ABQQ Reports FY 2024 Audited Financial Results, Introduces FY 2025 Outlook, Announces to Repurchase $5 Million of Shares by Year-End 2025

AB International Group (ABQQ) reported strong FY2024 financial results with revenue increasing 125% to $3.3 million and achieving operational profitability with net income of $542,331, compared to a net loss of $3.57 million in FY2023. Operating expenses decreased to $2.81 million from $5.03 million in the previous year. The company's Total Stockholders' Equity reached $1.46 million, up from $891K in FY2023. During FY2024, ABQQ repurchased 285 million shares for $50,699. The company announced plans to repurchase $5 million of shares by year-end 2025 and projects 150% revenue growth for FY2025 with EPS guidance of $0.001-$0.002.

AB International Group (ABQQ) ha riportato ottimi risultati finanziari per l'anno fiscale 2024, con un incremento del 125% dei ricavi, arrivando a 3,3 milioni di dollari, e ha raggiunto la redditività operativa con un utile netto di 542.331 dollari, rispetto a una perdita netta di 3,57 milioni di dollari nell'anno fiscale 2023. Le spese operative sono diminuite a 2,81 milioni di dollari, rispetto ai 5,03 milioni dell'anno precedente. Il Patrimonio Netto Totale della società ha raggiunto 1,46 milioni di dollari, in aumento rispetto ai 891K del FY2023. Durante l'anno fiscale 2024, ABQQ ha riacquistato 285 milioni di azioni per 50.699 dollari. La società ha annunciato piani per riacquistare azioni per 5 milioni di dollari entro la fine del 2025 e prevede una crescita dei ricavi del 150% per l'anno fiscale 2025, con previsioni di EPS di 0,001-0,002 dollari.

AB International Group (ABQQ) informó resultados financieros sólidos para el año fiscal 2024, con un aumento del 125% en los ingresos, alcanzando los 3.3 millones de dólares, y logrando rentabilidad operativa con un ingreso neto de 542,331 dólares, en comparación con una pérdida neta de 3.57 millones de dólares en el año fiscal 2023. Los gastos operativos disminuyeron a 2.81 millones de dólares desde 5.03 millones en el año anterior. El Patrimonio Total de los Accionistas de la empresa alcanzó 1.46 millones de dólares, en comparación con los 891K del año fiscal 2023. Durante el año fiscal 2024, ABQQ recompró 285 millones de acciones por 50,699 dólares. La empresa anunció planes para recomprar acciones por 5 millones de dólares para finales de 2025 y proyecta un crecimiento del 150% en los ingresos para el año fiscal 2025 con una guía de EPS de 0.001-0.002 dólares.

AB 국제 그룹 (ABQQ)는 2024 회계연도에 강력한 재무 결과를 보고했으며, 수익이 125% 증가하여 330만 달러에 달했습니다. 또한 순이익 542,331 달러로 운영 수익성을 달성했습니다, 2023 회계연도에 순손실 357만 달러에 비해 개선되었습니다. 운영 비용은 이전 연도의 503만 달러에서 281만 달러로 감소했습니다. 회사의 총 주주 자본은 146만 달러에 도달했으며, 2023 회계연도의 891K에서 증가했습니다. 2024 회계연도 동안 ABQQ는 5만 달러에 2억 8천5백만 주를 재구매했습니다. 회사는 2025년 말까지 500만 달러의 주식을 재구매할 계획을 발표했으며, 2025 회계연도에는 150%의 수익 성장과 EPS 가이던스 0.001-0.002 달러를 전망하고 있습니다.

AB International Group (ABQQ) a reported de solides résultats financiers pour l'exercice fiscal 2024, avec une augmentation de 125% des revenus, atteignant 3,3 millions de dollars, et a atteint la rentabilité opérationnelle avec un bénéfice net de 542 331 dollars, contre une perte nette de 3,57 millions de dollars lors de l'exercice fiscal 2023. Les frais d'exploitation ont diminué à 2,81 millions de dollars contre 5,03 millions l'année précédente. Les capitaux propres totaux de l'entreprise ont atteint 1,46 million de dollars, contre 891K en 2023. Au cours de l'exercice fiscal 2024, ABQQ a racheté 285 millions d'actions pour 50 699 dollars. L'entreprise a annoncé son intention de racheter pour 5 millions de dollars d'actions d'ici la fin de 2025 et prévoit une croissance des revenus de 150% pour l'exercice fiscal 2025 avec une prévision de BPA de 0,001-0,002 dollars.

AB International Group (ABQQ) berichtete über starke finanzielle Ergebnisse für das Geschäftsjahr 2024, mit einem Umsatzanstieg von 125% auf 3,3 Millionen Dollar und dem Erreichen der operativen Rentabilität mit einem Nettogewinn von 542.331 Dollar, im Vergleich zu einem Nettverlust von 3,57 Millionen Dollar im Geschäftsjahr 2023. Die Betriebskosten sanken auf 2,81 Millionen Dollar von 5,03 Millionen im Vorjahr. Das Gesamt-Eigenkapital des Unternehmens erreichte 1,46 Millionen Dollar, gestiegen von 891K im Geschäftsjahr 2023. Im Geschäftsjahr 2024 kaufte ABQQ 285 Millionen Aktien für 50.699 Dollar zurück. Das Unternehmen kündigte Pläne an, bis Ende 2025 Aktien im Wert von 5 Millionen Dollar zurückzukaufen, und prognostiziert eine Umsatzsteigerung von 150% für das Geschäftsjahr 2025 mit einer EPS-Prognose von 0,001-0,002 Dollar.

- Revenue growth of 125% to $3.3 million in FY2024

- Achieved profitability with net income of $542,331

- Operating expenses reduced by 44% to $2.81 million

- Total Stockholders' Equity increased to $1.46 million

- Announced $5 million share repurchase program

- Projects 150% revenue growth for FY2025

- Low share repurchase value of $50,699 in FY2024

- Low projected EPS range of $0.001-$0.002 for FY2025

- FY 2024 REVENUE INCREASED

125% TO A RECORD$3.3 MILLION - FY 2024 REACH OPERATIONAL PROFITABILITY NET INCOME TO A RECORD

$0.54 MILLION - GUIDES FY 2025 REVENUE GROWTH OF APPROX.

150% ; EPS RANGE OF$0.00 1 TO$0.00 2 - ANNOUNCES INCREASE TO PREVIOUSLY COMMUNICATED SHARE REPURCHASE GOAL, TO REPURCHASE

$5 MILLION OF SHARES BY YEAR END 2025

NEW YORK, Nov. 26, 2024 (GLOBE NEWSWIRE) -- AB International Group Corp. (OTC: ABQQ), an intellectual property (IP) and movie investment and licensing firm, announces financial and operating results for the year ended August 31, 2024. The audited financial results have been filed in a 10-K with the U.S. Securities and Exchange Commission (the "SEC"). The Company also provided its financial outlook for the fiscal year ending August 31, 2025.

“ABQQ achieved record results during fiscal year 2024, as we delivered revenue growth of

Key Financial Highlights:

Revenues for the year ended August 31, 2024, increased

Operating expenses were

We incurred a net income of

As of August 31, 2024.Total Stockholders’ Equity

During fiscal year 2024, the Company repurchased approximately 285 million shares of its common stock for a total of

Full Fiscal Year 2025 Outlook for the Twelve-Month Period Ending August 31, 2025

The Company's full fiscal year 2025 outlook is forward-looking in nature, reflecting our expectations as of November 26, 2024, and is subject to significant risks and uncertainties that limit our ability to accurately forecast results. This outlook assumes no meaningful changes to the Company's business prospects or risks and uncertainties identified by management that could impact future results, which include but are not limited to changes in economic conditions, including consumer confidence and discretionary spending, inflationary pressures, and foreign currency fluctuation; geopolitical tensions; and supply chain disruptions, constraints and related expenses.

Revenues are expected to increase approximately

Gross margin is expected to be approximately

Diluted earnings per share are expected to be in the range of

About AB International Group Corp.

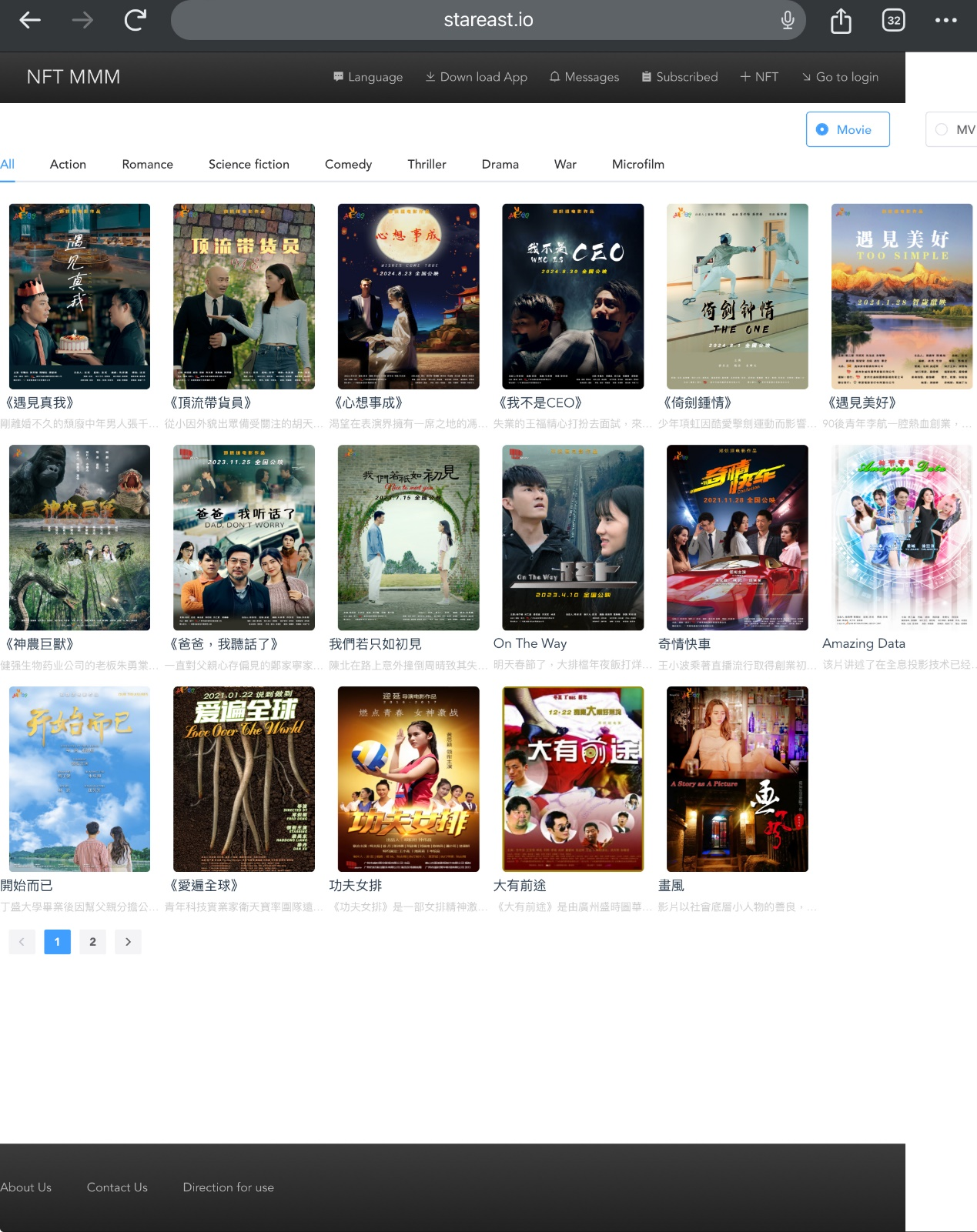

AB International Group Corp. is an intellectual property (IP) and movie investment and licensing firm, focused on acquisitions and development of various intellectual property. We are engaged in acquisition and distribution of movies. The company owns the IP of the NFT movie and music marketplace (NFT MMM) as the unique entertainment industry Non-Fungible Token. The Company operates AB Cinemas, physical movie theaters currently in NY with plans to expand nationwide (www.abcinemasny.com). The company also owns ABQQ.TV which is a movie and TV show online streaming platform. ABQQ TV generates revenue through a hybrid subscription model and advertising model like other online streaming platforms.

For additional information, visit www.abqqs.com, www.abcinemasny.com, https://stareastnet.io/ and www.ABQQ.tv.

Forward-Looking Statements

This press release contains “forward-looking statements” that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including statements relating to changes to the Company’s management team and statements relating to the Company’s transformation, financial and operational performance including the acceleration of revenue and margins, and the Company’s overall strategy. Because forward-looking statements inherently involve risks and uncertainties, actual future results may differ materially from those expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to, the possibility of business disruption, competitive uncertainties, and general economic and business conditions in AB International Group markets as well as the other risks detailed in company filings with the Securities and Exchange Commission. AB International Group undertakes no obligation to update any statements in this press release for changes that happen after the date of this release.

Investor Relations Contact:

Charles Tang

(852) 2622 2891

corp@abqqs.com

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/8ba28f62-fe9e-45be-89c9-c8c7a2fa9707

https://www.globenewswire.com/NewsRoom/AttachmentNg/d08431cf-b411-4d9f-80d4-ca34f1320c5f