Silver X Provides Update on Underground Resource Expansion Drilling at Tangana Mining Unit

Silver X Mining Corp. reported positive results from 14 drill holes at its Tangana Mining Unit, revealing significant silver-(gold)-polymetallic mineralization. Key findings include 148.89 g/t AgEq over 11.5 m in drill hole TN-2022-015, with new zones expected to enhance production at the Nueva Recuperada plant. The exploration aims to expand existing inferred resources and upgrade them to indicated resources, with 2,342 metres drilled so far, accounting for 62% of the planned program. The Tangana vein-field currently has an inferred resource of approximately 4.84 million tonnes grading 116.33 g/t Ag.

- Significant drill results with potential for enhanced production: 148.89 g/t AgEq over 11.5 m.

- Drilling program covers 2,342 metres, equating to 62% of planned drilling at Tangana 1.

- Inferred resource of 4,840,015 tonnes grading 116.33 g/t Ag supports resource expansion.

- Increased uncertainty regarding production as it is based on inferred mineral resources without a detailed economic assessment.

- Potential risks of mineral grades being lower than expected and ongoing operations proving more difficult or costly.

Insights

Analyzing...

VANCOUVER, BC / ACCESSWIRE / March 31, 2022 / SILVER X MINING CORP. (TSX-V:AGX) (OTCQB:AGXPF) ("Silver X" or the "Company") is pleased to report results from 14 drill holes forming part of its ongoing underground resource expansion and upgrade diamond drilling programme at its Tangana Mining Unit. Multiple in-mine exploration drill holes at our Tangana Mining Unit intersected significant intervals of silver-(gold)-polymetallic mineralization proximal to existing underground infrastructure in the Tangana 1 Vein. Results include 148.89 AgEq over 11.5 m in TN-2022-015 including 371.99 g/t AgEq over 1.5 m and 244.2 g/t AgEq over 2.76 m. Given the proximity to current mining operations, these new zones of mineralization should feed production at the Company's Nueva Recuperada processing plant in the following months. Since early 2022, a total of 2,342 metres of HQ diamond drilling has been completed in 25 holes, representing

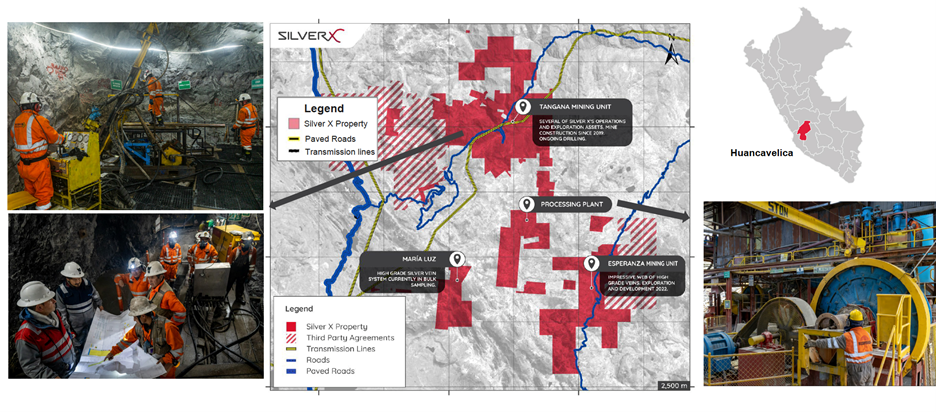

Figure 1: Silver X operations in the Nueva Recuperada project

These results support the Company's interpretation of Tangana as a mineralized silver-(gold)-polymetallic system with considerable resource expansion potential. The proximity to current mining operations at the Tangana Mining Unit and extensive underground infrastructure coupled with numerous unexploited zones in historical drifts should enable efficient low-cost mining. The Tangana vein-field currently has an inferred resource of 4,840,015 tonnes grading 116.33g/t Ag,

The three main objectives of this drilling were: (1) expansion of existing inferred mineral resources, (2) upgrading and re-categorization of some inferred mineral resources into indicated mineral resources, and (3) defining gaps in the mineralized structures. These holes were focused on securing the data require to upgrade and re-categorize some of our existing inferred mineral resources into indicated mineral resources. The results presented here are from 14 underground drill holes from 2021 & 2022 that tested the Tangana #1 silver-(gold)-polymetallic mineralized structure. Assay results for an additional 6 drill holes are outstanding.

| Drillhole ID | Coordinates (WGS84) | Orientation (True) | Intercept (metres) | AgEq Grade (g/t) | ||||

Easting | Northing | Azimuth | Dip | From | To | True Width | ||

| TN-2021-005 | 499661.27 | 8560903.09 | 229.48 | 60.8 | no significant results obtained | |||

| TN-2021-006 | 499662.53 | 8560907.27 | 326.65 | 49.49 | 299.5 | 300.85 | 0.68 | 129.46 |

| TN-2021-007 | 499662.07 | 8560907.55 | 337.55 | 44.09 | 275.9 | 279.9 | 1.72 | 192.71 |

| TN-2021-008 | 499611.68 | 8561008.08 | 339.71 | 39.91 | 138.8 | 139.2 | 0.24 | 80.57 |

| TN-2021-009 | 499611.89 | 8561007.55 | 338.74 | 57.28 | no significant results obtained | |||

| TN-2021-010 | 499613.97 | 8561007.84 | 16.37 | 73.3 | 135.9 | 136.65 | 0.26 | 82.39 |

| TN-2021-011 | 499616.14 | 8561005.3 | 73.13 | 72.15 | no significant results obtained | |||

| TN-2021-012 | 499616.14 | 8561005.3 | 336.57 | 56.47 | no significant results obtained | |||

| TN-2022-013 | 499576.043 | 8561175.94 | 214.41 | 53.41 | 89.3 | 90.60 | 0.69 | 289.16 |

| TN-2022-014 | 499574.852 | 8561176.39 | 265.50 | 27.60 | 149.5 | 151.1 | 1.23 | 96.98 |

| TN-2022-015 | 499479.322 | 8561275.16 | 228.88 | 33 | 141.50 | 157.25 | 11.50 | 148.89 |

Including | 141.5 | 145.1 | 2.76 | 244.19 | ||||

Including | 146.7 | 148.15 | 1.12 | 136.63 | ||||

Including | 150 | 151.95 | 1.50 | 371.99 | ||||

Including | 153.75 | 157.25 | 2.68 | 172.15 | ||||

| TN-2022-016 | 499477.439 | 8561277 | 267.58 | 25.62 | no significant results obtained | |||

| TN-2022-017 | 499476.249 | 8561018.35 | 37.32 | 53.06 | 164 | 169.6 | 3.60 | 152.42 |

| TN-2022-018 | 499475.665 | 8561018.16 | 6.32 | 52.69 | 161.8 | 164.85 | 1.80 | 390.62 |

168.85 | 170.8 | 1.15 | 131.77 | |||||

All drill holes testing the Tangana #1 structure intersected mineralization, with 9 of 14 holes returning potentially economic intersections of >80 g/t and up to 390 g/t AgEq. Highlights of drill assays received to date from the late 2021/2022 work program at Tangana #1 are as follows:

Drillhole ID | Tangana 1 - Intercept (m) | Gold - Silver - Polymetallic Grades | AgEq Grade | ||||||

From | To | True Width | Au (g/t) | Ag (g/t) | Cu (%) | Pb (%) | Zn (%) | (g/t) | |

| TN-2021-005 | No significant results obtained | ||||||||

| TN-2021-006 | 299.50 | 300.85 | 0.68 | 0.04 | 9.3 | 0.01 | 1.09 | 1.74 | 129.46 |

| TN-2021-007 | 275.90 | 279.90 | 1.72 | 0.16 | 28.1 | 0.09 | 1.39 | 2.10 | 192.71 |

| TN-2021-008 | 138.80 | 139.20 | 0.24 | 0.59 | 5.3 | 0.11 | 0.15 | 0.25 | 80.57 |

| TN-2021-009 | No significant results obtained | ||||||||

| TN-2021-010 | 135.90 | 136.65 | 0.26 | 0.21 | 43.5 | 0.17 | 0.04 | 0.02 | 82.39 |

| TN-2021-011 | No significant results obtained | ||||||||

| TN-2021-012 | No significant results obtained | ||||||||

| TN-2022-013 | 89.30 | 90.60 | 0.69 | 2.08 | 51.9 | 0.25 | 0.63 | 0.60 | 289.16 |

| TN-2022-014 | 149.50 | 151.10 | 1.23 | 0.39 | 0.4 | 0.11 | 0.63 | 0.72 | 96.98 |

| TN-2022-015 | 141.50 | 157.25 | 11.50 | 0.14 | 24.4 | 0.08 | 1.04 | 1.72 | 148.89 |

Including | 141.50 | 145.10 | 2.76 | 0.27 | 42.1 | 0.19 | 1.55 | 2.34 | 244.19 |

Including | 146.70 | 148.15 | 1.12 | 0.11 | 39.2 | 0.07 | 1.12 | 0.99 | 136.63 |

Including | 150.00 | 151.95 | 1.50 | 0.16 | 41.9 | 0.10 | 2.60 | 4.75 | 371.99 |

Including | 153.75 | 157.25 | 2.68 | 0.12 | 21.8 | 0.06 | 1.05 | 2.14 | 172.15 |

| TN-2022-016 | No significant results obtained | ||||||||

| TN-2022-017 | 164.00 | 169.60 | 3.60 | 0.18 | 21.2 | 0.22 | 1.02 | 1.25 | 152.42 |

| TN-2022-018 | 161.80 | 164.85 | 1.80 | 0.25 | 42.5 | 0.12 | 3.43 | 4.46 | 390.62 |

| TN-2022-018 | 168.85 | 170.80 | 1.15 | 0.06 | 73.2 | 0.37 | 0.25 | 0.03 | 131.77 |

*Silver equivalent (AgEq) values uses

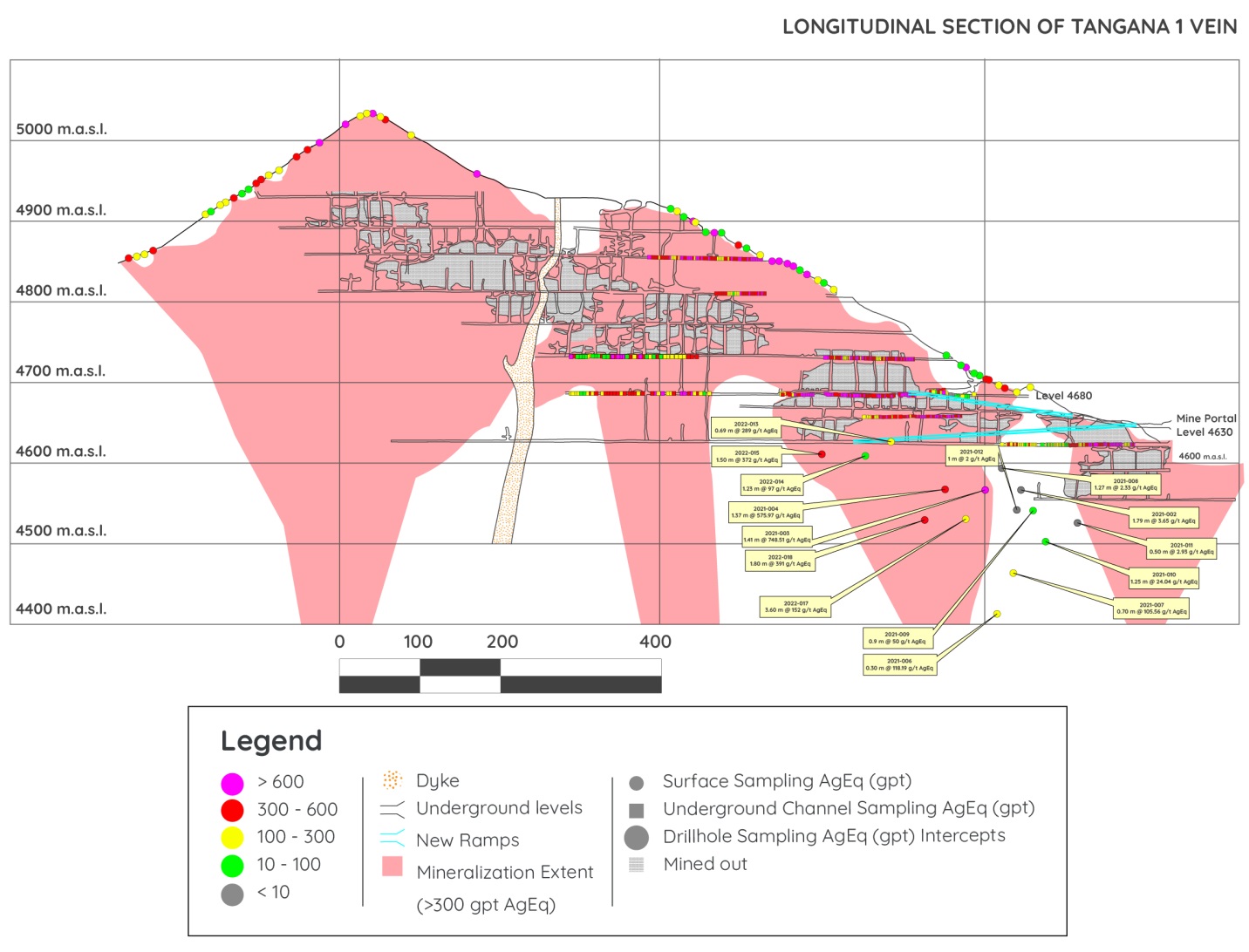

Silver X CEO, José Garcia commented: "Recent drill results from the Tangana #1 structure have confirmed an open-ended, mineralized corridor approximately 300 m long by 300 m deep open for expansion along strike and downdip. The proximity of these results to ongoing mining operations at our Tangana Mining unit reinforce our thesis that Tangana and its associated veins represents the future of production growth at Silver X. TN-2022-015 encountered a thick braided zone of veining which will be explored further. The understanding gained of the ore-shoots geometry will be applied to the other kilometre-scale veins that have yet to been drilled in the Tangana Sector. The Tangana Mining Unit extends for more than 11 km on a strike, including several parallel veins; and this is only one of those. Furthermore, the newly noted presence of gold is encouraging, and drilling will continue aimed at upgrading the inferred resource at Tangana".

Figure 2: Long section of Tangana Mining Unit showing recent drilling results.

Sampling, Analytical Analysis, Quality Assurance and Quality Control (QAQC)

Drill core from all drill holes is extracted in lengths of 1.52 meters (5 feet) and stored on-site in appropriate core trays in a secure Company core-shed. Drill hole orientation, downhole survey data, and collar coordinates are registered. Extracted core is first measured and marked up, then geologically and geotechnically logged. Splitting and sampling of all silver-(gold)-polymetallic mineralized structures identified in the drill core is done from start to finish of the mineralized structure. Minimum sample length is 30 centimeters. No sample collected through potentially economic mineralized intersections is longer than 50 centimeters. Sterile country rock hosting the mineralized structure is sampled for a minimum of 1.0 meter either side of the structure. The interval to be sampled is split by rock-saw and taking care to avoid contamination of the sample, carefully stored in a suitably prepared plastic bag. Samples have unique number identifiers for "chain of custody" tracking of samples and for subsequent incorporation into the database once QAQC sign-off on analytical results has been received. Depending on the diameter, length, and bulk density of the core sample, approximately 4-8 kg of sample are collected for analysis per one metre length of sample.

Rock-chips from all surface channel sampling are taken in representative manner: the weight and coordinates of the samples are recorded; a geological description is noted; samples are collected using a geological pick and captured in a plastic bag, taking care to avoid contamination; depending upon size and bulk density of the rock, approximately 3-4kg of sample are collected. Each sample has a unique number for "chain of custody" tracking and subsequent incorporation into the Company database once QAQC sign-off on analytical results has been received.

The samples are shipped by Company vehicle from the field to the Certimin S.A. independent analytical laboratory in Lima ("Certimin"). Certimin complies with ISO 9001, OHSAS 18001 and is a fully recognized and certified facility. After samples have been prepared for analysis (code G0640), sample pulps are analyzed for gold, silver and multi-elements using Certimin analytical methods. All samples are analyzed using 30g nominal weight fire assay with an ICP finish (code G0108) and multi-element four acid digestion ICP-AES/ICP-MS (code G0176). Where Au analytical results from G0108 are >10g/t, the analysis is repeated with 30g nominal weight fire assay and a gravimetric finish (code G0014). Where multi-element results from G0176 are greater than 100 ppm for Ag, the analysis is repeated with ore-grade four acid digestion method (Code G0002). Where multi-element results from G0176 are greater than 10,000 ppm for Cu, Pb or Zn, the analysis is repeated with ore-grade four acid digestion methods, respectively codes G0039, G0077 and G0388. Periodically, duplicate sample pulps are sent to independent umpire laboratories for review and checking of Certimin analytical results.

Silver X applies a fully NI 43-101 compliant quality assurance/quality control (QAQC) protocol on all of its advanced and exploration projects. Our trained QAQC staff insert both fine and coarse blank samples, field duplicates and twin samples into each batch of field samples prior to delivery to the laboratory. The QAQC control samples, including the random insertion of certified reference material, are designed to test the integrity of the samples by providing an independent check on precision, accuracy and possible contamination during sample preparation and analytical procedure within the laboratory. With the objective of assuring best practice compliance, resource and exploration related assay results are not reported until the results of internal QAQC procedures have been reviewed and approved.

1Oro X Mining Corp., "Amended & Restated NI 43-101 Technical Report for the Recuperada Project, Peru" (Effective Date: October 15, 2020; Issue Date: March 25, 2021).

Cautionary Note regarding Production without Mineral Reserves

The decision to commence production at the Nueva Recuperada Project and the Company's ongoing mining operations as referenced herein (the "Mining Operations" and Operations") are based on economic models prepared by the Company in conjunction with management's knowledge of the property and the existing estimate of inferred mineral resources on the property. The Production Decision and Operations are not based on a preliminary economic assessment, a pre-feasibility study or a feasibility study of mineral reserves demonstrating economic and technical viability. Accordingly, there is increased uncertainty and economic and technical risks of failure associated with the Production Decision and Operations, in particular: the risk that mineral grades will be lower than expected; the risk that additional construction or ongoing mining operations are more difficult or more expensive than expected; and production and economic variables may vary considerably, due to the absence of a detailed economic and technical analysis in accordance with NI 43-101.

Qualified Person

Mr. A. David Heyl who is a qualified person under NI 43-101, has reviewed and approved the technical content of this news release for Silver X. Mr. Heyl, B.Sc., C.P.G., QP is a Certified Professional Geologist and Qualified Person under NI 43-101. With over 25 years of field and upper management experience, Mr. Heyl has a solid geological background in generating and conducting exploration and mining programs for gold, rare earth metals, and base metals, resulting

in several discoveries. Mr. Heyl has 20 years of experience in Peru. He worked for Barrick Gold, was the exploration manager for Southern Peru Copper, and spent over twelve years working in and supervising underground and open pit mining operations in the Americas. Mr. A. David Heyl is a consultant for Silver X.

About Silver X

Silver X is a Canadian silver mining company with assets in Peru and Ecuador. The Company's flagship asset is the Tangana silver, gold, lead, zinc and copper project (the "Project") located in Huancavelica, Peru, 10 km north-northwest of the Nueva Recuperada polymetallic concentrate plant. Founders and management have a successful track record of increasing shareholder value. For more information visit our website at www.silverxmining.com.

ON BEHALF OF THE BOARD

José M García

CEO and Director

For further information, please contact:

Silver X Mining Corp.

+ 1 604 358 1382 | j.garcia@silverxmining.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding "Forward-Looking" Information

This press release contains forward-looking information within the meaning of applicable Canadian securities legislation ("forward-looking information"). Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain acts, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". All information contained in this press release, other than statements of current and historical fact, is forward looking information. Forward-looking information contained in this press release may include, without limitation, exploration plans, results of operations, expected performance at the Project, the ability of the new zones at the Project to feed production at the Company's Nueva Recuperada Plant in the near term, the Company's belief that the Tangana system will provide considerable resource expansion potential, that the Company will be able to mine the Tangana Mining Unit in an economic manner, and the expected financial performance of the Company.

The following are some of the assumptions upon which forward-looking information is based: that general business and economic conditions will not change in a material adverse manner; demand for, and stable or improving price for the commodities we produce; receipt of regulatory and governmental approvals, permits and renewals in a timely manner; that the Company will not experience any material accident, labour dispute or failure of plant or equipment or other material disruption in the Company's operations at the Project and Nueva Recuperada Plant; the availability of financing for operations and development; the Company's ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; that the estimates of the resources at the Project and the geological, operational and price assumptions on which these and the Company's operations are based are within reasonable bounds of accuracy (including with respect to size, grade and recovery); the Company's ability to attract and retain skilled personnel and directors; and the ability of management to execute strategic goals.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company, as the case may be, to be materially different from those expressed or implied by such forward-looking information, including but not limited to those risks described in the Company's annual and interim MD&As and in its public documents filed on www.sedar.com from time to time. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

SOURCE: Silver X Mining Corp.

View source version on accesswire.com:

https://www.accesswire.com/695470/Silver-X-Provides-Update-on-Underground-Resource-Expansion-Drilling-at-Tangana-Mining-Unit