Media Alert: Adobe Digital Price Index: Online Inflation Remains Elevated in January at 2.7%

- January marked 20th consecutive month of online inflation

- Prices for groceries and medical supplies hit record highs

-

Prices for electronics continued to drop

3.4% year-over-year

(Graphic: Business Wire)

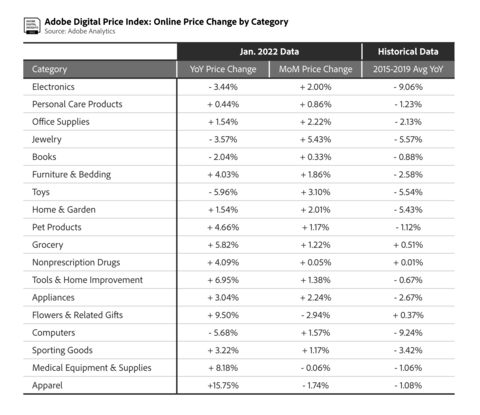

The DPI provides the most comprehensive view into how much consumers pay for goods online. Powered by Adobe Analytics, it analyzes one trillion visits to retail sites and over 100 million SKUs across 18 product categories: electronics, apparel, appliances, books, toys, computers, groceries, furniture/bedding, tools/home improvement, home/garden, pet products, jewelry, medical equipment/supplies, sporting goods, personal care products, flowers/related gifts, non-prescription drugs and office supplies.

“While price drops in categories like electronics and apparel have brought online inflation down slightly from the record high last November, consumers are still contending with elevated prices in the digital economy,” said

In

On a MoM basis, 15 of the 18 categories saw January price increases, with price drops observed in three categories, including apparel, medical equipment/supplies and flowers/related gifts.

Notable Categories in the Adobe Digital Price Index (

-

Groceries: Prices were up

5.8% YoY (up1.2% MoM), the highest increase for the category on an annual basis. It exceeded the high point inOctober 2020 , during the first year of the COVID-19 pandemic, when prices jumped5.2% YoY. January marks the 24th consecutive month where online prices have risen for groceries, making it the only category that has moved in lockstep with the Consumer Price Index, which captures prices consumers pay in physical stores.

-

Medical Equipment and Supplies: Prices were up

8.2% YoY (down0.1% MoM), the highest increase for the category on an annual basis. It coincided with a January surge in the COVID-19 Omicron variant, which drove greater demand for testing kits at a time when overall supply was constrained.

-

Office Supplies : After eight consecutive months where online prices fell or were flat on an annual basis, office supplies increased1.5% YoY (up2.2% MoM) in January. COVID-19 variants have kept many consumers working from home, driving up demand and prices for products in home offices.

-

Electronics: Prices were down

3.4% YoY, a greater price drop compared to December when online prices were down2.6% YoY. As one of the major categories in e-commerce, electronics’ price fluctuations have had a greater impact on topline inflation. On monthly basis, prices are up2.0% after holiday discounts seen in the prior month.

-

Apparel: Prices were up

15.8% YoY (down1.7% MoM), down from the holiday season where prices increased17.3% YoY inNovember 2021 and16.6% inDecember 2021 . The drop contributed to lower topline inflation for January, given the volume of e-commerce spending that occurs in this category.

Methodology

The DPI is modeled after the Consumer Price Index (CPI), published by the

Adobe uses a combination of Adobe Sensei, Adobe’s AI and machine learning framework, and manual effort to segment the products into the categories defined by the CPI manual. The methodology was first developed alongside renowned economists

About Adobe

Adobe is changing the world through digital experiences. For more information, visit www.adobe.com.

© 2022 Adobe. All rights reserved. Adobe and the Adobe logo are either registered trademarks or trademarks of Adobe in

View source version on businesswire.com: https://www.businesswire.com/news/home/20220210005314/en/

Adobe

kfu@adobe.com

Adobe

belkadi@adobe.com

Source: Adobe