Ximen Mining Closes $1,322,510 of Private Placement

Ximen Mining Corp. has successfully closed the first and second tranches of a private placement, raising gross proceeds of $1,322,510. The placement involved issuing 8,816,733 units at $0.15 each, with each unit comprising one common share and one purchase warrant exercisable at $0.25 for two years. The proceeds will fund exploration activities in British Columbia and for general working capital. Notably, a director participated in the offering, qualifying it as a related party transaction.

- Raised gross proceeds of $1,322,510 through successful private placements.

- Funds will support exploration activities in British Columbia and working capital.

- The transaction involved a related party, requiring exemptions from formal valuation and minority shareholder approval.

VANCOUVER, BC / ACCESSWIRE / April 20, 2022 / Ximen Mining Corp. (TSX.V:XIM)(FRA:1XMA)(OTCQB:XXMMF) (the "Company" or "Ximen") announces that it has closed the first tranche and second tranche of the private placement previously announced on April 1, 2022 for gross proceeds of

The first tranche totaled 6,966,733 shares and the Company paid a cash commission of

The second tranche totaled 1,850,000 shares and the Company paid a cash commission of

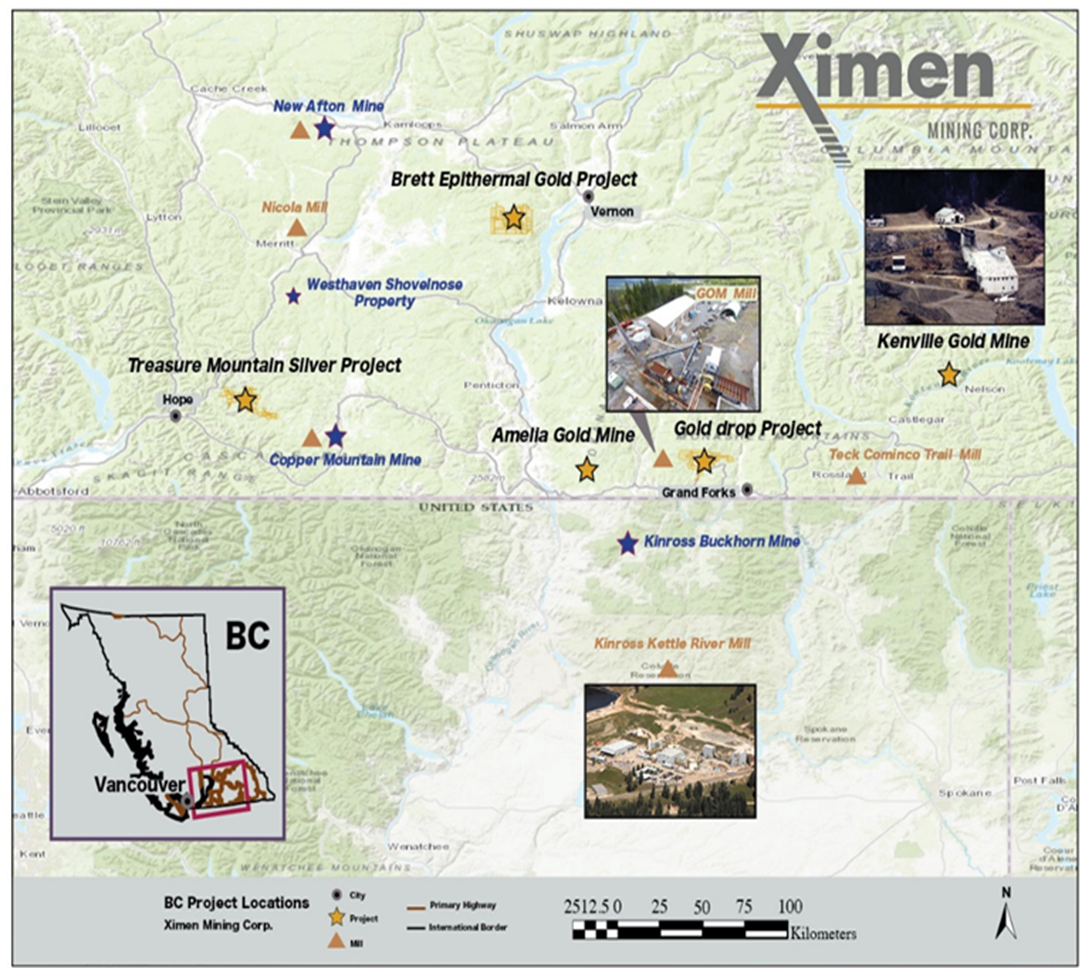

The net proceeds from the Offering will be used by the Company for exploration expenses on the Company's British Columbia mineral properties and general working capital. The closing of the first and second tranches of the private placement financing is subject to final TSX-V approval

Christopher Anderson a director and/or officer of the Company, participated in the Offering constituting a related party transaction pursuant to TSX Venture Exchange Policy 5.9 and Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The Company relied on section 5.5(a) of MI 61-101 for an exemption from the formal valuation requirement and section 5.7(1)(a) of MI 61-101 for an exemption from the minority shareholder approval requirement of MI 61-101 as the fair market value of the transaction did not exceed

On behalf of the Board of Directors,

"Christopher R. Anderson"

Christopher R. Anderson,

President, CEO and Director

604 488-3900

Investor Relations:

Sophy Cesar

604-488-3900

ir@XimenMiningCorp.com

About Ximen Mining Corp.

Ximen Mining Corp. owns

Ximen is a publicly listed company trading on the TSX Venture Exchange under the symbol XIM, in the USA under the symbol XXMMF, and in Frankfurt, Munich, and Berlin Stock Exchanges in Germany under the symbol 1XMA and WKN with the number as A2JBKL.

This press release contains certain "forward-looking statements" within the meaning of Canadian securities This press release contains certain "forward-looking statements" within the meaning of Canadian securities legislation, including statements regarding the receipt of TSX Venture Exchange approval and the exercise of the Option by Ximen. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are statements that are not historical facts; they are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "aims," "potential," "goal," "objective," "prospective," and similar expressions, or that events or conditions "will," "would," "may," "can," "could" or "should" occur, or are those statements, which, by their nature, refer to future events. The Company cautions that forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made and they involve a number of risks and uncertainties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Except to the extent required by applicable securities laws and the policies of the TSX Venture Exchange, the Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change. Factors that could cause future results to differ materially from those anticipated in these forward-looking statements include the possibility that the TSX Venture Exchange may not accept the proposed transaction in a timely manner, if at all. The reader is urged to refer to the Company's reports, publicly available through the Canadian Securities Administrators' System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com for a more complete discussion of such risk factors and their potential effects.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any state in the United States in which such offer, solicitation or sale would be unlawful.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Ximen Mining Corp

888 Dunsmuir Street - Suite 888, Vancouver, B.C., V6C 3K4 Tel: 604-488-3900

SOURCE: Ximen Mining Corp.

View source version on accesswire.com:

https://www.accesswire.com/698289/Ximen-Mining-Closes-1322510-of-Private-Placement

FAQ

What is the purpose of Ximen Mining's private placement announced on April 20, 2022?

How much did Ximen Mining raise in its recent private placement?

What is the exercise price of the warrants issued in Ximen Mining's private placement?

What are the hold periods for shares issued in Ximen Mining's private placement?