American Battery Technology Company Publishes Updated Initial Assessment and Economic Analysis for its Tonopah Flats Lithium Project for One of the Largest Identified Lithium Resources in the U.S.

ABTC CEO leads virtual walkthrough of one of the largest known lithium deposits in

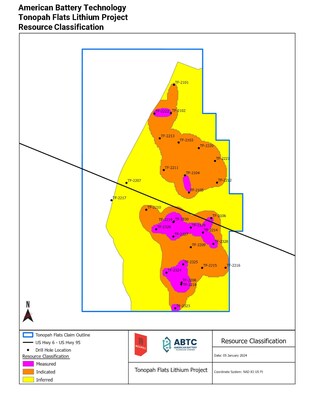

The TFLP is one of the largest identified lithium resources in the

This commercialization pathway allows for an engineered phased development, with improved access to the higher quality portions of the resource, and at improved project economics. ABTC recently completed construction of its multi-ton per day integrated demonstration facility for the processing of its lithium-bearing claystone material into lithium products. Updated project metrics for ABTC's TFLP resource utilizing its internally-developed and demonstrated processing technologies include:

- While the prior Initial Assessments included Inferred Mineral Resources, which are more speculative, this most recent Initial Assessment details a commercialization plan where only Measured and Indicated Mineral Resources would be utilized to service the lithium hydroxide refinery

- Total amount of claystone processed over life of mine reduced

7% , to 597 million tons - Average grade over life of mine increased by

8% , to 4,111 ppm LHM - Average production costs over life of mine decreased by

7% , to$4,302 - Net present value at

10% discount rate (NPV-10) increased by6% , to$4.67 billion

ABTC published the TFLP Initial Assessment in December 2023 and updated it in January 2024. ABTC is publishing this Amended Resource Estimate and Initial Assessment with Project Economics for the Tonopah Flats Lithium Project,

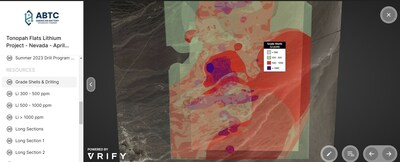

To describe and walkthrough this updated commercialization plan and project scale-up, ABTC CEO Ryan Melsert was interviewed by Vrify CEO Stephen De Jong to talk through these highlights with visual graphics of the TFLP and its related infrastructure.

The interview highlights:

- Drill Program II location and assay results

- Updated Drill Program III locations and assay results

- ABTC's lithium hydroxide pilot plant and commercial-scale refinery

- Recommended next steps for the project

To view the interview, click here.

To view the interactive 3D Model used during the interview, click here.

American Battery Technology Company's Measured, Indicated, and Inferred Lithium Mineral Resource

Resource Classification | Total kTons | Average ppm Li | Li kTons | LHM kTons | ||||||||||||||

Measured | 721,000 | 702 | 510 | 3,060 | ||||||||||||||

Indicated | 2,439,000 | 565 | 1,380 | 8,340 | ||||||||||||||

Measured + | 3,160,000 | 596 | 1,890 | 11,400 | ||||||||||||||

Inferred | 2,931,000 | 550 | 1,610 | 9,750 | ||||||||||||||

Total | 6,091,000 | 574 | 3,500 | 21,150 | ||||||||||||||

ABTC received support for the commercialization of these internally-developed technologies for the manufacturing of battery grade lithium hydroxide from

The Amended Initial Assessment supersedes all previously published reports effective as of April 5, 2024. To read the full Amended Initial Assessment, view updated 3D interactive resource graphics, and learn more about the ABTC Tonopah Flats Lithium Project, visit: www.americanbatterytechnology.com.

Qualified Person

The mineral resource estimates presented in the ABTC Tonopah Flats Initial Assessment were performed by third-party, qualified person RESPEC, LLC and were classified by geological and quantitative confidence in accordance with the Securities and Exchange Commission (SEC) Regulation S-K 1300.

Initial Assessment

Initial Assessment is a preliminary technical and economic study of the economic potential of all or parts of mineralization to support the disclosure of mineral resources. The Initial Assessment must be prepared by a qualified person and must include appropriate assessments of reasonably assumed technical and economic factors, together with any other relevant operational factors, that are necessary to demonstrate at the time of reporting that there are reasonable prospects for economic extraction. An Initial Assessment is required for disclosure of mineral resources but cannot be used as the basis for disclosure of mineral reserves. An Initial Assessment is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied that would enable them to be classified as mineral reserves. There is no certainty that the economic results of an Initial Assessment will be realized.

Inferred Resource

Inferred Mineral Resource is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. The level of geological uncertainty associated with an Inferred Mineral Resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. Because an Inferred Mineral Resource has the lowest level of geological confidence of all mineral resources, which prevents the application of the modifying factors in a manner useful for evaluation of economic viability, an Inferred Mineral Resource may not be considered when assessing the economic viability of a mining project, and may not be converted to a mineral reserve.

Indicated Resource

Indicated Mineral Resource is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of adequate geological evidence and sampling. The level of geological certainty associated with an Indicated Mineral Resource is sufficient to allow a qualified person to apply modifying factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Because an Indicated Mineral Resource has a lower level of confidence than the level of confidence of a Measured Mineral Resource, an Indicated Mineral Resource may only be converted to a Probable Mineral Reserve.

Measured Resource

Measured Mineral Resource is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of conclusive geological evidence and sampling. The level of geological certainty associated with a Measured Mineral Resource is sufficient to allow a qualified person to apply modifying factors, as defined in this section, in sufficient detail to support detailed mine planning and final evaluation of the economic viability of the deposit. Because a Measured Mineral Resource has a higher level of confidence than the level of confidence of either an Indicated Mineral Resource or an Inferred Mineral Resource, a Measured Mineral Resource may be converted to a Proven Mineral Reserve or to a Probable Mineral Reserve.

Probable Mineral Reserve

Probable Mineral Reserve is the economically mineable part of an indicated and, in some cases, a Measured Mineral Resource.

Proven Mineral Reserve

Proven Mineral Reserve is the economically mineable part of a Measured Mineral Resource and can only result from conversion of a Measured Mineral Resource.

Pre-Feasibility Study

A Preliminary Feasibility Study (or Pre-Feasibility Study) is a comprehensive study of a range of options for the technical and economic viability of a mineral project that has advanced to a stage where a qualified person has determined (in the case of underground mining) a preferred mining method, or (in the case of surface mining) a pit configuration, and in all cases has determined an effective method of mineral processing and an effective plan to sell the product. A Pre-Feasibility Study includes a financial analysis based on reasonable assumptions, based on appropriate testing, about the modifying factors and the evaluation of any other relevant factors that are sufficient for a qualified person to determine if all or part of the Indicated and Measured Mineral Resources may be converted to mineral reserves at the time of reporting. The financial analysis must have the level of detail necessary to demonstrate, at the time of reporting, that extraction is economically viable. A Pre-Feasibility Study is less comprehensive and results in a lower confidence level than a feasibility study. A Pre-Feasibility study is more comprehensive and results in a higher confidence level than an Initial Assessment.

About American Battery Technology Company

American Battery Technology Company (ABTC), headquartered in

Forward-Looking Statements

This press release contains "forward-looking statements" within the meaning of the safe harbor provisions of the

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/american-battery-technology-company-publishes-updated-initial-assessment-and-economic-analysis-for-its-tonopah-flats-lithium-project-for-one-of-the-largest-identified-lithium-resources-in-the-us-302126179.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/american-battery-technology-company-publishes-updated-initial-assessment-and-economic-analysis-for-its-tonopah-flats-lithium-project-for-one-of-the-largest-identified-lithium-resources-in-the-us-302126179.html

SOURCE American Battery Technology Company