White Gold Corp. Files Technical Report for Significant Increase of Mineral Resources to 1,203,000 oz Gold Indicated and 1,116,600 oz Gold Inferred on its Flagship White Gold Project, Yukon, Canada

White Gold Corp has filed a technical report updating the Mineral Resource Estimate (MRE) for its flagship White Gold Project in Yukon, Canada. The project now contains 1,203,000 ounces of gold in the Indicated Resource category (17.7 million tonnes averaging 2.12 g/t Au) and 1,116,600 ounces of gold in the Inferred Resource category (24.5 million tonnes averaging 1.42 g/t Au).

Key highlights include an 18.5% increase in inferred resources and a 4.3% increase in indicated resources compared to the 2023 MRE. Notably, 97.5% of the resources are near surface and within an open-pit configuration. The mineralization remains open for expansion, with additional opportunities through the Target for Further Exploration area, estimated at 10-12 million tonnes grading between 1-2 g/t Au.

White Gold Corp ha presentato un rapporto tecnico aggiornando la Stima delle Risorse Minerali (MRE) per il suo progetto principale White Gold nel Yukon, Canada. Il progetto ora contiene 1.203.000 once d'oro nella categoria delle Risorse Indicate (17,7 milioni di tonnellate con una media di 2,12 g/t Au) e 1.116.600 once d'oro nella categoria delle Risorse Inferite (24,5 milioni di tonnellate con una media di 1,42 g/t Au).

I principali punti salienti includono un aumento del 18,5% delle risorse inferite e un aumento del 4,3% delle risorse indicate rispetto alla MRE del 2023. È importante notare che il 97,5% delle risorse è vicino alla superficie e all'interno di una configurazione a cielo aperto. La mineralizzazione rimane aperta all'espansione, con ulteriori opportunità nell'area Target for Further Exploration, stimata in 10-12 milioni di tonnellate con un contenuto compreso tra 1-2 g/t Au.

White Gold Corp ha presentado un informe técnico que actualiza la Estimación de Recursos Minerales (MRE) para su proyecto insignia White Gold en Yukon, Canadá. El proyecto ahora contiene 1.203.000 onzas de oro en la categoría de Recursos Indicados (17,7 millones de toneladas con un promedio de 2,12 g/t Au) y 1.116.600 onzas de oro en la categoría de Recursos Inferidos (24,5 millones de toneladas con un promedio de 1,42 g/t Au).

Los aspectos más destacados incluyen un aumento del 18,5% en los recursos inferidos y un aumento del 4,3% en los recursos indicados en comparación con la MRE de 2023. Notablemente, el 97,5% de los recursos están cerca de la superficie y dentro de una configuración a cielo abierto. La mineralización sigue abierta para expansión, con oportunidades adicionales a través del área Target for Further Exploration, estimada en 10-12 millones de toneladas con leyes entre 1-2 g/t Au.

White Gold Corp는 캐나다 유콘의 대표 프로젝트인 White Gold 프로젝트의 광물 자원 추정치(MRE)를 업데이트하는 기술 보고서를 제출했습니다. 이 프로젝트는 현재 1,203,000 온스의 금을 포함하고 있으며, 이는 지정 자원 범주에 해당합니다(17.7백만 톤, 평균 2.12 g/t Au) 그리고 1,116,600 온스의 금은 추정 자원 범주에 해당합니다(24.5백만 톤, 평균 1.42 g/t Au).

주요 하이라이트로는 2023 MRE에 비해 추정 자원이 18.5% 증가하고, 지정 자원이 4.3% 증가한 것이 있습니다. 주목할 만한 점은 자원의 97.5%가 표면에서 가깝고 열린 구덩이 구조 내에 있다는 것입니다. 광물화는 확장 가능성이 열려 있으며, 추가 탐사를 위한 목표 지역을 통해 1-2 g/t Au의 등급으로 10-12백만 톤으로 추정됩니다.

White Gold Corp a déposé un rapport technique mettant à jour l'Estimation des Ressources Minières (MRE) pour son projet phare White Gold situé au Yukon, Canada. Le projet contient désormais 1.203.000 onces d'or dans la catégorie des Ressources Indiquées (17,7 millions de tonnes avec une moyenne de 2,12 g/t Au) et 1.116.600 onces d'or dans la catégorie des Ressources Inférées (24,5 millions de tonnes avec une moyenne de 1,42 g/t Au).

Les principaux points saillants incluent une augmentation de 18,5 % des ressources inférées et une augmentation de 4,3 % des ressources indiquées par rapport à la MRE de 2023. Il est à noter que 97,5 % des ressources sont proches de la surface et dans une configuration de carrière à ciel ouvert. La minéralisation demeure ouverte à l'expansion, avec des opportunités supplémentaires dans la zone Cible pour Poursuite des Explorations, estimée à 10-12 millions de tonnes avec des teneurs entre 1-2 g/t Au.

White Gold Corp hat einen technischen Bericht eingereicht, um die Mineralressourcenschätzung (MRE) für sein Flaggschiffprojekt White Gold im Yukon, Kanada, zu aktualisieren. Das Projekt enthält nun 1.203.000 Unzen Gold in der Kategorie der angezeigten Ressourcen (17,7 Millionen Tonnen mit einem Durchschnitt von 2,12 g/t Au) und 1.116.600 Unzen Gold in der Kategorie der geschätzten Ressourcen (24,5 Millionen Tonnen mit einem Durchschnitt von 1,42 g/t Au).

Zu den wichtigsten Höhepunkten gehören ein Anstieg der geschätzten Ressourcen um 18,5% und ein Anstieg der angezeigten Ressourcen um 4,3% im Vergleich zur MRE 2023. Bemerkenswert ist, dass 97,5% der Ressourcen in der Nähe der Oberfläche liegen und innerhalb einer Tagebaukonfiguration sind. Die Mineralisierung bleibt offen für eine Erweiterung, mit zusätzlichen Möglichkeiten im Bereich Ziel für weitere Erkundungen, der auf 10-12 Millionen Tonnen geschätzt wird und zwischen 1-2 g/t Au liegt.

- 18.5% increase in inferred resources to 1.12M oz gold

- 4.3% increase in indicated resources to 1.20M oz gold

- 97.5% of resources are near-surface and open-pittable

- Additional 10-12M tonnes of potential resources grading 1-2 g/t Au

- Mineralization remains open for expansion in multiple directions

- None.

TORNOTO, Jan. 06, 2025 (GLOBE NEWSWIRE) -- White Gold Corp. (TSX.V: WGO, OTCQX: WHGOF, FRA: 29W) (the "Company") is pleased to announce it has filed a technical report in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects to update the Mineral Resource Estimate (“MRE”) on its

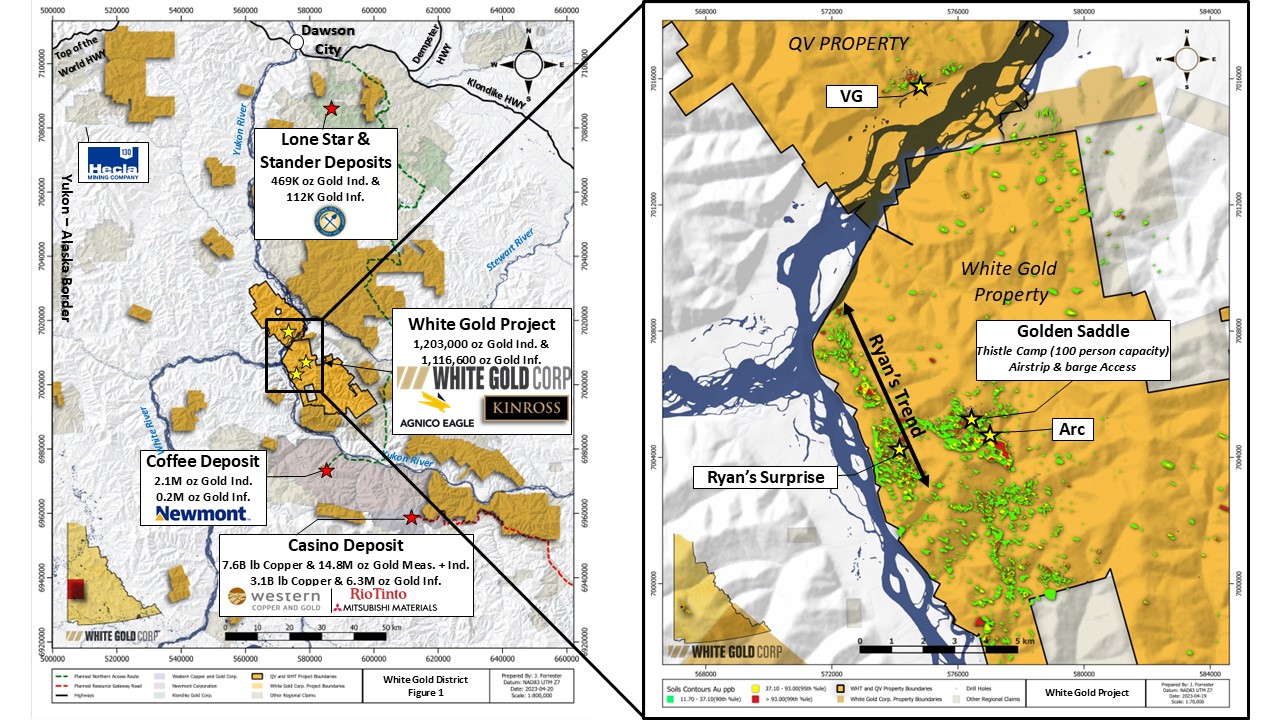

The Project is located (Figure 1) approximately 95 km south of Dawson City in west-central Yukon, Canada and is located 33 km north from the advanced Coffee project owned by Newmont Corporation with Indicated Resources of 2.14 Moz at 1.23 g/t Au, and Inferred Resources of 0.23 Moz at 1.01 g/t Au(2), and 58 km northwest from Western Copper and Gold Corporation’s Casino project, which has Measured and Indicated Resources of 7.6 billion lb Cu and 14.5 Moz Au and Inferred Resources of 3.3 billion lb Cu and 6.6 Moz Au(3).

The updated mineral resource includes a significant increase in total gold ounces, including an

“The filing of the updated MRE technical report on our flagship White Gold Project represents another significant milestone on the continued growth and advancement of our deposits, which now ranks as one of the highest-grade undeveloped open-pittable gold deposits in Canada. Several opportunities exist to continue to expand the resource size through further drilling, nearby targets and optimization of the resource block model and the significant Target for Further Exploration area which remains largely underexplored. We look forward to continuing to unlock the gold and critical mineral endowment of our prospective district scale land package in a tier 1 jurisdiction which has such a prolific history and prospectivity” stated David D’Onofrio, Chief Executive Officer.

Highlights:

- 17.660 million tonnes of Indicated Resources averaging 2.12 grams per tonne gold for 1.203 million ounces of gold, representing

52% of total resources. - 24.472 million tonnes of Inferred Resources averaging 1.42 grams per tonne gold for 1.117 million ounces of gold, representing

48% of total resources. - Inferred and Indicated Mineral Resources have increased by

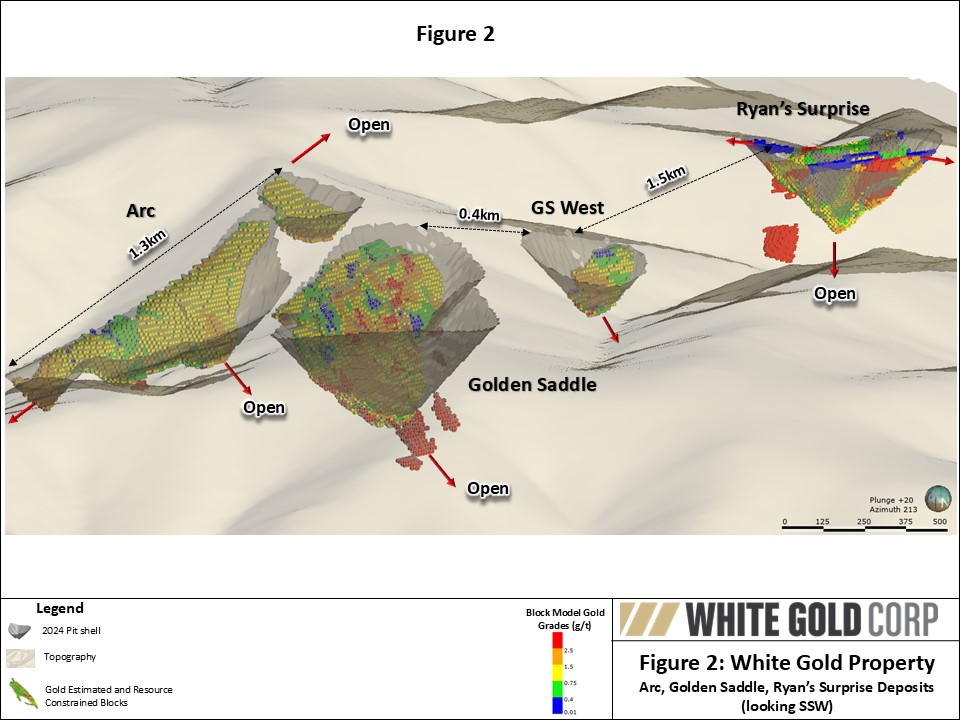

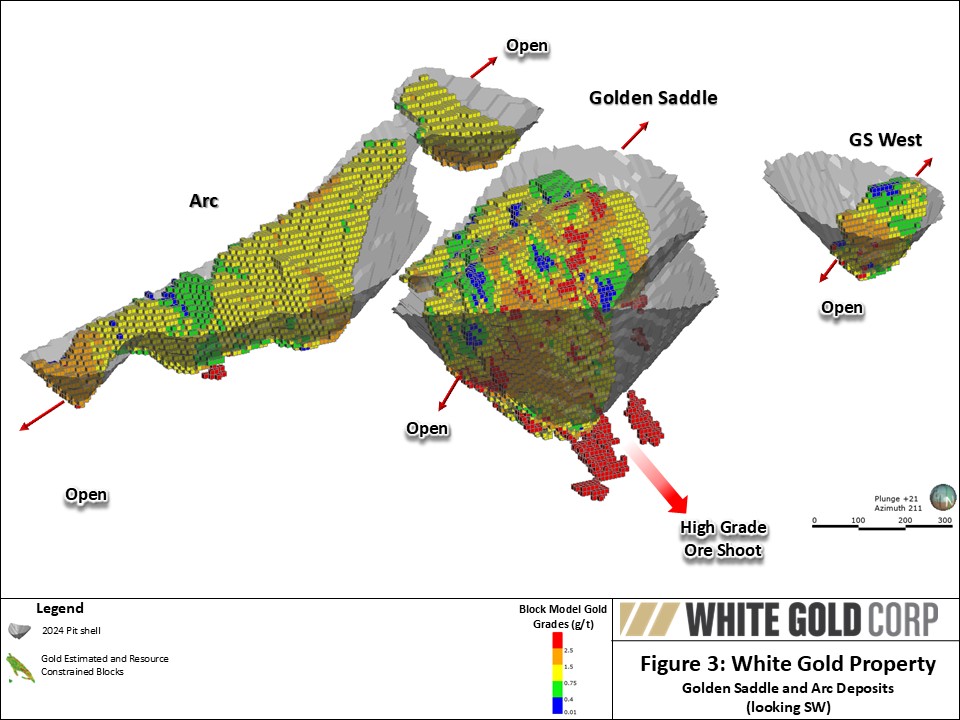

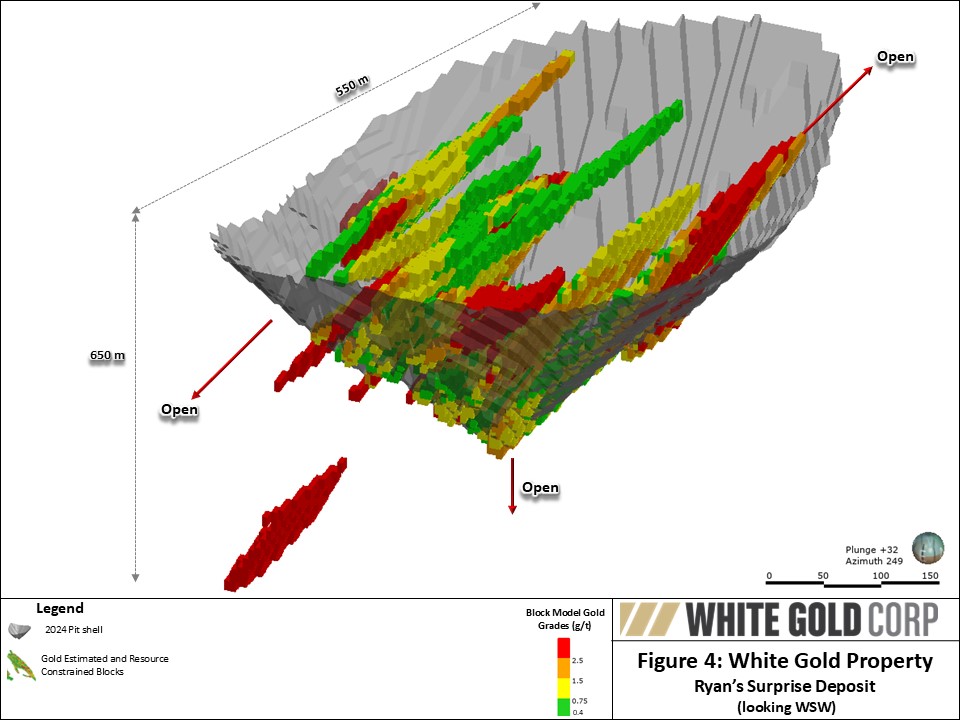

18.5% and4.3% respectively, compared to the previous 2023 MRE(1) 97.5% of the resources are near surface and within an open-pit. Indicated Resources of 1.201 million ounces of gold averaging 2.12 grams per tonne gold (an increase of6.7% ) and open-pit Inferred Resources of 1.061 million ounces of gold averaging 1.38 grams per tonne gold (an increase of24.4% ).- Mineralization at the Golden Saddle, Arc, Ryan’s Surprise and VG deposits all remain open along strike and down dip to further expand the deposits and in addition to multiple underexplored targets in close proximity.

- The project also hosts an additional estimated 10 – 12 million tonnes grading between 1 – 2 g/t Au of material classified as a Target for Further Exploration which has not been included in the current resource which may further increase the size of the resource and is currently being evaluated in this regard.

- The Company is also currently evaluating additional opportunities to further increase the size of the resources by optimizing the block model and wireframes of the Golden Saddle and Arc deposits to add additional tonnage.

- Additional results from the Company’s work program to be released in due course

Mineral Resource Estimate Details

Table 1. White Gold Project, Yukon Territory, Mineral Resource Statement, ACS October 28, 2024.

| Area | Type | Classification | Cut-off (g/t) | Tonnes (000's) | Grade (g/t) | Contained Gold (oz) |

| Golden Saddle | Open Pit | Indicated | 0.35 | 16,954 | 2.16 | 1,178,500 |

| Inferred | 5,396 | 1.45 | 250,900 | |||

| Underground | Indicated | 2.3 | 23 | 2.77 | 2,100 | |

| Inferred | 382 | 3.06 | 37,500 | |||

| Arc | Open Pit | Indicated | 0.35 | 683 | 1.02 | 22,400 |

| Inferred | 6,781 | 1.09 | 236,700 | |||

| Underground | Inferred | 2.3 | 47 | 3.00 | 4,600 | |

| Ryan | Open Pit | Inferred | 0.35 | 5,499 | 1.57 | 278,300 |

| Underground | Inferred | 2.3 | 127 | 3.19 | 13,100 | |

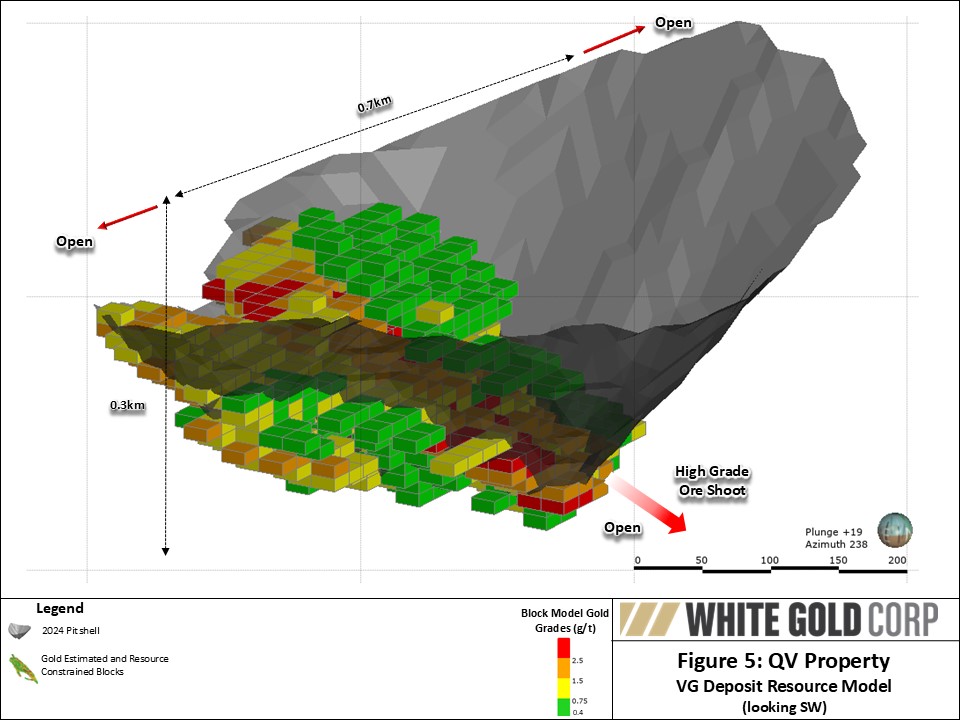

| QV | Open Pit | Inferred | 0.35 | 6,240 | 1.47 | 295,500 |

| All Deposits | Open Pit | Indicated | 0.35 | 17,637 | 2.12 | 1,200,900 |

| All Deposits | Open Pit | Inferred | 23,916 | 1.38 | 1,061,400 | |

| All Deposits | Underground | Indicated | 2.3 | 23 | 2.84 | 2,100 |

| All Deposits | Underground | Inferred | 556 | 3.09 | 55,200 | |

| All Deposits | Total | Indicated | 17,660 | 2.12 | 1,203,000 | |

| All Deposits | Total | Inferred | 24,472 | 1.42 | 1,116,600 |

- Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability.

- The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

- The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

- The Mineral Resources in this report were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

- Open pittable resources are constrained by GEOVIA Whittle optimized pit shells using a 0.35 g/t Au cut-of grade and are considered to have reasonable prospects for eventual economic extraction, assuming a gold price of US

$2,000 per ounce, a C$:US$ exchange rate of 0.75. an open pit mining cost of CDN$3.25 per tonne, a processing and G&A cost of CDN$27.50 per tonne milled, and gold recoveries of92% for Golden Saddle, and VG, along with85% for Arc and Ryan’s Surprise. Underground resources assume a mining cost of CDN$120 /tonne. - The following bulk density values for mineralized material were used: Golden Saddle (2.62 – 2.65 t/m3), Arc (2.55 t/m3), Ryan’s Surprise (2.63 t/m3) and VG (2.65 t/m3).

- High-grade gold assay values have been capped as follows: Golden Saddle and Arc (8 – 18 g/t Au), Ryan’s Surprise (9 g/t Au) and VG (3 – 10 g/t Au).

- The Statement of Estimates of Mineral Resources has been compiled by Mr. Gilles Arseneau, Ph.D.,P.Geo, of ARSENEAU Consulting Services (“ACS”). Mr. Arseneau has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and to the activity that he has undertaken to qualify as a Qualified Person as defined in the CIM Standards of Disclosure.

- All numbers are rounded. Overall numbers may not be exact due to rounding.

The current MRE for the White Gold project was carried out by Arseneau Consulting Services (“ACS”) of Vancouver, B.C. and is reported in accordance with the guidelines of the Canadian Securities Administrators National Instrument 43-101 (“NI 43-101”) and has been estimated in conformity with generally accepted Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) “Estimation and Mineral Resource and Mineral Reserve Best Practices” guidelines. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

The MRE presents updated estimates for the Golden Saddle, Arc, Ryan’s Surprise and VG deposits (Figures 2-5).

The updated MRE was prepared using a block model approach using ordinary kriging interpolation for the Golden Saddle, Arc and VG deposits and inverse distance squared (“ID2”) interpolation for the Ryan’s Surprise deposit. Block model sizes varied between deposits as follows: Golden Saddle and Arc (10 m); Ryan’s Surprise (5 – 10 m); and VG (10 – 20 m). GEMS 6.8.4 software was used for generating gold mineralization solids, a topography surface, and resource estimation. Statistical analysis and resource validations were performed using non-commercial software and with Sage2001. Near surface resources were constrained using GEOVIA Whittle pit optimization software. Pit slopes in rock were assumed at 50° and the MRE assumes a long-term gold price of US

Mineralization on portions of both the Golden Saddle and Arc deposits is known to extend beyond the limits of the current resource estimate, however, the mineralization in these areas did not meet the criteria to be classified as Mineral Resources. Based on drilling at Golden Saddle and current geologic models, there is an estimated 10 – 12 million additional tonnes grading between 1 – 2 g/t Au of material classified as a Target for Further Exploration (“TFFE”). The reader should be cautioned that the potential quantity and grade of the TFFE is conceptual in nature. There has been insufficient drilling to define a mineral resource and it is uncertain if further exploration will result in the target being advanced to a mineral resource. These zones form more continuous mineralized units at US

Resources & Opportunities in the White Gold District

West-central Yukon is host to several highly prospective mineral districts, including the White Gold, Dawson Range, Klondike and Sixtymile districts. The Klondike was the epicentre of the historic Klondike Gold Rush in 1896 with over 20 million ounces of placer gold production having occurred in the region since that time. The Company’s property portfolio, which covers large portions of the White Gold District, was assembled by renowned prospector Shawn Ryan, and represents the largest claim package in the region, consisting of 15,876 claims across 26 properties and covering approximately 315,000 hectares. Two significant advanced projects border the Company’s claims in the south including the Coffee project owned by Newmont Corporation with Indicated Resources of 2.14 Moz at 1.23 g/t Au, and Inferred Resources of 0.23 Moz at 1.01 g/t Au(2), and Western Copper and Gold Corporation’s Casino project, which has Measured and Indicated Resources of 7.6 billion lb Cu and 14.5 Moz Au and Inferred Resources of 3.3 billion lb Cu and 6.6 Moz Au(3). The region has seen significant investment by various other major mining companies recently and the Yukon is consistently ranked as a top 10 mining jurisdiction on the Investment Attractiveness Index based on the Fraser Institute’s Annual Survey of Mining Companies.

All four of White Gold’s near-surface deposits are interpreted to represent structurally-controlled orogenic gold deposits, collectively form the Company’s gold resource base in the heart of its large land package, and remain open for expansion.

Qualified Persons, Technical Information and Quality Control

The MRE for the White Gold Project was prepared by Dr. Gilles Arseneau of Arseneau Consulting Services (ACS), an Independent Qualified Person (“QP”) as defined under NI 43-101, who has reviewed and approved the contents of this news release. The technical content of this news release has also been reviewed and approved by Terry Brace, P.Geo. and Vice President of Exploration for the Company who is also a QP as defined under NI 43-101 – Standards of Disclosure of Mineral Projects.

QA/QC

White Gold’s drill core sampling consisted of collecting samples over 0.50 m to 2.50 m intervals (depending on lithology and style of mineralization) over the entire hole length. RC samples were collected at continuous 1.5 m intervals. All drill core was cut in half using a diamond saw, with half of the core placed in sample bags and the other half returned to the core box. Standard, blank, and duplicate samples were inserted into both the drill core and RC sample streams at regular intervals to meet a designated QA/QC sample insertion rate. All samples were organized into batches, flown via fixed-wing aircraft from camp, and transported via courier to an ISO-certified laboratory for analysis.

About White Gold Corp.

The Company owns a portfolio of 15,876 quartz claims across 26 properties covering approximately 315,000 hectares (3,150 km2) representing approximately

(1) See White Gold Corp. technical report titled “2023 Technical Report for the White Gold Project, Dawson Range, Yukon, Canada”, Effective Date April 15, 2023, Report Date May 30, 2023, NI 43-101 Compliant Technical Report prepared by Dr. Gilles Arseneau, P.Geo., available on SEDAR+.

(2) See Newmont Corporation Form 10-K: Annual report for the year ending December 31, 2023, in the Measured, Indicated, and Inferred Resources section, dated February 29, 2024, available on EDGAR. Reserves and resources disclosed in this Form 10-K have been prepared in accordance with the Regulation S-K 1300, and do not indicate NI43-101 compliance.

(3) See Western Copper and Gold Corporation technical report titled “Casino project, Form 43-101F1 Technical Report Feasibility Study, Yukon Canada”, Effective Date June 13, 2022, Issue Date August 8, 2022, NI 43-101 Compliant Technical Report prepared by Daniel Roth, PE, P.Eng., Mike Hester, F Aus IMM, John M. Marek, P.E., Laurie M. Tahija, MMSA-QP, Carl Schulze, P.Geo., Daniel Friedman, P.Eng., Scott Weston, P.Geo., available on SEDAR+.

Cautionary Note Regarding Forward Looking Information

This news release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “proposed”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this news release, forward-looking statements relate, among other things, the Company’s objectives, goals and exploration activities conducted and proposed to be conducted at the Company’s properties; future growth potential of the Company, including whether any proposed exploration programs at any of the Company’s properties will be successful; exploration results; and future exploration plans and costs and financing availability.

These forward-looking statements are based on reasonable assumptions and estimates of management of the Company at the time such statements were made. Actual future results may differ materially as forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to materially differ from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors, among other things, include: The expected benefits to the Company relating to the exploration conducted and proposed to be conducted at the White Gold properties; the receipt of all applicable regulatory approvals for the Offering; failure to identify any additional mineral resources or significant mineralization; the preliminary nature of metallurgical test results; uncertainties relating to the availability and costs of financing needed in the future, including to fund any exploration programs on the Company’s properties; business integration risks; fluctuations in general macroeconomic conditions; fluctuations in securities markets; fluctuations in spot and forward prices of gold, silver, base metals or certain other commodities; fluctuations in currency markets (such as the Canadian dollar to United States dollar exchange rate); change in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations pressures, cave-ins and flooding); inability to obtain adequate insurance to cover risks and hazards; the presence of laws and regulations that may impose restrictions on mining and mineral exploration; employee relations; relationships with and claims by local communities and indigenous populations; availability of increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); the unlikelihood that properties that are explored are ultimately developed into producing mines; geological factors; actual results of current and future exploration; changes in project parameters as plans continue to be evaluated; soil sampling results being preliminary in nature and are not conclusive evidence of the likelihood of a mineral deposit; title to properties; and those factors described under the heading “Risks Factors” in the Company’s annual information form dated July 29, 2020 available on SEDAR+. Although the forward-looking statements contained in this news release are based upon what management of the Company believes, or believed at the time, to be reasonable assumptions, the Company cannot assure shareholders that actual results will be consistent with such forward-looking statements, as there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements and information. There can be no assurance that forward-looking information, or the material factors or assumptions used to develop such forward-looking information, will prove to be accurate. The Company does not undertake to release publicly any revisions for updating any voluntary forward-looking statements, except as required by applicable securities law.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

For Further Information, Please Contact:

Contact Information:

David D’Onofrio

Chief Executive Officer

White Gold Corp.

(647) 930-1880

ir@whitegoldcorp.ca

Request Meeting: https://calendly.com/meet-with-wgo/15min

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/2054d17c-d97d-442d-8434-71d5bc042d6e

https://www.globenewswire.com/NewsRoom/AttachmentNg/8f5756b3-f93d-4a30-8d3b-3b24adc24da4

https://www.globenewswire.com/NewsRoom/AttachmentNg/b65ebb02-e116-4ab5-b94e-70b9e9a304e6

https://www.globenewswire.com/NewsRoom/AttachmentNg/a3176d26-1db6-4604-815d-0bce6711d4e1

https://www.globenewswire.com/NewsRoom/AttachmentNg/35328b4a-d616-4277-8aef-b656065d8680