Adjust: Mobile App Industry Set For Transformative Year, Riding Wave of AI And Privacy-First Technologies

Adjust’s Mobile App Trends 2025 report offers marketers a global performance benchmark and blueprint amid app economy’s continued return to growth

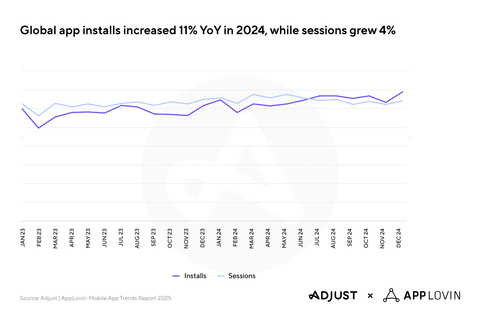

Global mobile app installs increased

“In 2025, the mobile landscape will be defined by the extensive use of AI to create high-quality content, with AI-driven automation of production processes significantly enhancing consumer mobile applications through personalized user experiences,” said Andrey Kazakov, CEO of Adjust. “The trend of products built cross-platform will continue unabated, with mobile web playing a valuable role in growth strategies by enabling seamless transitions between mobile web and native apps.”

Privacy-first tech paying off as consumer trust climbs

While data privacy regulations remain a significant barrier globally, resistance to change is seen to be slowing down and adoption of privacy-first technologies is increasing. AI and machine learning-powered advanced analytics and real-time contextual insights are speeding up decision-making and supercharging efficiency.

Meanwhile, App Tracking Transparency (ATT) opt-in rates are continuing to climb steadily – from an average of

Charting upward app growth across regions and verticals

Key takeaways include:

-

E-commerce is soaring across regions with installs growing

17% YoY in 2024, and sessions up13% . MENA stood out, with installs increasing55% and sessions by21% YoY. LATAM followed with27% and21% growth in installs and sessions, respectively, while APAC’s installs were strong (+26% ) but sessions flat.North America faced the steepest decline, where installs and sessions decreased by39% and29% , respectively. -

Gaming’s bouncing back as hyper casual games lead the charge. Gaming app installs grew by

4% YoY in 2024, even as sessions declined0.6% , with hyper casual gaming app installs making up27% of total installs, and puzzle and hybrid casual games each contributing11% . -

Banking and crypto apps are seeing impressive growth, with installs of banking apps up

33% and sessions increasing19% YoY. Crypto apps saw a significant45% increase in sessions. This contributed to a27% increase in total finance app installs in 2024, with sessions increasing by24% .

The report also explores the rise of ultracasual games; AI-powered hyperpersonalization from ad creatives to gameplay; the expansion of advertising channels in e-commerce; and crypto’s resurgence. These dynamics highlight the critical need for marketers to create seamless, omnichannel experiences that meet users wherever they are.

For additional findings and best practices, download the full report here.

About Adjust

Adjust, an AppLovin (NASDAQ: APP) company, is trusted by marketers around the world to measure and grow their apps across platforms, from mobile to CTV and beyond. Adjust works with companies at every stage of the app marketing journey, from fast-growing digital brands to brick-and-mortar companies launching their first apps. Adjust's powerful measurement and analytics provide visibility, insights and essential tools that drive better results.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250205267175/en/

Media Contact

Adjust

Joshua Grandy

pr@adjust.com

Source: Adjust