Adobe: U.S. Consumers Spent $1.7 Trillion Online During the Pandemic, Rapidly Expanding the Digital Economy

-

Groceries now a major category online, expected to top

$85 billion -

With inflation,

U.S. consumers paid$32 billion - “Buy Now Pay Later” and curbside pickup continue to reshape online shopping

-

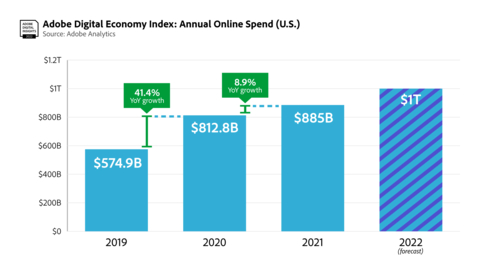

U.S. consumers to spend over$1 trillion

(Graphic: Business Wire)

After two years of the pandemic (

Inflation Contributes to E-Commerce Growth

Of the

In the first two months of 2022,

Groceries Become a Major E-Commerce Category

In 2021,

-

Groceries: 2020 was a breakout year for the category, with

$73.7 billion 103% YoY ($79.2 billion 7.2% YoY). Groceries is now8.9% of the e-commerce share overall, up from6.3% in 2019 and down slightly from 2020 (9.1% ) when demand surged early in the pandemic. Consumers now spend an average of$6.7 billion $3.1 billion $85 billion

-

Electronics: As the largest e-commerce category, electronics drove

$165 billion 8% YoY. This represents an18.6% share of e-commerce overall, down slightly from 2020 (18.8% ) and 2019 (21% ) as other categories grew. The pandemic cemented electronics as the top category, with consumers spending$152.7 billion 26.8% YoY.U.S. consumers now spend an average of$13.6 billion $9.9 billion $174 billion

-

Apparel: As consumers spent more time at home, apparel demand slumped. In 2020, apparel grew by

9.1% YoY ($115.8 billion 41% YoY. Growth was modest in 2021 at$126.2 billion 8% YoY. This represents a14.3% of e-commerce share overall, down from 2019 (18.5% ) and in line with 2020 (14.2% ). Pre-pandemic, apparel spend in 2019 was$14.4 billion $38.8 billion $10.2 billion $8.7 billion $130 billion

“E-commerce is being reshaped by grocery shopping, a category with minimal discounting compared to legacy categories like electronics and apparel,” said

Additional Insights

-

Out-of-Stock: Consumers have seen 60 billion out-of-stock (OOS) messages in the last 24 months (

March 2020 toFebruary 2022 ), in the face of supply chain constraints. The odds of seeing an OOS message are now one in 59 pages, up from one in 200 pages pre-pandemic (a235% increase). In the last four months (November 2021 throughFebruary 2022 ), consumers have seen over 12 billion OOS messages, a trend expected to persist in 2022.

-

Buy Now Pay Later (BNPL): As consumers spent more online during the pandemic and looked for new ways to manage their money, BNPL orders between October and

November 2020 increased528% YoY while revenue grew412% YoY. In recent months, growth has slowed, but demand remained strong: BNPL orders are up53% YoY while revenue is up56% YoY.

-

Curbside Pickup: The fulfillment method already saw strong adoption before the pandemic, but health and safety concerns gave it a boost. The demand has been durable, with many consumers now valuing the speed and convenience. In 2022 so far, curbside pickup accounted for

20% of all online orders (for retailers who offer the service), establishing itself as a major fulfilment method.

Methodology

The Adobe Digital Economy Index offers the most comprehensive set of insights of its kind, based on analysis through Adobe Analytics that covers over one trillion visits to

Adobe’s analysis is weighted by the real quantities of the products purchased in the two adjacent months. Adobe uses a combination of Adobe Sensei, Adobe’s AI and machine learning framework, and manual effort to segment the products into the categories defined by the CPI manual. The methodology was first developed alongside renowned economists

About Adobe

Adobe is changing the world through digital experiences. For more information, visit www.adobe.com.

© 2022 Adobe. All rights reserved. Adobe and the Adobe logo are either registered trademarks or trademarks of Adobe in

View source version on businesswire.com: https://www.businesswire.com/news/home/20220315005468/en/

Public relations contact

Adobe

kfu@adobe.com

Source: Adobe