Wavering brand loyalty challenging car manufacturers globally – Fifth car user survey by Asahi Kasei

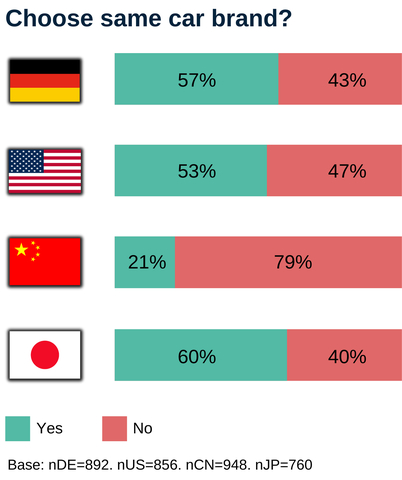

Asahi Kasei’s latest global car user survey reveals significant shifts in brand loyalty and EV buying behavior across four key automotive markets: Germany, the USA, China, and Japan. The survey highlights that over half of car users in Germany and the USA, and 79% in China, are inclined to switch car brands. Generation Z shows the lowest brand loyalty.

Common complaints about current vehicles include poor gas mileage, storage, and excessive noise, influencing buyers to prioritize quality and running costs. In China, the desire to try new premium brands is a major motivator.

Despite growing market shares for pure electric vehicles (EVs), willingness to buy EVs has not drastically changed since 2020. In the US, willingness decreased by 14 percentage points due to fading subsidies and high costs. Technological advancements in battery performance, lifetime, and safety are important for wider EV acceptance.

Key EV purchasing factors vary by region: driving range in Germany, battery lifetime in the US, and safety in China.

- None.

- None.

DÜSSELDORF,

Fig. 1: Brand Loyalty (Graphic: Business Wire)

In its fifth annual survey, the Japanese technology company Asahi Kasei asked car users in the four major automotive markets about brand loyalty and key motivators for buying electric vehicles (EVs).

The results of the newest survey confirm the trend in recent years - with tightening competition, new manufacturers, and changing customer needs, brand loyalty is wavering worldwide. More than half of the respondents in

To reignite brand loyalty, car manufacturers and suppliers must understand the end customers’ needs and find ways to differentiate from the increasing competition. When asked about the most annoying factors in their current car, car users in all four regions cited “poor gas mileage/fuel consumption,” “not enough storage space,” and “too much noise while driving”. This was also reflected in the main motivation to change the car brand, with a third of respondents in

Since the first survey was conducted in 2020, fuel/power efficiency and running costs have been the most influential factors in the buying process. Notably, the results for all features influencing purchasing choice have been consistent across each survey.

Enhancing battery performance key for convincing potential EV buyers

Stimulated by governmental subsidies, technological improvements and a growing network of charging stations, market shares of pure electric vehicles have been slowly growing in recent years, especially in Western markets and in

These findings indicate further technological advancements need to be achieved to convince most car users. In addition to cost aspects, further advancements in battery performance, lifetime, and safety will be needed to improve the acceptance of electric vehicles across all major regions. The main drivers for switching to an electric vehicle differ among the regions: while driving range is the major factor for car users in

About the Asahi Kasei Automotive Consumer Survey

This report summarizes key findings of the fifth edition of Asahi Kasei’s annual trend survey regarding car users’ purchasing decisions and preferences related to materials and features for the future of vehicles. Conducted in December 2023 via online interviews, Asahi Kasei asked a total of 4,158 car users across the four automotive core markets:

From its first edition in 2019, the survey has been conducted in cooperation with market research institute SKOPOS from

About Asahi Kasei

The Asahi Kasei Group contributes to life and living for people around the world. Since its founding in 1922 with ammonia and cellulose fiber businesses, Asahi Kasei has consistently grown through the proactive transformation of its business portfolio to meet the evolving needs of every age. With more than 49,000 employees worldwide, the company contributes to a sustainable society by providing solutions to the world's challenges through its three business sectors of Material, Homes, and Health Care. Its Material sector, comprised of Environmental Solutions, Mobility & Industrial, and Life Innovation, includes a wide array of products from battery separators and biodegradable textiles to engineering plastics and sound solutions. For more information, visit https://www.asahi-kasei.com/.

Asahi Kasei is also dedicated to sustainability initiatives and is contributing to reaching a carbon-neutral society by 2050. To learn more, visit https://www.asahi-kasei.com/sustainability/.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240709909670/en/

Europe Contact:

Asahi Kasei Europe GmbH

Sebastian Schmidt

sebastian.schmidt@asahi-kasei.eu

North America Contact:

Asahi Kasei America Inc.

Christian OKeefe

christian.okeefe@ak-america.com

Source: Asahi Kasei