Gold Terra Announces a 2 Year Extension on Option Agreement with Newmont to November 21st, 2027 to purchase 100% of Past Producing 16 g/t Gold Con Mine, Yellowknife, NWT

Gold Terra Resource Corp. (TSX-V:YGT, OTCQX:YGTFF) has extended its option agreement with Newmont subsidiaries to six years, allowing the company to purchase 100% of the past-producing Con Mine in Yellowknife, NWT. The extension provides Gold Terra more time to complete its evaluation before exercising the option. Key highlights include:

- Commitment to incur C$8 million in exploration expenditures over six years

- Requirement to complete a Pre-Feasibility Study with a minimum of 1.5 Moz resource

- Final cash payment of C$8 million upon closing

- Newmont retains a 2% NSR and a two-year back-in right for 51% interest

The agreement covers the Con Mine Property, which historically produced 6.1 Moz of gold at 16-20 g/t. Gold Terra's current drilling program aims to expand its initial Mineral Resource Estimate of 109,000 Indicated ounces and 432,000 Inferred ounces.

Gold Terra Resource Corp. (TSX-V:YGT, OTCQX:YGTFF) ha esteso il suo accordo di opzione con le sussidiarie di Newmont a sei anni, consentendo all'azienda di acquistare il 100% della storica miniera Con a Yellowknife, NWT. L'estensione offre a Gold Terra più tempo per completare la sua valutazione prima di esercitare l'opzione. I punti salienti includono:

- Impegno a sostenere C$8 milioni in spese di esplorazione nell'arco di sei anni

- Requisito di completare uno Studio di Pre-Fattibilità con un minimo di 1,5 Moz di risorse

- Pagamento finale in contanti di C$8 milioni al momento della chiusura

- Newmont mantiene un 2% NSR e un diritto di riacquisto di due anni per il 51% di interesse

L'accordo copre la proprietà della miniera Con, che storicamente ha prodotto 6,1 Moz di oro a 16-20 g/t. Il programma di perforazione attuale di Gold Terra mira ad ampliare la sua stima iniziale di Risorse Minerarie di 109.000 once Indicate e 432.000 once Inferred.

Gold Terra Resource Corp. (TSX-V:YGT, OTCQX:YGTFF) ha extendido su acuerdo de opción con las subsidiarias de Newmont a seis años, permitiendo a la empresa adquirir el 100% de la histórica mina Con en Yellowknife, NWT. La extensión brinda a Gold Terra más tiempo para completar su evaluación antes de ejercer la opción. Los aspectos destacados incluyen:

- Compromiso de incurrir en C$8 millones en gastos de exploración durante seis años

- Requisito de completar un Estudio de Pre-Factibilidad con un mínimo de 1,5 Moz de recursos

- Pago final en efectivo de C$8 millones al cerrar

- Newmont retiene un 2% NSR y un derecho de recompra de dos años para el 51% de interés

El acuerdo cubre la propiedad de la mina Con, que históricamente produjo 6,1 Moz de oro a 16-20 g/t. El programa de perforación actual de Gold Terra tiene como objetivo expandir su estimación inicial de Recursos Minerales de 109.000 onzas Indicadas y 432.000 onzas Inferidas.

Gold Terra Resource Corp. (TSX-V:YGT, OTCQX:YGTFF)는 Newmont 자회사가 옵션 계약을 6년으로 연장했다고 발표했습니다. 이를 통해 회사는 NWT의 Yellowknife에 있는 과거 생산된 Con 광산의 100%를 구매할 수 있습니다. 이번 연장은 Gold Terra가 옵션을 행사하기 전에 평가를 완료할 수 있는 더 많은 시간을 제공합니다. 주요 사항은 다음과 같습니다:

- 6년 동안 800만 캐나다 달러의 탐사 비용 발생 약속

- 150만 온스 최소 자원이 포함된 예비 타당성 조사 완료 필요

- 거래 완료 시 800만 캐나다 달러의 최종 현금 지급

- Newmont는 2% NSR과 51% 지분에 대한 2년 후입권을 유지합니다.

이번 계약은 역사적으로 6.1 Moz의 금을 16-20 g/t의 품위로 생산한 Con 광산 부지를 포함합니다. 현재 Gold Terra의 드릴링 프로그램은 109,000 인디케이티드 온스 및 432,000 인퍼레드 온스의 초기 광물 자원 추정치를 확장하는 것을 목표로 하고 있습니다.

Gold Terra Resource Corp. (TSX-V:YGT, OTCQX:YGTFF) a prolongé son accord d'option avec les filiales de Newmont pour six ans, permettant à l'entreprise d'acquérir 100 % de l'ancienne mine Con à Yellowknife, NWT. Cette extension donne à Gold Terra plus de temps pour finaliser son évaluation avant d'exercer l'option. Les points clés incluent :

- Engagement à engager 8 millions de CAD en dépenses d'exploration sur six ans

- Obligation de réaliser une étude de faisabilité préliminaire avec un minimum de 1,5 Moz de ressources

- Paiement final en espèces de 8 millions de CAD lors de la conclusion

- Newmont conserve un 2% NSR et un droit de retour de deux ans pour 51% d'intérêt

L'accord couvre la propriété de la mine Con, qui a historiquement produit 6,1 Moz d'or à 16-20 g/t. Le programme de forage actuel de Gold Terra vise à élargir son estimation initiale des ressources minérales de 109 000 onces indiquées et 432 000 onces inférées.

Gold Terra Resource Corp. (TSX-V:YGT, OTCQX:YGTFF) hat das Optionsabkommen mit den Tochtergesellschaften von Newmont auf sechs Jahre verlängert, was es dem Unternehmen ermöglicht, 100 % der früher produzierenden Con Mine in Yellowknife, NWT, zu erwerben. Die Verlängerung gibt Gold Terra mehr Zeit, um seine Bewertung abzuschließen, bevor die Option ausgeübt wird. Zu den wichtigsten Punkten gehören:

- Verpflichtung, 8 Millionen CAD für Explorationsausgaben über sechs Jahre zu tätigen

- Anforderung zur Durchführung einer Machbarkeitsstudie mit mindestens 1,5 Moz Ressourcen

- Endzahlung in bar von 8 Millionen CAD bei Abschluss

- Newmont behält einen 2% NSR und ein zwei Jahre langes Rückkaufsrecht für 51% Anteil

Das Abkommen betrifft das Con Mine Grundstück, das historisch 6,1 Moz Gold bei 16-20 g/t produzierte. Das aktuelle Bohrprogramm von Gold Terra zielt darauf ab, die anfängliche Mineralressourcenschätzung von 109.000 angezeigten Unzen und 432.000 geschätzten Unzen zu erweitern.

- Extension of option agreement provides more time for evaluation and resource delineation

- Historical high-grade production of 6.1 Moz gold at 16-20 g/t from the Con Mine

- Current mineral resource of 109,000 Indicated ounces at 7.55 g/t Au and 432,000 Inferred ounces at 6.74 g/t Au

- Access to existing infrastructure including shafts, buildings, and water treatment plant upon exercise of option

- Potential to consolidate strategic land position in the Yellowknife Gold Belt

- Requirement to incur C$8 million in exploration expenditures over six years

- Need to complete a Pre-Feasibility Study with a minimum 1.5 Moz resource to exercise option

- Final cash payment of C$8 million required to close the transaction

- Newmont retains a 2% NSR on future production

- Newmont has a back-in right for 51% interest if certain conditions are met

VANCOUVER, BC / ACCESSWIRE / September 9, 2024 / Gold Terra Resource Corp. (TSX-V:YGT)(Frankfurt:TX0)(OTCQX:YGTFF) ("Gold Terra" or the "Company") is pleased to announce it has extended its four (4) year definitive option agreement (the "Option Agreement") with Newmont Canada FN Holdings ULC ("Newmont FN") and Miramar Northern Mining Ltd. ("MNML"), both wholly owned subsidiaries of Newmont Corporation ("Newmont"), to a six (6) year agreement which grants Gold Terra the option, upon meeting certain minimum requirements, to purchase MNML from Newmont FN (the "Transaction"), which includes

Gerald Panneton, Chairman & CEO of Gold Terra, commented, "We are pleased with our continued excellent relationship with Newmont who is also a shareholder of the Company. The extension of the Option Agreement to acquire

Contained Indicated 109,000 ounces @ 7.55 g/t Au and Inferred 432,000 ounces @ 6.74 g/t Au near surface south of the Con Mine in the Yellorex area. (refer to Gold Terra Oct 21, 2022, Technical Report).

Total drilling of 31,947 metres to the end of 2023.

Total spending of approximately C

$10.9 million to the end of 2023Current 2024 drilling of more than 3,000 metres testing the down plunge of the Campbell shear.

The extended Option Agreement to six (6) years provides the Company more time to complete its evaluation before exercising its option to purchase

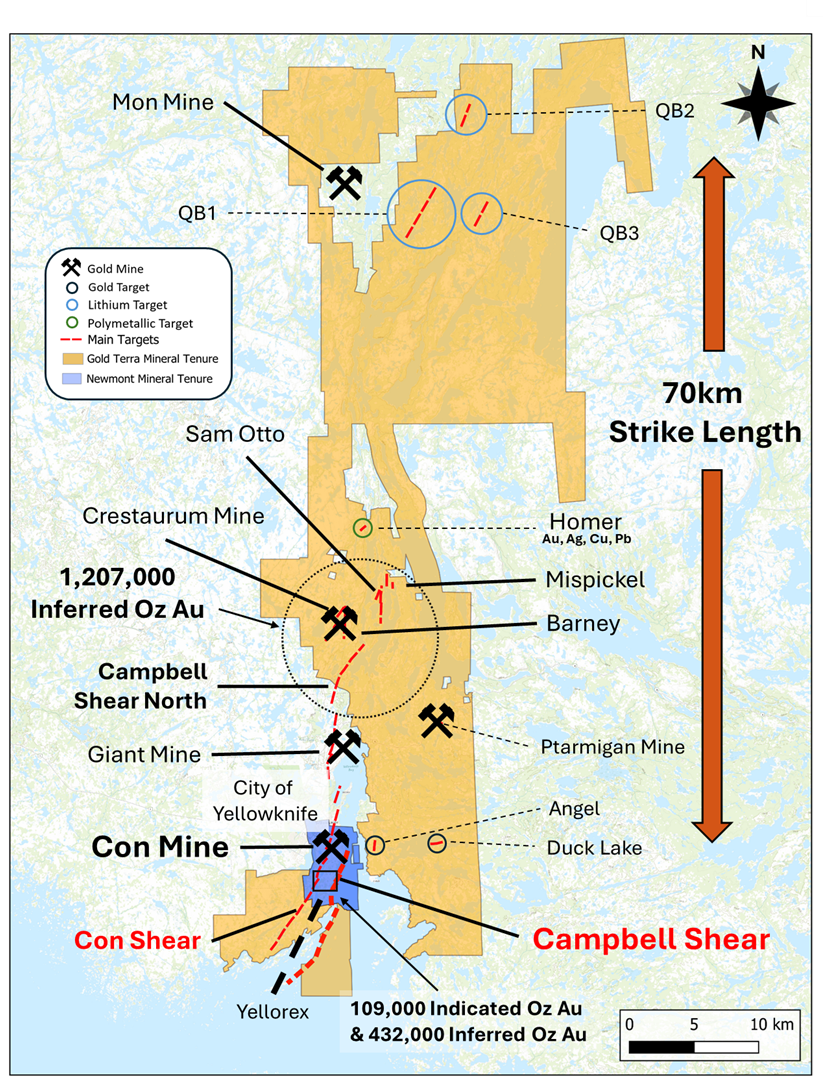

Figure 1: Con Mine Option Location

Option Agreement Highlights:

Execution of the 2021 Option Agreement to include all (

100% ) of MNML and the Con Mine Property (November 22, 2021 press release).The Option Agreement has now been extended whereby in order to retain the Earn-In Right and earn the Purchase Option, Gold Terra must, within six (6) years following the Effective Date complete the Earn-In specifications.

Gold Terra has agreed to incur a minimum of C

$8.0 million in exploration expenditures over a period of six (6) years, which will include all exploration expenditures incurred to date under the initial Exploration Agreement.Gold Terra has also agreed to:

Complete a Pre-Feasibility Study (PFS) of a mineral resource and a minimum of 1.5 Moz in all categories,

Obtain all necessary regulatory approvals for the purchase and transfer of MNML's assets and liabilities to Gold Terra,

Post a cash bond to reflect the status of the Con Mine reclamation plan at the time of closing.

The closing of the Transaction will then be completed with Gold Terra making a final cash payment of C

Newmont will retain a

After Gold Terra exercises its option, Newmont will have a period of two (2) years to exercise its one time back-in right of a

Substantial Benefits To UNLOCK

Upon exercise of the option, Gold Terra would have substantial benefit from owning

Mineral leases and overlying surface rights.

Access to infrastructure, including underground openings and shafts, buildings, storage facilities and roads. The hard assets include the original C -1 shaft opening, and the deep Robertson shaft (1,950 metres) with a 2,000 tpd (ton per day) capacity for future underground exploration and mining, valued for time and investment saving; surface infrastructure including a large 10,000 square foot warehouse and dry; surface vehicles; and a 2015 C

$20 M water treatment plant . These assets provide substantial future cost savings for potential development.Access to explore and potentially redevelop the remaining historic mineral reserves within the Con Mine Property. The Con Mine was shut down in 2003 following multiple years of low gold prices. Historically, a total of 6.1 Moz of high-grade gold were recovered from the underground Con Mine operation. Remaining historic sub-economic reserves based on a US

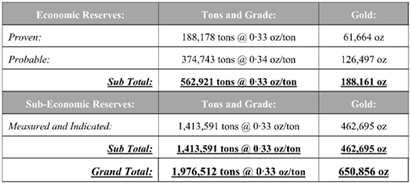

$370 /oz gold price at the Con Mine as of January 1, 2003, are shown in the following table:

Table 1: Historic Reserves as of January 1, 2003* (Source: Miramar Mining Corp Limited 2003)

*Note: The Historic Reserves and Resources quoted above are historical in nature and are not NI 43-101 compliant. They were compiled and reported by MNML during its operation and closure of the Con Mine (2003). The historical estimates are historical in nature and should not be relied upon, however, they do give indications of mineralization on the property. The Qualified Person has not done sufficient work to classify them as current Mineral Resources or Mineral Reserves and Gold Terra is not treating the historical estimates as current Mineral Resources or Mineral Reserves. (See Oct. 21, 2022 Technical Report)

Con Mine Option Property Deep Drilling Program

The objective of the upcoming Phase 2 drilling program is to continue testing for high-grade gold in the Campbell Shear (past production of 5.1 Moz @ 16 g/t, refer to the Oct. 21, 2022 Technical Report) on the Con Mine below the historic Con Mine underground workingsfrom the recently completed master hole GTCM24-056. Hole GTCM24-056 was drilled to a depth of 3,002 metres and will serve as a master hole from which to branch off with as many wedges as possible to evaluate the Campbell Shear in a first phase of wedge drilling from 600 metres to 700 metres below the current Robertson shaft depth, up-dip and laterally. The branching-off wedge drilling strategy from the same master hole will allow for the evaluation of the Campbell Shear with shorter and lower cost holes.

The 2024 deep drilling program aims to expand the September 2022 initial Mineral Resource Estimate ("MRE") (see September 7, 2022, press release) of 109,000 Indicated ounces of contained gold and 432,000 Inferred ounces of contained gold between surface and 400 metres below surface along a 2-kilometre corridor of the Campbell Shear (October 21, 2022 MRE titled "Initial Mineral Resource Estimate for the CMO Property, Yellowknife City Gold Project, Yellowknife, Northwest Territories, Canada") by Qualified Person, Allan Armitage, Ph. D., P. Geo., SGS Geological Services, which can be found on the Company's website athttps://www.goldterracorp.comand on SEDAR at www.sedar.com.

The technical information contained in this news release has been reviewed and approved by Joseph Campbell, Chief Operating Officer, a Qualified Person as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Corporate Update

The Company is pleased to announce the engagement of David Sears, DS Market Solutions Inc. (DS), to provide the Company with capital markets advisory and market-making services. DS will trade the securities of the Company on the TSXV for the purpose of maintaining an orderly market "in compliance with the provisions of TSXV Policy 3.4". In consideration of the services provided by DS, the Company will pay DS a monthly fee of

DS is an equity trading advisor to issuers looking to enhance liquidity in their public traded securities. DS was incorporated in Mississauga, Ontario in April 2024 and the offices of DS are located in Mississauga, Ontario. Mr. David Sears is the sole owner of DS and will be providing the services on behalf of DS. DS Market's contact is davidsears@dsmarketsolutions.com.

Town Hall Meeting with Drilling Update

The Company is pleased to announce that it will host a Town Hall Meeting on October 1st, 2024, at 5:30pm MDT at the Yellowknife Historical Society Museum, #510 Access Road, Yellowknife.

Gerald Panneton, Chairman & CEO, will provide shareholders and interested investors an update on the drilling program and answer any questions that investors may have regarding the Company's vision and exploration plans for the upcoming year.

About Gold Terra

The Yellowknife Project (YP) encompasses 918 sq. km of contiguous land immediately north, south and east of the City of Yellowknife in the Northwest Territories. Through a series of acquisitions, Gold Terra controls one of the six major high-grade gold camps in Canada. Being within 10 kilometres of the City of Yellowknife, the YP is close to vital infrastructure, including all-season roads, air transportation, service providers, hydro-electric power, and skilled tradespeople. Gold Terra is currently focusing its drilling on the prolific Campbell Shear, where approximately 14 Moz of gold has been produced, (refer to Gold Terra Oct 21, 2022, Technical Report) and most recently on the Con Mine Option (CMO) property claims immediately south of the past producing Con Mine which produced 6.1 Moz between the Con, Rycon, and Campbell shear structures (1938-2003).

The YP and CMO properties lie on the prolific Yellowknife greenstone belt, covering nearly 70 kilometres of strike length along the main mineralized shear system that hosts the former-producing high-grade Con and Giant gold mines. The Company's exploration programs have successfully identified significant zones of gold mineralization and multiple targets that remain to be tested which reinforces the Company's objective of re-establishing Yellowknife as one of the premier gold mining districts in Canada.

Visit our website at www.goldterracorp.com.

For more information, please contact:

Gerald Panneton, Chairman & CEO

gpanneton@goldterracorp.com

Mara Strazdins, Investor Relations

Phone: 1-778-897-1590 | 604-689-1749 ext 102

strazdins@goldterracorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Information Concerning Estimates of Mineral Resources

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Therefore, investors are cautioned not to assume that all or any part of an Inferred Mineral Resource could ever be mined economically. It cannot be assumed that all or any part of "Measured Mineral Resources," "Indicated Mineral Resources," or "Inferred Mineral Resources" will ever be upgraded to a higher category. The Mineral Resource estimates contained herein may be subject to legal, political, environmental or other risks that could materially affect the potential development of such mineral resources. Refer to the Technical Report, once filed, for more information with respect to the key assumptions, parameters, methods and risks of determination associated with the foregoing.

Cautionary Note to United States Investors

The Company prepares its disclosure in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Terms relating to Mineral Resources in this news release are defined in accordance with NI 43-101 under the guidelines set out in CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the Canadian Institute of Mining, Metallurgy and Petroleum Council on May 19, 2014, as amended ("CIM Standards"). The U.S. Securities and Exchange Commission (the "SEC") has adopted amendments effective February 25, 2019 (the "SEC Modernization Rules") to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the U.S. Securities Exchange Act of 1934. As a result of the adoption of the SEC Modernization Rules, the SEC will now recognize estimates of "Measured Mineral Resources", "Indicated Mineral Resources" and "Inferred Mineral Resources", which are defined in substantially similar terms to the corresponding CIM Standards. In addition, the SEC has amended its definitions of "Proven Mineral Reserves" and "Probable Mineral Reserves" to be substantially similar to the corresponding CIM Standards.

U.S. investors are cautioned that while the foregoing terms are "substantially similar" to corresponding definitions under the CIM Standards, there are differences in the definitions under the SEC Modernization Rules and the CIM Standards. Accordingly, there is no assurance any Mineral Resources that the Company may report as "Measured Mineral Resources", "Indicated Mineral Resources" and "Inferred Mineral Resources" under NI 43-101 would be the same had the Company prepared the Mineral Resource estimates under the standards adopted under the SEC Modernization Rules. In accordance with Canadian securities laws, estimates of "Inferred Mineral Resources" cannot form the basis of feasibility or other economic studies, except in limited circumstances where permitted under NI 43-101.

Cautionary Note Regarding Forward-Looking Information

Certain statements made and information contained in this news release constitute "forward-looking information" within the meaning of applicable securities legislation ("forward-looking information"). Generally, this forward-looking information can, but not always, be identified by use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or statements that certain actions, events, conditions or results "will", "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connotations thereof.

All statements other than statements of historical fact may be forward-looking information. Forward-looking information is necessarily based on estimates and assumptions that are inherently subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information. In particular, this news release contains forward-looking information regarding the current drilling on the Campbell Shear, potentially adding ounces to the Company's current YCG mineral resource, and the Company's objective of re-establishing Yellowknife as one of the premier gold mining districts in Canada.

There can be no assurance that such statements will prove to be accurate, as the Company's actual results and future events could differ materially from those anticipated in this forward-looking information as a result of the factors discussed in the "Risk Factors" section in the Company's most recent MD&A and annual information form available under the Company's profile at www.sedar.com.

Although the Company has attempted to identify important factors that would cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. The forward-looking information contained in this news release is based on information available to the Company as of the date of this news release. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. All of the forward-looking information contained in this news release is qualified by these cautionary statements. Readers are cautioned not to place undue reliance on forward-looking information due to the inherent uncertainty thereof. Except as required under applicable securities legislation and regulations applicable to the Company, the Company does not intend, and does not assume any obligation, to update this forward-looking information.

SOURCE: Gold Terra Resource Corp

View the original press release on accesswire.com