The Columbia Threadneedle Return to Normal Index Rises to 72% on Improving Activity Data, Increased Vaccinations

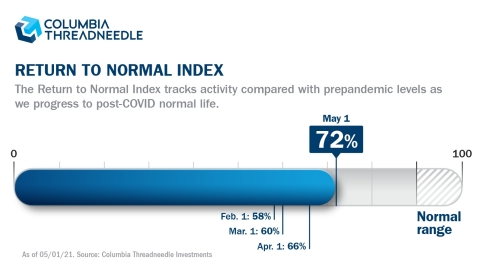

The Return to Normal Index by Columbia Threadneedle Investments increased to 72% as of May 1, 2021, up from 58% at the year's start. This index tracks various U.S. activities related to pre-pandemic levels, including travel and shopping. The surge in index value is attributed to wider vaccine eligibility, school reopenings, and lifted restrictions. The firm anticipates a potential rise to 90% of pre-pandemic levels by August 2021, with a potential upside to June if vaccination rates increase. Currently, activity remains 28% below pre-COVID levels.

- Return to Normal Index increased to 72% as of May 1, 2021.

- Predicted to reach 90% of pre-pandemic levels by August 2021.

- Analysis suggests U.S. immunity at approximately 70%, aiding recovery.

- Brick-and-mortar activity shows most promise at 82% of pre-pandemic levels.

- Travel and entertainment activities lag at only 57% of pre-pandemic levels.

- Index indicates U.S. remains 28% below pre-COVID activity levels.

Columbia Threadneedle Investments today announced its Return to Normal Index rose to

The Columbia Threadneedle Return to Normal Index as of May 1, 2021.

The firm’s analysis suggests the U.S. has reached an important immunity range (~

Paul DiGiacomo, Head of U.S. Equity Research at Columbia Threadneedle Investments, said: “We are seeing some countries face a critical rise in cases, while others are experiencing green shoots that suggest return to normal consumer behavior is swift and can even exceed pre-Covid levels for a period of time. With that said, the index could hit ‘normal’ at a point lower than 100 due to continued changes in behavior like working from home and reduced business travel.”

DiGiacomo continued, “This index, powered by our firm’s research intensity, is a valuable tool that provides us with a systematic and efficient way to monitor real-time data and generate actionable insights for our investment teams.”

By design, the index is focused on measuring components of daily life rather than economic indicators like GDP growth. The data science team aggregates data from sources such as OpenTable, TSA, and hotel bookings to pinpoint sector-level activity, whether it’s identifying positive momentum or trouble spots. The index suggests that we’re still

The Columbia Threadneedle Return to Normal Index is updated on a monthly basis and can be accessed here.

About Columbia Threadneedle Investments

Columbia Threadneedle Investments is a leading global asset manager that provides a broad range of investment strategies and solutions for individual, institutional and corporate clients around the world. With more than 2,000 people, including over 450 investment professionals based in North America, Europe and Asia, we manage

Columbia Threadneedle Investments is the global asset management group of Ameriprise Financial, Inc. (NYSE: AMP). For more information, please visit columbiathreeedneedleus.com. Follow us on Twitter.

Columbia Threadneedle Investments (Columbia Threadneedle) is the global brand name of the Columbia and Threadneedle group of companies.

1As of March 31, 2021. Includes all assets managed by entities in the Columbia and Threadneedle group of companies.

© 2021 Columbia Management Investment Advisers, LLC. All rights reserved.

Adtrax: 3567094

View source version on businesswire.com: https://www.businesswire.com/news/home/20210503005443/en/

FAQ

What is the Return to Normal Index by Columbia Threadneedle Investments?

What level has the Return to Normal Index reached as of May 1, 2021?

When is the Return to Normal Index expected to reach 90%?

What factors contributed to the increase in the Return to Normal Index?