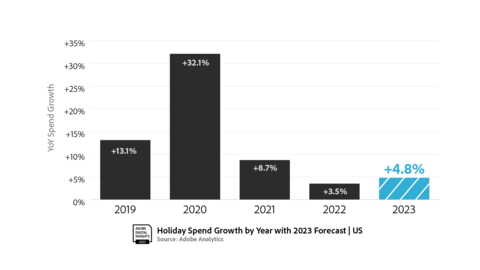

Adobe Forecasts $221.8 Billion U.S. Holiday Season Online, Cyber Monday To Top $12 Billion

- Mobile shopping set to overtake desktop for the first time, as consumers get increasingly comfortable transacting on smaller screens

-

Discounts expected to hit record highs this season, peaking at

35% off listed price for toys,30% for electronics and25% for apparel -

Buy Now, Pay Later usage set to drive a record

$17 billion

(Graphic: Business Wire)

Adobe expects

Cyber Week – the shopping period including Thanksgiving, Black Friday and Cyber Monday – is expected to drive

“Despite an unpredictable economic environment, where consumers face several challenges including rising interest rates, we expect strong e-commerce growth this season on account of record discounts and flexible payment methods,” said Patrick Brown, vice president of growth marketing at Adobe. “Buy Now, Pay Later in particular has become increasingly mainstream and will make it easier for shoppers to hit the buy button, especially on mobile devices where over half of online spending will take place.”

Record Discounts Expected This Season

Adobe anticipates discounts will hit record highs – up to

The deepest discounts are expected to hit during Cyber Week, the best time to shop for bargain hunters. Black Friday (Nov. 24) will be the best day to shop for TVs, while Saturday (Nov. 25) will have the best deals for computers. The deepest discounts for toys and apparel will be on Sunday (Nov. 26), and Cyber Monday (Nov. 27) will have the best deals for electronics and furniture. Those looking for the best deals in appliances will find them on Tuesday (Nov. 30); the biggest discounts for sporting goods are expected on Wednesday (Dec. 4).

While Cyber Week is expected to have the best deals, consumers will see bargains as early as the second week of October, where discounts are expected to be as high as

Buy Now, Pay Later Continues Growing

The flexible Buy Now, Pay Later (BNPL) payment method is expected to set new records this season, driving

BNPL has already seen strong traction this year. Thus far in 2023, BNPL users have spent

Additional Adobe Analytics Insights

-

Mobile shopping overtakes desktop for the first time: Adobe anticipates over half (

51.2% ) of online spending will take place on mobile devices this holiday season, a milestone reflecting improved small screen shopping experiences. Mobile spending is set to hit a record$113 billion 13.7% YoY, with usage peaking on days when consumers are likely with friends and family, such as Thanksgiving and Christmas.

- Top sellers expected this holiday season: LEGO Minifigures, Kanoodle 3D, Barbie the Movie products, Shape Shifting Box, Tamagotchi Nano x Harry Potter, and Transforming Ariel Fashion Doll in toys. Top gaming consoles will include Sony PlayStation 5, Xbox Series X, Nintendo Switch OLED and Meta Quest 3 VR Headset, while top games will include Madden NFL 24, NBA 2k24, Mortal Kombat 1, Marvel's Spider-Man 2, Super Mario Bros Wonder, Cities Skylines 2, Call of Duty: Modern Warfare 3, Hogwarts Legacy, and Starfield. Other top sellers this holiday season will include iPhone 15 models, headphones, e-readers and Kindles, Fujifilm Instax Mini Evo cameras, Ember Mugs, Roombas, and Birkenstock Bostons.

-

E-commerce categories driving growth: Electronics, apparel, furniture/home goods, groceries and toys will contribute

$144.2 billion $221.8 billion $49.9 billion 3.4% YoY), furniture/home goods at$26.6 billion 4.7% YoY), groceries at$18.9 billion 10.9% YoY as consumers plan holiday meals – and toys at$7.8 billion 5.4% YoY). Apparel remains a major category and is set to drive$41 billion 0.7% YoY, indicating some shift back to in-store shopping.

-

Earlier shopping expected this year: A second Prime Day event (Oct. 10-11) and other promotional events will drive early discounting, enticing consumers to start shopping earlier. October's Prime Day event is expected to bring in

$8.1 Billion 6.1% YoY), with discounts as high as18% . July’s Prime Day event drove record online sales for the retail industry overall, with$12.7 billion 6.1% YoY). Adobe’s survey of over 1,000U.S. consumers found that49% of respondents expect to start this year's holiday shopping in October.

Strong consumer spend continues to be driven by net-new demand, and not just higher prices. Adobe’s Digital Price Index shows prices online have fallen consecutively for 12 months (down

About Adobe

Adobe is changing the world through digital experiences. For more information, visit www.adobe.com.

*Per the Digital Commerce 360 Top 500 report (2021)

© 2023 Adobe. All rights reserved. Adobe and the Adobe logo are either registered trademarks or trademarks of Adobe in

Disclaimer: The information and analysis in this release have been prepared by Adobe Inc. for informational purposes only and may contain statements about future events that could differ from actual results. Adobe Inc. does not warrant that the material contained herein is accurate or free of errors and has no responsibility to update or revise information presented herein. Adobe Inc. shall not be liable for any reliance upon the information provided herein.

View source version on businesswire.com: https://www.businesswire.com/news/home/20231005143372/en/

Public relations contact

Jane Vaden

Adobe

jvaden@adobe.com

Source: Adobe