MEDIA ALERT: Wolters Kluwer Tax Experts Available to Speak on Congress Passing Inflation Reduction Act

Wolters Kluwer Tax & Accounting announced the passage of the Inflation Reduction Act of 2022, which was approved by Congress on August 12, 2022. This landmark legislation introduces substantial tax breaks for clean energy and healthcare, funded by a 15% corporate minimum tax and a 1% tax on corporate stock buybacks. Tax expert Mark Luscombe emphasized these enhanced incentives will make green technologies more attractive. A free public webinar discussing these tax implications will be held on August 17, 2022, at 3:00 p.m. ET.

- None.

- None.

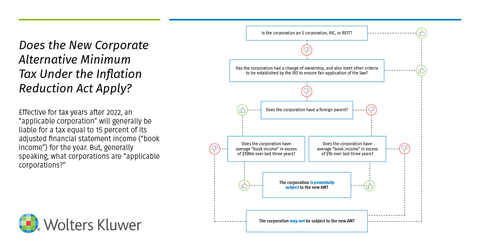

Does the New Corporate Alternative Minimum Tax Under the Inflation Reduction Act Apply? Follow the Infographic. (Graphic: Business Wire)

What:

Who: Tax expert

According to Mark: “The enhanced tax breaks available to individuals and businesses should make green vehicles and energy efficient homes and businesses much more economically attractive, as well as easier to plan for with significantly lengthened effective dates.”

Learn more about some of the changes outlined in this recently published Inflation Reduction Act of 2022 tax briefing from

Free webinar open to the public

Included in this 50-minute, CPE- and CE-eligible webinar:

- Provisions of the Act, and their potential tax implications

- How to field questions your clients may have about the various provisions

-

Where the

IRS funding is going and how it will be used

Media Contact:

To arrange an interview with

View source version on businesswire.com: https://www.businesswire.com/news/home/20220815005176/en/

KELLY DE CASTRO

614-288-5640

Kelly.deCastro@wolterskluwer.com

Source:

FAQ

What is the Inflation Reduction Act of 2022 as announced by Wolters Kluwer Tax & Accounting?

Who is discussing the tax changes of the Inflation Reduction Act?

When is the free webinar about the Inflation Reduction Act hosted by Wolters Kluwer Tax & Accounting?

What topics will be covered in the Wolters Kluwer Tax & Accounting webinar?

How can I register for the Wolters Kluwer Tax & Accounting webinar on the Inflation Reduction Act?