High Tide Resources Acquires Lac Pegma Copper-Nickel-Cobalt Sulphide Deposit Near Fermont, Quebec

Avidian Gold Corp. (TSXV:AVG)(OTCQB:AVGDF) announces its subsidiary, High Tide Resources Corp., has entered a purchase agreement with Globex Mining Enterprises Inc. to acquire 100% of the Lac Pegma Copper-Nickel-Cobalt deposit in Quebec. The acquisition price includes $10,000 in cash and 650,000 shares, expected to close before September 30, 2021. The deposit holds potential for clean energy applications and is situated near key infrastructure. Historical estimates point to significant mineral reserves, although they lack current compliance verification.

- Acquisition of Lac Pegma enhances High Tide's portfolio with a strategically important project.

- The property is located near existing infrastructure, facilitating potential development.

- Demand for copper-nickel-cobalt deposits is increasing due to their role in low carbon technology.

- The historical resource estimate is not NI 43-101 compliant, raising concerns about its reliability.

- Acquisition terms involve share issuance, potentially diluting current shareholders.

TORONTO, ON / ACCESSWIRE / February 8, 2021 / Avidian Gold Corp. (TSXV:AVG)(OTCQB:AVGDF) is pleased to announce that its majority controlled private subsidiary High Tide Resources Corp. ("High Tide or the "Company") has entered into a purchase agreement with Globex Mining Enterprises Inc. ("Globex" GMX-TSX, GLBXF-OTCQX International, G1MN-Frankfurt) to purchase

High Tide's President and VP of Exploration, Steve Roebuck, states: "Copper-nickel-cobalt sulphide deposits are key to low carbon technology and are highly sought after. We are very pleased to add Lac Pegma to the Company's portfolio of high-quality projects in the southern Labrador Trough area of Quebec and Labrador. Metals required for clean energy applications are becoming very important in the new economy and we think that Lac Pegma has great exploration potential with the ability to become an important project in this space. The property is bisected by a major Hydro Quebec electrical transmission line which provides overland access and very interesting green-focused, low carbon development scenarios."

The last exploration program completed on Lac Pegma was by Diadem Resources in 1996 drilling 84 short BQ-diameter diamond drill holes totalling a reported 5248 metres. In a report filed on Quebec's MERN website (GM54771) in May 1997, Diadem Resources reported a non NI 43-101 compliant "indicated reserve of 2 million tons of

DISCLAIMER: *Please note a Qualified Person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves.

The terms of the purchase agreement are as follows; the Company will pay Globex

Qualified Person Statement

All scientific and technical information disclosed in this news release was prepared and approved by Steve Roebuck, P.Geo., President & VP Exploration of High Tide Resources Corp. who is a Qualified Person as defined by NI 43-101 and has reviewed and approved this news release.

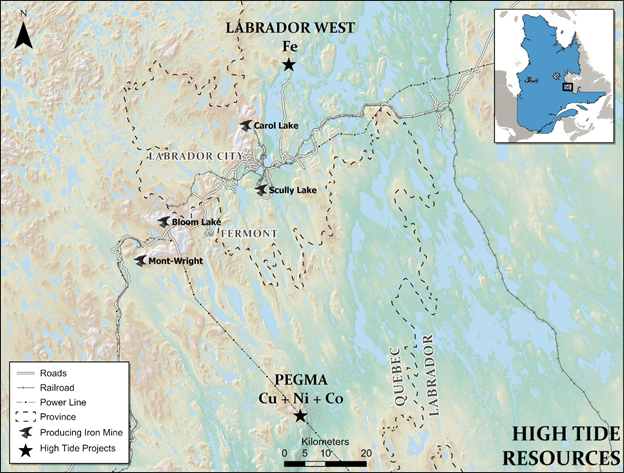

Figure 1

About High Tide Resources Corp.

High Tide is a private corporation that is focused on, and committed to, the development of advanced-stage mineral projects in Canada using industry best practices combined with a strong social license from local communities. It has a disciplined and veteran management team of technical and business-oriented professionals that is advancing its Labrador West iron property located in Newfoundland & Labrador, Canada. High Tide is majority owned by Avidian Gold Corp.

About Avidian Gold Corp.

Avidian brings a disciplined and veteran team of project managers together with a focus on advanced stage gold exploration projects in Alaska. Avidian's Golden Zone project hosts a NI 43-101 Indicated gold resource of 267,400 ounces (4,187,000 tonnes at 1.99 g/t Au) plus an Inferred gold resource of 35,900 ounces (1,353,000 tonnes at 0.83 g/t Au)*. Additional projects include the Amanita and the Amanita NE gold properties which are both adjacent to Kinross Gold's Fort Knox gold mine in Alaska, and the Jungo gold/copper property in Nevada. *Technical Report on the Golden Zone Property, August 17, 2017, L. McGarry P.Geo & I. Trinder P.Geo, A.C.A Howe International Ltd.

For further information, please contact:

Steve Roebuck

High Tide President & VP Exploration

Mobile: (905) 741-5458

Email: sroebuck@avidiangold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Forward-looking information

This News Release includes certain "forward-looking statements". These statements are based on information currently available to the Company and the Company provides no assurance that actual results will meet management's expectations. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results relating to, among other things, results of exploration, project development, reclamation and capital costs of the Company's mineral properties, and the Company's financial condition and prospects, could differ materially from

those currently anticipated in such statements for many reasons such as: changes in general economic conditions and conditions in the financial markets; changes in demand and prices for minerals; litigation, legislative, environmental and other judicial, regulatory, political and competitive developments; technological and operational difficulties encountered in connection with the activities of the Company; and other matters discussed in this news release. This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on the Company's forward-looking statements. The Company does not undertake to update any forward-looking statement that may be made from time to time by the Company or on its behalf, except in accordance with applicable securities laws.

SOURCE: Avidian Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/628242/High-Tide-Resources-Acquires-Lac-Pegma-Copper-Nickel-Cobalt-Sulphide-Deposit-Near-Fermont-Quebec

FAQ

What is the purpose of Avidian Gold's acquisition of Lac Pegma?

How much did Avidian Gold pay for the Lac Pegma deposit?

What is the significance of the Lac Pegma Copper-Nickel-Cobalt deposit?

When is the acquisition of Lac Pegma expected to close?