Solitario Resources Discovers Gold in First Three Golden Crest Drill Holes

Rhea-AI Summary

Solitario Resources Corp. (NYSE American:XPL)(TSX:SLR) has announced significant gold discoveries from its first three drill holes at the Golden Crest Project. Highlights include:

- 32.0 meters averaging 1.7 g/t gold, including 14.2 meters at 3.1 g/t

- 26.4 meters averaging 2.6 g/t gold, including 14.4 meters at 4.2 g/t

The mineralization occurs within a brecciated evaporite horizon with silicification and hydrothermal alteration. The company plans to drill about a dozen core holes totaling up to 5,000 meters this year, testing two of ten high-priority target areas. Four more targets are scheduled for drilling in 2025. Solitario's Golden Crest properties are located near the Homestake-Wharf mining district, which has historically produced 52 million ounces of gold.

Positive

- Discovery of significant gold mineralization in first three drill holes

- High-grade intercepts: 32.0m @ 1.7 g/t Au and 26.4m @ 2.6 g/t Au

- Mineralization open in all directions, indicating potential for expansion

- Confirmation of subsurface gold potential from surface anomalies

- Large land position (35,000 acres) with multiple high-priority targets

- Oxidized mineralization, potentially favorable for processing

- Proximity to historic Homestake-Wharf gold district

Negative

- Early-stage exploration project with drilling to date

- Permitting still at early stages for most priority targets

- Significant additional drilling required to define resource potential

News Market Reaction 1 Alert

On the day this news was published, XPL declined 2.60%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

26.4 Meters Averaging 2.6 g/t Gold; including 14.4 Meters at 4.2 g/t

32.0 Meters Averaging 1.7 g/t Gold; including 14.2 Meters at 3.1 g/t

DENVER, CO / ACCESSWIRE / September 16, 2024 / Solitario Resources Corp. ("Solitario") (NYSE American:XPL)(TSX:SLR) is pleased to announce the results of the first three core holes ever drilled on its Golden Crest Project. All three holes intersected significant thicknesses of mineralization, with two of the holes displaying high-grade intercepts. Cross sections of the three holes can be viewed here. This zone, although currently limited in size due to the lack of offset drilling, is laterally open in all directions. Highlights include:

DDH Hole | Interval | Thickness | Grade |

Number | (meters) | (meters) | (grams/tonne) |

GC-001 | 9.1 to 41.1 | 32.0 | 1.68 |

including | 10.7 to 24.9 | 14.2 | 3.10 |

|

|

|

|

GC-002 | 7.9 to 17.8 | 9.9 | 0.72 |

| 23.3 to 33.2 | 9.9 | 1.88 |

| 40.2 to 46.3 | 6.1 | 0.55 |

|

|

|

|

GC-003 | 5.0 to 31.4 | 26.4 | 2.56 |

including | 11.4 to 25.8 | 14.4 | 4.18 |

including | 19.8 to 21.8 | 2.0 | 13.13 |

| 38.9 to 50.6 | 11.7 | 0.60 |

Estimated true thickness of reported intervals: GC-001: | |||

Chris Herald, President and CEO of Solitario, stated: "These core holes represent a true new gold discovery that are potentially part of a major new district-scale extension of the Homestake-Wharf super giant gold district. Considering that these are the first holes ever drilled on our huge 35,000-acre property, they are truly outstanding. Significant gold mineralization over substantial widths with excellent continuity was intersected in all three holes. Importantly, these results also confirm that the multiple high-quality surface anomalies we have generated during the past three years have the potential to have sizable subsurface roots in both grade and size.

We also firmly believe the best is yet to come. This year's program is only testing two of our ten best high-potential target areas. The other eight are still undergoing various stages of permitting with drilling planned on four more in 2025. We are also encouraged that other potential gold horizons below the mineralized Downpour zone are returning anomalous gold and trace element values.. With additional drilling, we will have the ability to vector into significant mineralization in structures and multiple stratigraphic horizons that have been very productive in the historic Homestake-Wharf mining district. All mineralization encountered to date is oxidized."

What Do These Results Mean and Drilling Details

Gold mineralization at Downpour occurs within an intensely brecciated evaporite stratigraphic horizon that has undergone significant silicification and hydrothermal alteration. This favorable zone is sub-horizontal and appears to occur throughout Solitario's land position. Solitario has identified a number of other high-priority prospects in this favorable horizon. Besides the excellent grade and thickness of mineralization encountered in drilling, the potential for high-grade feeder structures is considered excellent.

All three core holes were drilled at the Downpour prospect from the same platform near exceptional gold assay results in trenches (previously reported). Total meterage for the first three holes is 963.5 meters. We expect drilling to continue well into November. Remaining drilling consists of widely spaced holes over Solitario's vast 35,000-acre land holding. We are on track to complete about a dozen core holes totaling up to 5,000 meters.

Golden Crest Future Drill Hole Plans

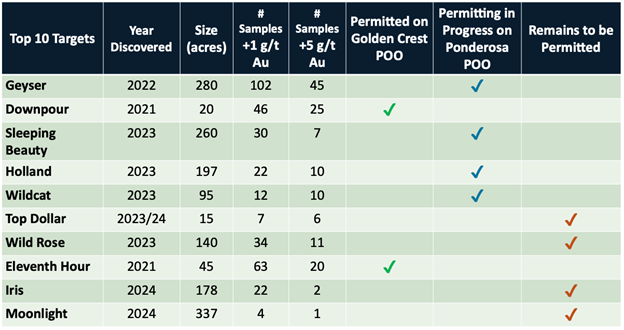

Solitario has identified ten high priority surface targets as shown in the table below. Two of the targets, Downpour and Eleventh Hour, will be drilled this year. Four new targets are currently being permitted and are scheduled to be drilled in 2025. The other four high-priority targets may undergo future permitting after further review. Besides the ten currently defined high-priority targets, Solitario has identified another dozen promising target areas that require additional surface exploration work. Three years of concentrated exploration surface work has defined approximately 80-square kilometers of gold bearing hydrothermal alteration.

Permitting Still at Early Stage for Priority Targets

Solitario's

Sample Type, Sampling Methodology, Chain of Custody, Quality Control and Assurance

All Golden Crest exploration core samples have been prepared and analyzed at the American Assay Laboratories in Reno, Nevada, which is independent from Solitario. Thorough QA/QC protocols are followed on the Project, including insertion of duplicate, blank and standard samples in the assay stream for all drill holes. The samples are collected directly from the drill rig, logged, photographed, split into two samples, and half of each sample submitted directly to American Assay Labs through secure chain of custody protocols. All activities prior to shipment are directly supervised by Solitario geologists. Samples are pulverized from a 250g sample to

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Sandor Ringhoffer, CPG, SME RM, a geologic consultant of Solitario, who is a qualified person as defined by NI 43-101, Standards of Disclosure for Mineral Projects.

About Solitario

Solitario is a natural resource exploration company focused on high-quality Tier-1 gold and zinc exploration projects. The Company is traded on the NYSE American ("XPL") and on the Toronto Stock Exchange ("SLR"). In addition to its South Dakota property holdings, Solitario holds a

Solitario has a long history of committed Environmental, Social and Responsible Governance ("ESG") of its business. We realize ESG issues are also important to investors, employees, and all stakeholders, including communities in which we work. We are committed to conducting our business in a manner that supports positive environmental and social initiatives and responsible corporate governance. Importantly, we work with joint venture partners that not only value the importance of ESG issues in the conduct of their business on our joint venture projects but are leaders in the industry in this important segment of our business.

For More Information Please Contact:

Chris Herald, President and CEO

Solitario Resources Corp.

Tel. 303-534-1030 ext. 1

Cautionary Statement Regarding Forward Looking Information

This press release contains forward-looking statements within the meaning of the U.S. Securities Act of 1933 and the U.S. Securities Exchange Act of 1934, and as defined in the United States Private Securities Litigation Reform Act of 1995 (and the equivalent under Canadian securities laws),that are intended to be covered by the safe harbor created by such sections. Forward-looking statements are statements that are not historical facts. They are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made and address activities, events or developments that Solitario expects or anticipates will or may occur in the future, and are based on current expectations and assumptions. Forward-looking statements involve numerous risks and uncertainties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Solitario's Golden Crest land position does not cover any of the areas of historical gold production or historical unmined resources. Certain historical information concerning exploration and gold production in the Black Hills region has been obtained through both public and private sources and are believed to be substantially factual, but Solitario can give no assurances of the accuracy of such information. The existence of historic mines and resources adjacent to Solitario's land position do not necessarily support the existence economic mineral deposits on Solitario's land position. Such forward-looking statements include, without limitation, statements regarding the Company's expectation of the projected timing and outcome of engineering studies; expectations regarding the receipt of all necessary permits and approvals to implement a mining plan, if any, at any of its mineral properties. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, among others, risks relating to risks that Solitario's and its joint venture partners' exploration and property advancement efforts will not be successful; risks relating to fluctuations in the price of zinc, gold, lead and silver; the inherently hazardous nature of mining-related activities; uncertainties concerning reserve and resource estimates; availability of outside contractors, and other activities; uncertainties relating to obtaining approvals and permits from governmental regulatory authorities; the possibility that environmental laws and regulations will change over time and become even more restrictive; and availability and timing of capital for financing the Company's exploration and development activities, including uncertainty of being able to raise capital on favorable terms or at all; risks relating to the impacts of Covid-19 or similar variants; as well as those factors discussed in Solitario's filings with the U.S. Securities and Exchange Commission (the "SEC") including Solitario's latest Annual Report on Form 10-K and its other SEC filings (and Canadian filings) including, without limitation, its latest Quarterly Report on Form 10-Q. The Company does not intend to publicly update any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required under applicable securities laws.

SOURCE: Solitario Resources Corp.

View the original press release on accesswire.com