Gaming App Growth Rebounds, Fueled By AI, Hybrid Monetization And New UA Strategies

Adjust's Gaming App Insights 2025 report reveals a resilient gaming industry recovery after 2023, with global gaming app installs rising 4% YoY in 2024, despite a slight -0.6% dip in sessions. MENA (+10%) and LATAM (+8%) led install growth, while North America saw declines in both installs (-11%) and sessions (-14%).

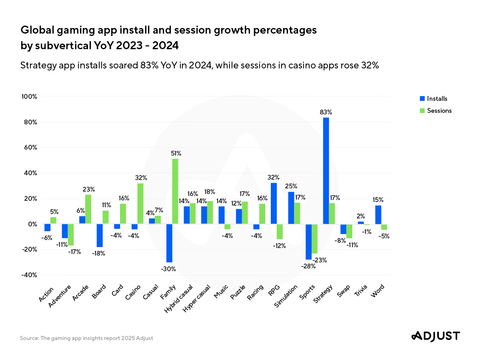

The report highlights significant trends across gaming subverticals:

- Hyper casual games maintained highest install share (27%) but only 11% of sessions

- Strategy apps showed highest YoY install growth (83%)

- Action games averaged 45.15-minute sessions

- RPG saw 32% install growth but 12% session decline

Gaming ATT opt-in rates increased to 37.9% in Q1 2025, with arcade games seeing the largest jump to 59.3%. Key industry shifts include AI-driven personalization, hybrid monetization strategies, cross-platform play expansion, and emerging user acquisition channels like CTV and influencer marketing.

Il report di Adjust sulle App di Gioco 2025 rivela una ripresa resiliente dell'industria dei giochi dopo il 2023, con un aumento globale delle installazioni di app di gioco del 4% su base annua nel 2024, nonostante un leggero calo dello -0,6% nelle sessioni. MENA (+10%) e LATAM (+8%) hanno guidato la crescita delle installazioni, mentre il Nord America ha registrato cali sia nelle installazioni (-11%) che nelle sessioni (-14%).

Il report evidenzia tendenze significative nei sotto-settori del gioco:

- I giochi hyper casual hanno mantenuto la quota di installazioni più alta (27%) ma solo l'11% delle sessioni

- Le app strategiche hanno mostrato la crescita di installazioni più alta su base annua (83%)

- I giochi d'azione hanno avuto una media di sessioni di 45,15 minuti

- Gli RPG hanno visto una crescita delle installazioni del 32% ma un calo delle sessioni del 12%

I tassi di opt-in per il Gaming ATT sono aumentati al 37,9% nel primo trimestre del 2025, con i giochi arcade che hanno registrato il salto più grande al 59,3%. I principali cambiamenti nel settore includono la personalizzazione guidata dall'IA, strategie di monetizzazione ibride, espansione del gioco cross-platform e canali emergenti per l'acquisizione degli utenti come CTV e marketing degli influencer.

El informe de Adjust sobre Aplicaciones de Juegos 2025 revela una recuperación resiliente de la industria de los juegos tras el 2023, con un aumento global del 4% en las instalaciones de aplicaciones de juegos en 2024, a pesar de una ligera caída del -0.6% en las sesiones. MENA (+10%) y LATAM (+8%) lideraron el crecimiento de instalaciones, mientras que América del Norte vio disminuciones tanto en instalaciones (-11%) como en sesiones (-14%).

El informe destaca tendencias significativas en los subsectores de juegos:

- Los juegos hyper casual mantuvieron la mayor cuota de instalaciones (27%) pero solo el 11% de las sesiones

- Las aplicaciones de estrategia mostraron el mayor crecimiento de instalaciones interanual (83%)

- Los juegos de acción promediaron sesiones de 45.15 minutos

- Los RPG vieron un crecimiento del 32% en instalaciones pero una caída del 12% en sesiones

Las tasas de opt-in para Gaming ATT aumentaron al 37.9% en el primer trimestre de 2025, siendo los juegos arcade los que experimentaron el mayor salto al 59.3%. Los cambios clave en la industria incluyen la personalización impulsada por IA, estrategias de monetización híbridas, expansión del juego multiplataforma y canales emergentes de adquisición de usuarios como CTV y marketing de influencers.

Adjust의 2025 게임 앱 인사이트 보고서는 2023년 이후 게임 산업의 회복력을 보여주며, 2024년 전 세계 게임 앱 설치가 전년 대비 4% 증가했지만 세션 수는 -0.6% 감소했다고 전합니다. MENA (+10%) 및 LATAM (+8%)가 설치 성장률을 이끌었고, 북미는 설치(-11%)와 세션(-14%) 모두 감소했습니다.

보고서는 게임 하위 분야에서의 중요한 트렌드를 강조합니다:

- 하이퍼 캐주얼 게임은 설치 점유율이 가장 높았으나 (27%) 세션은 11%에 불과했습니다.

- 전략 앱은 전년 대비 설치 성장률이 가장 높았습니다 (83%).

- 액션 게임은 평균 45.15분의 세션을 기록했습니다.

- RPG는 32%의 설치 성장률을 보였지만 세션은 12% 감소했습니다.

Gaming ATT 옵트인 비율은 2025년 1분기 37.9%로 증가했으며, 아케이드 게임은 59.3%로 가장 큰 증가폭을 보였습니다. 주요 산업 변화로는 AI 기반 개인화, 하이브리드 수익화 전략, 크로스 플랫폼 플레이 확장 및 CTV, 인플루언서 마케팅과 같은 새로운 사용자 유치 채널이 포함됩니다.

Le rapport d'Adjust sur les Applications de Jeu 2025 révèle une reprise résiliente de l'industrie du jeu après 2023, avec une augmentation mondiale de 4% des installations d'applications de jeu en 2024, malgré une légère baisse de -0,6% des sessions. MENA (+10%) et LATAM (+8%) ont conduit la croissance des installations, tandis que l'Amérique du Nord a connu des baisses tant dans les installations (-11%) que dans les sessions (-14%).

Le rapport met en lumière des tendances significatives dans les sous-secteurs du jeu :

- Les jeux hyper casual ont maintenu la plus grande part d'installations (27%) mais seulement 11% des sessions

- Les applications de stratégie ont montré la plus forte croissance des installations d'une année sur l'autre (83%)

- Les jeux d'action ont eu une durée moyenne de session de 45,15 minutes

- Les RPG ont enregistré une croissance des installations de 32% mais une baisse des sessions de 12%

Les taux d'opt-in pour le Gaming ATT ont augmenté à 37,9% au premier trimestre 2025, les jeux d'arcade enregistrant la plus forte augmentation à 59,3%. Les principales évolutions du secteur incluent la personnalisation pilotée par l'IA, des stratégies de monétisation hybrides, l'expansion du jeu multiplateforme et des canaux d'acquisition d'utilisateurs émergents tels que CTV et le marketing d'influence.

Der Gaming App Insights 2025 Bericht von Adjust zeigt eine resiliente Erholung der Gaming-Industrie nach 2023, mit einem globalen Anstieg der Installationen von Gaming-Apps um 4% im Jahresvergleich im Jahr 2024, trotz eines leichten Rückgangs der Sitzungen um -0,6%. MENA (+10%) und LATAM (+8%) führten das Installationswachstum an, während Nordamerika sowohl bei den Installationen (-11%) als auch bei den Sitzungen (-14%) Rückgänge verzeichnete.

Der Bericht hebt bedeutende Trends in den Gaming-Subvertikalen hervor:

- Hyper-Casual-Spiele hielten den höchsten Installationsanteil (27%) aber nur 11% der Sitzungen

- Strategie-Apps zeigten das höchste jährliche Installationswachstum (83%)

- Action-Spiele hatten durchschnittlich 45,15 Minuten Sitzungsdauer

- RPGs verzeichneten ein Installationswachstum von 32%, aber einen Rückgang der Sitzungen um 12%

Die Opt-in-Raten für Gaming ATT stiegen im ersten Quartal 2025 auf 37,9%, wobei Arcade-Spiele den größten Anstieg auf 59,3% verzeichneten. Wichtige Veränderungen in der Branche umfassen KI-gesteuerte Personalisierung, hybride Monetarisierungsstrategien, die Erweiterung des plattformübergreifenden Spiels und aufkommende Kanäle zur Benutzerakquise wie CTV und Influencer-Marketing.

- Global gaming app installs increased 4% YoY in 2024

- Strategy apps showed strong 83% YoY install growth

- Casino (+32%) and arcade (+23%) apps demonstrated robust session growth

- Action games showed strong user engagement with 45.15-minute average sessions

- MENA and LATAM markets showed significant growth in both installs and sessions

- Overall sessions declined 0.6% YoY in 2024

- North American market declined significantly with -11% installs and -14% sessions

- RPG segment showing retention challenges with 12% session drop despite install growth

- Hyper casual games showing high churn rates with 27% installs but only 11% of sessions

- European market showed weakness with -1% installs and -6% sessions

Adjust Gaming App Insights 2025 report details data-backed growth opportunities for marketers amid shifting engagement trends and monetization strategies

While hyper casual, hybrid casual, puzzle and simulation games all continued to expand, RPG told a different story: Despite a

“After a period of market volatility, mobile gaming is back on a growth trajectory,” noted Tiahn Wetzler, Director of Content and Insights at Adjust. "As mobile-first adoption accelerates in regions like LATAM and MENA, game developers and marketers that prioritize long-term player relationships over short-term acquisition will reap the rewards.”

Emerging markets leading mobile gaming growth

Adjust found that MENA (+

Elsewhere, APAC posted mixed results: Installs grew

ATT opt-in rates seeing incremental growth globally

Gaming App Tracking Transparency (ATT) opt-in rates increased slightly in Q1 of 2025 to

Gaming subvertical install and session growth patterns

Adjust’s data shows hyper casual games retained the highest global installs share (

Notably, strategy apps had the highest YoY install growth at

Key overall shifts Adjust observes in the mobile gaming industry in 2025 include:

- AI-driven personalization enhancing player engagement: AI is revolutionizing in-game experiences and predictive retention strategies.

- Hybrid monetization on the rise: Developers are increasingly blending in-app purchases (IAP), ads, subscriptions and battle passes to diversify revenue streams.

- Cross-platform play expands: Seamless transitions between mobile, PC and console are increasing retention and lifetime value (LTV).

- New UA frontiers emerge: Connected TV (CTV), influencer marketing and alternative app stores are reshaping game discovery.

For additional findings and industry best practices, download the full report here.

About Adjust

Adjust, an AppLovin (NASDAQ: APP) company, is trusted by marketers around the world to measure and grow their apps across platforms, from mobile to CTV and beyond. Adjust works with companies at every stage of the app marketing journey, from fast-growing digital brands to brick-and-mortar companies launching their first apps. Adjust's powerful measurement and analytics provide visibility, insights and essential tools that drive better results.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250314915427/en/

Media Contact

Adjust

Joshua Grandy

pr@adjust.com

Source: Adjust