Adjust Finds 119% YoY Revenue Increase In Finance Apps Globally, Indicating Sustained Sector Growth Through 2024

New Finance app insights report shows renewed interest in crypto; details how tech advancements, increased user spending and engagement will drive industry growth

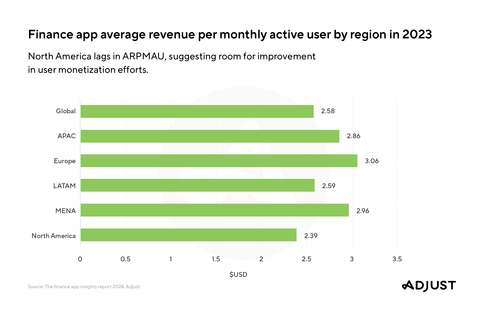

Finance app average revenue per monthly active user by region in 2023; Source: The finance app insights report 2024, Adjust |

“Despite the tumultuous economic conditions of recent years, the outlook for the remainder of 2024 and beyond is promising,” said Tiahn Wetzler, Director, Content & Insights at Adjust. “By leveraging next-generation measurement approaches, such as incrementality and media mix modeling, alongside traditional attribution, finance app marketers can unlock new avenues for growth. Emphasizing secure, user-friendly experiences with a focus on personalization will be crucial in retaining users – maximizing lifetime value and driving sustained success.”

The finance app insights report provides finance app marketers and developers with key insights, including:

-

Significant global finance app growth in 2024. Q1 installs were up

36% YoY and sessions were up by23% . -

Rise in mobile payments and banking illustrates shift towards digital-first financial solutions. Bank app installs surged

111% YoY in Q1 2024; payment app sessions increased27% YoY in 2023, with session lengths up by12% YoY in Q1, highlighting their essential role in daily transactions. -

The APAC region is primed for growth. While the median effective cost per install (eCPI) for finance apps was

$1.21 $0.63 -

App Tracking Transparency (ATT) opt-in rates for finance apps have continued to climb globally from

18% in Q1 2023 to25% in Q1 2024.

For additional findings and analysis, download the full report here.

About Adjust

Adjust, an AppLovin (NASDAQ: APP) company, is trusted by marketers around the world to measure and grow their apps across platforms, from mobile to CTV and beyond. Adjust works with companies at every stage of the app marketing journey, from fast-growing digital brands to brick-and-mortar companies launching their first apps. Adjust's powerful measurement and analytics provide visibility, insights and essential tools that drive better results.

SOURCE: Adjust

View source version on businesswire.com: https://www.businesswire.com/news/home/20240627094885/en/

Adjust

Joshua Grandy

pr@adjust.com

Source: AppLovin Corp.