Art's Way Manufacturing Improves Results Despite Ag Market Turmoil; Modular Building Segment Continues to Thrive

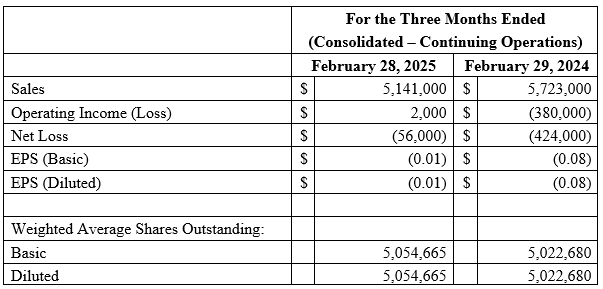

Art's Way Manufacturing (ARTW) reports Q1 2025 financial results showing mixed performance across segments. Overall sales declined 10.2% to $5.14 million, but the company achieved a 3.4% gross profit improvement and 19.4% reduction in operating expenses compared to Q1 2024.

The Agricultural Products segment faced challenges with sales dropping 30.4% to $2.95 million, primarily due to high interest rates and low commodity prices. However, the company maintains stable gross margins through cost-cutting measures implemented in 2024.

The Modular Buildings segment showed strong growth with sales increasing 47.5% to $2.19 million and net income improving by $262,000 to $291,000. The segment benefits from a robust backlog and continued strong demand.

Overall net loss narrowed to $56,000 ($0.01 per share) in Q1 2025, a significant improvement from the $368,000 loss in Q1 2024. Management remains optimistic despite market uncertainties, citing potential interest rate cuts and improving dealer inventory levels as positive indicators.

Art's Way Manufacturing (ARTW) riporta i risultati finanziari del Q1 2025 mostrando performance miste tra i segmenti. Le vendite complessive sono diminuite del 10,2% a $5,14 milioni, ma l'azienda ha ottenuto un miglioramento del 3,4% nel profitto lordo e una riduzione del 19,4% nelle spese operative rispetto al Q1 2024.

Il segmento Prodotti Agricoli ha affrontato sfide con vendite in calo del 30,4% a $2,95 milioni, principalmente a causa dei tassi di interesse elevati e dei prezzi delle materie prime bassi. Tuttavia, l'azienda mantiene margini lordi stabili grazie a misure di riduzione dei costi implementate nel 2024.

Il segmento Edifici Modulari ha mostrato una forte crescita con vendite aumentate del 47,5% a $2,19 milioni e un reddito netto migliorato di $262.000 a $291.000. Il segmento beneficia di un robusto portafoglio ordini e di una continua forte domanda.

La perdita netta complessiva si è ridotta a $56.000 ($0,01 per azione) nel Q1 2025, un miglioramento significativo rispetto alla perdita di $368.000 nel Q1 2024. La direzione rimane ottimista nonostante le incertezze del mercato, citando potenziali tagli ai tassi di interesse e miglioramenti nei livelli di inventario dei concessionari come indicatori positivi.

Art's Way Manufacturing (ARTW) informa sobre los resultados financieros del Q1 2025, mostrando un rendimiento mixto entre los segmentos. Las ventas totales cayeron un 10,2% a $5,14 millones, pero la empresa logró una mejora del 3,4% en el beneficio bruto y una reducción del 19,4% en los gastos operativos en comparación con el Q1 2024.

El segmento de Productos Agrícolas enfrentó desafíos con una caída de ventas del 30,4% a $2,95 millones, principalmente debido a las altas tasas de interés y los bajos precios de las materias primas. Sin embargo, la empresa mantiene márgenes brutos estables gracias a las medidas de reducción de costos implementadas en 2024.

El segmento de Edificios Modulares mostró un fuerte crecimiento con un aumento de ventas del 47,5% a $2,19 millones y una mejora en el ingreso neto de $262,000 a $291,000. Este segmento se beneficia de una sólida cartera de pedidos y una continua fuerte demanda.

La pérdida neta total se redujo a $56,000 ($0,01 por acción) en el Q1 2025, una mejora significativa respecto a la pérdida de $368,000 en el Q1 2024. La dirección sigue siendo optimista a pesar de las incertidumbres del mercado, citando posibles recortes en las tasas de interés y la mejora en los niveles de inventario de los concesionarios como indicadores positivos.

Art's Way Manufacturing (ARTW)는 Q1 2025 재무 결과를 보고하며, 각 세그먼트에서 혼합된 성과를 보여줍니다. 전체 매출은 10.2% 감소하여 514만 달러에 이르렀으나, 회사는 총 이익이 3.4% 개선되고 운영 비용이 Q1 2024에 비해 19.4% 감소했습니다.

농업 제품 세그먼트는 높은 금리와 낮은 원자재 가격으로 인해 매출이 30.4% 감소하여 295만 달러에 그쳤습니다. 그러나 회사는 2024년에 시행된 비용 절감 조치를 통해 안정적인 총 마진을 유지하고 있습니다.

모듈 건물 세그먼트는 매출이 47.5% 증가하여 219만 달러에 도달하고 순이익이 26만 2천 달러 증가하여 29만 1천 달러로 개선되었습니다. 이 세그먼트는 강력한 수주 잔고와 지속적인 높은 수요의 혜택을 보고 있습니다.

Q1 2025의 전체 순손실은 56,000달러($0.01 per share)로 줄어들어, Q1 2024의 368,000달러 손실에서 상당한 개선을 이루었습니다. 경영진은 시장의 불확실성에도 불구하고 낙관적인 태도를 유지하며, 잠재적인 금리 인하와 개선된 대리점 재고 수준을 긍정적인 지표로 언급하고 있습니다.

Art's Way Manufacturing (ARTW) annonce les résultats financiers du Q1 2025, montrant une performance mixte entre les segments. Les ventes globales ont diminué de 10,2 % pour atteindre 5,14 millions de dollars, mais l'entreprise a réalisé une amélioration de 3,4 % de son bénéfice brut et une réduction de 19,4 % de ses frais d'exploitation par rapport au Q1 2024.

Le segment Produits Agricoles a rencontré des défis, avec des ventes en baisse de 30,4 % à 2,95 millions de dollars, principalement en raison des taux d'intérêt élevés et des bas prix des matières premières. Cependant, l'entreprise maintient des marges brutes stables grâce à des mesures de réduction des coûts mises en œuvre en 2024.

Le segment Bâtiments Modulaires a montré une forte croissance avec des ventes en hausse de 47,5 % à 2,19 millions de dollars et un revenu net amélioré de 262 000 dollars à 291 000 dollars. Ce segment bénéficie d'un solide carnet de commandes et d'une demande toujours forte.

La perte nette globale s'est réduite à 56 000 dollars (0,01 dollar par action) au Q1 2025, une amélioration significative par rapport à la perte de 368 000 dollars au Q1 2024. La direction reste optimiste malgré les incertitudes du marché, citant des réductions potentielles des taux d'intérêt et l'amélioration des niveaux de stock chez les concessionnaires comme des indicateurs positifs.

Art's Way Manufacturing (ARTW) berichtet über die finanziellen Ergebnisse des Q1 2025, die eine gemischte Leistung in den Segmenten zeigen. Der Gesamtumsatz fiel um 10,2 % auf 5,14 Millionen USD, doch das Unternehmen erzielte eine Verbesserung des Bruttogewinns um 3,4 % und eine Reduzierung der Betriebskosten um 19,4 % im Vergleich zum Q1 2024.

Das Segment Landwirtschaftliche Produkte sah sich Herausforderungen gegenüber, da die Verkäufe um 30,4 % auf 2,95 Millionen USD zurückgingen, hauptsächlich aufgrund hoher Zinssätze und niedriger Rohstoffpreise. Dennoch hält das Unternehmen stabile Bruttomargen durch Kostensenkungsmaßnahmen, die 2024 umgesetzt wurden.

Das Segment Modulare Gebäude zeigte ein starkes Wachstum, da die Verkäufe um 47,5 % auf 2,19 Millionen USD stiegen und der Nettogewinn um 262.000 USD auf 291.000 USD verbessert wurde. Dieses Segment profitiert von einem robusten Auftragsbestand und einer weiterhin starken Nachfrage.

Der gesamte Nettoverlust verringerte sich im Q1 2025 auf 56.000 USD (0,01 USD pro Aktie), was eine signifikante Verbesserung gegenüber dem Verlust von 368.000 USD im Q1 2024 darstellt. Das Management bleibt optimistisch trotz der Unsicherheiten auf dem Markt und nennt mögliche Zinssenkungen sowie verbesserte Lagerbestände bei den Händlern als positive Indikatoren.

- Modular Buildings segment sales up 47.5% to $2.19M with strong backlog

- Overall gross profit improved 3.4% despite revenue decline

- Operating expenses reduced by 19.4%

- Net loss significantly improved to $56,000 from $424,000 year-over-year

- Agricultural segment maintained stable gross margins despite sales decline

- Overall sales declined 10.2% to $5.14M

- Agricultural Products segment sales dropped 30.4%

- Continued impact of high interest rates and low commodity prices on demand

- Expected cost increases due to steel tariffs

- Company remains in loss-making position with -$56,000 net income

Insights

Art's Way Manufacturing's Q1 2025 results demonstrate operational resilience amid agricultural sector headwinds. Despite a

The tale of two segments is particularly telling. The Agricultural Products division continues struggling with

Management's commentary about agricultural destocking nearing completion and potential interest rate cuts points to cautious optimism. The company appears to have right-sized operations to maintain profitability at lower revenue levels, which should position it well if agricultural markets recover as anticipated. The near break-even results despite significant agricultural sector stress demonstrate that their diversification strategy and cost management approaches are working effectively, providing significant operational leverage for when conditions improve.

ARMSTRONG, IA / ACCESS Newswire / April 9, 2025 / Art's Way Manufacturing Co., Inc. (Nasdaq:ARTW) (the "Company"), a diversified manufacturer and distributor of equipment serving agricultural and research needs, announces its financial results for the first quarter of fiscal 2025.

President, CEO and Chairman Marc McConnell reports, "We are pleased to finish the first quarter with meaningful operational and profitability improvements despite challenging conditions that persist. While headwinds continue to affect overall demand in the ag equipment space, we see strength in product categories that are benefitting from favorable beef and dairy prices. In our modular buildings segment, the momentum continues, and we are very pleased with both our operational performance and the strong demand we are seeing. In both segments we are keeping a close eye on the impact of tariffs on both our costs and demand profile. Amid quite a lot of uncertainty we do remain optimistic for how we will perform the balance of the year."

Consolidated - continuing operations

Sales of

$5,141,000 for Q1 2025,10.2% decline from Q1 2024.Gross profit improvement of

3.4% compared to Q1 2024.Operating expenses reduced by

19.4% from Q1 2024.Net loss of

$56,000 for Q1 2025,$368,000 improvement from Q1 2024

Agricultural Products

Sales of

$2,948,000 for Q1 2025, a30.4% decline from Q1 2024.Gross profit declined

0.2% from Q1 2024.Operating expenses reduced by

25.6% from Q1 2024.Net loss of

$346,000 , improvement of$107,000 from Q1 2024.

After a period of heightened demand in fiscal 2023, we started to see a decline in demand for our agricultural products in Q1 2024 due to rising interest rates, declining commodity prices and decreases in expected net farm incomes as high as

Modular Buildings

Sales of

$2,193,000 for Q1 2025, up47.5% from Q1 2025.Gross profit improvement of

10% compared to Q1 2024.Operating expenses increased by

14.3% from Q1 2024.Net income of

$291,000 , improved by$262,000 from Q1 2024.

A strong demand driven backlog at the end of fiscal 2024 compared to a limited backlog at the end of fiscal 2023 drove our increase in sales for Q1 of fiscal 2025. We continued to see strong demand for our buildings in the first fiscal quarter of 2025, and we intend to focus on moving projects currently under contract in the engineering phase to signed construction contracts in Q2 of fiscal 2025 to continue our strong run from the past two fiscal years. In Q1 of fiscal 2025, we brought on a Director of Business Development and Sales who is transitioning to replace our current President and Director of Sales of this segment. We expect the overlap in these positions in fiscal 2025 will provide additional sales opportunities for us in fiscal 2025. We also expect to utilize our outgoing President and Director of Sales as a consultant moving forward to improve sales and maintain customer relationships.

Income (Loss) per Share: Loss per basic and diluted share for the first quarter of fiscal 2025 was

Art's-Way Manufacturing Co., Inc.

Art's Way Manufacturing is a small, publicly traded company that specializes in equipment manufacturing. For over 65 years, it has been committed to designing and building high-quality machinery for all operations. It has approximately 100 employees across two branch locations: Art's Way Manufacturing in Armstrong, Iowa and Art's Way Scientific in Monona, Iowa. Art's Way manure spreaders, forage boxes, high dump carts, bale processors, graders, land planes, sugar beet harvesters and grinder mixers are designed to optimize production, increase efficiency and meet the growing demands of customers. Art's Way Manufacturing has two reporting segments: Agricultural Products and Modular Buildings.

For more information, contact: Marc McConnell, President, Chief Executive Officer and Chairman

712-208-8467

marc.mcconnell@artsway.com

Or visit the Company's website at www.artsway.com/

Cautionary Statements

This release includes "forward-looking statements" within the meaning of the federal securities laws. Statements made in this release that are not strictly statements of historical facts, including the Company's expectations regarding: (i) the Company's business position; (ii) demand and potential growth within the Company's business segments; (iii) future results, including but not limited to, revenue and margin expectations, expectations with respect to the impact of price increases, and expectations with respect to backlog and product mix; (iv) the Company's ability to increase production with capital investments and other activities, (v) future agricultural sales and plans to enter into building contracts; (vi) cash flows and plans to fund strategic initiatives and pay down debt; and (vii) the benefits of the Company's business model and strategy, are forward-looking statements. Statements of anticipated future results are based on current expectations and are subject to a number of risks and uncertainties, including, but not limited to: customer demand for the Company's products; credit-worthiness of the Company's customers; the Company's ability to operate at lower expense levels; the Company's ability to complete projects in a timely and efficient manner in accordance with customer specifications; the Company's ability to renew or obtain financing on reasonable terms; the Company's ability to repay current debt, continue to meet debt obligations and comply with financial covenants; inflation and tariffs and their effect on the Company's supply chain and demand for its products, domestic and international economic conditions; the Company's ability to attract and maintain an adequate workforce in a competitive labor market; factors affecting the strength of the agricultural sector; the cost of raw materials; unexpected changes to performance by any of the Company's operating segments; and other factors detailed from time to time in the Company's Securities and Exchange Commission filings. Actual results may differ markedly from management's expectations. Readers are cautioned not to place undue reliance upon any such forward-looking statements. The Company does not intend to update forward-looking statements other than as required by law.

SOURCE: Art's-Way Manufacturing Co.

View the original press release on ACCESS Newswire