Astronics Corporation Reports 25% Growth in Sales in 2024 Third Quarter

Astronics (ATRO) reported strong Q3 2024 results with sales increasing 25% to $203.7 million, the highest quarterly level since Q1 2019. The company's Aerospace segment achieved operating income of $14.3 million with adjusted operating margin of 14.2%. Despite recording a net loss of $11.7 million due to $7.0 million in refinancing costs, adjusted net income was $12.2 million. Adjusted EBITDA grew 207% to $27.1 million. The company generated $8.5 million in cash from operations and maintained a solid backlog of $611.9 million. Based on performance, Astronics revised its 2024 revenue guidance to $777-797 million.

Astronics (ATRO) ha riportato risultati solidi per il terzo trimestre del 2024, con un incremento delle vendite del 25%, raggiungendo 203,7 milioni di dollari, il livello trimestrale più alto dal primo trimestre del 2019. Il segmento Aerospaziale dell'azienda ha registrato un reddito operativo di 14,3 milioni di dollari con un margine operativo rettificato del 14,2%. Nonostante un perdita netta di 11,7 milioni di dollari a causa di costi di rifinanziamento di 7,0 milioni, l'utile netto rettificato è stato di 12,2 milioni di dollari. L'EBITDA rettificato è cresciuto del 207%, raggiungendo 27,1 milioni di dollari. L'azienda ha generato 8,5 milioni di dollari in contante dalle operazioni e ha mantenuto un solido portafoglio ordini di 611,9 milioni di dollari. Sulla base delle prestazioni, Astronics ha rivisto al rialzo le previsioni di fatturato per il 2024 a 777-797 milioni di dollari.

Astronics (ATRO) anunció resultados sólidos para el tercer trimestre de 2024, con un aumento del 25% en las ventas, alcanzando 203,7 millones de dólares, el nivel trimestral más alto desde el primer trimestre de 2019. El segmento Aeroespacial de la compañía logró un ingreso operativo de 14,3 millones de dólares con un margen operativo ajustado del 14,2%. A pesar de registrar una pérdida neta de 11,7 millones de dólares debido a costos de refinanciamiento de 7,0 millones, el ingreso neto ajustado fue de 12,2 millones de dólares. El EBITDA ajustado creció un 207% hasta 27,1 millones de dólares. La empresa generó 8,5 millones de dólares en efectivo de operaciones y mantuvo un sólido backlog de 611,9 millones de dólares. Basado en su desempeño, Astronics revisó sus perspectivas de ingresos para 2024 a 777-797 millones de dólares.

Astronics (ATRO)는 2024년 3분기 강력한 실적을 발표했으며, 매출이 25% 증가하여 2억 3,700만 달러에 달했으며, 이는 2019년 1분기 이후 가장 높은 분기 실적입니다. 회사의 항공우주 부문은 1,430만 달러의 운영 소득과 14.2%의 조정된 운영 마진을 달성했습니다. 700만 달러의 재융자 비용으로 인해 1,170만 달러의 순손실이 기록되었지만, 조정된 순이익은 1,220만 달러였습니다. 조정된 EBITDA는 207% 증가하여 2,710만 달러에 달했습니다. 회사는 운영에서 850만 달러의 현금을 생성했으며, 6억 1,190만 달러의 탄탄한 미결제 잔고를 유지하고 있습니다. 성과를 바탕으로 Astronics는 2024년 수익 가이던스를 7억 7,700만-7억 9,700만 달러로 수정했습니다.

Astronics (ATRO) a annoncé de bons résultats pour le troisième trimestre 2024, avec une augmentation des ventes de 25% pour atteindre 203,7 millions de dollars, le niveau trimestriel le plus élevé depuis le premier trimestre 2019. Le segment Aérospatial de l'entreprise a réalisé un revenu opérationnel de 14,3 millions de dollars avec une marge opérationnelle ajustée de 14,2%. Bien qu'un perte nette de 11,7 millions de dollars ait été enregistrée en raison de coûts de refinancement de 7,0 millions de dollars, le revenu net ajusté s'est élevé à 12,2 millions de dollars. L'EBITDA ajusté a crû de 207% pour atteindre 27,1 millions de dollars. L'entreprise a généré 8,5 millions de dollars en liquidités provenant des opérations et maintenu un solide carnet de commandes de 611,9 millions de dollars. Sur la base des performances, Astronics a révisé ses prévisions de revenus pour 2024 à 777-797 millions de dollars.

Astronics (ATRO) hat starke Ergebnisse für das dritte Quartal 2024 vermeldet, mit einem Anstieg der Verkaufszahlen um 25% auf 203,7 Millionen Dollar, dem höchsten Quartalswert seit dem ersten Quartal 2019. Das Segment Luft- und Raumfahrt des Unternehmens erzielte einen operativen Gewinn von 14,3 Millionen Dollar mit einer bereinigten operativen Marge von 14,2%. Trotz eines Nettverlusts von 11,7 Millionen Dollar aufgrund von Refinanzierungskosten in Höhe von 7,0 Millionen Dollar betrug der bereinigte Nettogewinn 12,2 Millionen Dollar. Das bereinigte EBITDA wuchs um 207% auf 27,1 Millionen Dollar. Das Unternehmen generierte 8,5 Millionen Dollar an Bargeld aus dem operativen Geschäft und hielt einen soliden Auftragsbestand von 611,9 Millionen Dollar. Basierend auf der Leistung hat Astronics seine Umsatzprognose für 2024 auf 777-797 Millionen Dollar überarbeitet.

- Sales grew 25% YoY to $203.7 million, highest since Q1 2019

- Adjusted EBITDA increased 207% to $27.1 million (13.3% margin)

- Aerospace segment adjusted operating margin improved to 14.2%

- Strong backlog of $611.9 million

- Commercial Transport sales increased 31.6% to $133.9 million

- Net loss of $11.7 million ($0.34 per share)

- $7.0 million loss on debt extinguishment

- $3.5 million warranty reserve for product field modification

- Test Systems segment operating at near break-even

- Potential significant legal damages in UK patent case up to $105 million

Insights

The Q3 2024 results show significant operational improvements for Astronics Sales increased 25% to

While the company reported a net loss of

The revised 2024 revenue guidance of

The patent litigation situation presents significant financial risk. The multi-jurisdictional nature of the cases has produced mixed results: favorable outcomes in the US and France (patent invalidity), partial success in Germany with

The pending UK damages ruling expected in late 2024 or early 2025 is particularly critical. While Astronics has reserved

-

Sales increased

$40.8 million $203.7 million -

Higher sales drove Aerospace operating income of

$14.3 million 8.0% ; Adjusted Aerospace operating income1 was$25.3 million 14.2% of sales -

Net loss for the quarter of

$11.7 million $0.34 $7.0 million $12.2 million $0.35 -

Adjusted EBITDA1 grew

207% to$27.1 million 13.3% of sales, up$18.2 million $6.8 million -

Generated

$8.5 million -

Bookings in the quarter were

$189.2 million $611.9 million -

Revised 2024 revenue guidance to a new range of

$777 million $797 million

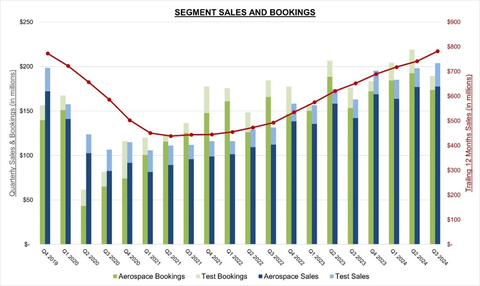

Astronics Segment Sales and Bookings (Graphic: Business Wire)

Peter J. Gundermann, Chairman, President and Chief Executive Officer, commented, “We delivered a solid third quarter operationally. Revenue was at the high end of our range, up

1 Adjusted gross profit, adjusted gross margin, adjusted operating income, adjusted operating margin, adjusted segment operating profit, adjusted segment operating margin, adjusted EBITDA, adjusted EBITDA margin, adjusted net income and adjusted diluted earnings per share (“EPS”) are Non-GAAP Performance Measures. Please see the reconciliation of GAAP to non-GAAP performance measures in the tables that accompany this release. |

Third Quarter Results

|

Three Months Ended |

|

Nine Months Ended |

||||||||||||||||

($ in thousands) |

September 28, 2024 |

|

September 30, 2023 |

% Change |

|

September 28, 2024 |

|

September 30, 2023 |

% Change |

||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

Sales |

$ |

203,698 |

|

|

$ |

162,922 |

|

25.0 |

% |

|

$ |

586,886 |

|

|

$ |

493,914 |

|

18.8 |

% |

Income (Loss) from Operations |

$ |

8,374 |

|

|

$ |

(14,479 |

) |

157.8 |

% |

|

$ |

17,590 |

|

|

$ |

(14,453 |

) |

221.7 |

% |

Operating Margin % |

|

4.1 |

% |

|

|

(8.9 |

)% |

|

|

|

3.0 |

% |

|

|

(2.9 |

)% |

|

||

Net Gain on Sale of Business |

$ |

— |

|

|

$ |

— |

|

|

|

$ |

— |

|

|

$ |

(3,427 |

) |

|

||

Loss on Extinguishment of Debt |

$ |

6,987 |

|

|

$ |

— |

|

|

|

$ |

6,987 |

|

|

$ |

— |

|

|

||

Net Loss |

$ |

(11,738 |

) |

|

$ |

(16,983 |

) |

30.9 |

% |

|

$ |

(13,383 |

) |

|

$ |

(33,397 |

) |

59.9 |

% |

Net Loss % |

|

(5.8 |

)% |

|

|

(10.4 |

)% |

|

|

|

(2.3 |

)% |

|

|

(6.8 |

)% |

|

||

|

|

|

|

|

|

|

|

|

|

||||||||||

Adjusted Net Income (Loss)1 |

$ |

12,163 |

|

|

$ |

(2,262 |

) |

637.7 |

% |

|

$ |

21,287 |

|

|

$ |

(3,892 |

) |

646.9 |

% |

Adjusted EBITDA1 |

$ |

27,059 |

|

|

$ |

8,827 |

|

206.5 |

% |

|

$ |

66,375 |

|

|

$ |

30,749 |

|

115.9 |

% |

Adjusted EBITDA Margin %1 |

|

13.3 |

% |

|

|

5.4 |

% |

|

|

|

11.3 |

% |

|

|

6.2 |

% |

|

||

Third Quarter 2024 Results (compared with the prior-year period, unless noted otherwise)

Consolidated sales were up

Gross profit increased

Third quarter 2024 selling, general and administrative expenses (“SG&A”) included

Despite the unusual impacts to gross profit and operating income, consolidated operating income increased

Improved operating income reflects the operating leverage gained on higher sales volume, partially offset by

Third quarter 2024 expenses included a

Tax expense in the quarter was

Consolidated net loss was

Consolidated adjusted EBITDA1 increased to

Bookings were

Aerospace Segment Review (refer to sales by market and segment data in accompanying tables)

Aerospace Third Quarter 2024 Results (compared with the prior-year period, unless noted otherwise)

Aerospace segment sales increased

Military Aircraft sales increased

Aerospace segment operating profit of

The segment’s operating profit in the third quarter of 2024 was impacted by

Aerospace bookings were

Mr. Gundermann commented, “Our Aerospace business had a strong quarter, with sales up

Test Systems Segment Review (refer to sales by market and segment data in accompanying tables)

Test Systems Third Quarter 2024 Results (compared with the prior-year period, unless noted otherwise)

Test Systems segment sales were

Test Systems segment operating loss was near break-even, compared with operating loss of

Additional restructuring initiatives were implemented in the 2024 fourth quarter. In October 2024, the Company offered a voluntary separation program which is currently expected to provide annualized savings of approximately

Bookings for the Test Systems segment in the quarter were

Mr. Gundermann commented, “Our Test business had some success in the third quarter, with revenue up

Liquidity and Financing

Cash provided by operations in the third quarter of 2024 was

Capital expenditures in the quarter were

On July 11, 2024, the Company announced it had amended and expanded its revolving line of credit and refinanced its term loan. The refinancing provided improved liquidity, lower cash costs, and greater financial flexibility for the Company. The refinancing was comprised of an expanded asset-based line of credit and a reduced, lower-cost term loan. Both mature in July 2027.

Legal Proceedings

Since 2010, the Company has been defending itself in a long-running series of patent infringement cases brought by a single plaintiff. Cases were filed in

The French case similarly found that the subject patent was invalid, though the plaintiff is seeking to appeal that decision.

The German court dismissed some claims of the patent but upheld others and found that Astronics had been infringing. The Company has paid

Unlike in the US, French, and German proceedings, the

The Company believes that permission will be granted to either or both of the parties to appeal the judgement to a higher court subsequently.

All patents related to the infringement cases have expired years ago and the lawsuits do not restrict the Company’s current business activities.

2024 Outlook

The Company expects fourth quarter sales of

Backlog at the end of the third quarter was

Mr. Gundermann commented, “We are closing in on another year of strong double-digit growth. Assuming we attain the mid-point of the range for 2024, we will have averaged

Third Quarter 2024 Webcast and Conference Call

The Company will host a teleconference today at 4:45 p.m. ET. During the teleconference, management will review the financial and operating results for the period and discuss Astronics’ corporate strategy and outlook. A question-and-answer session will follow.

The Astronics conference call can be accessed by calling (201) 493-6784. The listen-only audio webcast can be monitored at investors.astronics.com. To listen to the archived call, dial (412) 317-6671 and enter replay pin number 13749130. The telephonic replay will be available from 8:00 p.m. on the day of the call through Wednesday, November 20, 2024. The webcast replay can be accessed via the investor relations section of the Company’s website where a transcript will also be posted once available.

About Astronics Corporation

Astronics Corporation (Nasdaq: ATRO) serves the world’s aerospace, defense, and other mission-critical industries with proven innovative technology solutions. Astronics works side-by-side with customers, integrating its array of power, connectivity, lighting, structures, interiors, and test technologies to solve complex challenges. For over 50 years, Astronics has delivered creative, customer-focused solutions with exceptional responsiveness. Today, global airframe manufacturers, airlines, military branches, completion centers, and Fortune 500 companies rely on the collaborative spirit and innovation of Astronics. The Company’s strategy is to increase its value by developing technologies and capabilities that provide innovative solutions to its targeted markets.

Safe Harbor Statement

This news release contains forward-looking statements as defined by the Securities Exchange Act of 1934. One can identify these forward-looking statements by the use of the words “expect,” “anticipate,” “plan,” “may,” “will,” “estimate,” “feeling” or other similar expressions and include all statements with regard to the timing for the ruling on the Company’s

FINANCIAL TABLES FOLLOW

ASTRONICS CORPORATION |

|||||||||||||||

CONSOLIDATED STATEMENT OF OPERATIONS DATA |

|||||||||||||||

(Unaudited, $ in thousands, except per share amounts) |

|||||||||||||||

|

|

|

|

||||||||||||

|

Three Months Ended |

|

Nine Months Ended |

||||||||||||

|

9/28/2024 |

|

9/30/2023 |

|

9/28/2024 |

|

9/30/2023 |

||||||||

Sales |

$ |

203,698 |

|

|

$ |

162,922 |

|

|

$ |

586,886 |

|

|

$ |

493,914 |

|

Cost of products sold |

|

160,955 |

|

|

|

142,304 |

|

|

|

468,598 |

|

|

|

413,091 |

|

Gross profit |

|

42,743 |

|

|

|

20,618 |

|

|

|

118,288 |

|

|

|

80,823 |

|

Gross margin |

|

21.0 |

% |

|

|

12.7 |

% |

|

|

20.2 |

% |

|

|

16.4 |

% |

|

|

|

|

|

|

|

|

||||||||

Selling, general and administrative |

|

34,369 |

|

|

|

35,097 |

|

|

|

100,698 |

|

|

|

95,276 |

|

SG&A % of sales |

|

16.9 |

% |

|

|

21.5 |

% |

|

|

17.2 |

% |

|

|

19.3 |

% |

Income (loss) from operations |

|

8,374 |

|

|

|

(14,479 |

) |

|

|

17,590 |

|

|

|

(14,453 |

) |

Operating margin |

|

4.1 |

% |

|

|

(8.9 |

)% |

|

|

3.0 |

% |

|

|

(2.9 |

)% |

|

|

|

|

|

|

|

|

||||||||

Net gain on sale of business |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,427 |

) |

Loss on extinguishment of debt |

|

6,987 |

|

|

|

— |

|

|

|

6,987 |

|

|

|

— |

|

Other expense (income) |

|

343 |

|

|

|

348 |

|

|

|

1,214 |

|

|

|

(562 |

) |

Interest expense, net |

|

6,217 |

|

|

|

5,991 |

|

|

|

17,832 |

|

|

|

17,381 |

|

Loss before tax |

|

(5,173 |

) |

|

|

(20,818 |

) |

|

|

(8,443 |

) |

|

|

(27,845 |

) |

Income tax expense (benefit) |

|

6,565 |

|

|

|

(3,835 |

) |

|

|

4,940 |

|

|

|

5,552 |

|

Net loss |

$ |

(11,738 |

) |

|

$ |

(16,983 |

) |

|

$ |

(13,383 |

) |

|

$ |

(33,397 |

) |

Net loss % of sales |

|

(5.8 |

)% |

|

|

(10.4 |

)% |

|

|

(2.3 |

)% |

|

|

(6.8 |

)% |

|

|

|

|

|

|

|

|

||||||||

Basic loss per share: |

$ |

(0.34 |

) |

|

$ |

(0.51 |

) |

|

$ |

(0.38 |

) |

|

$ |

(1.02 |

) |

Diluted loss per share: |

$ |

(0.34 |

) |

|

$ |

(0.51 |

) |

|

$ |

(0.38 |

) |

|

$ |

(1.02 |

) |

|

|

|

|

|

|

|

|

||||||||

Adjusted net income (loss)1 |

$ |

12,163 |

|

|

$ |

(2,262 |

) |

|

$ |

21,287 |

|

|

$ |

(3,892 |

) |

Adjusted diluted earnings (loss) per share1 |

$ |

0.35 |

|

|

$ |

(0.07 |

) |

|

$ |

0.61 |

|

|

$ |

(0.12 |

) |

|

|

|

|

|

|

|

|

||||||||

Weighted average diluted shares outstanding (in thousands) |

|

35,011 |

|

|

|

33,000 |

|

|

|

34,961 |

|

|

|

32,707 |

|

|

|

|

|

|

|

|

|

||||||||

Capital expenditures |

$ |

1,850 |

|

|

$ |

2,231 |

|

|

$ |

5,244 |

|

|

$ |

6,037 |

|

Depreciation and amortization |

$ |

6,041 |

|

|

$ |

6,385 |

|

|

$ |

18,572 |

|

|

$ |

19,758 |

|

1 Adjusted Net Income and adjusted diluted EPS are Non-GAAP Performance Measures. Please see the reconciliation of GAAP to non-GAAP performance measures in the tables that accompany this release. |

Use of Non-GAAP Financial Metrics and Additional Financial Information

In addition to reporting financial results in accordance with generally accepted accounting principles, or GAAP, Astronics provides Adjusted Non-GAAP information as additional information for its operating results. References to Adjusted Non-GAAP information are to non-GAAP financial measures. These measures are not required by, in accordance with, or an alternative for, GAAP and may be different from non-GAAP financial measures used by other companies. Astronics management uses these measures for reviewing the financial results of Astronics for budget planning purposes and for making operational and financial decisions. Management believes that providing these non-GAAP financial measures to investors, as a supplement to GAAP financial measures, help investors evaluate Astronics core operating and financial performance and business trends consistent with how management evaluates such performance and trends.

ASTRONICS CORPORATION |

|||||||||||||||

RECONCILIATION OF NET LOSS TO ADJUSTED EBITDA |

|||||||||||||||

(Unaudited, $ in thousands) |

|||||||||||||||

|

|

|

|

|

|

|

|

||||||||

|

Consolidated |

||||||||||||||

|

Three Months Ended |

|

Nine Months Ended |

||||||||||||

|

9/28/2024 |

|

9/30/2023 |

|

9/28/2024 |

|

9/30/2023 |

||||||||

Net loss |

$ |

(11,738 |

) |

|

$ |

(16,983 |

) |

|

$ |

(13,383 |

) |

|

$ |

(33,397 |

) |

Add back (deduct): |

|

|

|

|

|

|

|

||||||||

Interest expense |

|

6,217 |

|

|

|

5,991 |

|

|

|

17,832 |

|

|

|

17,381 |

|

Income tax (benefit) expense |

|

6,565 |

|

|

|

(3,835 |

) |

|

|

4,940 |

|

|

|

5,552 |

|

Depreciation and amortization expense |

|

6,041 |

|

|

|

6,385 |

|

|

|

18,572 |

|

|

|

19,758 |

|

Equity-based compensation expense |

|

1,772 |

|

|

|

1,611 |

|

|

|

6,414 |

|

|

|

5,603 |

|

Non-cash annual stock bonus accrual |

|

— |

|

|

|

— |

|

|

|

1,448 |

|

|

|

— |

|

Non-cash 401K contribution and quarterly bonus accrual |

|

— |

|

|

|

1,237 |

|

|

|

3,454 |

|

|

|

3,773 |

|

Restructuring-related charges including severance |

|

259 |

|

|

|

— |

|

|

|

1,033 |

|

|

|

564 |

|

Legal reserve, settlements and recoveries |

|

(332 |

) |

|

|

(1,227 |

) |

|

|

(332 |

) |

|

|

(2,532 |

) |

Litigation-related legal expenses |

|

5,558 |

|

|

|

4,574 |

|

|

|

13,680 |

|

|

|

14,024 |

|

Equity investment accrued payable write-off |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,800 |

) |

Net gain on sale of business |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,427 |

) |

Loss on extinguishment of debt |

|

6,987 |

|

|

|

— |

|

|

|

6,987 |

|

|

|

— |

|

Non-cash reserves for customer bankruptcy |

|

2,203 |

|

|

|

11,074 |

|

|

|

2,203 |

|

|

|

11,074 |

|

Warranty reserve |

|

3,527 |

|

|

|

— |

|

|

|

3,527 |

|

|

|

— |

|

Deferred liability recovery |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(5,824 |

) |

Adjusted EBITDA |

$ |

27,059 |

|

|

$ |

8,827 |

|

|

$ |

66,375 |

|

|

$ |

30,749 |

|

|

|

|

|

|

|

|

|

||||||||

Sales |

$ |

203,698 |

|

|

$ |

162,922 |

|

|

$ |

586,886 |

|

|

$ |

493,914 |

|

Adjusted EBITDA margin % |

|

13.3 |

% |

|

|

5.4 |

% |

|

|

11.3 |

% |

|

|

6.2 |

% |

Adjusted EBITDA is defined as net income before interest expense, income taxes, depreciation, amortization, and other adjustments. Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by sales. Adjusted EBITDA and Adjusted EBITDA Margin are not measures determined in accordance with GAAP and may not be comparable with Adjusted EBITDA and Adjusted EBITDA Margin as used by other companies. Nevertheless, the Company believes that providing non-GAAP financial measures, such as Adjusted EBITDA and Adjusted EBITDA Margin, are important for investors and other readers of the Company’s financial statements.

ASTRONICS CORPORATION |

|||||||||||||||

RECONCILIATION OF GROSS PROFIT TO ADJUSTED GROSS PROFIT |

|||||||||||||||

(Unaudited, $ in thousands) |

|||||||||||||||

|

|

|

|

|

|

|

|

||||||||

|

Consolidated |

||||||||||||||

|

Three Months Ended |

|

Nine Months Ended |

||||||||||||

|

9/28/2024 |

|

9/30/2023 |

|

9/28/2024 |

|

9/30/2023 |

||||||||

Gross profit |

$ |

42,743 |

|

|

$ |

20,618 |

|

|

$ |

118,288 |

|

|

$ |

80,823 |

|

Add back (deduct): |

|

|

|

|

|

|

|

||||||||

Warranty reserve |

|

3,527 |

|

|

|

— |

|

|

|

3,527 |

|

|

|

— |

|

Non-cash reserves for customer bankruptcy |

|

909 |

|

|

|

3,601 |

|

|

|

909 |

|

|

|

3,601 |

|

Deferred liability recovery |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(5,824 |

) |

Adjusted gross profit |

$ |

47,179 |

|

|

$ |

24,219 |

|

|

$ |

122,724 |

|

|

$ |

78,600 |

|

|

|

|

|

|

|

|

|

||||||||

Sales |

$ |

203,698 |

|

|

$ |

162,922 |

|

|

$ |

586,886 |

|

|

$ |

493,914 |

|

|

|

|

|

|

|

|

|

||||||||

Gross margin |

|

21.0 |

% |

|

|

12.7 |

% |

|

|

20.2 |

% |

|

|

16.4 |

% |

Adjusted gross margin |

|

23.2 |

% |

|

|

14.9 |

% |

|

|

20.9 |

% |

|

|

15.9 |

% |

Adjusted Gross Profit is defined as gross profit as reported, adjusted for certain items. Adjusted Gross Profit Margin is defined as Adjusted Gross Profit divided by sales. Adjusted Gross Profit and Adjusted Gross Margin are not measures determined in accordance with GAAP and may not be comparable with Adjusted Gross Profit and Adjusted Gross Profit Margin as used by other companies. Nevertheless, the Company believes that providing non-GAAP financial measures, such as Adjusted Gross Profit and Adjusted Gross Profit Margin, are important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current quarter’s and current year's gross profit and gross profit margin to the historical periods' gross profit, as well as facilitates a more meaningful comparison of the Company’s gross profit and gross profit margin to that of other companies.

ASTRONICS CORPORATION |

|||||||||||||||

RECONCILIATION OF OPERATING INCOME TO ADJUSTED OPERATING INCOME |

|||||||||||||||

(Unaudited, $ in thousands) |

|||||||||||||||

|

|

|

|

|

|

|

|

||||||||

|

Consolidated |

||||||||||||||

|

Three Months Ended |

|

Nine Months Ended |

||||||||||||

|

9/28/2024 |

|

9/30/2023 |

|

9/28/2024 |

|

9/30/2023 |

||||||||

Income (loss) from operations |

$ |

8,374 |

|

|

$ |

(14,479 |

) |

|

$ |

17,590 |

|

|

$ |

(14,453 |

) |

Add back (deduct): |

|

|

|

|

|

|

|

||||||||

Restructuring-related charges including severance |

|

259 |

|

|

|

— |

|

|

|

1,033 |

|

|

|

564 |

|

Legal reserve, settlements and recoveries |

|

(332 |

) |

|

|

(1,227 |

) |

|

|

(332 |

) |

|

|

(2,532 |

) |

Litigation-related legal expenses |

|

5,558 |

|

|

|

4,574 |

|

|

|

13,680 |

|

|

|

14,024 |

|

Non-cash reserves for customer bankruptcy |

|

2,203 |

|

|

|

11,074 |

|

|

|

2,203 |

|

|

|

11,074 |

|

Warranty reserve |

|

3,527 |

|

|

|

— |

|

|

|

3,527 |

|

|

|

— |

|

Deferred liability recovery |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(5,824 |

) |

Adjusted operating income (loss) |

$ |

19,589 |

|

|

$ |

(58 |

) |

|

$ |

37,701 |

|

|

$ |

2,853 |

|

|

|

|

|

|

|

|

|

||||||||

Sales |

$ |

203,698 |

|

|

$ |

162,922 |

|

|

$ |

586,886 |

|

|

$ |

493,914 |

|

|

|

|

|

|

|

|

|

||||||||

Operating margin |

|

4.1 |

% |

|

|

(8.9 |

)% |

|

|

3.0 |

% |

|

|

(2.9 |

)% |

Adjusted operating margin |

|

9.6 |

% |

|

|

— |

% |

|

|

6.4 |

% |

|

|

0.6 |

% |

Adjusted Operating Income is defined as income from operations as reported, adjusted for certain items. Adjusted Operating Margin is defined as Adjusted Operating Income divided by sales. Adjusted Operating Income and Adjusted Operating Margin are not measures determined in accordance with GAAP and may not be comparable with Adjusted Operating Income and Adjusted Operating Margin as used by other companies. Nevertheless, the Company believes that providing non-GAAP financial measures, such as Adjusted Operating Income and Adjusted Operating Margin, are important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current quarter’s and current year's income from operations to the historical periods' income from operations and operating margin, as well as facilitates a more meaningful comparison of the Company’s income from operations and operating margin to that of other companies.

ASTRONICS CORPORATION |

|||||||||||||||

RECONCILIATION OF NET INCOME AND DILUTED EARNINGS PER SHARE TO ADJUSTED NET INCOME AND ADJUSTED DILUTED EARNINGS PER SHARE |

|||||||||||||||

(Unaudited, $ in thousands, except per share amounts) |

|||||||||||||||

|

|

|

|

|

|

|

|

||||||||

|

Consolidated |

||||||||||||||

|

Three Months Ended |

|

Nine Months Ended |

||||||||||||

|

9/28/2024 |

|

9/30/2023 |

|

9/28/2024 |

|

9/30/2023 |

||||||||

Net loss |

$ |

(11,738 |

) |

|

$ |

(16,983 |

) |

|

$ |

(13,383 |

) |

|

$ |

(33,397 |

) |

Add back (deduct): |

|

|

|

|

|

|

|

||||||||

Amortization of intangibles |

|

3,188 |

|

|

|

3,381 |

|

|

|

9,728 |

|

|

|

10,577 |

|

Restructuring-related charges including severance |

|

259 |

|

|

|

— |

|

|

|

1,033 |

|

|

|

564 |

|

Legal reserve, settlements and recoveries |

|

(332 |

) |

|

|

(1,227 |

) |

|

|

(332 |

) |

|

|

(2,532 |

) |

Litigation-related legal expenses |

|

5,558 |

|

|

|

4,574 |

|

|

|

13,680 |

|

|

|

14,024 |

|

Equity investment accrued payable write-off |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,800 |

) |

Net gain on sale of business |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,427 |

) |

Loss on extinguishment of debt |

|

6,987 |

|

|

|

— |

|

|

|

6,987 |

|

|

|

— |

|

Non-cash reserves for customer bankruptcy |

|

2,203 |

|

|

|

11,074 |

|

|

|

2,203 |

|

|

|

11,074 |

|

Warranty reserve |

|

3,527 |

|

|

|

— |

|

|

|

3,527 |

|

|

|

— |

|

Deferred liability recovery |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(5,824 |

) |

Normalize tax rate1 |

|

2,511 |

|

|

|

(3,081 |

) |

|

|

(2,156 |

) |

|

|

6,849 |

|

Adjusted net income (loss) |

$ |

12,163 |

|

|

$ |

(2,262 |

) |

|

$ |

21,287 |

|

|

$ |

(3,892 |

) |

|

|

|

|

|

|

|

|

||||||||

Weighted average diluted shares outstanding (in thousands) |

|

35,011 |

|

|

|

33,000 |

|

|

|

34,961 |

|

|

|

32,707 |

|

|

|

|

|

|

|

|

|

||||||||

Diluted loss per share |

$ |

(0.34 |

) |

|

$ |

(0.51 |

) |

|

$ |

(0.38 |

) |

|

$ |

(1.02 |

) |

Adjusted diluted earnings (loss) per share |

$ |

0.35 |

|

|

$ |

(0.07 |

) |

|

$ |

0.61 |

|

|

$ |

(0.12 |

) |

Adjusted Net Income and Adjusted Diluted EPS are defined as net income and diluted EPS as reported, adjusted for certain items, including amortization of intangibles, and also adjusted for a normalized tax rate. Adjusted Net Income and Adjusted Diluted EPS are not measures determined in accordance with GAAP and may not be comparable with the measures used by other companies. Nevertheless, the Company believes that providing non-GAAP financial measures, such as Adjusted Net Income and Adjusted Diluted EPS, are important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current quarter’s and current year's net income and diluted EPS to the historical periods' net income and diluted EPS, as well as facilitates a more meaningful comparison of the Company’s net income and diluted EPS to that of other companies. The Company believes that presenting Adjusted Diluted EPS provides a better understanding of its earnings power inclusive of adjusting for the non-cash amortization of intangible assets, reflecting the Company’s strategy to grow through acquisitions as well as organically.

1 Applies a normalized tax rate of |

ASTRONICS CORPORATION |

|||||||||||||

SEGMENT SALES AND OPERATING PROFIT |

|||||||||||||

(Unaudited, $ in thousands) |

|||||||||||||

|

|

|

|||||||||||

|

Three Months Ended |

|

Nine Months Ended |

||||||||||

|

9/28/2024 |

9/30/2023 |

|

9/28/2024 |

9/30/2023 |

||||||||

Sales |

|

|

|

|

|

||||||||

Aerospace |

$ |

177,564 |

|

$ |

142,116 |

|

|

$ |

518,187 |

|

$ |

436,217 |

|

Less inter-segment |

|

(10 |

) |

|

(12 |

) |

|

|

(52 |

) |

|

(134 |

) |

Total Aerospace |

|

177,554 |

|

|

142,104 |

|

|

|

518,135 |

|

|

436,083 |

|

|

|

|

|

|

|

||||||||

Test Systems |

|

26,183 |

|

|

20,818 |

|

|

|

68,790 |

|

|

57,831 |

|

Less inter-segment |

|

(39 |

) |

|

— |

|

|

|

(39 |

) |

|

— |

|

Total Test Systems |

|

26,144 |

|

|

20,818 |

|

|

|

68,751 |

|

|

57,831 |

|

|

|

|

|

|

|

||||||||

Total consolidated sales |

|

203,698 |

|

|

162,922 |

|

|

|

586,886 |

|

|

493,914 |

|

|

|

|

|

|

|

||||||||

Segment operating profit (loss) and margins |

|

|

|

|

|

||||||||

Aerospace |

|

14,251 |

|

|

(7,464 |

) |

|

|

45,628 |

|

|

10,342 |

|

|

|

8.0 |

% |

|

(5.3 |

)% |

|

|

8.8 |

% |

|

2.4 |

% |

Test Systems |

|

(13 |

) |

|

(1,781 |

) |

|

|

(8,428 |

) |

|

(8,521 |

) |

|

|

— |

% |

|

(8.6 |

)% |

|

|

(12.3 |

)% |

|

(14.7 |

)% |

Total segment operating profit (loss) |

|

14,238 |

|

|

(9,245 |

) |

|

|

37,200 |

|

|

1,821 |

|

|

|

|

|

|

|

||||||||

Net gain on sale of business |

|

— |

|

|

— |

|

|

|

— |

|

|

(3,427 |

) |

Loss on extinguishment of debt |

|

6,987 |

|

|

— |

|

|

|

6,987 |

|

|

— |

|

Interest expense |

|

6,217 |

|

|

5,991 |

|

|

|

17,832 |

|

|

17,381 |

|

Corporate expenses and other |

|

6,207 |

|

|

5,582 |

|

|

|

20,824 |

|

|

15,712 |

|

Loss before taxes |

$ |

(5,173 |

) |

$ |

(20,818 |

) |

|

$ |

(8,443 |

) |

$ |

(27,845 |

) |

ASTRONICS CORPORATION |

|||||||||||||||

RECONCILIATION OF SEGMENT OPERATING PROFIT TO ADJUSTED SEGMENT OPERATING PROFIT |

|||||||||||||||

(Unaudited, $ in thousands) |

|||||||||||||||

|

|

|

|||||||||||||

|

Three Months Ended |

|

Nine Months Ended |

||||||||||||

|

9/28/2024 |

|

9/30/2023 |

|

9/28/2024 |

|

9/30/2023 |

||||||||

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

||||||||

Aerospace operating profit (loss) |

$ |

14,251 |

|

|

$ |

(7,464 |

) |

|

$ |

45,628 |

|

|

$ |

10,342 |

|

Restructuring-related charges including severance |

|

237 |

|

|

|

— |

|

|

|

237 |

|

|

|

— |

|

Legal reserve, settlements and recoveries |

|

(332 |

) |

|

|

(1,227 |

) |

|

|

(332 |

) |

|

|

(2,532 |

) |

Litigation-related legal expenses |

|

5,405 |

|

|

|

2,658 |

|

|

|

13,161 |

|

|

|

6,779 |

|

Non-cash reserves for customer bankruptcy |

|

2,203 |

|

|

|

11,074 |

|

|

|

2,203 |

|

|

|

11,074 |

|

Warranty reserve |

|

3,527 |

|

|

|

— |

|

|

|

3,527 |

|

|

|

— |

|

Adjusted Aerospace operating profit |

$ |

25,291 |

|

|

$ |

5,041 |

|

|

$ |

64,424 |

|

|

$ |

25,663 |

|

|

|

|

|

|

|

|

|

||||||||

Aerospace sales |

$ |

177,554 |

|

|

$ |

142,104 |

|

|

$ |

518,135 |

|

|

$ |

436,083 |

|

|

|

|

|

|

|

|

|

||||||||

Aerospace margin |

|

8.0 |

% |

|

|

(5.3 |

)% |

|

|

8.8 |

% |

|

|

2.4 |

% |

Adjusted Aerospace margin |

|

14.2 |

% |

|

|

3.5 |

% |

|

|

12.4 |

% |

|

|

5.9 |

% |

|

|

|

|

|

|

|

|

||||||||

Test Systems operating loss |

$ |

(13 |

) |

|

$ |

(1,781 |

) |

|

$ |

(8,428 |

) |

|

$ |

(8,521 |

) |

Restructuring-related charges including severance |

|

22 |

|

|

|

— |

|

|

|

796 |

|

|

|

564 |

|

Litigation-related legal expenses |

|

153 |

|

|

|

1,916 |

|

|

|

519 |

|

|

|

7,245 |

|

Deferred liability recovery |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(5,824 |

) |

Adjusted Test Systems operating profit (loss) |

$ |

162 |

|

|

$ |

135 |

|

|

$ |

(7,113 |

) |

|

$ |

(6,536 |

) |

|

|

|

|

|

|

|

|

||||||||

Test Systems sales |

$ |

26,144 |

|

|

$ |

20,818 |

|

|

$ |

68,751 |

|

|

$ |

57,831 |

|

|

|

|

|

|

|

|

|

||||||||

Test Systems margin |

|

— |

% |

|

|

(8.6 |

)% |

|

|

(12.3 |

)% |

|

|

(14.7 |

)% |

Adjusted Test Systems margin |

|

0.6 |

% |

|

|

0.6 |

% |

|

|

(10.3 |

)% |

|

|

(11.3 |

)% |

Adjusted Segment Operating Profit is defined as segment operating profit as reported, adjusted for certain items. Adjusted Segment Margin is defined as Adjusted Segment Operating Profit divided by segment sales. Adjusted Segment Operating Profit and Adjusted Segment Margin are not measures determined in accordance with GAAP and may not be comparable with Adjusted Segment Operating Profit and Adjusted Segment Margin as used by other companies. Nevertheless, the Company believes that providing non-GAAP financial measures, such as Adjusted Segment Operating Profit and Adjusted Segment Margin, are important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current quarter’s and current year's segment operating profit to the historical periods' segment operating profit and segment margin, as well as facilitates a more meaningful comparison of the Company’s segment operating profit and segment margin to that of other companies.

ASTRONICS CORPORATION |

|||||

CONSOLIDATED BALANCE SHEET DATA |

|||||

($ in thousands) |

|||||

|

(unaudited) |

|

|

||

|

9/28/2024 |

|

12/31/2023 |

||

ASSETS |

|

|

|

||

Cash and cash equivalents |

$ |

5,177 |

|

$ |

4,756 |

Restricted cash |

|

1,187 |

|

|

6,557 |

Accounts receivable and uncompleted contracts |

|

193,494 |

|

|

172,108 |

Inventories |

|

204,952 |

|

|

191,801 |

Other current assets |

|

19,371 |

|

|

14,560 |

Property, plant and equipment, net |

|

81,309 |

|

|

85,436 |

Other long-term assets |

|

32,236 |

|

|

34,944 |

Intangible assets, net |

|

55,702 |

|

|

65,420 |

Goodwill |

|

58,169 |

|

|

58,210 |

Total assets |

$ |

651,597 |

|

$ |

633,792 |

|

|

|

|

||

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

||

Current maturities of long-term debt |

$ |

550 |

|

$ |

8,996 |

Accounts payable and accrued expenses |

|

130,342 |

|

|

112,309 |

Customer advances and deferred revenue |

|

19,144 |

|

|

22,029 |

Long-term debt |

|

178,423 |

|

|

159,237 |

Other liabilities |

|

73,934 |

|

|

81,703 |

Shareholders' equity |

|

249,204 |

|

|

249,518 |

Total liabilities and shareholders' equity |

$ |

651,597 |

|

$ |

633,792 |

ASTRONICS CORPORATION |

|||||||

CONSOLIDATED CASH FLOWS DATA |

|||||||

|

|

|

|

||||

|

Nine Months Ended |

||||||

(Unaudited, $ in thousands) |

9/28/2024 |

|

9/30/2023 |

||||

Cash flows from operating activities: |

|

|

|

||||

Net loss |

$ |

(13,383 |

) |

|

$ |

(33,397 |

) |

Adjustments to reconcile net loss to cash from operating activities: |

|

|

|

||||

Non-cash items: |

|

|

|

||||

Depreciation and amortization |

|

18,572 |

|

|

|

19,758 |

|

Amortization of deferred financing fees |

|

2,711 |

|

|

|

2,148 |

|

Provisions for non-cash losses on inventory and receivables |

|

8,023 |

|

|

|

13,713 |

|

Equity-based compensation expense |

|

6,414 |

|

|

|

5,603 |

|

Loss on extinguishment of debt |

|

6,987 |

|

|

|

— |

|

Net gain on sale of business |

|

— |

|

|

|

(3,427 |

) |

Operating lease non-cash expense |

|

3,869 |

|

|

|

3,816 |

|

Non-cash 401K contribution and quarterly bonus accrual |

|

3,454 |

|

|

|

3,773 |

|

Non-cash annual stock bonus accrual |

|

1,448 |

|

|

|

— |

|

Non-cash litigation provision adjustment |

|

— |

|

|

|

(1,305 |

) |

Non-cash deferred liability reversal |

|

— |

|

|

|

(5,824 |

) |

Other |

|

2,899 |

|

|

|

911 |

|

Cash flows from changes in operating assets and liabilities: |

|

|

|

||||

Accounts receivable |

|

(22,712 |

) |

|

|

(12,980 |

) |

Inventories |

|

(19,829 |

) |

|

|

(24,024 |

) |

Accounts payable |

|

(3,304 |

) |

|

|

4,033 |

|

Accrued expenses |

|

13,517 |

|

|

|

5,111 |

|

Income taxes |

|

798 |

|

|

|

3,443 |

|

Operating lease liabilities |

|

(3,777 |

) |

|

|

(3,660 |

) |

Customer advance payments and deferred revenue |

|

(2,919 |

) |

|

|

(562 |

) |

Supplemental retirement plan liabilities |

|

(309 |

) |

|

|

(304 |

) |

Other assets and liabilities |

|

1,690 |

|

|

|

898 |

|

Net cash provided (used) by operating activities |

|

4,149 |

|

|

|

(22,276 |

) |

Cash flows from investing activities: |

|

|

|

||||

Proceeds on sale of business and assets |

|

— |

|

|

|

3,427 |

|

Capital expenditures |

|

(5,244 |

) |

|

|

(6,037 |

) |

Net cash used by investing activities |

|

(5,244 |

) |

|

|

(2,610 |

) |

Cash flows from financing activities: |

|

|

|

||||

Proceeds from long-term debt |

|

195,978 |

|

|

|

135,732 |

|

Principal payments on long-term debt |

|

(187,498 |

) |

|

|

(125,984 |

) |

Stock award and employee stock purchase plan activity |

|

(3,219 |

) |

|

|

2,480 |

|

Financing-related costs |

|

(5,863 |

) |

|

|

(6,447 |

) |

Financing extinguishment costs |

|

(3,210 |

) |

|

|

— |

|

Proceeds from at-the-market stock sales |

|

— |

|

|

|

13,045 |

|

Other |

|

(96 |

) |

|

|

(47 |

) |

Net cash (used) provided by financing activities |

|

(3,908 |

) |

|

|

18,779 |

|

Effect of exchange rates on cash |

|

54 |

|

|

|

(20 |

) |

Decrease in cash and cash equivalents and restricted cash |

|

(4,949 |

) |

|

|

(6,127 |

) |

Cash and cash equivalents and restricted cash at beginning of period |

|

11,313 |

|

|

|

13,778 |

|

Cash and cash equivalents and restricted cash at end of period |

$ |

6,364 |

|

|

$ |

7,651 |

|

Supplemental disclosure of cash flow information |

|

|

|

||||

Interest paid |

$ |

15,261 |

|

|

$ |

14,136 |

|

Income taxes refunded, net of payments |

$ |

3,975 |

|

|

$ |

2,192 |

|

ASTRONICS CORPORATION |

|||||||||||||||

SALES BY MARKET |

|||||||||||||||

(Unaudited, $ in thousands) |

|||||||||||||||

|

|

|

|

|

|||||||||||

|

Three Months Ended |

|

Nine Months Ended |

2024 YTD |

|||||||||||

|

9/28/2024 |

9/30/2023 |

% Change |

|

9/28/2024 |

9/30/2023 |

% Change |

% of Sales |

|||||||

Aerospace Segment |

|

|

|

|

|

|

|

|

|||||||

Commercial Transport |

$ |

133,850 |

$ |

101,724 |

31.6 |

% |

|

$ |

383,679 |

$ |

308,016 |

24.6 |

% |

65.4 |

% |

Military Aircraft |

|

21,685 |

|

16,687 |

30.0 |

% |

|

|

63,545 |

|

44,335 |

43.3 |

% |

10.8 |

% |

General Aviation |

|

18,077 |

|

16,193 |

11.6 |

% |

|

|

56,643 |

|

60,656 |

(6.6 |

)% |

9.7 |

% |

Other |

|

3,942 |

|

7,500 |

(47.4 |

)% |

|

|

14,268 |

|

23,076 |

(38.2 |

)% |

2.4 |

% |

Aerospace Total |

|

177,554 |

|

142,104 |

24.9 |

% |

|

|

518,135 |

|

436,083 |

18.8 |

% |

88.3 |

% |

|

|

|

|

|

|

|

|

|

|||||||

Test Systems Segment1 |

|

|

|

|

|

|

|

|

|||||||

Government & Defense |

|

26,144 |

|

20,818 |

25.6 |

% |

|

|

68,751 |

|

57,831 |

18.9 |

% |

11.7 |

% |

|

|

|

|

|

|

|

|

|

|||||||

Total Sales |

$ |

203,698 |

$ |

162,922 |

25.0 |

% |

|

$ |

586,886 |

$ |

493,914 |

18.8 |

% |

|

|

SALES BY PRODUCT LINE |

|||||||||||||||

(Unaudited, $ in thousands) |

|||||||||||||||

|

|

|

|

|

|||||||||||

|

Three Months Ended |

|

Nine Months Ended |

2024 YTD |

|||||||||||

|

9/28/2024 |

9/30/2023 |

% Change |

|

9/28/2024 |

9/30/2023 |

% Change |

% of Sales |

|||||||

Aerospace Segment |

|

|

|

|

|

|

|

|

|||||||

Electrical Power & Motion |

$ |

90,467 |

$ |

64,312 |

40.7 |

% |

|

$ |

263,919 |

$ |

185,712 |

42.1 |

% |

45.0 |

% |

Lighting & Safety |

|

46,921 |

|

38,496 |

21.9 |

% |

|

|

135,162 |

|

116,967 |

15.6 |

% |

23.0 |

% |

Avionics |

|

29,151 |

|

22,347 |

30.4 |

% |

|

|

83,716 |

|

83,011 |

0.8 |

% |

14.3 |

% |

Systems Certification |

|

4,460 |

|

6,535 |

(31.8 |

)% |

|

|

12,272 |

|

19,832 |

(38.1 |

)% |

2.1 |

% |

Structures |

|

2,613 |

|

2,914 |

(10.3 |

)% |

|

|

8,798 |

|

7,485 |

17.5 |

% |

1.5 |

% |

Other |

|

3,942 |

|

7,500 |

(47.4 |

)% |

|

|

14,268 |

|

23,076 |

(38.2 |

)% |

2.4 |

% |

Aerospace Total |

|

177,554 |

|

142,104 |

24.9 |

% |

|

|

518,135 |

|

436,083 |

18.8 |

% |

88.3 |

% |

|

|

|

|

|

|

|

|

|

|||||||

Test Systems Segment1 |

|

26,144 |

|

20,818 |

25.6 |

% |

|

|

68,751 |

|

57,831 |

18.9 |

% |

11.7 |

% |

|

|

|

|

|

|

|

|

|

|||||||

Total Sales |

$ |

203,698 |

$ |

162,922 |

25.0 |

% |

|

$ |

586,886 |

$ |

493,914 |

18.8 |

% |

|

|

1 Test Systems sales in the nine months ended September 30, 2023 included a |

ASTRONICS CORPORATION |

||||||||||

ORDER AND BACKLOG TREND |

||||||||||

(Unaudited, $ in thousands) |

||||||||||

|

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

Trailing

|

|||||

|

9/30/2023 |

12/31/2023 |

3/30/2024 |

9/28/2024 |

9/28/2024 |

|||||

Sales |

|

|

|

|

|

|||||

Aerospace |

$ |

168,747 |

$ |

163,638 |

$ |

176,943 |

$ |

177,554 |

$ |

686,882 |

Test Systems |

|

26,545 |

|

21,436 |

|

21,171 |

|

26,144 |

|

95,296 |

Total Sales |

$ |

195,292 |

$ |

185,074 |

$ |

198,114 |

$ |

203,698 |

$ |

782,178 |

|

|

|

|

|

|

|||||

Bookings |

|

|

|

|

|

|||||

Aerospace |

$ |

172,106 |

$ |

184,149 |

$ |

192,515 |

$ |

173,569 |

$ |

722,339 |

Test Systems |

|

11,176 |

|

19,986 |

|

26,359 |

|

15,597 |

|

73,118 |

Total Bookings |

$ |

183,282 |

$ |

204,135 |

$ |

218,874 |

$ |

189,166 |

$ |

795,457 |

|

|

|

|

|

|

|||||

Backlog |

|

|

|

|

|

|||||

Aerospace1 |

$ |

511,540 |

$ |

532,051 |

$ |

547,623 |

$ |

543,638 |

|

|

Test Systems |

|

75,036 |

|

73,586 |

|

78,774 |

|

68,227 |

|

|

Total Backlog |

$ |

586,576 |

$ |

605,637 |

$ |

626,397 |

$ |

611,865 |

|

N/A |

|

|

|

|

|

|

|||||

Book:Bill Ratio |

|

|

|

|

|

|||||

Aerospace |

|

1.02 |

|

1.13 |

|

1.09 |

|

0.98 |

|

1.05 |

Test Systems |

|

0.42 |

|

0.93 |

|

1.25 |

|

0.60 |

|

0.77 |

Total Book:Bill |

|

0.94 |

|

1.10 |

|

1.10 |

|

0.93 |

|

1.02 |

1 In October of 2024, a customer reported within the Aerospace segment declared bankruptcy. Aerospace and Total Backlog included |

View source version on businesswire.com: https://www.businesswire.com/news/home/20241106971275/en/

For more information:

Company:

David C. Burney, Chief Financial Officer

Phone: (716) 805-1599, ext. 159

Email: david.burney@astronics.com

Investor Relations:

Deborah K. Pawlowski, Kei Advisors LLC

Phone: (716) 843-3908

Email: dpawlowski@keiadvisors.com

Source: Astronics Corporation