Arcturus Therapeutics Announces Second Quarter 2022 Financial Update and Pipeline Progress

Arcturus Therapeutics (ARCT) announced encouraging data from its ARCT-154 booster study, revealing a 44-fold increase in neutralizing antibodies against Omicron BA.1 and a 39-fold increase against BA.2 at Day 91 post-vaccination. The company also shared new stability data for its lyophilized vaccine platform, showing room temperature stability for 4 days and refrigerator stability for 6 months. The European Commission granted Orphan Medicinal Product Designation to ARCT-810 for OTC deficiency, promising support for its development. Financial results show revenues of $27.1 million, a significant increase from previous years.

- 44-fold and 39-fold increases in neutralizing antibodies against Omicron BA.1 and BA.2, respectively, at Day 91 after booster.

- New lyophilized vaccine data shows stability for room temperature storage (4 days) and refrigerator storage (6 months).

- European Commission's Orphan Medicinal Product Designation for ARCT-810 supports future development and market exclusivity.

- Revenue increased to $27.1 million for Q2 2022 compared to $2 million in Q2 2021.

- Net loss of approximately $21.6 million for Q2 2022, although down from $54.6 million in Q2 2021.

- Cash balance decreased to $283.5 million as of June 30, 2022, down from $370.5 million at year-end 2021.

New ARCT-154 clinical booster data demonstrate promising durability; 44- and 39-fold increases in neutralizing antibody response against Omicron BA.1 and BA.2 at Day 91

New cold chain data for Arcturus’ lyophilized vaccine platform shows favorable stability, shipping, and storage advantages

Investor conference call at

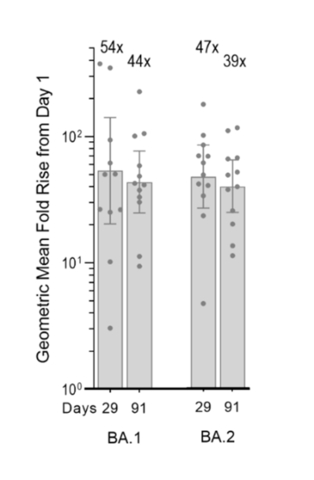

Figure 1: Exploratory pseudovirus microneutralization (MNT) assay results (left: BA.1, right: BA.2), showing GMFR levels of neutralizing antibody responses over Day 1 (baseline levels prior to boosting with ARCT-154) calculated with virus neutralization concentrations (with

“Arcturus continues to demonstrate increasing value of our next generation mRNA vaccine and therapeutic platforms,” said

Recent Corporate Highlights

-

Arcturus shared additional data from the ARCT-154 arm of its ongoing Phase 1/2 study in the

U.S. ,Singapore , andSouth Africa evaluating a single 5-mcg booster dose of ARCT-154 given at least five months following two primary doses of Comirnaty®. In exploratory microneutralization titer (MNT) assays, ARCT-154 demonstrates a robust neutralizing antibody response against the Omicron BA.1 and BA.2 variants up to 91 days after administration. Against BA.1 the Geometric Mean Fold Rise (GMFR) was 44-fold at Day 91 compared to 54-fold at Day 29. Against BA.2 the GMFR was 39-fold at Day 91 compared to 47-fold at Day 29 (Figure 1). Six-month data for Omicron variants, including BA.5, is being collected and will be shared this quarter. -

New stability data supports the advantages of using a lyophilized vaccine powder to mitigate the cold chain challenges associated with frozen liquid mRNA vaccines. Our lyophilized COVID vaccine powder demonstrated room temperature stability (25°C RT;

60% RH) for 4 days, refrigerator stability (2-8°C) for 6 months, and a predicted long-term stability (-25°C to -15°C) for 18 months. Importantly, the lyophilized powder was not impacted by multiple temperature cycling stress (-20°C to 2-8°C or RT) enabling global shipping logistics and supply of a stable usable solid COVID vaccine product at 2-8°C. -

ARCT-810 Orphan Medicinal Product Designation: Arcturus was notified by the

European Commission that ARCT-810 has been designated as an Orphan Medicinal Product for the treatment of OTC deficiency. The designation provides significant incentives to promote the development of the drug including protocol assistance, access to the centralized authorization procedure, fee reductions, and research grants, as well as 10 years of market exclusivity. - ARCT-810, the Company’s mRNA therapeutic candidate for OTC deficiency will be evaluated in a randomized, double-blind, placebo-controlled, nested single and multiple ascending dose Phase 2 study in 24 adolescents and adults with OTC deficiency. Participating sites have identified several dozen patients in pre-screening, with the goal of obtaining interim proof-of-concept data by year end.

- Due to additional non-clinical data requirements, ARCT-032 (the Company’s inhaled mRNA therapeutic candidate for cystic fibrosis) is now expected to file for a Clinical Trial Application in Q4 2022.

-

The Vinbiocare manufacturing facility in

Hanoi, Vietnam , is anticipated to achieve commercial scale production capability in Q4 2022. -

The Vietnam Ministry of Health (MOH) is undergoing a significant reorganization resulting in a delay of the ARCT-154 Emergency Use Authorization (EUA) for the primary series. During the reorganization, the MOH communicated that the Clinical section review is complete and adequate. The MOH provided comments to the Chemistry, Manufacturing, and Controls (CMC) section, requesting three manufacturing runs to support full Market Authorization. ARCT-154 is now expected to receive EUA in Q4 2022, with full Marketing Authorization anticipated in early 2023 if booster studies meet noninferior immunogenicity and safety objectives. - Arcturus expects a registrational booster study for ARCT-154 to begin in Q4 2022. Based on recent health authority guidance, the Company is considering an updated design consisting of two trials to support global registration of ARCT-154 as a booster.

Financial Results for Second Quarter Ended

Revenues in conjunction with strategic alliances and collaborations: Arcturus’ primary sources of revenues were from consulting and related technology transfer fees, reservation fees, license fees and collaborative payments received from research and development arrangements with pharmaceutical and biotechnology partners. For the three months ended

Operating expenses: Total operating expenses for the three months ended

Research and development expenses: Research and development expenses for the three months ended

Net Loss: For the three months ended

Cash Position: The Company’s cash balance totaled

Earnings Call:

Domestic: 1-800-263-0877

International: 1-323-794-2094

Conference ID: 8017918

Webcast: Link

About

Founded in 2013 and based in

Forward Looking Statements

This press release contains forward-looking statements that involve substantial risks and uncertainties for purposes of the safe harbor provided by the Private Securities Litigation Reform Act of 1995. Any statements, other than statements of historical fact included in this press release, are forward-looking statements, including those regarding strategy, future operations, the expectations for or likelihood of success of any collaborations, the promise of the company’s platform technologies for multiple types of nucleic acid medicines, the likelihood of success (including safety and efficacy) of the Company’s pipeline (including ARCT-154, ARCT-810, ARCT-032 and a STARR mRNA candidate for influenza), the likelihood that any independent verification by Arcturus, or any regulatory body’s assessment of data will be consistent with the information shared by Vinbiocare from the ARCT-154 study in

Trademark Acknowledgements

The Arcturus logo and other trademarks of Arcturus appearing in this announcement, including LUNAR® and STARR™, are the property of Arcturus. All other trademarks, services marks and trade names in this announcement are the property of their respective owners.

|

||||||||

CONDENSED CONSOLIDATED BALANCE SHEETS |

||||||||

(in thousands, except par value information) |

||||||||

|

|

|

|

|

||||

|

|

(unaudited) |

|

|

||||

Assets |

|

|

|

|

||||

Current assets: |

|

|

|

|

||||

Cash and cash equivalents |

|

$ |

283,491 |

|

|

$ |

370,492 |

|

Accounts receivable |

|

|

2,247 |

|

|

|

3,367 |

|

Prepaid expenses and other current assets |

|

|

5,767 |

|

|

|

5,102 |

|

Total current assets |

|

|

291,505 |

|

|

|

378,961 |

|

Property and equipment, net |

|

|

8,951 |

|

|

|

5,643 |

|

Operating lease right-of-use asset, net |

|

|

34,480 |

|

|

|

5,618 |

|

Equity-method investment |

|

|

— |

|

|

|

515 |

|

Non-current restricted cash |

|

|

2,078 |

|

|

|

2,077 |

|

Total assets |

|

$ |

337,014 |

|

|

$ |

392,814 |

|

Liabilities and stockholders’ equity |

|

|

|

|

||||

Current liabilities: |

|

|

|

|

||||

Accounts payable |

|

$ |

5,762 |

|

|

$ |

10,058 |

|

Accrued liabilities |

|

|

33,614 |

|

|

|

23,523 |

|

Current portion of long-term debt |

|

|

27,018 |

|

|

|

22,474 |

|

Deferred revenue |

|

|

26,349 |

|

|

|

43,482 |

|

Total current liabilities |

|

|

92,743 |

|

|

|

99,537 |

|

Deferred revenue, net of current portion |

|

|

5,590 |

|

|

|

19,931 |

|

Long-term debt, net of current portion |

|

|

35,761 |

|

|

|

40,633 |

|

Operating lease liability, net of current portion |

|

|

32,203 |

|

|

|

4,502 |

|

Total liabilities |

|

$ |

166,297 |

|

|

$ |

164,603 |

|

Stockholders’ equity |

|

|

|

|

||||

Common stock: |

|

|

26 |

|

|

|

26 |

|

Additional paid-in capital |

|

|

590,913 |

|

|

|

575,675 |

|

Accumulated deficit |

|

|

(420,222 |

) |

|

|

(347,490 |

) |

Total stockholders’ equity |

|

|

170,717 |

|

|

|

228,211 |

|

Total liabilities and stockholders’ equity |

|

$ |

337,014 |

|

|

$ |

392,814 |

|

|

||||||||||||

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS |

||||||||||||

(unaudited) |

||||||||||||

(in thousands except per share data) |

||||||||||||

|

|

Three Months Ended |

||||||||||

|

|

|

|

|

||||||||

|

|

2022 |

|

2021 |

|

2022 |

||||||

Revenue |

|

$ |

27,093 |

|

|

$ |

2,001 |

|

|

$ |

5,244 |

|

Operating expenses: |

|

|

|

|

|

|

||||||

Research and development, net |

|

|

38,189 |

|

|

|

45,679 |

|

|

|

44,893 |

|

General and administrative |

|

|

10,993 |

|

|

|

10,042 |

|

|

|

10,730 |

|

Total operating expenses |

|

|

49,182 |

|

|

|

55,721 |

|

|

|

55,623 |

|

Loss from operations |

|

|

(22,089 |

) |

|

|

(53,720 |

) |

|

|

(50,379 |

) |

Loss from equity-method investment |

|

|

(131 |

) |

|

|

(328 |

) |

|

|

(384 |

) |

Gain (loss) from foreign currency |

|

|

1,217 |

|

|

|

(13 |

) |

|

|

158 |

|

Finance expense, net |

|

|

(560 |

) |

|

|

(520 |

) |

|

|

(564 |

) |

Net loss |

|

$ |

(21,563 |

) |

|

$ |

(54,581 |

) |

|

$ |

(51,169 |

) |

Net loss per share, basic and diluted |

|

$ |

(0.82 |

) |

|

$ |

(2.07 |

) |

|

$ |

(1.94 |

) |

Weighted-average shares outstanding, basic and diluted |

|

|

26,425 |

|

|

|

26,323 |

|

|

|

26,376 |

|

Comprehensive loss: |

|

|

|

|

|

|

||||||

Net loss |

|

$ |

(21,563 |

) |

|

$ |

(54,581 |

) |

|

$ |

(51,169 |

) |

Comprehensive loss |

|

$ |

(21,563 |

) |

|

$ |

(54,581 |

) |

|

$ |

(51,169 |

) |

View source version on businesswire.com: https://www.businesswire.com/news/home/20220809006007/en/

IR and Media Contacts

IR@arcturusrx.com

Kendall Investor Relations

(617) 914-0008

ctanzi@kendallir.com

Source:

FAQ

What are the results of the recent ARCT-154 booster study?

What stability advantages does Arcturus' lyophilized vaccine offer?

What designation did the European Commission grant to ARCT-810?

What were Arcturus Therapeutics' revenues in the second quarter of 2022?