Art's Way Announces Fiscal 2024 Results, Led By Strong Year From Modular Building Segment And Improved Liquidity Despite Difficult AG Conditions

Art's-Way Manufacturing (NASDAQ:ARTW) has reported mixed financial results for fiscal 2024. The Agricultural Products segment saw a 34.7% decrease in net sales to $14.66M, driven by below-average commodity prices and decreased demand. However, the Modular Buildings segment showed strong performance with a 25.9% increase in net sales to $9.84M, particularly in research markets.

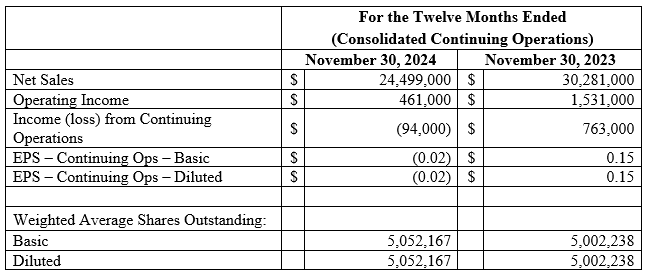

The company reported consolidated operating income from continuing operations of $461,000, down from $1.53M in 2023. The Agricultural Products segment posted an operating loss of $1.51M, while Modular Buildings achieved operating income of $1.97M. Overall consolidated net income was $307,000, slightly up from $267,000 in 2023.

Current backlog stands at $3.49M for Agricultural Products and $2.39M for Modular Buildings as of February 4, 2025. The company completed the sale of its discontinued Tools segment real estate for $1.8M in October 2024. Management expects improved profitability in 2025, citing positive indicators in dairy and livestock markets and sustained momentum in the Modular Buildings segment.

Art's-Way Manufacturing (NASDAQ:ARTW) ha riportato risultati finanziari misti per l'esercizio fiscale 2024. Il segmento Prodotti Agricoli ha registrato una diminuzione del 34,7% delle vendite nette, scendendo a $14,66M, a causa di prezzi delle materie prime inferiori alla media e di una diminuita domanda. Tuttavia, il segmento Edifici Modulari ha mostrato una performance forte con un aumento del 25,9% delle vendite nette, arrivando a $9,84M, in particolare nei mercati della ricerca.

La società ha riportato un reddito operativo consolidato dalle operazioni continuative di $461.000, in calo rispetto a $1,53M nel 2023. Il segmento Prodotti Agricoli ha registrato una perdita operativa di $1,51M, mentre gli Edifici Modulari hanno raggiunto un reddito operativo di $1,97M. L'utile netto consolidato totale è stato di $307.000, leggermente superiore rispetto ai $267.000 del 2023.

Il portafoglio attuale è di $3,49M per Prodotti Agricoli e $2,39M per Edifici Modulari a partire dal 4 febbraio 2025. La società ha completato la vendita del suo immobile del segmento Utensili dismesso per $1,8M nell'ottobre 2024. La direzione si aspetta un miglioramento della redditività nel 2025, citando indicatori positivi nei mercati lattiero-caseari e dei bestiami e una continua spinta nel segmento Edifici Modulari.

Art's-Way Manufacturing (NASDAQ:ARTW) ha informado resultados financieros mixtos para el año fiscal 2024. El segmento de Productos Agrícolas experimentó una disminución del 34,7% en las ventas netas, alcanzando los $14,66M, impulsada por precios de productos básicos inferiores a la media y una demanda reducida. Sin embargo, el segmento de Edificios Modulares mostró un buen rendimiento con un incremento del 25,9% en las ventas netas, llegando a $9,84M, especialmente en mercados de investigación.

La empresa reportó un ingreso operativo consolidado de las operaciones continuas de $461.000, en comparación con $1,53M en 2023. El segmento de Productos Agrícolas registró una pérdida operativa de $1,51M, mientras que Edificios Modulares logró un ingreso operativo de $1,97M. El ingreso neto consolidado total fue de $307.000, ligeramente superior a los $267.000 de 2023.

El backlog actual es de $3,49M para Productos Agrícolas y $2,39M para Edificios Modulares a partir del 4 de febrero de 2025. La empresa completó la venta de su propiedad del segmento de Herramientas descontinuado por $1,8M en octubre de 2024. La dirección espera una rentabilidad mejorada en 2025, citando indicadores positivos en los mercados lácteos y ganaderos y un impulso sostenido en el segmento de Edificios Modulares.

Art's-Way Manufacturing (NASDAQ:ARTW)는 2024 회계연도의 혼합된 재무 결과를 발표했습니다. 농업 제품 부문은 평균 이하의 원자재 가격과 감소한 수요로 인해 순매출이 34.7% 감소하여 1,466만 달러에 그쳤습니다. 그러나 모듈식 건물 부문은 연구 시장에서 특히 강한 성과를 나타내며 순매출이 25.9% 증가하여 984만 달러에 달했습니다.

회사는 계속 운영에서 통합된 운영 소득이 461,000 달러로, 2023년의 153만 달러에서 감소했다고 보고했습니다. 농업 제품 부문은 운영 손실이 151만 달러를 기록한 반면, 모듈식 건물은 197만 달러의 운영 소득을 올렸습니다. 전체 통합 순소득은 307,000 달러로, 2023년의 267,000 달러에서 약간 증가했습니다.

현재 잔고는 2025년 2월 4일 기준으로 농업 제품은 349만 달러, 모듈식 건물은 239만 달러입니다. 회사는 2024년 10월에 단종된 도구 부문의 부동산을 180만 달러에 매각했습니다. 경영진은 유제품 및 축산 시장에서 긍정적인 지표를 인용하며, 모듈식 건물 부문에서 지속적인 모멘텀을 바탕으로 2025년에는 개선된 수익성을 기대하고 있습니다.

Art's-Way Manufacturing (NASDAQ:ARTW) a rapporté des résultats financiers mitigés pour l'exercice 2024. Le segment des Produits Agricoles a connu une baisse de 34,7 % de ses ventes nettes, s'établissant à 14,66 millions de dollars, due à des prix des matières premières inférieurs à la moyenne et à une demande en déclin. En revanche, le segment des Bâtiments Modulaires a affiché une solide performance avec une augmentation de 25,9 % des ventes nettes à 9,84 millions de dollars, en particulier sur les marchés de la recherche.

L'entreprise a déclaré un revenu opérationnel consolidé provenant des opérations continues de 461 000 dollars, en baisse par rapport à 1,53 million de dollars en 2023. Le segment des Produits Agricoles a affiché une perte opérationnelle de 1,51 million de dollars, tandis que les Bâtiments Modulaires ont réalisé un revenu opérationnel de 1,97 million de dollars. Le revenu net consolidé total s'élevait à 307 000 dollars, légèrement supérieur aux 267 000 dollars de 2023.

Le carnet de commandes actuel est de 3,49 millions de dollars pour les Produits Agricoles et de 2,39 millions de dollars pour les Bâtiments Modulaires au 4 février 2025. L'entreprise a finalisé la vente de l'immobilier de son segment Outils retiré en octobre 2024 pour 1,8 million de dollars. La direction s'attend à une rentabilité améliorée en 2025, citant des indicateurs positifs sur les marchés laitiers et de l'élevage ainsi qu'un élan soutenu dans le segment des Bâtiments Modulaires.

Art's-Way Manufacturing (NASDAQ:ARTW) hat gemischte finanzielle Ergebnisse für das Geschäftsjahr 2024 gemeldet. Der Agrarprodukte-Sektor verzeichnete einen Rückgang der Nettoumsätze um 34,7% auf 14,66 Millionen USD, beeinflusst von unterdurchschnittlichen Rohstoffpreisen und sinkender Nachfrage. Der Modular-Bau-Segment hingegen zeigte eine starke Leistung mit einem Anstieg der Nettoumsätze um 25,9% auf 9,84 Millionen USD, insbesondere auf den Forschungsmarkt.

Das Unternehmen berichtete von einem konsolidierten Betriebsergebnis aus fortgeführten Geschäften in Höhe von 461.000 USD, ein Rückgang von 1,53 Millionen USD im Jahr 2023. Der Agrarprodukte-Sektor wies einen operativen Verlust von 1,51 Millionen USD auf, während die Modular-Bauten ein Betriebsergebnis von 1,97 Millionen USD erzielten. Der konsolidierte Nettogewinn belief sich auf 307.000 USD, was einen leichten Anstieg gegenüber 267.000 USD im Jahr 2023 bedeutete.

Der aktuelle Auftragsbestand beträgt 3,49 Millionen USD für Agrarprodukte und 2,39 Millionen USD für Modular-Bauten zum 4. Februar 2025. Das Unternehmen hat den Verkauf seiner stillgelegten Werkzeuge-Segmentimmobilie im Oktober 2024 für 1,8 Millionen USD abgeschlossen. Die Geschäftsführung erwartet eine verbesserte Rentabilität im Jahr 2025 und verweist auf positive Indikatoren auf den Milch- und Viehmärkten sowie auf die anhaltende Dynamik im Modular-Bau-Segment.

- None.

- None.

Insights

Art's Way's fiscal 2024 performance demonstrates the strategic value of its diversification strategy amid challenging agricultural market conditions. The Agricultural Products segment saw revenue decline

The company's focus on debt reduction has yielded significant results, reaching historical low debt levels. This strategic achievement positions Art's Way favorably in the current high-interest-rate environment, potentially reducing interest expenses and improving future cash flows. The successful divestiture of the Tools segment, generating

Looking ahead, several indicators suggest potential improvement in fiscal 2025:

- Early signs of recovery in dairy and livestock markets could drive demand for agricultural products

- Strong project pipeline in the Modular Buildings segment, despite lower backlog figures

- Operational efficiency improvements and cost reduction initiatives in the Agricultural Products segment

- Reduced interest expense from lower debt levels should positively impact bottom-line performance

While current backlog figures show some weakness (

ARMSTRONG, IA / ACCESS Newswire / February 11, 2025 / Art's-Way Manufacturing Co., Inc. (Nasdaq:ARTW) (the "Company"), a diversified, international manufacturer and distributor of equipment serving agricultural and research needs, announces its financial results for fiscal 2024.

Agricultural Products: Our Agricultural Products segment's net sales for the 2024 fiscal year were

Modular Buildings: Our Modular Buildings segment's net sales for the 2024 fiscal year were

Discontinued Operations: On June 7, 2023 we announced we would be discontinuing our Tools segment with the last day of normal operations occurring on July 14, 2023. Just over a year later, on October 21, 2024, we completed the sale of the remaining real estate associated with our Tools segment for

Operating income (continuing operations): Our consolidated operating income from continuing operations for the 2024 fiscal year was

Net income (loss) per share (continuing operations): Loss per basic and diluted share from continuing operations for the 2024 fiscal year was

Consolidated net income (continuing and discontinued operations): Consolidated net income for the 2024 fiscal year was

Backlog: The Company's backlog of orders varies on a daily basis. The Company's Agricultural Products segment had a net backlog of approximately

Marc McConnell, Chairman, President and CEO of Art's Way states, "Fiscal 2024 was a year of considerable challenges and transition at Art's Way, yet one that demonstrated the benefits of our diversification strategy. Amid a significant down cycle in the farm equipment industry, we experienced a reduction in demand along with our industry peers. Meanwhile we benefited greatly from the tremendous growth and operational performance in our Modular Buildings segment. We responded to challenges in our Agricultural Products segment by focusing closely on cost reductions, reducing debt, and improving cashflow while maintaining our emphasis on quality, innovation, and customer experience. We are confident these measures position the company for improving markets in the future and are pleased to report that our current debt level represents a historical low.

Going forward we have meaningful reason for optimism in both business segments for 2025 and beyond. There are positive indications in the dairy and livestock markets that could drive demand for our products serving those markets. We also carry positive momentum into the new year in our Modular Buildings segment that we believe we can sustain. On a consolidated basis we anticipate that solid demand, reduced overhead expenses, improved liquidity and reduced interest expense from debt reduction will result in improved profitability and cashflow in fiscal 2025."

Art's-Way Manufacturing Co., Inc.

Art's Way Manufacturing is a small, publicly traded company that specializes in equipment manufacturing. For over 65 years, it has been committed to designing and building high-quality machinery for all operations. It has approximately 130 employees across two branch locations: Art's Way Manufacturing in Armstrong, Iowa and Art's Way Scientific in Monona, Iowa. Art's Way manure spreaders, forage boxes, high dump carts, bale processors, graders, land planes, sugar beet harvesters and grinder mixers are designed to optimize production, increase efficiency and meet the growing demands of customers. Art's Way Manufacturing has two reporting segments: Agricultural Products and Modular Buildings.

For more information, contact: Marc McConnell, Chairman, President and Chief Executive Officer.

712-208-8467

investorrelations@artsway-mfg.com

Or visit our website at www.artsway.com/

Cautionary Note Regarding Forward-Looking Statements

This release includes "forward-looking statements" within the meaning of the federal securities laws. Statements made in this release that are not strictly statements of historical facts are forwarding-looking statements. In some cases, forward-looking statements may be identified by the use of words such as "may," "should," "anticipate," "believe," "expect," "plan," "future," "intend," "could," "estimate," "predict," "hope," "potential," "continue," "foresee," or the negative of these terms or other similar expressions. Forward-looking statements in this release generally relate to our expectations regarding: (i) the Company's business position; (ii) potential growth in the Company's business segments and sales, including positive momentum in its Modular Buildings segment; (iii) future results, including but not limited to, expectations regarding demand, the impact of higher interest rates, inventory requirements, revenue and margins; (iv) the Company's beliefs about indications in the dairy and livestock markets and how such indications may affect future demand for the Company's products; (v) the Company's expectations regarding how cost reduction efforts may benefit future performance; (vi) the Company's beliefs regarding backlog, contracting projects, and completion of projects, including revenues resulting therefrom; and (vii) the benefits of the Company's business model and strategy. Statements of anticipated future results are based on current expectations and are subject to a number of risks and uncertainties, including, but not limited to: customer demand for the Company's products; credit-worthiness of its customers; its ability to operate at lower expense levels; its ability to complete projects in a timely and efficient manner in accordance with customer specifications; its ability to renew or obtain financing on reasonable terms; its ability to repay current debt, continue to meet debt obligations and comply with financial covenants; inflation and its effect on our supply chain and demand for its products, domestic and international economic conditions; its ability to attract and maintain an adequate workforce in a competitive labor market; factors affecting the strength of the agricultural sector; the cost of raw materials; unexpected changes to performance by its operating segments; obstacles related to liquidation of product lines and controlling costs; and other factors detailed from time to time in the Company's Securities and Exchange Commission filings. Actual results may differ markedly from management's expectations. The Company cautions readers not to place undue reliance upon any such forward-looking statements. The Company does not intend to update forward-looking statements other than as required by law.

SOURCE: Art's-Way Manufacturing Co.

View the original press release on ACCESS Newswire