HomeAdvisor Partners with Affirm to Bring Flexible Pay-Over-Time Financing Options to Homeowners

HomeAdvisor, a digital home services marketplace under ANGI Homeservices (NASDAQ: ANGI), has partnered with Affirm to introduce flexible payment options for customers. This initiative allows homeowners to finance projects using HomeAdvisor Pay, choosing terms from three to 36 months, with a $5,000 project example costing $452 monthly at 15% APR. Since its launch in April 2020, HomeAdvisor Pay has processed $1 million weekly. This partnership aims to enhance payment transparency and ease, addressing the financial stress of home improvement projects.

- Partnership with Affirm enhances payment flexibility for customers.

- HomeAdvisor Pay processes an average of $1 million weekly.

- Allows homeowners to finance projects easily, reducing financial stress.

- None.

Insights

Analyzing...

DENVER, Dec. 17, 2020 /PRNewswire/ -- HomeAdvisor, a leading digital home services marketplace and operating business of ANGI Homeservices (NASDAQ: ANGI), is partnering with Affirm, a flexible and transparent alternative to credit cards, to offer easy to understand flexible payment options for HomeAdvisor customers. HomeAdvisor is the first home services marketplace to offer Affirm's transparent pay-over-time options with no hidden fees to customers for hundreds of home projects.

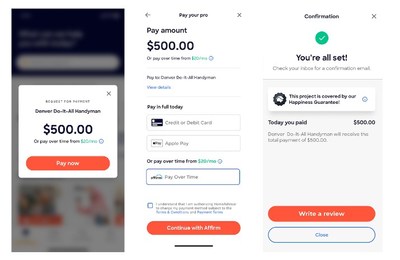

Now when homeowners pay for a project through HomeAdvisor Pay via the HomeAdvisor app, they will be able to select Affirm at checkout. With Affirm, consumers can check eligibility in seconds, and if approved, select from term lengths ranging from three to 36 months. For example, a

"Payment is a particularly stressful part of the home services experience, be it due to unexpected expenses or the lack of transparency around the cost of many home improvement projects," said Brandon Ridenour, Chief Executive Officer, ANGI Homeservices. "With the launch of our digital payment system and now the partnership with Affirm, we are making it fast and easy to book, finance and pay for any home improvement job, no matter the project type or size. Our homes are one of the largest investments we will make in our lives and require constant maintenance and work. With HomeAdvisor, every customer now has an opportunity to either maintain or upgrade their homes on their budget and their terms."

"People have spent more time in their homes this year than ever before, and many have been investing in making their living spaces more comfortable. This includes increased spending on everything from home repairs and improvement projects, to new furniture and appliances," said Silvija Martincevic, Chief Commercial Officer, Affirm. "We're thrilled to partner with HomeAdvisor to bring flexibility and transparency to the way people pay for home service projects. Now, homeowners can pay for these projects over time in simple, easy-to-understand payments without any concern of hidden or late fees."

HomeAdvisor customers will also be able to use Affirm at checkout for our instant pre-priced projects as well as any managed project.

The procurement of home services is quickly going digital as more consumers find and hire pros online. Over the last 12 months, consumers turned to our brands for over 28 million home projects. However, traditional payment methods, like cash or check, make up the majority of the ways that homeowners pay for home projects. According to HomeAdvisor Research's 2019 State of Home Spending Report, 60 percent of consumers still pay for their home service projects via traditional methods like cash or check and a poll from Bankrate found that

Since its initial rollout in April 2020 amid the beginning of the pandemic, HomeAdvisor's digital payment platform, HomeAdvisor Pay has facilitated tens of millions of dollars of total payments, processing on average

About HomeAdvisor

HomeAdvisor® is a digital marketplace evolving the way homeowners connect with service professionals to complete home projects. With HomeAdvisor's on-demand platform, homeowners can find and vet local, prescreened home service professionals; view average home project costs using True Cost Guide; and instantly book appointments online or through HomeAdvisor's award-winning mobile app, which is compatible with all iOS, Android and virtual assistants, including Amazon Echo. HomeAdvisor is based in Denver, Colo., and is an operating business of ANGI Homeservices, Inc. (NASDAQ: ANGI).

About Affirm

Affirm is purpose-built from the ground up to provide consumers and merchants with honest financial products and services that improve their lives. We are revolutionizing the financial industry to be more accountable and accessible while growing a network that is beneficial for consumers and merchants. Affirm provides more than 6.2 million consumers a better alternative to traditional credit cards, giving them the flexibility to buy now and pay over time at virtually any store. Unlike payment options that have late fees, compounding interest and unexpected costs, Affirm shows customers up front exactly what they'll pay — with no hidden fees and no surprises. Affirm partners with over 6,500 merchants in the U.S., helping them grow sales and access new consumers. Our merchants include brands like Walmart, Peloton, Oscar de la Renta, Audi, and Expedia, and span verticals including home and lifestyle, travel, personal fitness, electronics, apparel and beauty, auto, and more. Payment options through Affirm are provided by these lending partners: affirm.com/lenders.

Affirm and its lending partners do business in accordance with federal Fair Lending laws.

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/homeadvisor-partners-with-affirm-to-bring-flexible-pay-over-time-financing-options-to-homeowners-301194713.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/homeadvisor-partners-with-affirm-to-bring-flexible-pay-over-time-financing-options-to-homeowners-301194713.html

SOURCE HomeAdvisor