Wells Fargo Expands Advice and Planning, LifeSync® Access to All Consumer Customers

Strategic expansion to provide more customers personalized, digital goal-setting experiences

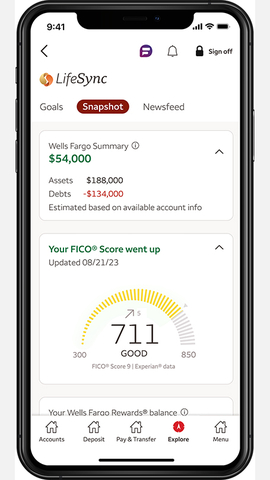

LifeSync is now available to all consumer customers. (Photo: Wells Fargo)

“Expanding availability of LifeSync to our consumer customers is the first proof point in Wells Fargo’s strategic delivery of digital-first, personalized financial advice and planning offerings,” said Michael Liersch, head of Advice and Planning at Wells Fargo. “Since it launched earlier this year, LifeSync has delivered on its promise to enable WIM clients to more easily share their goals with their advisor, see how they’re progressing toward them in real-time, and deliver relevant content and context to better understand what’s influencing those goals. We are thrilled to expand the LifeSync experience to millions of consumer customers this fall.”

Through an intuitive digital experience, LifeSync can provide real-time progress on goals and track key information — including their full Wells Fargo account summary, FICO® scores, market indexes, and credit card reward balances. Timely and relevant Wells Fargo content is delivered through its “Newsfeed” feature as goals or life events change and evolve.

LifeSync will be fully integrated with a customer’s branch experience, providing the option to create a multichannel experience through both digital and banker touchpoints. Customers can choose to either have a goals conversation with a banker and then track those goals in LifeSync, or articulate their goals in LifeSync first and then follow up with a banker.

As recently uncovered in Logica Research’s Future of Money study, Americans report needing more help with financial decisions than ever, with Gen Z having the highest percentage of respondents indicating a desire to obtain financial advice, especially around managing their money during uncertain economic times. The consumer customer availability of LifeSync further supports Wells Fargo’s digital strategy to provide customers with an intuitive banking journey that meets their individual financial needs.

“Since redesigning our mobile app, including launching new features like our Fargo™ 1 virtual assistant, customer satisfaction and usage are growing exponentially,” said Michelle Moore, head of Consumer and Wealth & Investment Management Digital at Wells Fargo. “This expanded availability of LifeSync builds on that momentum by providing meaningful money guidance to help our customers feel supported in reaching their financial goals.”

Today’s announcement marks a continuation of Wells Fargo’s holistic digital transformation, as signified by the rollout of

1 |

|

Availability may be affected by your mobile carrier’s coverage area. Your mobile carrier’s message and data rates may apply. |

2 |

|

Wells Fargo Online® and the Wells Fargo Mobile® app may not be available in Spanish to all customers and some products, services, and communications may only be offered in English. |

About Wells Fargo

Wells Fargo & Company (NYSE: WFC) is a leading financial services company that has approximately

News, insights, and perspectives from Wells Fargo are also available at Wells Fargo Stories.

Additional information may be found at www.wellsfargo.com | Twitter: @WellsFargo

Cautionary Statement about Forward-Looking Statements

This news release contains forward-looking statements about our future financial performance and business. Because forward-looking statements are based on our current expectations and assumptions regarding the future, they are subject to inherent risks and uncertainties. Do not unduly rely on forward-looking statements as actual results could differ materially from expectations. Forward-looking statements speak only as of the date made, and we do not undertake to update them to reflect changes or events that occur after that date. For information about factors that could cause actual results to differ materially from our expectations, refer to our reports filed with the Securities and Exchange Commission, including the “Forward-Looking Statements” discussion in Wells Fargo’s most recent Quarterly Report on Form 10-Q as well as to Wells Fargo’s other reports filed with the Securities and Exchange Commission, including the discussion under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2018, available on its website at www.sec.gov.

News Release Category: WF-IT

View source version on businesswire.com: https://www.businesswire.com/news/home/20231012742310/en/

Media

Natalie Papaj, 703-586-0048

natalie.papaj@wellsfargo.com

Source: Wells Fargo & Company