Golden Minerals Commences Reverse Circulation Drill Program; Drills 13.9m Grading 2.9 g/t Au at Rodeo Gold-Silver Mine

Golden Minerals Company (AUMN) announced the completion of 20 diamond drill holes and the initiation of a reverse circulation drill program at its Rodeo gold-silver mine in Mexico. The program, conducted by Major Drilling, will involve 35 holes over 2,500 meters, aiming to expand the high-grade resource being mined. Recent assay results showed several significant gold-silver intersections, including 78.7m grading 1.06 g/t Au. CEO Warren Rehn expects to complete drilling by September and incorporate potential increases in mineral inventory into the mine plan later this year.

- Completion of 20 diamond drill holes, enhancing the resource assessment.

- Initiation of a reverse circulation drill program with 35 holes over 2,500 meters.

- Significant assay results, including 78.7m grading 1.06 g/t Au and 10.1 g/t Ag.

- Potential increases in mineral inventory expected to be integrated into the mine plan.

- None.

Insights

Analyzing...

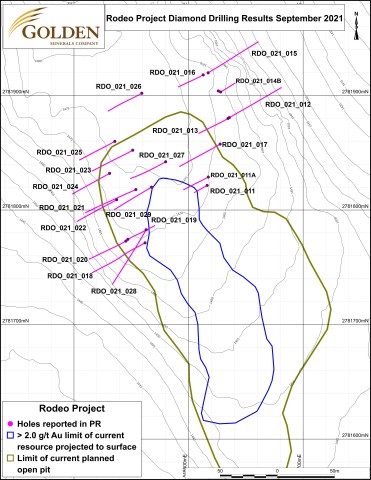

Figure 1: Diamond drill-hole locations,

The reverse circulation program is being conducted by

The Company has reported assay results from an additional 20 holes, totaling 1,253 meters, from the ongoing diamond drilling program that is exploring for the continuation of Au-Ag mineralization to the north of the current mining area. Drilling has intersected several wide zones of disseminated gold mineralization and has identified several additional high-grade zones that appear to be hosted in a series of silicified structures running parallel to the high-grade gold zones currently being mined. Highlights of the new assay results include:

RDO_21_028

- 78.7m grading 1.06 g/t Au and 10.1 g/t Ag

- Including 13.9m grading 2.88 g/t Au and 4.3 g/t Ag

RDO_021_022

- 70.0m grading 0.56 g/t Au and 6.0 g/t Ag

- Including 14.2m grading 1.07 g/t Au and 14.8 g/t Ag

RDO_021_018

- 64.4m grading 0.85 g/t Au and 8.6 g/t Ag

RDO_021_011A

- 26.0m grading 0.82 g/t Au and 6.5 g/t Ag

Significant results are summarized in the table below, with complete results available on the Company website. [link]

Hole ID |

From |

To |

Interval |

Au (g/t) |

Ag (g/t) |

RDO_021_011 |

Hole lost before reaching target depth |

||||

RDO_021_011A |

21.3 |

47.3 |

26.0 |

0.82 |

6.5 |

including |

21.3 |

26.9 |

5.6 |

1.71 |

6.4 |

including |

46.8 |

47.3 |

0.6 |

5.65 |

77.9 |

RDO_021_012 |

24.0 |

40.8 |

16.8 |

0.74 |

7.1 |

including |

35.8 |

40.8 |

5.1 |

1.43 |

16.6 |

RDO_021_013 |

27.2 |

27.7 |

0.5 |

1.04 |

6.2 |

RDO_021_014 |

Hole lost before reaching target depth |

||||

RDO_021_014B |

No Significant Results |

||||

RDO_021_015 |

59.2 |

59.7 |

0.5 |

1.15 |

1.5 |

RDO_021_016 |

29.2 |

30.8 |

1.6 |

1.00 |

3.1 |

RDO_021_017 |

24.5 |

53.6 |

29.1 |

0.58 |

6.0 |

including |

43.7 |

45.8 |

2.2 |

1.04 |

10.2 |

including |

51.1 |

53.6 |

2.6 |

1.97 |

26.1 |

RDO_021_018 |

0.0 |

64.4 |

64.4 |

0.85 |

8.6 |

including |

0.0 |

4.5 |

4.5 |

2.39 |

1.9 |

including |

0.0 |

1.6 |

1.6 |

5.81 |

2.1 |

including |

34.3 |

53.9 |

19.6 |

1.07 |

14.4 |

including |

45.6 |

52.6 |

7.0 |

1.51 |

21.3 |

RDO_021_019 |

23.5 |

24.9 |

1.4 |

1.16 |

16.3 |

RDO_021_019 |

43.2 |

44.6 |

1.4 |

1.14 |

27.4 |

RDO_021_020 |

3.0 |

49.9 |

47.0 |

0.58 |

2.9 |

Including |

3.0 |

8.3 |

5.3 |

1.22 |

3.2 |

Including |

35.9 |

42.1 |

6.2 |

1.21 |

3.8 |

RDO_021_021 |

9.7 |

37.2 |

27.5 |

0.64 |

2.2 |

Including |

10.2 |

13.8 |

3.7 |

2.79 |

3.1 |

RDO_021_022 |

0.0 |

70.0 |

70.0 |

0.56 |

6.0 |

Including |

0.0 |

10.2 |

10.2 |

1.00 |

3.2 |

Including |

55.8 |

70.0 |

14.2 |

1.07 |

14.8 |

RDO_021_023 |

No Significant Results |

||||

RDO_021_024 |

1.5 |

33.1 |

31.6 |

0.39 |

1.2 |

Including |

1.5 |

11.2 |

9.7 |

0.62 |

1.5 |

RDO_021_025 |

No Significant Results |

||||

RDO_021_026 |

No Significant Results |

||||

RDO_021_027 |

18.9 |

19.9 |

1.0 |

2.66 |

9.6 |

RDO_021_028 |

0.0 |

78.7 |

78.7 |

1.06 |

10.1 |

Including |

0.0 |

13.9 |

13.9 |

2.88 |

4.3 |

RDO_021_029 |

9.4 |

44.0 |

34.6 |

0.73 |

4.5 |

Including |

23.0 |

34.0 |

11.0 |

1.25 |

7.3 |

Note: Intervals in the table represent drilled length. It is expected that true thickness is approximately

About Rodeo

Rodeo is a gold-silver open pit mine located in Durango State,

Cautionary Note to United States Investors Regarding Estimates of Indicated Mineral Resources

This press release uses the terms "mineral resources" and "indicated mineral resources" which are defined in, and required to be disclosed by, Canadian National Instrument NI 43-101 (“NI 43-101”). We advise U.S. investors that these terms are not recognized under SEC Industry Guide 7. Accordingly, the disclosures regarding mineralization in this news release may not be comparable to similar information disclosed by

Review by Qualified Person and Quality Control

The technical contents of this press release have been reviewed by

To ensure reliable sample results,

About

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended, and applicable Canadian securities legislation, including statements regarding the Company’s plans and expected timeline for the reverse circulation drill program at the

For additional information please visit http://www.goldenminerals.com/.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210916005176/en/

(303) 839-5060

Source: