Ximen Mining Financing Fully Subscribed and Submits for Closing

Ximen Mining Corp has fully subscribed its private placement offering of 8 million units at $0.07 per unit, raising $560,000. Each unit includes one common share and one purchase warrant, exercisable at $0.10 for five years. Participation may include insiders, with a finder's fee possible upon TSX-V approval. Net proceeds will fund exploration in British Columbia and support general working capital. There are no undisclosed material changes, and all securities will have a four-month hold period after closing.

- Private placement successfully fully subscribed, raising $560,000.

- Proceeds will be used for exploration and working capital.

- None.

VANCOUVER, BC / ACCESSWIRE / July 4, 2022 ./ Ximen Mining Corp. (TSXV:XIM)(FRA:1XMA)(OTCQB:XXMMF) (the "Company" or "Ximen") is pleased to announce that its previously announced private placement on June 28, 2022, is fully subscribed and the Company is submitting documentation with the TSX Venture Exchange to close the placement.

The non-brokered private placement is for 8 million units at a price of

Directors, officers or other insiders of the Company may participate in the foregoing offerings, and such parties may sell securities of the Company owned or controlled by them personally through the facilities of the TSX Venture Exchange to finance participation in such offerings. There is no material fact or material change of the Company that has not been generally disclosed. A finder's fee may be paid to eligible finders in accordance with the TSX Venture Exchange policies. All securities issued pursuant to the offering will be subject to a hold period of four months and one day from the date of closing. The offering and payment of finders' fees are both subject to approval by the TSX-V. The net proceeds from the Offering will be used by the Company for exploration expenses on the Company's British Columbia mineral properties and general working capital.

On behalf of the Board of Directors,

"Christopher R. Anderson"

Christopher R. Anderson,

President, CEO and Director

604 488-3900

Investor Relations:

Sophy Cesar,

604-488-3900,

ir@XimenMiningCorp.com

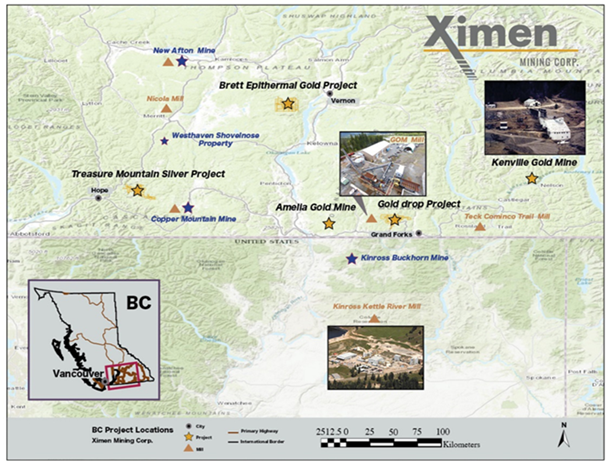

About Ximen Mining Corp.

Ximen Mining Corp. owns

This press release includes certain statements that may be deemed "forward-looking statements" within the meaning of Canadian securities legislation. All statements in this release, other than statements of historical facts, that address future exploration drilling, exploration activities and events or developments that the Company expects, are forward looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include exploitation and exploration successes, continued availability of financing, and general economic, market or business conditions. The reader is urged to refer to the Company's reports, publicly available through the Canadian Securities Administrators' System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com for a more complete discussion of such risk factors and their potential effects.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any state in the United States in which such offer, solicitation or sale would be unlawful.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Ximen Mining Corp.

View source version on accesswire.com:

https://www.accesswire.com/707484/Ximen-Mining-Financing-Fully-Subscribed-and-Submits-for-Closing

FAQ

What is the private placement amount by Ximen Mining Corp?

How many units did Ximen Mining Corp issue in the private placement?

What is the exercise price of warrants in Ximen Mining's private placement?

What will the proceeds from the private placement be used for?