Wolfden Reports Initial Mineral Resource Estimate for Rice Island Nickel

Wolfden Resources Corporation has released an initial NI43-101 compliant mineral resource estimate for its Rice Island Nickel-Copper-Cobalt and PGE Project in Manitoba. The estimate includes 4.3 million tonnes at 1.11% NiEq indicated and 3.4 million tonnes at 0.89% NiEq inferred resources. The company plans a 2,500 metre expansion drilling program in Q1 2022, targeting deeper mineralization based on geophysical data. The Rice Island project highlights significant potential due to proximity to infrastructure and anticipated grade increases, which may positively impact its valuation within the North American EV market.

- Initial mineral resource estimate reveals 4.3 Mt at 1.11% NiEq indicated and 3.4 Mt at 0.89% NiEq inferred.

- Expansion drilling program of 2,500m planned for Q1 2022 to explore deeper mineralization.

- Proximity to infrastructure supports the asset’s development potential.

- Mineral resources have not demonstrated economic viability and may be affected by various risks.

- Inferred resources carry a lower confidence level and are not guaranteed to be upgraded to reserves.

Includes 4.3 Mt at

Expansion Drilling to recommence in Q1 2022

THUNDER BAY, ON / ACCESSWIRE / December 13, 2021 / Wolfden Resources Corporation (TSX-V:WLF.V) ("Wolfden" or the "Company") is pleased to release an initial NI43-101 compliant Mineral Resource Estimate for its wholly owned Rice Island Nickel-Copper-Cobalt and PGE Project in northern Manitoba and provide guidance on an upcoming expansion drill program.

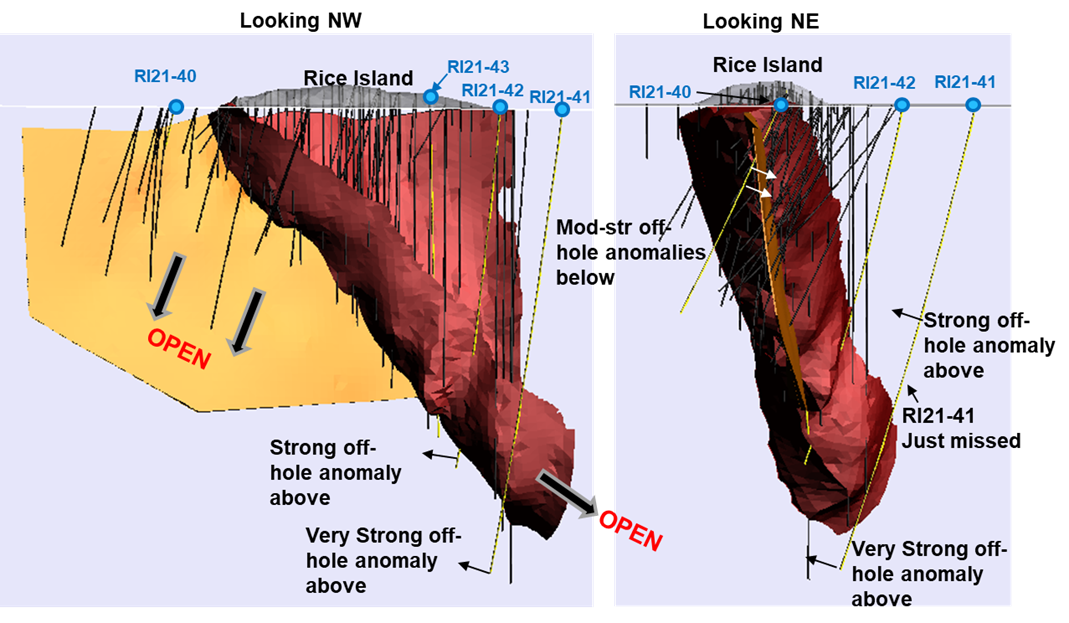

The Deposit consists of a steeply plunging, U-shaped, sulphide-enriched keel and intersecting feeder zone with potential expansion of the Mineral Resources at depth as indicated by down hole geophysical survey data (see Figure 1).

"This initial Mineral Resource Estimate confirms that Rice Island Deposit has sufficient size, grade and expansion potential to be regarded as a significant development project in the North American EV metal space," commented Ron Little, President and CEO for Wolfden. "The proximity of the Project to the existing infrastructure in Snow Lake, the simple, predictable geometry and excellent expansion potential all support that this asset should be re-valued to the upside, within Wolfden's pipeline of high-quality advanced projects."

Mineral Resource Estimate Summary:

DECEMBER 13, 2021 - UNDERGROUND MINERAL RESOURCE ESTIMATE | |||||||||

Classification | Tonnage | Ni | Cu | Au | Pt | Pd | Co | NiEq | NiEq |

tonnes | % | % | g/t | g/t | g/t | % | % | tonnes | |

Indicated | 4,293,000 | 0.74 | 0.49 | 0.06 | 0.02 | 0.03 | 0.03 | 1.11 | 47,700 |

Inferred | 3,395,000 | 0.55 | 0.37 | 0.09 | 0.02 | 0.04 | 0.04 | 0.89 | 30,300 |

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. There is no certainty that Mineral Resources will be converted to Mineral Reserves.

- The Inferred Mineral Resource in this estimate has a lower level of confidence that that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

- NiEq was calculated using metal prices of US

$7.50 /lb nickel, US$3.50 /lb copper, US$24 per pound cobalt, US$1,700 /oz gold, US$1,000 /oz platinum and US$2,100 /oz palladium. NiEq% = Ni% + (Cu% x 0.467) + (Co% x 3.200) + (Au g/t x 0.331) + (Pt g/t x 0.194) + (Pd g/t x 0.408). An assumed metallurgical recovery of85% was used in the Mineral Resource Estimate and is therefore incorporated into the NiEq% value calculation. - Underground Mineral Resources were calculated using a

0.5% NiEq cut-off after an estimated process recovery of85% using a nickel price of US$7.50 /lb, an exchange rate US$:C$ of 0.78, mining cost of C$65 /t, processing cost of C$20 /t and G&A cost of C$5 /t. - The Mineral Resource Estimate was classified into Indicated and Inferred in accordance with CIM Definition Standards on Mineral Resources and Reserves adopted by the CIM Council on May 10, 2014 and CIM Best Practices (2019)

- The Mineral Resource Estimate was prepared, supervised, and reviewed by Independent Qualified Persons ("QPs") Yungang Wu, P.Geo., Eugene Puritch, P.Eng. and David Barga, P.Geo. of P&E Mining Consultants Inc. with an effective date of December 13, 2021.

Expansion Drill Program Q1-2022

A 2,500 metre expansion drill program is planned for Q1 2022. The 7 to 10 hole program has been designed to test the down-plunge extension of the Keel Zone and down-dip extension of the Feeder Zone. Geophysical, bore hole electromagnetic data indicates that the conductive zones associated with the nickel mineralization continues beyond the current depth of 450 metres. In addition, at least one other, untested conductive target, along trend to the northeast of Rice Island, will be drilled.

Other Drill targets

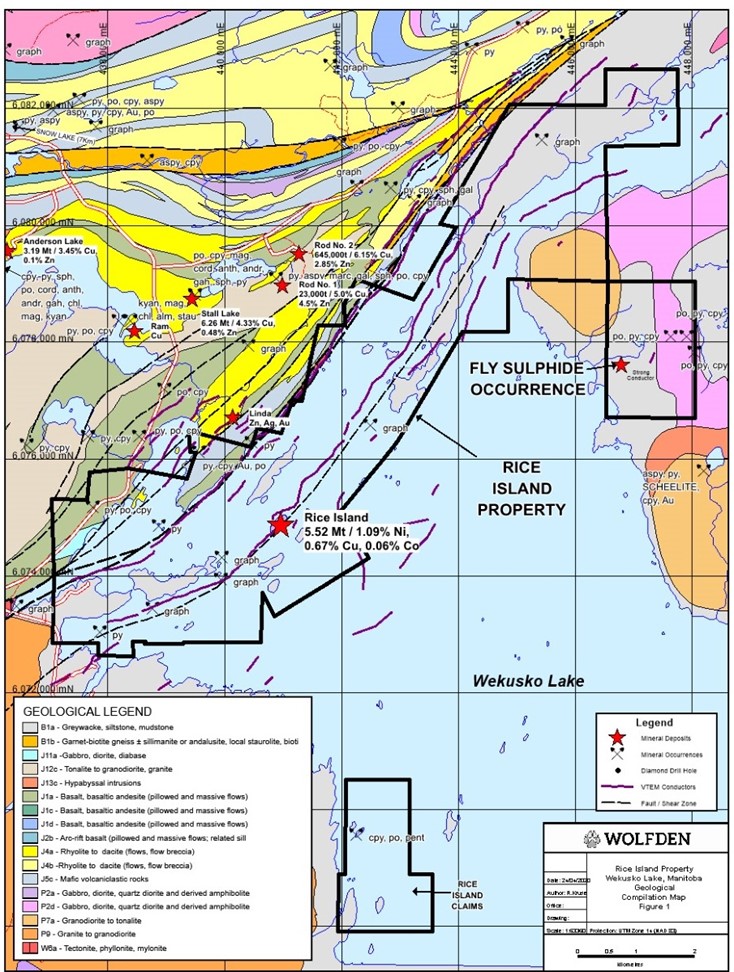

Wolfden is also evaluating and planning to drill test two other mafic intrusion-hosted nickel bearing targets; the Eureka and Fly Zones, (see Figure 2). Both are similar in character to the Rice Island Deposit, however, have larger footprints, and are currently being covered by time domain electromagnetic and magnetic surveys. Any conductive zones identified in these surveys will become high priority drill targets and included in the 2022 drill program.

About the Rice Island Deposit

The Rice Island Ni-Cu-Co-PGE sulphide deposit is comprised of a ‘keel' of higher-grade mineralization where previous drilling returned intercepts of up to 14.7 metres grading

QA/QC

Wolfden adheres to strict Quality Assurance and Quality Control protocols including routine insertion of blanks and certified reference materials (CRMs) in each sample batch of drill core that is sent to the lab for analyses. During this program, certified reference materials (CRM) were inserted every 18 samples, blanks every 13.5 samples and duplicates every 21.6 samples. Drill core samples are cut in half using a diamond saw with one half saved for reference and the other half shipped via secure transport to Activation Laboratories sample preparation facility in Thunder Bay, Ontario. All samples returned acceptable blank analyses and four of the CRMs returned values within 2 standard deviations (SD) and two samples returned Ni values off by just over 2SD, however, were deemed acceptable. Drill core samples were analyzed for nickel, copper and cobalt utilizing sodium peroxide fusions (lab code FUS_Na2O2). Gold, platinum and palladium is analyzed by fire assay (30 g) utilizing AA finish (Code 1A2).

About Wolfden

Wolfden is an exploration and development company focused on high-margin metallic mineral deposits including base, precious and strategic metals. Its wholly owned Pickett Mountain Project is one of the highest-grade polymetallic projects in North America (Zn, Pb, Cu, Ag, Au).

For further information please contact Ron Little, President & CEO, at (807) 624-1136 or Don Dudek VP Exploration at (647) 401-9138.

The information in this news release has been reviewed and approved by Don Dudek, P. Geo., VP Exploration, Ron Little P.Eng., President and CEO and Eugene Puritch, P.Eng, President of P&E Mining Consultants Inc., all of whom are Qualified Persons' under National Instrument 43-101. Mr. Puritch is independent of Wolfden.

Cautionary Statement Regarding Forward-Looking Information

This press release contains forward-looking information (within the meaning of applicable Canadian securities legislation) that involves various risks and uncertainties regarding future events. Such forward-looking information includes statements based on current expectations involving a number of risks and uncertainties and such forward-looking statements are not guarantees of future performance of the Company, and include, without limitation, metal price assumptions, cash flow forecasts, and the timing and completion of drill programs in Manitoba and the respective drill results. There are numerous risks and uncertainties that could cause actual results and the Company's plans and objectives to differ materially from those expressed in the forward-looking information in this news release, including without limitation, the following risks and uncertainties: (i) risks inherent in the mining industry; (ii) regulatory and environmental risks; (iii) results of exploration activities and development of mineral properties; (iv) risks relating to the estimation of Mineral Resources; (v) stock market volatility and capital market fluctuations; and (vi) general market and industry conditions. Actual results and future events could differ materially from those anticipated in such information. This forward-looking information is based on estimates and opinions of management on the date hereof and is expressly qualified by this notice. Risks and uncertainties about the Company's business are more fully discussed in the Company's disclosure materials filed with the securities regulatory authorities in Canada at www.sedar.com. The Company assumes no obligation to update any forward-looking information or to update the reasons why actual results could differ from such information unless required by applicable law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Figure 1. Rice Island Deposit Model 3D View - Keel, in red plunges steeply east, Feeder Zone in tan color

Figure 2. Rice Island Regional Geology Map and Wolfden Landing Holdings (black outline)

SOURCE: Wolfden Resources Corporation

View source version on accesswire.com:

https://www.accesswire.com/677169/Wolfden-Reports-Initial-Mineral-Resource-Estimate-for-Rice-Island-Nickel

FAQ

What is Wolfden Resources Corporation's stock symbol?

What did Wolfden Resources report on December 13, 2021?

What are the indicated and inferred resources for the Rice Island project?

When is the expansion drilling program for Rice Island scheduled to start?