American Shared Hospital Services Announces Closing of Acquisition of 60% Majority Interest in Three Radiation Therapy Cancer Centers in Rhode Island

American Shared Hospital Services (AMS) has acquired a 60% majority interest in three radiation therapy cancer centers in Rhode Island, adding $9-$10 million in annual revenue with a positive net income contribution. The acquisition more than doubles the revenue backlog to over $210 million, expanding the company's U.S. footprint and product offering.

Acquisition adds $9-$10 million in annual revenue with positive net income contribution

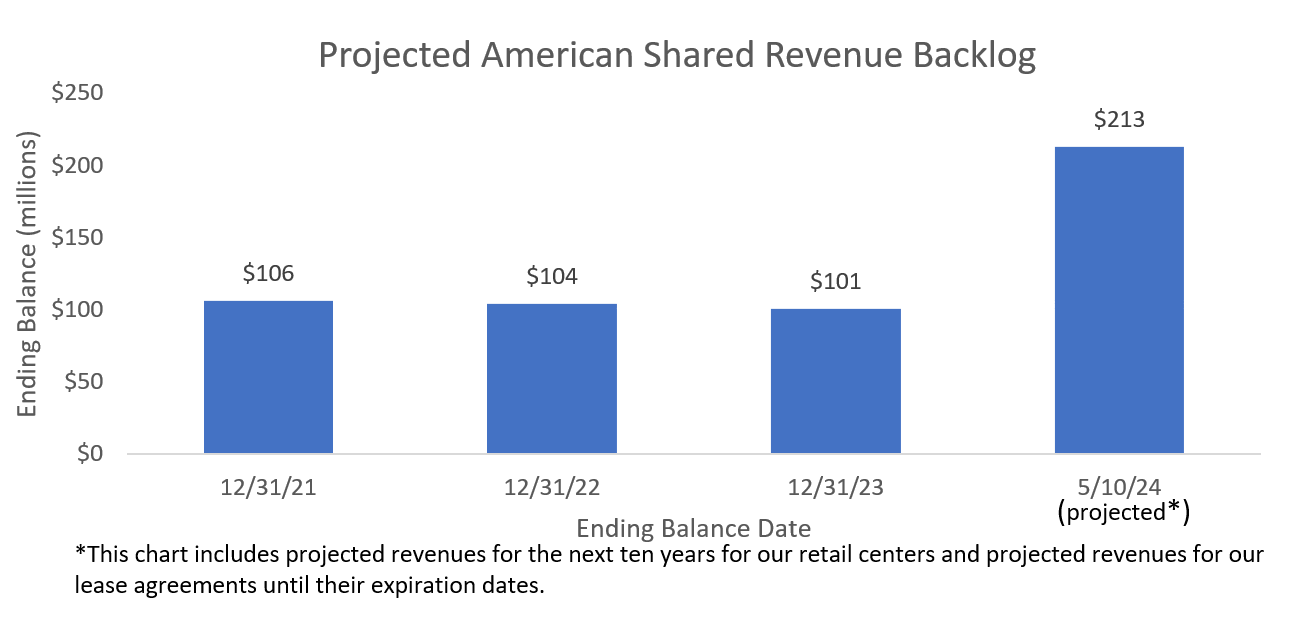

Acquisition more than doubles revenue backlog to over $210 million

Expands U.S. footprint and product offering

Projected revenue backlog increases significantly from $106 million in 2021 to an estimated $213 million in May 2024

Ownership of three Rhode Island radiation therapy cancer centers, two international facilities, and 85% ownership of a third facility ensures revenue generation for at least the next ten years

- None.

Insights

- Adds

- Acquisition more than Doubles Backlog to over

- Expands U.S. Footprint and Product Offering -

SAN FRANCISCO, May 09, 2024 (GLOBE NEWSWIRE) -- American Shared Hospital Services (NYSE American: AMS) (the "Company"), a leading provider of turnkey technology solutions for stereotactic radiosurgery and advanced radiation therapy cancer treatment systems and services, today announced the closing of its acquisition of a

The Company anticipates this transaction to add

American Shared estimates that our projected revenue backlog has increased significantly, from

The Companies operate three fully functional turn-key radiation therapy cancer centers in Rhode Island, and all three sites are equipped with state-of-the-art cancer treatment technology using Linear Accelerators (LINACs) along with CT Simulators and comprehensive treatment planning software for tumor localization. The Investment interests that were acquired are for facilities that reside on or adjacent to Care New England and Roger Williams Medical Center which are the second and third largest health systems in the State of Rhode Island and are equity members of the subject facilities. The facilities include the Southern New England Regional Cancer Center LLC in Woonsocket, RI and Southern New England Radiation Therapy LLC-Kent in Warwick, RI. The third facility Roger Williams Radiation Therapy LLC is in Providence, RI.

Ray Stachowiak, Executive Chairman of ASHS, commented, “This is a strong milestone for our Company that expands our footprint of owned and operated radiation oncology centers into the U.S. The acquisition adds new revenue streams from each of the three facilities that are accretive to our base and is an excellent use of our capital as we continue to build momentum and execute on our growth strategy. A key to this acquisition is that our ownership preserves the offering of radiation therapy services at the strategically convenient Woonsocket, Providence and Warwick demographic locations. In addition, this ensures patients continued access to community based high quality radiation therapy today and in the future.”

David E. Wazer, MD, Professor and Chairman of Radiation Oncology, Alpert Medical School of Brown University, commented, “It is very fortunate for Rhode Island cancer patients that ASHS was able to step into the void created by the GenesisCare bankruptcy. Had ASHS not taken this action, it is very likely that several treatment facilities would have been closed by the end of year which could have caused severe disruption for the roughly 70 patients per day that receive their care in these facilities. It is not an exaggeration to say that the responsible action by ASHS averted a statewide healthcare emergency.”

Ray Stachowiak continued, “In addition to being a very positive contribution to our company it’s great to have the support of our JV partners, Care New England Health System and Prospect CharterCARE, LLC d/b/a Roger Williams Medical Center. We look forward to growing those relationships and exploring future additional possibilities. The success of these centers is based on the strong local relationships we now have in place and this includes the second and third largest healthcare systems in the state.”

These newly acquired Centers are part of the Seller’s and its affiliates’ Chapter 11 bankruptcy process. The closing of the transaction was subject to certain events and conditions being met including (i) bankruptcy court approval, (ii) approval from the Rhode Island Department of health in accordance with the change in control of the majority member from GenesisCare to American Shared HospitalServices and (iii) other customary closing conditions.

About American Shared Hospital Services (NYSE American: AMS)

American Shared Hospital Services (ASHS) is a leading provider of creative financial and turnkey solutions to Cancer Treatment Centers, hospitals, and large cancer networks worldwide. The company works closely with all major global Original Equipment Manufacturers (OEMs) that provide leading edge clinical treatment systems and software to treat cancer using Radiation Therapy and Radiosurgery. The company is vendor agnostic and provides financial support for a wide range of products including MR Guided Radiation Therapy Linacs, Advanced Digital Linear Accelerators, Proton Beam Radiation Therapy Systems, Brachytherapy systems and suites, and through the Company’s subsidiary, GK Financing LLC., the Leksell Gamma Knife product and services. For more information, please visit: www.ashs.com

Safe Harbor Statement

This press release may be deemed to contain certain forward-looking statements with respect to the financial condition, results of operations and future plans of American Shared Hospital Services (including statements regarding the expected continued growth of the Company and the expansion of the Company’s Gamma Knife, proton therapy and MR/LINAC business, which involve risks and uncertainties including, but not limited to, the risks of economic and market conditions, the risks of variability of financial results between quarters, the risks of the Gamma Knife and proton therapy businesses, the risks of changes to CMS reimbursement rates or reimbursement methodology, the risks of the timing, financing, and operations of the Company’s Gamma Knife, proton therapy, and MR/LINAC businesses, the risk of expanding within or into new markets, the risk that the integration or continued operation of acquired businesses could adversely affect financial results and the risk that current and future acquisitions may negatively affect the Company’s financial position. Further information on potential factors that could affect the financial condition, results of operations and future plans of American Shared Hospital Services is included in the filings of the Company with the Securities and Exchange Commission, including the Company's Annual Report on Form 10-K for the year ended December 31, 2023, and the definitive Proxy Statement for the Annual Meeting of Shareholders to be held on June 25, 2024.

Contacts:

American Shared Hospital Services

Ray Stachowiak, Executive Chairman and CEO

rstachowiak@ashs.com

Investor Relations

Kirin Smith, President

PCG Advisory, Inc.

ksmith@pcgadvisory.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/7aa17d06-4f9e-4955-881d-8ecb06af5b1d