US Benchmark Series Announces Launch of the US Treasury 6 Month Bill ETF

F/m Investments has launched the US Treasury 6 Month Bill ETF (Ticker: XBIL), expanding its US Benchmark Series of ETFs. This series aims to provide simplified access to the US Treasury market, with each ETF holding the most current US Treasury security for its tenor. Since the series' inception last August, it has amassed over

- Launch of XBIL enhances access to high-yield US Treasury securities.

- The US Benchmark Series has raised over $700 million since inception.

- 6-month Treasuries currently yielding over 5% meet strong investor demand.

- None.

Launch of XBIL continues success of US Benchmark Series

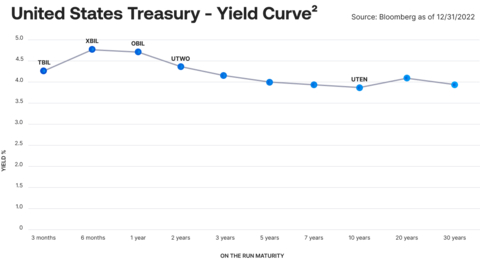

XBIL is the latest addition to F/m’s fast growing US Benchmark Series – a suite of ETFs designed to simplify access to the

XBIL joins the other four ETFs in the US Benchmark Series, which now give investors direct access to the

-

US Treasury 10 Year ETF (Ticker: UTEN); -

US Treasury 2 Year ETF (Ticker: UTWO); -

US Treasury 12 Month Bill ETF (Ticker: OBIL); -

US Treasury 6 Month Bill ETF (Ticker: XBIL); and -

US Treasury 3 Month Bill ETF (Ticker: TBIL).

Since the initial launch of the US Benchmark Series last August, the ETFs have raised over

“With this launch of XBIL, we’re responding to investor demand for simplified access to the highest yielding

The Yield Curve is the foundation for nearly all investing. The US Benchmark Series offers investors the following:

-

Simplified access to the current benchmark tenor

US Treasury securities. - Monthly dividends, providing a more frequent and regular interest payment than holding the underlying securities.

- Automatic rolls that provide constant benchmark exposure without hassle or added expense.

-

At

$50 -

The other benefits and operational efficacies of the Funds:

- Tax efficiency

- Intraday liquidity with equity trading and settlement

- Access to shorting, and options, facilitating expression of a variety of views on US rates

Lead market maker for XBIL will be

About The US Benchmark Series

The US Benchmark Series allows investors of all sizes to own each of the “Benchmark” US Treasuries in a single-security ETF. Each ETF holds the most current (“on the run”)

About F/m Investments

F/m is a

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the Fund, please call (888)123-4589 or visit our website at www.ustreasuryetf.com Read the prospectus or summary prospectus carefully before investing.

Investments involve risk. Principal loss is possible.

i

View source version on businesswire.com: https://www.businesswire.com/news/home/20230307005390/en/

For

tslosburg@lyceusgroup.com

Source: F/m Investments

FAQ

What is the US Treasury 6 Month Bill ETF (XBIL)?

How much AUM has the US Benchmark Series raised?

What is the current yield for 6-month Treasuries?

Who is the lead market maker for XBIL?