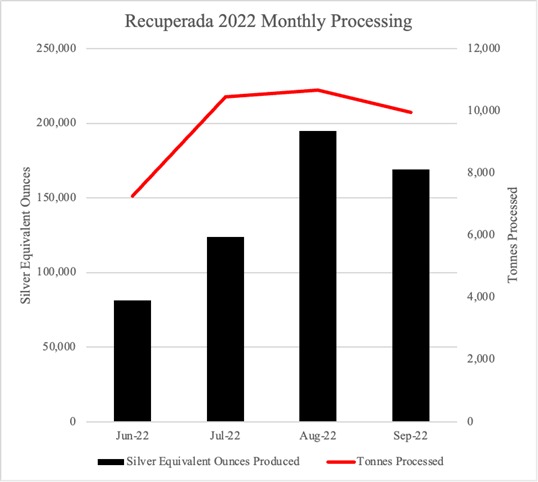

Silver X Provides September 2022 Operations Update: 162,049 Silver Equivalent Ounces* Processed

Silver X Mining Corp. (AGXPF) released its operational update for September 2022, reporting 162,049 silver equivalent ounces processed. The average processing plant head grade was 18 oz/T AgEq with metal recoveries of 86.88% for silver, 79.83% for gold, 84.71% for lead, and 74.76% for zinc. The company advanced 245 meters in workings at the Tangana project while focusing on grade control and mine expansion, despite recent operational challenges. Upcoming potential improvements are expected from recent drill intersections.

- Processed 162,049 silver equivalent ounces in September 2022.

- Average processing plant head grade of 18 oz/T AgEq.

- High silver recovery rate of 86.88% achieved during the month.

- 245 meters of workings advanced at the Tangana project.

- Production was impacted by an accident at operations.

- There are increased risks due to production without defined mineral reserves.

Insights

Analyzing...

VANCOUVER, BC / ACCESSWIRE / October 5, 2022 / SILVER X MINING CORP. (TSXV:AGX)(OTCQB:AGXPF)(F:WPZ) ("Silver X" or the "Company") is pleased to provide a monthly operational update for September 2022.

September 2022 Highlights

- 162,049 silver equivalent ounces* (AgEq) processed in September

- Average processing plant head grade of 18 oz/T (564 g/T) AgEq* in September

- September processing plant metal calculated recoveries of

84% for silver,80% for gold,75% for zinc and85% for lead - Advanced 245 meters of workings at Tangana, both in drifting along Tangana & Cauca veins, development ramps, and cross cutting.

In September 2022 the head grade at the Recuperada processing plant averaged 18.12 oz/T AgEq*. Recoveries at the plant in September were

Notes:

*Silver equivalent ounces for September were calculated using the monthly average sales prices for concentrates of

** 2022 Silver equivalent ounces were calculated using the average sale prices of each metal for each month, and the revenues from concentrate sales does not consider metallurgical recoveries in the calculations as the metal recoveries are built into the sales amounts.

Please see "Cautionary Note regarding Production without Mineral Reserves" at the end of this news release.

Monthly Summary

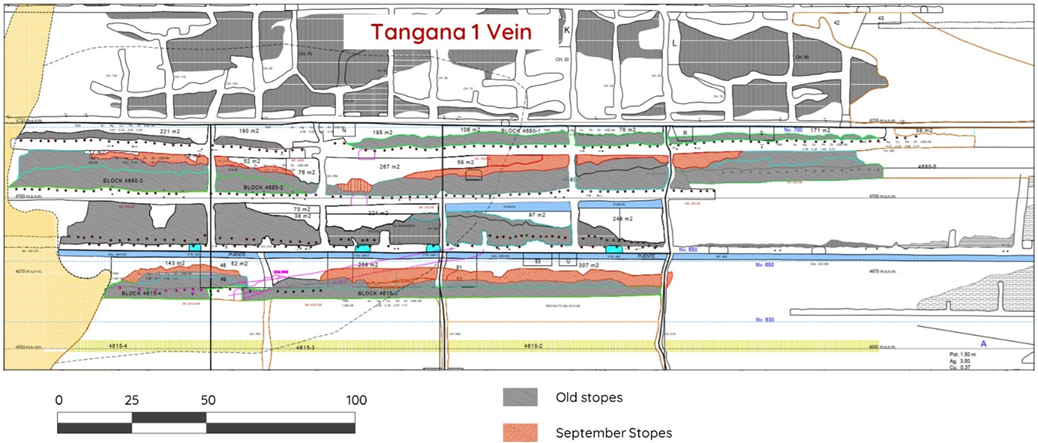

"Despite the shutdown due an accident at the operations, the Tangana team has maintained consistent production levels" stated José M. Garcia, CEO of Silver X. "Production remains concentrated on the Tangana 1 vein where the focus remains on grade control and mine expansion as well an all-encompassing review of all safety procedures. The Tangana contracting crew received additional equipment in September to enable them to increase the production rate. Also of note, the recent drill intersects support our belief that the current mineralization has significant production potential."

Qualified Person

Mr. A. David Heyl, who is a qualified person under NI 43-101, has reviewed and approved the technical content of this news release for Silver X. Mr. Heyl, B.Sc., C.P.G., QP is a Certified Professional Geologist and] Qualified Person under NI 43-101. With over 35 years of field and upper management experience, Mr. Heyl has a solid geological background in generating and conducting exploration and mining programs for gold, rare earth metals, and base metals, resulting in several discoveries. Mr. Heyl has 20 years of experience in Peru. He worked for Barrick Gold, was the exploration manager for Southern Peru Copper, and spent over twelve years working in and supervising underground and open pit mining operations in the Americas. Mr. A. David Heyl is a consultant for Silver X.

Cautionary Note regarding Production without Mineral Reserves

The decision to commence production at the Nueva Recuperada Project and the Company's ongoing mining operations as referenced herein (the "Production Decision and Operations") are based on economic models prepared by the Company in conjunction with management's knowledge of the property and the existing estimate of inferred mineral resources on the property. The Production Decision and Operations are not based on a preliminary economic assessment, a pre-feasibility study or a feasibility study of mineral reserves demonstrating economic and technical viability. Accordingly, there is increased uncertainty and economic and technical risks of failure associated with the Production Decision and Operations, in particular: the risk that mineral grades will be lower than expected; the risk that additional construction or ongoing mining operations are more difficult or more expensive than expected; and production and economic variables may vary considerably, due to the absence of a detailed economic and technical analysis in accordance with NI 43-101.

About Silver X

Silver X is a Canadian silver mining company with assets in Peru. The Company's flagship asset is the Tangana silver, gold, lead, zinc and copper project (the "Project") located in Huancavelica, Peru, 10 km north-northwest of the Nueva Recuperada polymetallic concentrate plant. Founders and management have a successful track record of increasing shareholder value. For more information visit our website at www.silverxmining.com.

ON BEHALF OF THE BOARD

José M. Garcia

CEO and Director

For further information, please contact:

Silver X Mining Corp.

José M. Garcia, CEO

+1 604 358 1382 | j.garcia@silverxmining.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding "Forward-Looking" Information

This press release contains forward-looking information within the meaning of applicable Canadian securities legislation ("forward-looking information"). Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain acts, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". All information contained in this press release, other than statements of current and historical fact, is forward looking information. Forward-looking information contained in this press release may include, without limitation, exploration plans, results of operations, expected performance at the Project, the ability of the new zones at the Project to feed production at the Company's Nueva Recuperada Plant in the near term, the Company's belief that the Tangana system will provide considerable resource expansion potential, that the Company will be able to mine the Tangana Mining Unit in an economic manner, and the expected financial performance of the Company.

The following are some of the assumptions upon which forward-looking information is based: that general business and economic conditions will not change in a material adverse manner; demand for, and stable or improving price for the commodities we produce; receipt of regulatory and governmental approvals, permits and renewals in a timely manner; that the Company will not experience any material accident, labour dispute or failure of plant or equipment or other material disruption in the Company's operations at the Project and Nueva Recuperada Plant; the availability of financing for operations and development; the Company's ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; that the estimates of the resources at the Project and the geological, operational and price assumptions on which these and the Company's operations are based are within reasonable bounds of accuracy (including with respect to size, grade and recovery); the Company's ability to attract and retain skilled personnel and directors; and the ability of management to execute strategic goals.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company, as the case may be, to be materially different from those expressed or implied by such forward-looking information, including but not limited to those risks described in the Company's annual and interim MD&As and in its public documents filed on www.sedar.com from time to time. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

SOURCE: Silver X Mining Corp.

View source version on accesswire.com:

https://www.accesswire.com/719016/Silver-X-Provides-September-2022-Operations-Update-162049-Silver-Equivalent-Ounces-Processed