YY Group Holding Limited Projects US$28 Million for New Integrated Facility Management Division Following Property Facility Services Pte. Ltd. Acquisition

YY Group Holding (NASDAQ: YYGH) has announced the acquisition of Property Facility Services Pte. (PFS), marking a significant expansion into the Integrated Facility Management (IFM) industry. The strategic move combines PFS's 24 years of expertise with YY Group's existing cleaning division and Hong Ye Group operations.

The Company projects revenue growth of US$28 million over the next three years from this integration. The acquisition positions YYGH to capitalize on Singapore's IFM market, which is expected to reach USD 4.25 billion by 2030 with a 3.1% CAGR (2025-2030). The global IFM market is projected to grow from USD 117.7 billion in 2023 to USD 218.6 billion by 2032.

The new IFM division will focus on key performance metrics including work order completion rate, preventative maintenance compliance, customer satisfaction, energy consumption, and space utilization rate.

YY Group Holding (NASDAQ: YYGH) ha annunciato l'acquisizione di Property Facility Services Pte. (PFS), segnando un'espansione significativa nel settore della gestione integrata delle strutture (IFM). Questa mossa strategica unisce i 24 anni di esperienza di PFS con la divisione di pulizie esistente di YY Group e le operazioni del Hong Ye Group.

La società prevede una crescita dei ricavi di 28 milioni di dollari USA nei prossimi tre anni grazie a questa integrazione. L'acquisizione pone YYGH in una posizione vantaggiosa per capitalizzare il mercato IFM di Singapore, che si prevede raggiunga 4,25 miliardi di dollari USA entro il 2030, con un CAGR del 3,1% (2025-2030). Il mercato globale dell'IFM è previsto crescere da 117,7 miliardi di dollari USA nel 2023 a 218,6 miliardi di dollari USA entro il 2032.

La nuova divisione IFM si concentrerà su metriche chiave di prestazione, tra cui il tasso di completamento degli ordini di lavoro, la conformità alla manutenzione preventiva, la soddisfazione del cliente, il consumo energetico e il tasso di utilizzo degli spazi.

YY Group Holding (NASDAQ: YYGH) ha anunciado la adquisición de Property Facility Services Pte. (PFS), marcando una expansión significativa en la industria de gestión integrada de instalaciones (IFM). Este movimiento estratégico combina los 24 años de experiencia de PFS con la división de limpieza existente de YY Group y las operaciones del Hong Ye Group.

La compañía proyecta un crecimiento de ingresos de 28 millones de dólares estadounidenses en los próximos tres años gracias a esta integración. La adquisición posiciona a YYGH para aprovechar el mercado de IFM en Singapur, que se espera alcance 4,25 mil millones de dólares estadounidenses para 2030 con un CAGR del 3,1% (2025-2030). Se proyecta que el mercado global de IFM crecerá de 117,7 mil millones de dólares estadounidenses en 2023 a 218,6 mil millones de dólares estadounidenses para 2032.

La nueva división de IFM se centrará en métricas clave de rendimiento, incluyendo la tasa de finalización de órdenes de trabajo, el cumplimiento del mantenimiento preventivo, la satisfacción del cliente, el consumo de energía y la tasa de utilización del espacio.

YY Group Holding (NASDAQ: YYGH)는 Property Facility Services Pte. (PFS)의 인수를 발표하며 통합 시설 관리(IFM) 산업으로의 중요한 확장을 의미합니다. 이 전략적 조치는 PFS의 24년간의 전문성을 YY Group의 기존 청소 부서 및 Hong Ye Group 운영과 결합합니다.

회사는 이 통합으로 인해 향후 3년 동안 2800만 달러의 수익 성장을 전망하고 있습니다. 이 인수는 YYGH가 싱가포르의 IFM 시장을 활용할 수 있는 위치에 놓이게 하며, 이 시장은 2030년까지 42억 5천만 달러에 이를 것으로 예상되며, 연평균 성장률(CAGR)은 2025년부터 2030년까지 3.1%로 추정됩니다. 글로벌 IFM 시장은 2023년 1177억 달러에서 2032년 2186억 달러로 성장할 것으로 예상됩니다.

새로운 IFM 부서는 작업 주문 완료율, 예방 유지보수 준수, 고객 만족도, 에너지 소비 및 공간 활용률과 같은 주요 성과 지표에 집중할 것입니다.

YY Group Holding (NASDAQ: YYGH) a annoncé l'acquisition de Property Facility Services Pte. (PFS), marquant une expansion significative dans l'industrie de la gestion intégrée des installations (IFM). Ce mouvement stratégique associe les 24 ans d'expertise de PFS avec la division nettoyage existante de YY Group et les opérations du Hong Ye Group.

La société prévoit une croissance des revenus de 28 millions de dollars USD au cours des trois prochaines années grâce à cette intégration. L'acquisition positionne YYGH pour tirer parti du marché IFM à Singapour, qui devrait atteindre 4,25 milliards de dollars USD d'ici 2030, avec un taux de croissance annuel composé (CAGR) de 3,1 % (2025-2030). Le marché mondial de l'IFM devrait passer de 117,7 milliards de dollars en 2023 à 218,6 milliards de dollars d'ici 2032.

La nouvelle division IFM se concentrera sur des indicateurs de performance clés, y compris le taux d'achèvement des commandes de travail, la conformité à la maintenance préventive, la satisfaction client, la consommation d'énergie et le taux d'utilisation de l'espace.

YY Group Holding (NASDAQ: YYGH) hat die Übernahme von Property Facility Services Pte. (PFS) bekannt gegeben, was eine bedeutende Expansion in die Branche des integrierten facility managements (IFM) markiert. Dieser strategische Schritt kombiniert die 24-jährige Expertise von PFS mit der bestehenden Reinigungsabteilung von YY Group und den Operationen der Hong Ye Group.

Das Unternehmen prognostiziert eine Umsatzsteigerung von 28 Millionen USD über die nächsten drei Jahre durch diese Integration. Die Übernahme positioniert YYGH, um vom IFM-Markt in Singapur zu profitieren, der voraussichtlich bis 2030 4,25 Milliarden USD erreichen wird mit einer jährlichen Wachstumsrate (CAGR) von 3,1 % (2025-2030). Der globale IFM-Markt wird voraussichtlich von 117,7 Milliarden USD im Jahr 2023 auf 218,6 Milliarden USD bis 2032 wachsen.

Die neue IFM-Abteilung wird sich auf wichtige Leistungskennzahlen konzentrieren, einschließlich der Abschlussquote von Arbeitsaufträgen, der Einhaltung präventiver Wartungsmaßnahmen, der Kundenzufriedenheit, des Energieverbrauchs und der Raumnutzung.

- Projected revenue increase of US$28 million over next three years

- Entry into Singapore's IFM market worth USD 4.25 billion by 2030

- Integration with existing cleaning division enhances service portfolio

- Access to PFS's 24 years of industry expertise

- None.

Insights

The acquisition marks a calculated expansion into the high-growth IFM sector, with several compelling financial implications for YYGH. The projected

The Singapore market opportunity is particularly attractive, with the local IFM sector projected to grow at a

Key value drivers include:

- Operational synergies through integration with existing cleaning division

- Enhanced service breadth leading to larger contract opportunities

- Recurring revenue model improving earnings visibility

- Technology-enabled services commanding premium pricing

The focus on metrics like work order completion and preventative maintenance compliance suggests a sophisticated approach to operational efficiency that should support margin expansion. The emphasis on energy consumption monitoring also positions YYGH to capitalize on growing demand for sustainable facility management solutions, a premium segment of the market.

The strategic timing of this acquisition coincides with several favorable market dynamics. The IFM sector is experiencing a fundamental shift as organizations increasingly prioritize outsourced, integrated solutions over fragmented service providers. This trend is particularly pronounced in Singapore, where real estate and high operating costs drive demand for efficient facility management.

Market analysis reveals three critical growth catalysts:

- Rising adoption of smart building technologies requiring sophisticated management solutions

- Increasing focus on sustainability and energy efficiency

- Post-pandemic emphasis on health and safety protocols in facility management

The acquisition positions YYGH to capture premium market segments through PFS's 24-year expertise and established client relationships. The combined entity's ability to offer comprehensive IFM solutions addresses the growing client preference for single-source providers capable of managing complex facility portfolios.

The focus on key performance metrics aligns with industry best practices and positions YYGH to compete effectively against larger international players. The emphasis on preventative maintenance and space utilization particularly resonates with Singapore's property market dynamics, where operational efficiency directly impacts property values and tenant satisfaction.

Singapore, Feb. 03, 2025 (GLOBE NEWSWIRE) -- YY Group Holding Limited (NASDAQ: YYGH) (“YY Group,” “YYGH,” or the “Company”) proudly announces the successful acquisition of Property Facility Services Pte. Ltd. ("PFS"). This strategic acquisition strengthens YY Group’s position in the Integrated Facility Management (IFM) industry and lays the groundwork for a transformative approach to facility management services.

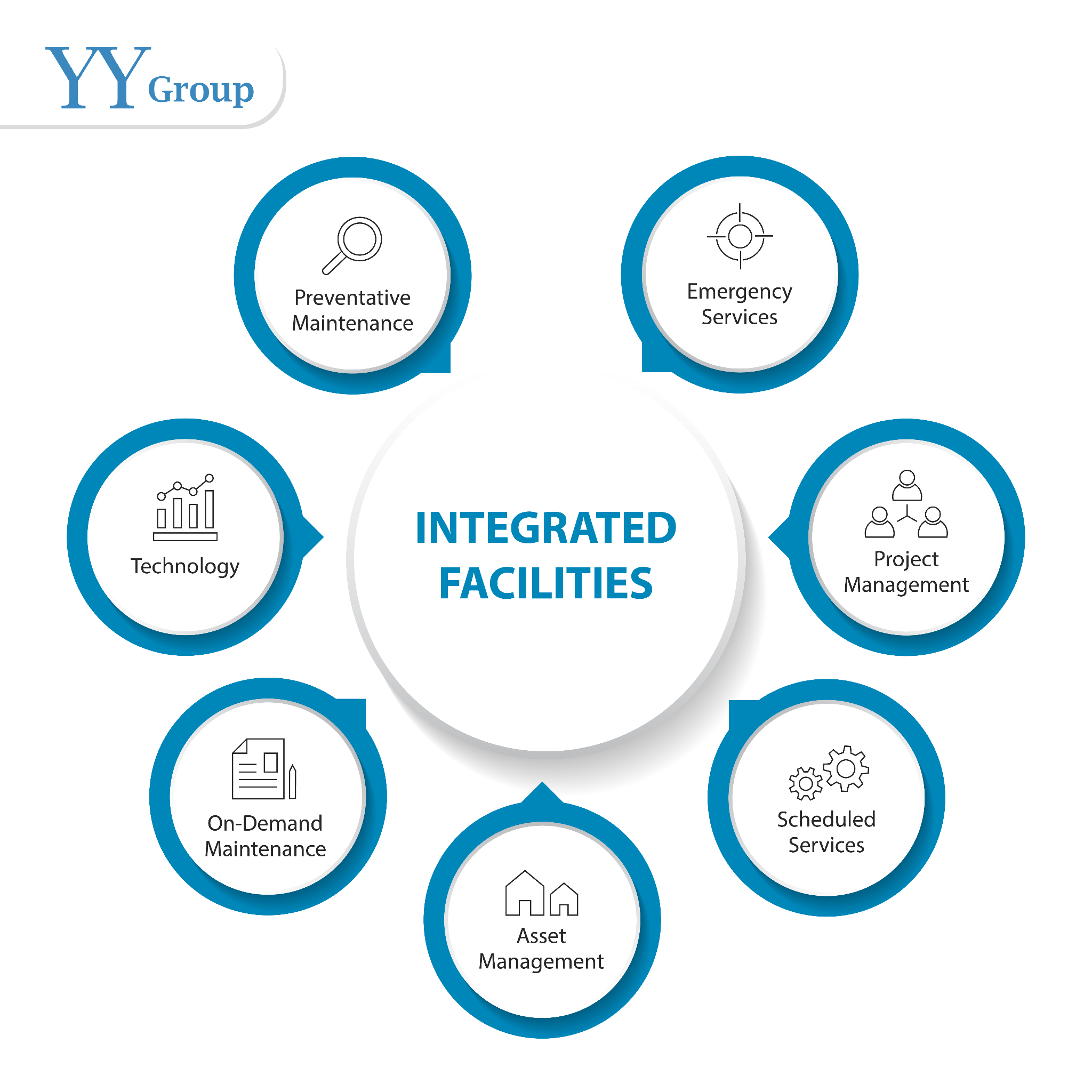

Image credit: YY Group Holding Limited.

PFS’s well-established reputation, underpinned by 24 years of industry expertise, was a key factor in YY Group’s decision. PFS operates within an IFM market that is projected to reach USD 4.25 billion in Singapore by 2030, growing at a Compound Annual Growth Rate (CAGR) of

By integrating PFS with the Company’s existing cleaning division and that of Hong Ye Group Pte. Ltd., YY Group aims to create a comprehensive IFM division capable of delivering seamless, cost-effective, and sustainable solutions to its clients. The combined expertise and resources will position YY Group as a leader in Singapore’s IFM sector, offering enhanced services tailored to evolving client needs.

Image credit: Property Facility Services Pte. Ltd.

The acquisition brings significant added value to YY Group’s operations and its investors. Projections indicate that this strategic move will drive an increase in revenue by US

Key Industry Success Metrics

To ensure the success of the new IFM division, YY Group will focus on critical performance indicators, including:

- Work Order Completion Rate: Measuring operational efficiency by tracking the percentage of timely completed tasks.

- Preventative Maintenance Compliance: Ensuring adherence to scheduled maintenance activities to minimize downtime.

- Customer Satisfaction: Regularly evaluating service quality through client feedback.

- Energy Consumption: Monitoring and optimizing energy usage to support sustainability goals.

- Space Utilization Rate: Analyzing how facilities are used to improve cost efficiency and effectiveness.

These metrics will guide YY Group’s commitment to delivering exceptional service, operational excellence, and measurable results for stakeholders.

Driving Growth Through Innovation and Value-Added Services

This acquisition aligns with YY Group’s strategy to enhance its digital and operational capabilities. Through the integration of advanced technologies and sustainable practices, YY Group is poised to meet the growing demand for intelligent and green facility management solutions.

About YY Group Holdings Limited:

YY Group Holding Limited is a Singapore-based data and technology-driven company that specializes in creating enterprise intelligent labor matching services and smart cleaning solutions. Rooted in innovation and a commitment to user-centric experiences.

For more information on the Company, please log on to https://yygroupholding.com/.

About Property Facility Services Pte Ltd:

Property Facility Services is a premier managing agent specializing in the management and maintenance of properties across Singapore. With a client-centric approach and a commitment to operational excellence, PFS has built a solid reputation for delivering efficient, reliable, and tailored property management solutions. Its extensive experience and industry knowledge make it a trusted partner for property owners and residents alike.

Investor Contact:

Phua Zhi Yong, Chief Financial Officer

YY Group

Enquiries@yygroupholding.com