Renters of color pay higher upfront costs

Rhea-AI Summary

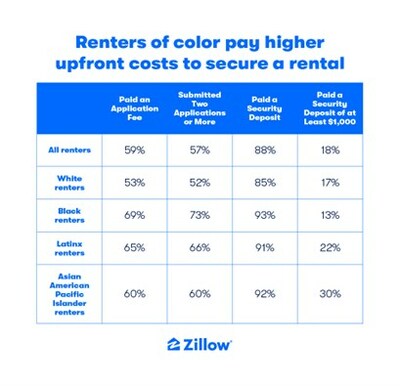

The rising costs of renting have disproportionately affected renters of color, according to a recent report from Zillow. Black, Latinx, and Asian American Pacific Islander renters face application fees 43% higher than their white counterparts. A significant 30% of AAPI renters report security deposits of at least $1,000, compared to just 17% of white renters. Zillow’s Consumer Housing Trends Report shows that Black and Latinx renters are nearly twice as likely to submit five or more applications, often incurring $50 fees per application. Zillow aims to alleviate these costs with an online application process, allowing renters to apply for multiple rentals for a flat fee. However, most renters (85%) still report paying security deposits averaging between $500 and $999, further straining their finances.

Positive

- Zillow's online application process allows renters to apply for multiple rentals for a flat fee, potentially saving them over $100.

- The universal application feature uses a 'soft' credit pull, helping renters protect their credit scores.

Negative

- Renters of color face significantly higher upfront costs, exacerbating financial strain.

- High application fees (averaging $50) and security deposits (often $500-$999) pose barriers to securing rentals.

News Market Reaction 1 Alert

On the day this news was published, ZG gained 2.59%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Higher security deposits and more application fees add to an already stressful and pricey renting experience

- Black, Latinx and Asian American Pacific Islander renters report paying application fees that are

43% higher than those paid by white renters. 30% of Asian American Pacific Islander renters report paying at least$1,000 for a security deposit compared to17% of white renters.- Zillow allows renters to apply for an unlimited number of participating rentals for 30 days for a flat fee.

SEATTLE, April 6, 2023 /PRNewswire/ -- It's more difficult than ever to afford a rental after prices skyrocketed during the pandemic. With affordability as tight as it is, the upfront costs for renting are a major burden that could put the cost of moving to a new rental out of reach. Renters of color are more likely to report paying these upfront costs, and oftentimes, the fees are higher.

According to Zillow's Consumer Housing Trends Report1, the typical Black, Latinx and Asian American Pacific Islander (AAPI) renter all reported spending

"Monthly rent prices are nearly the highest they've ever been, and unfortunately for so many people, finding a place to rent comes at an even higher cost," said Manny Garcia, a population scientist at Zillow. "We so often hear about the benefits of renting and the flexibility it offers, but disparities persist, and many renters of color aren't granted the same mobility as others because of higher upfront costs."

Renters looking to lower the cost of application fees may have options. Zillow offers renters an online application process that provides renters with a single form they can use to apply to as many participating properties on Zillow as they'd like over a 30-day period for a flat fee.

Zillow data indicates that the average renter who used Zillow Applications in 2022 applied for at least three rentals. Considering the median application fee is

Application fees are not the only upfront costs to consider. Once a rental is secured, nearly all renters (

The burden is often greater for renters of color, who are more likely to report paying a more expensive security deposit:

Given these affordability constraints, it's especially important for renters to be aware of their rights in the communities where they are searching. Zillow rental listings display available local legal protections, including source of income and LGBTQ+ anti-discrimination laws. While source of income protections do not currently exist in all 50 states, Zillow believes families who depend on alternative sources of income, including housing choice vouchers, should be able to secure a comfortable home, free from discrimination. Zillow strongly supports efforts to expand these protections nationwide.

About Zillow Group

Zillow Group, Inc. (NASDAQ: Z and ZG) is reimagining real estate to make it easier to unlock life's next chapter. As the most visited real estate website in the United States, Zillow® and its affiliates offer customers an on-demand experience for selling, buying, renting, or financing with transparency and ease.

Zillow Group's affiliates and subsidiaries include Zillow®; Zillow Premier Agent®; Zillow Home Loans™; Zillow Closing Services™; Trulia®; Out East®; StreetEasy®; HotPads®; and ShowingTime+℠ , which houses ShowingTime®, Bridge Interactive®, and dotloop® and interactive floor plans. Zillow Home Loans, LLC is an Equal Housing Lender, NMLS #10287 (www.nmlsconsumeraccess.org).

1 2022 Zillow Consumer Housing Trends Report. Zillow Group Population Science conducted a nationally representative survey of 8,300 unique renters — more than 2,500 recent renters and 5,700 tenured renters. The study was fielded between March and June 2022.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/renters-of-color-pay-higher-upfront-costs-301791394.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/renters-of-color-pay-higher-upfront-costs-301791394.html

SOURCE Zillow