation's housing crisis," said Lori Chatman, President, Capital, Enterprise Community Partners. "Equally critical is working with a dedicated partner like Bank of America Community Development Banking which brings commitment and know-how along with an unparalleled network of national partnerships. Together through the Middle-Income Housing Preservation Fund, we are investing equity capital to help mission-aligned housing providers prevent displacement while keeping good homes affordable for the long term."

3) Supportive services & healthcare access – CDB has a strong focus on developments that incorporate resident services, including access to financial education, and overall health and well-being through programs such as: academic support, jobs readiness, training programs, family programs, food education, access to healthy food, and other critical supportive services. In 2023, CDB financed 4,500 housing units that incorporated a health component. Though partnerships with hospitals or health service providers, these developments incorporated on-site care dedicated to health and wellness.

"Mercy Housing recognizes the link between stable housing and good health and understands that you can't have one without the other," said Ismael Guerrero, President & CEO of Mercy Housing. "By prioritizing the need for stable and affordable housing with onsite resident services, we are elevating the health outcomes and quality of life for every resident."

CDB is active in all 50 states. Since 2005, it has financed over 287,000 total housing units of which 247,000 are affordable.

Harnessing the strength and reach of Bank of America, our banking and markets businesses provided an additional

These efforts are part of the company's commitment to deploying capital to address global issues outlined in the United Nations Sustainable Development Goals (SDGs).

Bank of America

Bank of America is one of the world's leading financial institutions, serving individual consumers, small and middle-market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services. The company provides unmatched convenience in

For more Bank of America news, including dividend announcements and other important information, visit the Bank of America newsroom and register for news email alerts.

Reporters may contact:

Anu Ahluwalia, Bank of America

Phone: 1.646.855.3375

anu.ahluwalia@bofa.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/bofa-delivers-7-1-billion-in-financing-to-build-11-000-housing-units-302075799.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/bofa-delivers-7-1-billion-in-financing-to-build-11-000-housing-units-302075799.html

SOURCE Bank of America Corporation