AllianceBernstein: China’s Green Enablers Deserve a Place in Equity Funds

AllianceBernstein highlights the critical role of Chinese firms in the global transition to a greener future, noting a missed opportunity for investors as many environmental funds lack exposure to China. Research indicates that five of the ten largest global environmental equity funds had no holdings in China by 2022. Chinese companies dominate vital sectors for decarbonization, including solar energy, wind power, and electric vehicles (EVs), accounting for significant shares in global supply chains. The report underscores the potential for attractive returns from investing in about 400 Chinese stocks aligned with net-zero goals despite macroeconomic challenges.

- Chinese firms are critical in solar and wind energy production, holding a 37% share in global solar demand.

- China processes 58% of the world's lithium and 87% of rare earths, essential for green technologies.

- Chinese EV manufacturers, like BYD, account for 18% of the global market share.

- Investors can identify resilient opportunities among 400 Chinese stocks involved in the net-zero transition.

- None.

NORTHAMPTON, MA / ACCESSWIRE / March 22, 2023 / AllianceBernstein:

Investors focusing on climate change often overlook Chinese firms. We think that's a mistake. Chinese companies are playing an indispensable role in the global transition to a greener future-and carefully selected shares offer attractive return potential.

Most environmental funds have little or no holdings in China. Five of the 10 largest global environmental equity funds by assets under management had no exposure to China at all at the end of 2022, according to our research based on Morningstar data. Four of the remaining five had less than

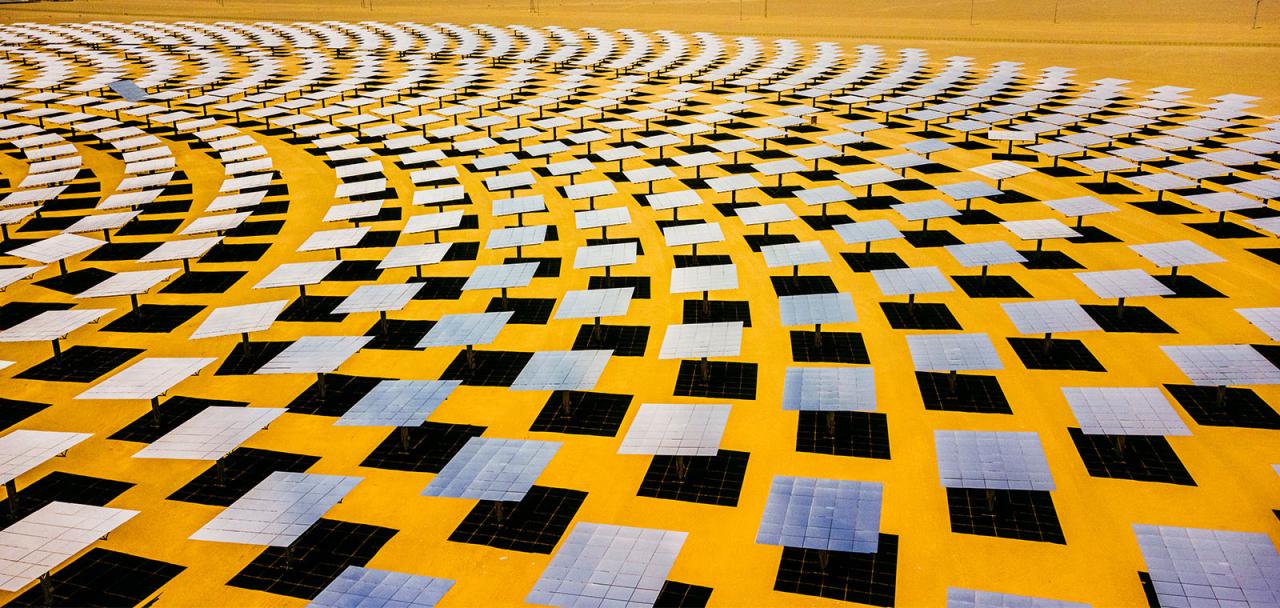

All Environmental Roads Lead to Chinese Companies

That seems like a missed opportunity. Accelerating decarbonization efforts around the world require Chinese products. Demand for solar energy, wind power and electric vehicles (EVs) draw on vast global supply chains. And Chinese companies dominate some global markets for raw materials, products and components that enable the green transition.

For example, Chinese copper and nickel are essential ingredients for wind turbines, solar panels and EVs. China also processes

Energy Transition: Here Comes the Sun and Wind

Solar energy installations are mushrooming. China accounts for

Businesses and homeowners around the world seeking to install solar power will need equipment that relies on raw materials such as polysilicon, which China dominates. China also manufactures

As a result, Chinese solar equipment makers are poised for tremendous growth both from increased demand in China and from other countries pressing ahead with net-zero agendas. Examples include JinkoSolar and JA Solar, two large integrated solar module suppliers, with a combined global market share of about

Chinese companies are also prominent in wind energy. Ming Yang Smart Energy Group is a leading Chinese wind turbine manufacturer, especially in offshore wind. The company has a

Empowering the EV Revolution

China is already the world's largest EV market-and Chinese automakers are intensifying competition for EVs with global carmakers. For example, BYD of Shenzhen makes electric cars and buses and is the world's second-largest EV supplier globally, after Tesla. When including plug-in hybrids, BYD is the largest supplier of vehicles powered by new energy sources, with an

Beyond the carmakers, the EV supply chain is brimming with opportunities. For example, about

Examples of Chinese EV enablers include CATL, the largest global EV battery maker with a

Infrastructure Solutions for Environmental Efficiency

Achieving net-zero goals requires infrastructure solutions for EVs, alternative energy, as well as initiatives to make more efficient use of energy, water and environmentally friendlier materials. Copper miners, undersea electrical cable makers and smart grid solution providers are all contributing to the global efforts to upgrade and streamline infrastructure.

NARI Technology is a good example. The company is a provider of equipment for power grids, supplying technology solutions in areas including system automation, smart grids, renewable energy and energy conservation. NARI has a market share of

How to Invest in China's Net-Zero Enablers

International investors may have some concerns about investing in Chinese companies given the significant influence of policy decisions on the economy. However, we believe a disciplined approach focused on Chinese enablers of the global energy transition that is aligned with China's long-term policy objectives can help mitigate regulatory risks.

Investors who understand the nuances of China's policy and the economic landscape can find resilient, long-term opportunities. China's commitment to reaching carbon neutrality by 2060 is a key long-term policy trend that should support companies involved in the transition.

There are plenty of companies to choose from in sectors ranging from industrials to utilities, materials, consumer discretionary and technology. We've identified about 400 Chinese onshore and offshore stocks that are participating in the net-zero transition and have a market capitalization of at least

Despite challenging macroeconomic conditions, we think the push to wean the global economy off fossil fuels will continue unabated. This should translate into persistent growth drivers for companies empowering the energy transition. By focusing on Chinese companies with solid fundamentals that are deeply embedded in this global green effort, portfolios can capture an attractive source of return potential that has gone largely unnoticed by investment managers.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

References to specific securities are presented to illustrate the application of our investment philosophy only and are not to be considered recommendations by AB. The specific securities identified and described do not represent all of the securities purchased, sold or recommended for the portfolio, and it should not be assumed that investments in the securities identified were or will be profitable.

View additional multimedia and more ESG storytelling from AllianceBernstein on 3blmedia.com.

Contact Info:

Spokesperson: AllianceBernstein

Website: https://www.3blmedia.com/profiles/alliancebernstein

Email: info@3blmedia.com

SOURCE: AllianceBernstein

View source version on accesswire.com:

https://www.accesswire.com/745174/AllianceBernstein-Chinas-Green-Enablers-Deserve-a-Place-in-Equity-Funds

FAQ

What does AllianceBernstein say about Chinese firms in the press release dated March 22, 2023?

What percentage of global solar demand does China represent?

What is the market share of BYD in the global EV market?

How many Chinese stocks are identified by AllianceBernstein for investment in the green transition?