New Accenture Report Highlights Significant Spike in Consumer Fraud, Offers Steps for Public Safety Agencies to Help Counter the Increase

Accenture (NYSE: ACN) reports a significant rise in consumer fraud, with cases tripling from 2020 to 2021. The report analyzed data from eight nations and noted a 22.5% annual growth rate in fraud during the pandemic, compared to 6.8% from 2013 to 2019. By 2027, up to 24% of the population could be affected under pessimistic scenarios. Accenture emphasizes the need for proactive collaboration among public safety agencies and outlines strategies focused on intelligence gathering, incident detection, and prevention efforts.

- Accenture's report highlights a growing need for public safety agencies to innovate strategies against rising consumer fraud.

- The report provides a framework for improving operational response systems across varying maturity levels.

- Consumer fraud cases have shown a substantial rise, significantly impacting consumers and businesses.

- Forecasts indicate that by 2027, 24% of the population may be affected by fraud under pessimistic scenarios.

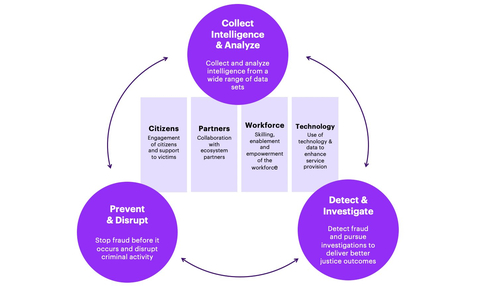

A framework for evolving the prevention and detection of fraud (Graphic: Business Wire)

The report, Cracking the Code on Consumer Fraud, compiled data from eight developed nations (

“Our analysis revealed the cost of consumer fraud during the pandemic exceeded the level seen over six years prior to 2020,” said

The report includes scenarios forecasting consumer fraud rates over the next five years. Under the most optimistic scenario, the annual growth rate of consumer fraud would fall to the pre-pandemic level of

“We found that approximately

Accenture’s report points to a range of activities that public safety agencies can consider elevating to counter consumer fraud. While countries and agencies studied were found to be at widely varying levels of maturity, in terms of their approaches and capabilities to fight fraud, the report offers a framework to build more effective operational response systems regardless of the current status of efforts within specific countries.

Areas of operational response to consumer fraud fall into three categories: collect and analyze intelligence, detect and investigate incidents of fraud, and (when possible) prevent and disrupt attempts before fraud occurs. The report calls out four areas of opportunity – citizens, partners, workforce, and technology – and offers guidance for steps to expand efforts in each area of opportunity across the breadth of operational response categories.

“In light of the fast rise and already massive extent of consumer fraud, we are calling for more of an intelligence-led, proactive and collaborative path forward,” Slessor added. “As consumer fraud becomes more intrusive, sophisticated and spans across borders, our call is to elevate efforts with a whole-ecosystem approach in which governments and many partners work together to innovate and deter fraud.”

About Accenture

Accenture is a global professional services company with leading capabilities in digital, cloud and security. Combining unmatched experience and specialized skills across more than 40 industries, we offer Strategy and Consulting, Interactive, Technology and Operations services — all powered by the world’s largest network of Advanced Technology and Intelligent Operations centers. Our 699,000 people deliver on the promise of technology and human ingenuity every day, serving clients in more than 120 countries. We embrace the power of change to create value and shared success for our clients, people, shareholders, partners and communities. Visit us at accenture.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220404005027/en/

Accenture

+1 512 694 6422

joseph.r.dickie@accenture.com

Source: Accenture

FAQ

What did the Accenture report reveal about consumer fraud rates for ACN?

How many countries were analyzed in the Accenture report on consumer fraud?

What is the projected impact of consumer fraud on the population by 2027 according to Accenture?

What strategies does Accenture suggest for public safety agencies to combat consumer fraud?