TD Ameritrade Investor Movement Index: IMX Score Rebounds as Markets Hit December Highs

The Investor Movement Index (IMX) increased by 15.71% to 6.26 in December, reflecting a higher level of investor engagement at TD Ameritrade. The reading ranks 'Middle' compared to historic averages, indicating optimism regarding economic recovery amid ongoing pandemic challenges. Major indices, including the S&P 500 and Nasdaq, reached record levels during this period. Despite a winter surge in Covid-19 cases, investor sentiment improved as Congress considered a relief package and vaccine distribution advanced. Net buying activity was observed in equities, with popular purchases including Pfizer, Moderna, and Tesla.

- IMX increased 15.71% to 6.26, indicating growing investor engagement.

- Major indices like the S&P 500 and Nasdaq reached historic levels.

- Net buying activity in equities reflects optimism among TD Ameritrade clients.

- Popular stocks bought included Pfizer, Moderna, and Tesla.

- None.

Insights

Analyzing...

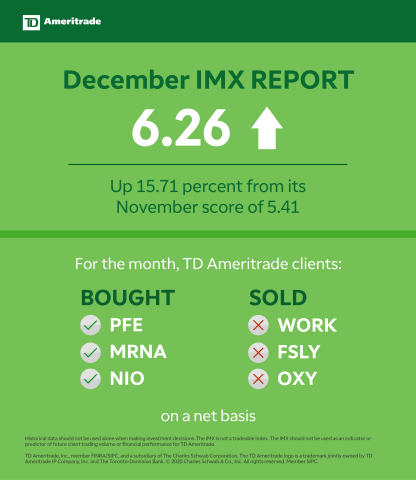

The Investor Movement Index® (IMXSM) increased to 6.26 in December, up 15.71 percent from its November score of 5.41. The IMX is TD Ameritrade’s proprietary, behavior-based index, aggregating Main Street investor positions and activity to measure what investors actually were doing and how they were positioned in the markets.

TD Ameritrade December 2020 Investor Movement Index (Graphic: TD Ameritrade)

The reading for the four-week period ending December 24, 2020 ranks “Middle” compared to historic averages.

“To cap off a tumultuous year, the positive headlines in December offered an opportunity for TD Ameritrade clients to increase their exposure to the markets,” said JJ Kinahan, chief market strategist at TD Ameritrade. ”There’s no question that the final trading period of the year reflected a growing sense of optimism around economic recovery and hope for an end to the pandemic. In 2021, however, the pandemic will most likely continue as the No. 1 news story for at least the first half of the year and with that, it will most likely remain the greatest source of market volatility.”

Equity markets moved higher during the December IMX period, to historic levels. The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all rose to record levels, with the S&P 500 closing above 3,700 and the Nasdaq Composite nearing 13,000. All three indices posted increases during the period, with the Nasdaq having the best month, increasing nearly five percent. Markets improved as investors grew optimistic that Congress would pass another coronavirus-relief package. Even as a winter wave of new Covid-19 cases pushed the death toll above 300,000 in the U.S., positive headlines abounded as a special Food and Drug Administration (FDA) advisory panel recommended broad distribution of the first Covid-19 vaccine in the U.S., clearing the way for the FDA to grant emergency authorization to two vaccines.

In the December period, TD Ameritrade clients were net buyers overall and net buyers of equities. Some of the popular names bought during the period were:

- Pfizer Inc. (PFE)

- Moderna Inc. (MRNA)

- NIO Inc. (NIO)

- Tesla Inc. (TSLA)

- Salesforce Inc. (CRM)

Although clients were net buyers of equities, they found some names to sell during the period, including:

- Slack Technologies Inc. (WORK)

- Fastly Inc. (FSLY)

- Occidental Petroleum Corp. (OXY)

- Haliburton Co. (HAL)

- Twitter Inc. (TWTR)

2020 in Review

The IMX started 2020 at a 15-month high as equity markets reached all-time heights. The U.S. and China signed a deal to ease trade tensions, and solid economic data was released, including an unemployment rate at a 50-year low of 3.5 percent. This market euphoria was short-lived, however, as the Covid-19 pandemic entered the U.S. and equity markets turned lower, entering a bear market in March. As volatility increased and many states imposed economic restrictions to combat the pandemic, TD Ameritrade clients reduced exposure to equity markets and in April the IMX reached a seven-year low. The IMX then began a five-month increase starting in May as states’ economic restrictions eased and clients net bought equities. The IMX dipped slightly near the end of the year before ending 2020 at its highest level in nearly 3 years, with the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all reaching record levels.

The five most popular stocks net bought by TD Ameritrade clients throughout the year were:

- Apple Inc. (AAPL)

- Microsoft Corp. (MSFT)

- Tesla Inc. (TSLA)

- Pfizer Inc. (PFE)

- Boeing Co. (BA)

The five most popular stocks net sold throughout the year by clients included:

- Twitter Inc. (TWTR)

- MGM Resorts International (MGM)

- Corteva Inc. (CTVA)

- IQIYI Inc. (IQ)

- Tencent Holdings (TCEHY)

About the IMX

The IMX value is calculated based on a complex proprietary formula. Each month, TD Ameritrade pulls a sample from its client base of more than 13 million funded accounts, which includes all accounts that completed a trade in the past month. The holdings and positions of this statistically significant sample are evaluated to calculate individual scores, and the median of those scores represents the monthly IMX.

For more information on the Investor Movement Index, including historical IMX data going back to January 2010; to view the full report from December 2020; or to sign up for future IMX news alerts, please visit www.tdameritrade.com/IMX. Additionally, TD Ameritrade clients can chart the IMX using the symbol $IMX in either the thinkorswim® or thinkorswim Mobile platforms.

Inclusion of specific security names in this commentary does not constitute a recommendation from TD Ameritrade to buy, sell, or hold. All investments involve risk including the possible loss of principal. Please consider all risks and objectives before investing.

Past performance of a security, strategy, or index is no guarantee of future results or investment success.

Historical data should not be used alone when making investment decisions. Please consult other sources of information and consider your individual financial position and goals before making an independent investment decision.

The IMX is not a tradable index. The IMX should not be used as an indicator or predictor of future client trading volume or financial performance for TD Ameritrade.

About TD Ameritrade

TD Ameritrade provides investing services and education to approximately 13 million client accounts totaling approximately

Brokerage services provided by TD Ameritrade, Inc., member FINRA (www.FINRA.org) / SIPC (www.SIPC.org), and a wholly owned subsidiary of The Charles Schwab Corporation. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc. and The Toronto-Dominion Bank. © 2020 Charles Schwab & Co. Inc. All rights reserved. Member SIPC (www.SIPC.org).

View source version on businesswire.com: https://www.businesswire.com/news/home/20210104005069/en/